Auto Industry Briefing — week ending 28th October 2018

BMW’s relentless self-driving collective; cars as power stations; and stop over-thinking robot decision making. Please enjoy our auto industry and mobility briefing for 22nd October to 28th October. A PDF version can be found here.

Favourite stories of the past week…?

- Big Attack — BMW welcomed two software firms into its self-driving collaboration. They have been brought in to adapt the core technology for other OEMs (so that BMW can concentrate on its own cars). At present, everyone is so focused on getting a self-driving system to work (see this article on Cruise’s problems) that the notion of redundancy still isn’t getting much attention. Could BMW’s technology become the secondary system of choice?

- All Sparks — Nissan says it has enough Leaf owners in Germany signed up for its vehicle to grid charging scheme that it can sign up as a power station for electricity trading purposes. Using the (relatively) large batteries of electric cars, when they are parked, to manage peaks and troughs of energy demand seems very sensible, but it needs scale to work, since the benefits of a swarm are needed to offset the irregular choices occasionally made by individual users. Have Nissan reached critical mass to turn the theory into practice? How big an impact will Tesla have when they get their act in gear?

- (Waiting For) The Ghost Train — Researchers in America have concluded after years of studying responses to an online survey about trolley problems, that there is no right answer. Millions of people gave their opinion on what an autonomous car should do if presented with a certain crash but a choice of who to run over and when the votes were counted, different cultures had varying interpretations. Since, even if they could agree, many (most?) humans are incapable of exercising such judgement in a real-life pressure situation, why are we spending time trying to hold robots (and their programmers) accountable?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Increased the size of a recall linked to diesel cars with EGR problems to cover 1.6 million vehicles. (BMW)

- Announced that software firms KPIT and TTTech would join its self-driving platform with the specific aim of developing tailored solutions for third parties. (BMW)

- BMW might bid for its own 5G spectrum in Germany, rather than relying on the mobile phone companies to provide the infrastructure the company believes it needs. (Handelsblatt)

- Announced Q3 2018 financial results. Revenue of €40.2 billion was down (1)% on a year-over-year basis, EBIT of €2.5 billion was down (27)% (previously declared). Daimler called the business environment “volatile”. (Daimler)

- As rumoured, Daimler and Geely formed a “premium ride-hailing” joint venture that will use Mercedes-Benz cars, and in time possibly some of Geely’s offerings, for on-demand travel in Chinese cities. It isn’t yet clear how the service will integrate with Geely’s existing CaoCao ride hailing venture. (Daimler)

- CEO Zetsche said he wouldn’t rule out a future collaboration with Tesla, despite having sold all Daimler’s shareholding. Daimler’s PR said he was talking in hypothetical terms. (Reuters)

- Launched a new range of prams featuring AMG-inspired wheels. Although Daimler declined to comment on specific volume and profit expectations, it appears the benefit of the new product was already taken into account in the company’s recent profit warning. (Daimler)

- Opened a new technology centre for the Truck and Bus group in Lisbon, Portugal. (Daimler)

- Said that it might make some money on electric cars. (Seeking Alpha)

- Looking at alternative production locations that would reduce the effect of tariffs on vehicles shipped from the USA to China but believes it is too early to say anything about what it might do. (Reuters)

- Under investigation from US regulators for the way in which it handles recalls (they think: too slowly). (Bloomberg)

- Idling minivan production in Windsor, Canada for one week. (Blackburn News)

- Reported Q3 2018 financial results. Revenue of $37.6 billion was slightly improved versus the prior year but adjusted profit of $1.7 billion was $(0.6) billion worse than Q3 2018. Only North America and Middle East and Africa were profitable. (Ford)

- Said that market conditions had been tougher than expected and the business was no longer on track to meet the 2020 financial objectives it recently set itself, but that the executive team still intends to achieve them at an as-yet undetermined future date. (Ford)

- Said that the European business has two key problems: cost control and too few SUV products. (Ford)

- Shutting down vehicle production in Valencia, Spain for nine days and engine production for 13 days, citing lower demand. (Reuters)

- Will start testing self-driving cars in Washington DC. (Ford)

- Stopped production of JLR engines in Bridgend for a week, mirroring the customer shutdown. (Wales Online)

- Launched production of the Ranger pick-up at the Michigan Assembly plant. (Ford)

- Hired a new CEO in China and reorganised its operations so that China will now report directly to the head of global markets rather than through the Asia Pacific region. Ford’s press release also said the leader of the rump Asia business would head up a new International Markets unit, implying a wider reorganisation including some of the markets in Europe, Middle East and South America. (Ford)

- VW and Ford are reportedly exploring in-depth sharing of autonomous driving technology. Ford already has a majority share in partner Argo AI whilst VW has partnered with Aurora but was apparently rebuffed in an informal takeover approach. Ford executives stressed that nothing was off the table. (Bloomberg)

- Recalling 1.46 million Focus vehicles in North America to fix a problem that might lead to cars stalling. Ford has advised customers to keep tanks at least half full until they’ve been serviced. (USA Today)

- Skipping the 2019 Geneva show, after missing Paris in 2018. Sources said it still considers the event an ongoing priority but just doesn’t think it will have enough interesting things to talk about. (Autocar)

Geely (includes Volvo) (history)

- Volvo reported Q3 2018 revenue of 56.8 billion SEK (~$6 billion), up 18% on a year earlier and operating profit of 1.8 billion SEK (~$200 million), down (50)% on the prior year — blamed by Volvo on launch costs, higher tariffs and royalties. Volvo preferred to focus on the full year, where it expects to beat 2017. (Volvo)

- As rumoured, Daimler and Geely formed a “premium ride-hailing” joint venture that will use Mercedes-Benz cars, and in time possibly some of Geely’s offerings, for on-demand travel in Chinese cities. It isn’t yet clear how the service will integrate with Geely’s existing CaoCao ride hailing venture. (Daimler)

- Volvo invested in charging firm FreeWire. (Volvo)

- Lynk&Co might enter the US market by selling merchandise first and only putting cars on sale once the brand has become established. (Automotive News)

- GM’s Cruise self-driving unit is having problems meeting pre-launch targets, according to off-the-record sources, but the unit’s CEO expressed confidence in the previously announced 2019 launch date. (Reuters)

- Implication: The concerns focus on the vehicle AI’s ability to identifying other road users and in correctly assessing whether they are moving or stationary. These are common problems to self-driving researchers, with many systems struggling with the particular problem (called out in the article) of working out whether an object is a locked up bicycle, a person on a bicycle or someone walking with a bicycle.

- Said that a nationwide US zero emissions vehicle incentive program could boost demand such that in 2030 there would be 7 million such vehicles on the road. (GM)

- Implication: Since 7 million vehicles isn’t a very large number in terms of the overall fleet, GM’s statement implies the company only believes market shares in excess of 15% are possible with sales incentives.

- Korea’s state development bank said that although it was not “unconditionally” opposed to a separation of GM’s production and research units in the country, but wanted to see more information on how it would be run as a going concern. (Yonhap)

- Reportedly considering producing the Fit small car in Japan for sale into the US market. It is currently shipped from Mexico. Honda denied any firm plan was already in place. (Reuters)

- Will use technology from SoundHound to create an AI personal assistant. (SoundHound)

- Hyundai reported Q3 2018 Financial results. Sales of 1.121 million units were down (0.5)% versus the same period in 2017. Revenue of 24.4 trillion KRW (~$21.4 billion) was up 1%, driven by increased financing. Operating income of 289 billion KRW (~$250 million) was down (76)% with the automotive division recording a loss — blamed on one-time recall costs. (Hyundai)

- KIA reported Q3 2018 revenue of 14 trillion KRW (~$12 billion), down (0.2)% on a year-over-year basis. Operating profit of 117 billion KRW (~$100 million) was a turnaround of almost 550 billion KRW (~$480 million) from the prior year loss. (KIA)

Mazda

- Revised full year profit expectations downwards, citing the impact of floods earlier in the year and adverse exchange rates. (Nikkei)

Nissan (includes Mitsubishi) (history)

- Said it had enough Nissan Leaf vehicles enrolled in its vehicle-to-grid scheme to qualify as a power station under German regulations. (Nissan)

PSA (includes Opel/Vauxhall) (history)

- Announced Q3 2018 revenues (PSA only reports profits at half-year and full-year) of €15.4 billion, up from €14.3 billion in Q3 2017 (but missing one month of Opel / Vauxhall sales). (PSA)

- Faurecia will buy navigation systems supplier Clarion after agreeing terms with majority shareholder Hitachi. It will headquarter its connectivity-related businesses in Japan. (Faurecia)

- Chose Washington DC as the first location for Free2Move carsharing services. Users will also be able to access a variety of bicycle and scooter rental options. It looks like Chevrolet is providing the vehicles. (PSA)

- Reported Q3 2018 revenue of €11.48 billion (Renault only reports profits at half-year and full-year), down (6)% on a year-over-year basis. Renault said the decrease was down to exchange rate volatility and weakness in markets outside Europe. Renault expects market growth in the full year to be worse than previously hoped for. (Renault)

- Will reportedly increase annual production in Casablanca, Morocco to 160,000 units by 2022. Combined with another plant in Tangier Renault will have capacity for 500,000 units in the country. (Xinhua)

- Transferred production of the Renault Twizy to a Renault-Samsung factory in Busan, South Korea. The 33 workers who had previously manned the line will now make PHEV battery packs instead. (Wards)

- Launched operations at JLR’s new plant in Nitra, Slovakia. JLR has already launched a second stage of recruitment to take employment from 1,500 to around 2,350. (JLR)

- Reported financial results for Q3 2018. Revenue of $6.8 billion was up 129% on a year-over-year basis, explained by higher shipments. Net income of $312 million was almost $1 billion better than Q3 2017. Tesla also had positive cash flow. (Tesla)

- During the earnings call, Tesla confirmed that it intends to launch an autonomous ride hailing network that will run both customer-owned and Tesla-owner cars. Elon Musk speculated at a 30% cut for Tesla on the billings of customer-owned vehicles. (Seeking Alpha)

- Implication: We could well be proven wrong but we believe the number of private customers opting in will be low. The premium they will expect — several hundred dollars in revenue per month based on our straw polls — plus Tesla’s mark-up is likely to make the cost per mile similar to taxis today. The high level of Musk’s figure (versus about 10% commission that is common on platforms like eBay and Amazon) suggests Tesla has not thoroughly researched the topic yet.

- Intends to reduce delivery times from factory gate release to customer handover to under 10 days for North American vehicles. (Seeking Alpha)

- Believes latent demand for Model 3 is between 500,000 and 1 million vehicles per year, seeing BMW 3 Series as a competitor it should outsell. (Seeking Alpha)

- Implication: As our 2017 analysis showed, we strongly disagree with Tesla’s analysis, seeing 3 Series as having a distinct advantage in terms of: product portfolio; dealership network and strength of finance offering.

- CEO Musk said “many” interior options for Model S and Model X will be dropped from the start of November. He said this was to simplify production. (Business Insider)

- Tesla’s new factory in China will produce two models, according to environmental assessments. (Reuters)

- The US state of Oregon clawed back tax credits awarded to Tesla solar power projects saying costs had been inflated. Tesla denied any wrongdoing, but also pointed out this had happened prior to the SolarCity takeover. (CNBC)

- Under investigation by the FBI for the statements it made around Model 3 production. (Economic Times of India)

- Considering an all-electric MR2. (Autocar)

- CEO Diess said there was too much emotion in the debate about retrofitting German diesel-powered vehicles with additional hardware to improve emissions. (Handelsblatt)

- VW’s Heycar used car sales platform is apparently growing faster than the targets it was set and has sold over 320,000 vehicles. (Handelsblatt)

- VW is reportedly planning to produce batteries with SK Innovation and might collaborate with Waymo on ride hailing. The firm is said to be contemplating purchasing a 10% stake in Waymo for €12 billion. (Reuters)

- VW is reducing its sales forecast for China according to the head of its local business unit. (Nikkei)

- Unveiled the T-Cross, saying SUVs will make up 50% of VW brand sales by 2025. (VW)

- Undertook a restructuring of the truck division so that the energy and powertrain portfolio stays with Volkswagen group and the truck and bus unit (Traton) can approach an IPO as a “pure” business unit. (VW)

- Audi said that more than 95% of electric vehicle batteries could be recycled, in a laboratory. It will now develop a higher volume process and a way to re-use the recovered raw materials. (VW)

- Agreed with its Algerian JV partner to produce Amarok pick-up trucks in the country. (VW)

- VW and Ford are reportedly exploring in-depth sharing of autonomous driving technology. Ford already has a majority share in partner Argo AI whilst VW has partnered with Aurora but was apparently rebuffed in an informal takeover approach. Ford executives stressed that nothing was off the table. (Bloomberg)

- Porsche suggested that it could charge US dealers between $300,000 to $400,000 each to partially offset some of the cost of superchargers the company proposes to install on their premises. (Automotive News)

- Lamborghini’s boss said the firm is contemplating building a limited series super car following the example of the McLaren Senna and Aston Martin Valkyrie. (Autocar)

- Unveiled an “extensive update” for the Audi R8. (Audi)

Other

- Dyson’s electric car will be built in Singapore. Production is due to start in 2021. (Auto Express)

- McLaren unveiled the £1.75 million Speedtail hypercar. The vehicle has several design features to emphasise aerodynamic performance including front wheel fairings and retractable rear view cameras. (McLaren)

- Chinese firm Aiways plans to build several hundred RG Nathalie fuel cell sportscars and says it has a factory in China capable of building 150,000 mass-market cars per year. (Autocar)

- WM Motor is reportedly raising over $400 million in a round that will value it at around $3 billion. (Reuters)

- Fisker has received strategic investment from Caterpillar’s VC arm. (Caterpillar)

- Aston Martin opened a new (and slightly cramped) design studio in China, saying it would work on interiors for forthcoming vehicles. (Aston Martin)

- Chinese automaker FAW secured a 1 trillion yuan ($144 billion) credit line, but didn’t explain what it needed that much money for. (Reuters)

- Uniti is creating a pilot production plant in the UK at Silverstone. (Uniti)

- Faraday Future reportedly announced layoffs and a 20% salary cut to staff in an effort to save money after a dispute with its newest investor, who said that nearly $800 million has been spent in only a few months. Faraday Future now says it welcomes “all investors who share our vision”. (Faraday Future)

- Lucid Motors has reportedly gone on a massive hiring spree. (Thinknum)

News about other companies and trends

Suppliers

- Gestamp reported financial results for Q3 2018. Year to date revenue is €6 billion. (Gestamp)

- Faurecia will buy navigation systems supplier Clarion after agreeing terms with majority shareholder Hitachi. It will headquarter its connectivity-related businesses in Japan. (Faurecia)

- Lear reported financial results for Q3 2018. Revenue was $4.9 billion and net income was $253 million. (Lear)

- Faurecia launched a joint venture with Liuzhou Wuling for emissions components. The two companies already have a partnership for automotive interiors. (Faurecia)

- Veoneer said it would achieve long-term profit targets later than expected because lucrative contracts were being delayed by problems in customer vehicle programs. (Reuters)

- Autoliv reported $2 billion of revenue and $193 million of operating income in Q3 2018. (Autoliv)

- Goodyear reported Q3 2018 financial results. Revenue was down but profits were up. (Goodyear)

- Magna is acquiring mechatronics control company Haptronik. (Magna)

- Gestamp opened a new stampings plant in Matsuska, Japan. (Gestamp)

Dealers

- Due to high demand for used cars in the UK, some dealers are finding there is a shortage of cars in good condition and so are purchasing lower quality vehicles and spending money reconditioning them. (Motor Trader) There is also a strong demand for used diesel vehicles, despite the drops in new car sales. (Motor Trader)

Ride-Hailing, Car Sharing & Rental (history)

- Uber will support drivers in London, UK to buy electric cars with higher incentives for those who drive more and have shown loyalty to the firm. The money is coming from a levy on all trips in London. (Autocar)

- Waze will start offering its carpooling service throughout the USA. (Detroit News)

- As rumoured, Daimler and Geely formed a “premium ride-hailing” joint venture that will use Mercedes-Benz cars, and in time possibly some of Geely’s offerings, for on-demand travel in Chinese cities. It isn’t yet clear how the service will integrate with Geely’s existing CaoCao ride hailing venture. (Daimler)

Driverless / Autonomy (history)

- Waymo has started charging customers to ride in self-driving vehicles. (Financial Times)

- Lyft acquired augmented reality develop Blue Vision labs in a deal said to be worth up to $100 million. (BlueVision)

- Lidar developer Innovusion raised $30 million from a group of investors including NIO Capital and said it would begin sales of Cheetah lidar units. (Innovusion)

- Researchers published a paper that collated data collected from an online survey of 40 million responses to the best way to act in trolley problem scenarios (i.e. where one of two people / groups must die to spare the other). The results showed that opinion varied considerably by country. (Technology Review)

- Implication: Although trolley problems are frequently among the earliest arguments against self-driving cars raised by sceptics (as if most humans are even aware enough to decide such things for themselves in the heat of the moment), the paper shows the limitation of such thinking. Namely, there is no “right” answer, that is, a common rule set that is universal across cultures. In addition, since this is a decision humans are normally incapable of making even when placed in the same situation, it holds the machines to an artificial standard few can claim to properly understand.

- ai has launch a free ride hailing scheme in Texas to test its autonomous vehicles. (Auto Rental News)

- A senior official at the US department of transportation criticised the quality of safety metrics being used by self-driving vehicle developers and said they were insufficient to prove that vehicles are road-worthy. (Bloomberg)

- US authorities halted the testing of an autonomous school bus saying that the terms of the permit didn’t cover transportation of school children, despite the presence of a full time conductor, the trips being on a closed course and the maximum speed of the vehicle being set at 8mph. (BBC)

- Implication: Although US rules appear to encourage a laissez-faire approach to self-driving vehicle development, this is a reminder that regulators will have few qualms about shutting down tests they dislike, even if the risks appear very low.

- Indian ride sharing start-up Zoomcar will install Netradyne driver monitoring hardware in customer vehicles to provide “feedback” on the quality of their driving. (Autocar)

- BMW announced that software firms KPIT and TTTech would join its self-driving platform with the specific aim of developing tailored solutions for third parties. (BMW)

- VW and Ford are reportedly exploring in-depth sharing of autonomous driving technology. Ford already has a majority share in partner Argo AI whilst VW has partnered with Aurora but was apparently rebuffed in an informal takeover approach. Ford executives stressed that nothing was off the table. (Bloomberg)

- Or, VW might collaborate with Waymo on ride hailing. The firm is said to be contemplating purchasing a 10% stake in Waymo for €12 billion. (Reuters)

- BASF agreed a cobalt and nickel supply deal with Norilsk Nickel. (Reuters)

- Sun Mobility has opened several battery swapping stations in India and intends to gradually move from two wheelers and buses to vehicles, once it can convince OEMs to install its batteries. (Autocar)

- VinFast aims to open charging locations at 20,000 petrol stations run by PetroVietnam by 2020. (Reuters)

- Battery developer Enevate received funding from LG Chem. The firm believes it can create batteries that achieve 75% charge in five minutes. (Enevate)

- Volvo invested in charging firm FreeWire. (Volvo)

- Battery maker Kokam was acquired by SolarEdge. (Inside EVs)

- Nissan said it had enough Leaf vehicles enrolled in its vehicle-to-grid scheme to qualify as a power station under German regulations. (Nissan)

- Audi said that more than 95% of electric vehicle batteries could be recycled, in a laboratory. It will now develop a higher volume process and a way to re-use the recovered raw materials. (VW)

- Porsche suggested that it could charge US dealers between $300,000 to $400,000 each to partially offset some of the cost of superchargers the company proposes to install on their premises. (Automotive News)

Connectivity

- Comroads launched a peer-to-peer service for sharing dashcam footage. The idea behind the service is that users might get better crash footage than if they only have their own camera’s video. (ZDNet)

- Infineon launched a new “trusted platform” chip that the company says ensures secure remote access to vehicle control functions, and can be continuously updated to deal with emerging cyber security threats. (Autocar)

- BMW might bid for its own 5G spectrum in Germany, rather than relying on the mobile phone companies to provide the infrastructure the company believes it needs. VW and Daimler also see promise in dedicated networks but hope that the spectrum will be provided free of charge. (Handelsblatt)

Other

- Electric scooter rental firms Grin and Ride have merged. (TechCrunch)

- Electric motorbike manufacturer Alta Motors is reportedly winding down operations. (Asphalt & Rubber)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 21st October 2018

Tesla shrinks into the crowd; weak carmakers lose influence with politicians; and making public transport free for all. Please enjoy our auto industry and mobility briefing for 15th October to 21st October. A PDF version can be found here.

Favourite stories of the past week…?

- I Hate You So Much Right Now — A group of cross-party UK politicians want new sales of internal combustion engine powered vehicles to be banned by 2032, pouring scorn on the government’s current (unlegislated) timeline of 2040. Carmakers should be concerned. The opportunity cost for politicians to pull forward what they are expecting to be technological inevitability by a few years is very low compared to the potential kudos of environmental leadership. By complaining too much about the pace of regulatory change, manufacturers are losing credibility and might find themselves unable to properly influence decisions where politics is trumping environmental and economic concerns.

- All Right Now — The French town of Dunkirk has made all travel on local buses free for residents. The council says that it had to subsidise 90% of the costs anyway, so why not go the whole hog? After a month, usage is up by 50% and left-leaning groups are crowing about its success. But isn’t a 50% increase when you made something FREE a compelling case against route-based public transport? The council’s circa €50 million annual budget could pay for a lot of on-demand pooled rides…

- Lookin’ For A Leader — Tesla has removed the option to pre-purchase full sell driving because, apparently, it’s “confusing” customers that it isn’t nearly ready yet. Although the change is understandable, is it a worrying sign that Tesla has lost its bravado? The company’s brand is built on being a technology leader that commits to new capabilities earlier than it probably should do. Can it maintain cachet while playing it safe?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Created a joint venture with Northvolt and Umicore to improve recycling of used electric car batteries. (BMW)

- Unveiled the production version of the X7. (BMW)

- Recalling charging cords for electric vehicles in the US. (Green Car Reports)

- Released preliminary financial results for Q3 2018 because profits were lower than expected (about €1 billion lower than the prior year). The blame was placed on lower than expected sales of vans, potential recall costs over air conditioning refrigerants and “governmental proceedings and measures” related to diesel vehicles. (Daimler)

- Investing in Soul Machines, a developer of digital avatars. (Reseller)

- Agreed a deal to sell Magneti Marelli to KKR-backed Calsonic Kansei for €6.2 billion and expects the transaction to close in the first half of 2019. (FCA)

- Maserati will reportedly use an 800 volt electric drive developed by Ferrari. (Autocar)

Ferrari

- Maserati will reportedly use an 800 volt electric drive developed by Ferrari. (Autocar)

- Implication: Since Maserati’s first electric cars will be launched in the early 2020s and Ferrari have yet to confirm any product plans (silent development mules notwithstanding), either we can expect a similar launch window for the Ferrari hybrids or there has been an unusual decision to let Maserati launch first.

- Ford promised US dealers that it will cut delivery times for new orders from 82 to 38 days. (Reuters)

- Signed collaboration agreement with Mahindra and Mahindra that will see the Indian firm build a small engine for Ford’s Indian vehicles and a jointly shared telematics platform. (Mahindra)

- Dealers complained that Ford was not giving them enough information about future plans and the amount of exposure to senior leaders had fallen. (Automotive News)

- Increasing lifetime production of the GT to 1,350 units. (Ford)

- Incensed French politicians and unions by refusing a takeover offer from Belgian company Punch Powerglide for the Bordeaux transmissions plant, saying that it would instead proceed with a closure. Although politicians said Ford’s position was incomprehensible, it turns out that the new supplier’s plan had demanded Ford guarantee orders until 2021 (when it wants to stop taking products from 2019) and would only save half the jobs. (Sud Ouest)

- The US safety regulator opened an investigation into F-Series power tailgates that open unexpectedly when the vehicle is in motion. (Detroit News)

- Released a new series of adverts in the USA featuring the “built Ford proud” strapline. In one expensively produced slot Brian Cranston talks down the hot air from the competition (presumably with Tesla in their sights). (Ford)

- Implication: If only the people involved had looked at the script with a slightly more critical eye they might have thought better of including shots of Ford’s bulldozed Dagenham foundry whilst talking about how well Ford prepares for the future (they perhaps mistook it for the Rouge) and been slightly less conceited given that Elon Musk is still on his first car company when it took Henry Ford three tries to get the formula right.

Geely (includes Volvo) (history)

- Hoping to raise €950 million to refinance debt resulting from the its Volvo AB stake. (Reuters)

- Says that 50% of the Care by Volvo subscription users bought the service using their mobile phones. (Engadget)

- Will work with Engie and Air Liquide to boost hydrogen infrastructure for fuel cells. (Yonhap)

Nissan (includes Mitsubishi) (history)

- Mitsubishi commenced production at its new engine plant in China, a joint venture with GAC. (Mitsubishi)

- Nissan created a new business unit to cover Latin American markets. (Nissan)

- Nissan now offers a range of aftermarket option packs aimed at fleet. Nissan says the products can increase residual values and fleets will benefit from discounts and the availability of dealers to fit the accessories. (Nissan)

PSA (includes Opel/Vauxhall) (history)

- German investigators raided Opel’s office and said the firm would need to recall around 100,000 Cascada, Insignia and Zafira cars. Opel said it would challenge any recall order. (Reuters)

- Opel / Vauxhall will continue to use GEFCO for its logistics. (Autocar)

- Withdrawing from rally competitions because it thinks that without electrified vehicles the sport will lose relevance, or it wants to save on marketing spending; whichever version you want to believe. (PSA)

- Opel will offer German customers up to €8,000 to trade in older diesel vehicles for a new car. (Opel)

- Renault’s JV with Brilliance will create a new factory in Liaoning, China to make electric light commercial vehicles. There will be three new, as yet unspecified, models. (Renault)

- CEO Musk said the company will begin installing a new driver assistance chip in about six months. Buyers who have already pre-paid for “self-driving” will receive the chip free of charge. For anyone else, it will cost $5,000 to have the upgrade (presumably including software updates). (Reuters)

- Launched a derivative of the Model 3 with a smaller battery and a $45,000 starting price. (Wired)

- Purchased the land for its new factory in Shanghai, China. (CNBC)

- CEO Musk said he had just realised there were major gaps in the servicing coverage for customers in North America, promising to sort the problem out within 3 to 6 months. (Clean Technica)

- Removed the ability to pre-order “full self-driving” on cars, despite having announced an improved driver assistance chip. Elon Musk said the option was causing too much confusion. (The Verge)

- Implication: Apart from the obvious questions about Tesla’s ability to deliver on its promises, the move also tarnishes Tesla’s technology leadership crown and leaves a space for other companies to claim.

- The head of Toyota’s self-driving program in the US said the safety argument for robotaxis was flawed because the gains were insufficiently large over human drivers. (IEEE Spectrum)

- Ran an advertising pilot that claimed a 21% improvement in performance from using blockchain to verify that real users had been shown advertisements. The press release was heavy on mentions of blockchain but light on explanation. (Lucidity)

- Porsche’s CFO said that if VW were to spin off its luxury brands, they could reach a collective valuation of between €60 billion and €70 billion but the company quickly rowed back on the comments. (CNBC)

- CEO Diess told suppliers there would be a €50 billion to €60 billion market for battery cells in Europe soon, and the opportunity could even rise to €100 billion. He also believes that German carmakers have a 50:50 chance of retaining their competitive advance in 10 years. Diess once again took the opportunity to complain about CO2 regulations in Europe and said that with the current mix of electricity generation in Germany (lots of coal), electric vehicles were not that clean. (VW)

- Announced a new factory in Anting, China in partnership with SAIC that will be purpose built to produce electric cars on the MEB platform. The plant will produce up to 300,000 units annually. (VW)

- Audi will pay a €800 million fine to German prosecutors for its part in the diesel scandal. (Audi)

- Launched a big marketing program for diesel owners in Germany, with discounts of between €4,000 to €8,000 depending on the combination of new and traded in vehicle. VW is also offering incremental discounts to buyers in 14 areas with the worst emissions. (VW)

- The Audi etron battery electric SUV is suffering launch delays of several weeks caused by software issues. (Reuters)

- Porsche wants to price the Taycan (Mission E as was) between the Cayenne and Panamera, indicating a starting price around €80,000. There could be performance versions priced as high as €200,000, with a Taycan Turbo S nameplate mooted — confusing since there wouldn’t be a turbo in sight. (Automotive News)

- To nobody’s surprise, Porsche confirmed the Mission E Cross Turismo had been approved for series production. The 300 jobs the firm says will be created indicate and expected annual volume of around 5,000 units. (Porsche)

- Executives said Porsche would have an all-electric “big SUV” by 2022, thought to be a new vehicle in the line-up beyond the Taycan Cross Turismo since “the Taycan derivatives have already been showcased”. (Autocar)

- Sharing the development costs for the forthcoming PPE platform between Porsche and Audi will reportedly save both brands 30% versus going it alone. (Porsche)

- Started production of the SEAT Tarraco at the Wolfsburg plant. (VW)

- Audi says it will implement a new type of panel quality checking system in its press shops. It will replace a camera system that uses image recognition specific to the type of panel being made with one that can recognise defects in all kinds of parts. Although Audi had to spend lots of time teaching the new system, the company says it will be worth it when it can introduce new parts with less effort. (Audi)

- Škoda’s next c-car will be called the Scala, with the Rapid nameplate being retired. (Autocar)

- Implication: Rapid, Rapide are on the way out. Vitesse seems permanently confined to the dustbin. Veloster soldiers on. Superfast and Speedster are brand new. What does this mean for velocity-related nameplates?

Other

- Aston Martin trademarked the “Valhalla” name and seems set to use it in either its forthcoming hypercar or mid-engined sportscar. The former is more likely. (Motor 1)

- ATS will make 12 McLaren-based GTs with an advertised price of €740,000. (EVO)

- NIO had delivered 3,368 cars by the end of September. It is aiming for 10,000 by the end of the year. (NIO)

- Foton said it wanted to sell up to 67% of Borgward to help the brand grow. (China Daily)

News about other companies and trends

Economic / Political News

- European passenger car registrations in September of 1.12 million were down (23.4)% on the same period a year earlier. On a year to date basis, sales are up 2.3%. (ACEA)

- A cross-party group of UK politicians called for a ban on gasoline and diesel vehicles by 2032. (The Guardian)

- EU politicians want a 35% decrease in CO2 from commercial vehicles from 2021 levels, mirroring the improvements earlier proposed for passenger cars. (Auto Blog)

Suppliers

- Michelin announced Q3 financial results. Revenue was down year-on-year, and full year profit outlook was “refined” (Michelin-speak for downgraded). (Michelin)

- ZF is working on augmented safety systems using interior cameras to detect interior cabin arrangements, such as whether the seats are reclined, to tailor crash setting and improve survivability. (ZF)

- Adient reported preliminary Q3 20018 and full year financial results. (Adient)

- Denso released its annual report and announced the firm’s “second founding” as a mobility company. (Denso)

- Sundaram-Clayton opened a new foundry in Chennai, India. (Autocar)

- ZF purchased a 35% stake in engineering services provider ASAP for an undisclosed sum. (ZF)

- FCA agreed a deal to sell Magneti Marelli to KKR-backed Calsonic Kansei for €6.2 billion and expects the transaction to close in the first half of 2019. (FCA)

Dealers

- Chinese used car online sales platform Chehaoduo raised $162 million. (Shine)

- Start-up LotBlok will launch a blockchain-based car sales platform. (LotBlok)

Ride-Hailing, Car Sharing & Rental (history)

- Uber is reportedly seeking a $120 billion valuation for its IPO (The Guardian) and recently raised $2 billion in debt to tide it over until that mega payday. (CNBC)

- Electric car sharing firm Scoot launched services in Chile. (Scoot)

- The French town of Dunkirk made all its bus services free for residents, saying that fares only covered 10% of the operating costs anyway. One month after the scheme was implemented, usage had risen by 50%. (The Guardian)

- Uber is creating a business leasing trailers for heavy goods vehicles. (Uber)

- Careem announced $200 million of a hoped-for $500 million fund raising round. (Careem)

- Ride hailing start-up Alto raised $13 million and will soon start operations in Texas. (Dallas Innovates)

- Ford’s Chariot service will start offering private bookings. It isn’t clear how the utilisation will be sufficiently high to make the service cheaper than existing options. (Ford)

- Uber studied 1.5 million rides to determine the best way of apologising to customers (and found out it is by giving them a $5 discount). (Business Insider) the firm is also studying a short term staffing business. (TechCrunch)

Driverless / Autonomy (history)

- Lidar firm SOS Lab raised $6 million. (Optics)

- Autonomous driving developer Momenta raised $46 million in a round valuing it at over $1 billion. (Momenta)

- Self-driving simulation company Cognata raised $18.5 million. (Reuters)

- Lidar developer Leddartech recently opened new development sites, in Austria and Canada. (Leddartech)

- UK Taxi firm Addison Lee and autonomous vehicle developer Oxbotica announced a plan to commence services with self-driving taxis in London by 2021. (The Guardian)

- Uber has reportedly been receiving unsolicited bids for its self-driving arm. (Financial Times)

- An article suggested that Google’s initial self-driving cars had a worse safety record than official documents show, because of the cavalier attitude of some of the developers. (New Yorker)

- Rinspeed unveiled a new, smaller, version of its skateboard concept called the MicroSNAP. (Car Scoops)

- Sensor fusion company Vayavision raised $8 million. They claim that through processing, their technology can dramatically upscale lidar and radar inputs. (PE Hub)

- The head of Toyota’s self-driving program in the US said the safety argument for robotaxis was flawed because the gains were insufficiently large over human drivers. (IEEE Spectrum)

- US lawmakers proposed to remove the cap on federal rebates for zero emission vehicles. Under current rules, once a carmaker sells 200,000 units the $7,500 tax credit starts to drop. Tesla and GM would be the primary beneficiaries since they are already near or over the limit. (Yahoo)

- Researchers think they have cracked the problem of high-power wireless charging. In a laboratory they demonstrated a 120 kW system (only slightly lower power than Tesla superchargers) working at 97% efficiency. (Inside EVs)

- Workhorse launched the NGEN-1000 light commercial vehicle saying it had opted for a 100-mile range with a smaller battery to better compere on cost with diesel vehicles. (Workhorse)

- Implication: Since the received wisdom is that greater range is better and commercial operators feel constrained by shorter range (although plenty of use cases are satisfied by the specifications). It will be interesting to see whether Workhorse’s logic works.

- BMW, Northvolt and Umicore created a joint venture to improve recycling of used electric car batteries. (BMW)

Connectivity

- Intel and Simacan are creating the infrastructure for trucks to platoon on high traffic routes in Germany. (Intel)

- Ford will use technology from Wind River to manage over the air updates. (Telematics News)

- TomTom lost its contract to supply Volvo with in-built mapping. (Reuters)

Other

- Geely-owned flying car firm Terrafugia started taking orders but hasn’t yet announced pricing. (Automotive News)

- The Bloodhound supersonic car program went into administration, needing £25 million to complete the program objectives. Executives appeared bullish on the prospects for a recovery. (Autocar)

- Volvo Trucks said it would have to recall some trucks because degradation of components could cause vehicles to exceed emissions regulations as they aged. (Reuters)

- Bicycle sharing start-up Zoov uses electrically-assisted bikes with a non-traditional rack for charging. Although the bicycles have to be docked, they do not use locks. (Engadget)

- Electric scooter rental firm Grin raised $45 million to expand in South and Central America. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 14th October 2018

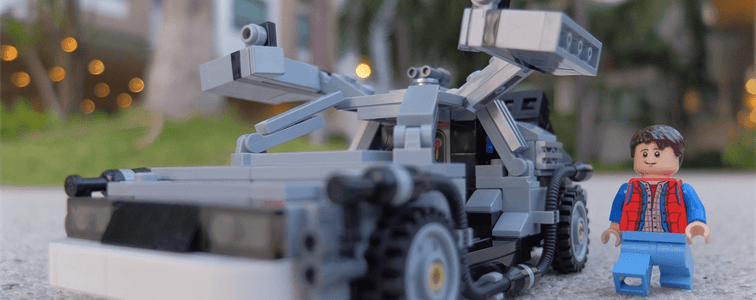

Verifying the safety of driverless vehicles; Executives and politicians play pass the parcel; and move over Marty McFly. Please enjoy our auto industry and mobility briefing for 8th October to 14th October. A PDF version can be found here.

Favourite stories of the past week…?

- Paperback Writer — Uber commissioned a report about measuring autonomous safety from RAND. It makes for interesting reading although it raises more questions than it answers. RAND say they weren’t seeking to determine a way forward, just point out considerations, but their inability to identify a clear path forward suggests governments need to get their thinking caps on and talk to each other.

- Angry Again — VW’s CEO went on a bit of a rampage criticising EU politicians for setting emissions targets that will cause “a painful revolution instead of a transition”. VW believes that to meet new emissions targets (likely to be 35% lower by 2030 than 2021) would mean nearly half of vehicles would have to be fully electric (our maths is VERY different). But can the industry really complain that 12 years isn’t enough time to plan? Are automotive executives worried about unforeseen shocks, or just angry at having to confront entrenched interests they were hoping would fade away?

- Message In A Bottle — PSA’s CEO received a letter from himself in 2038. He described a world where autonomous cars speed around and ride hailing services send us on journeys with like-minded individuals who might want to discuss what we’ve seen on tv (and in-car olives? They weren’t mentioned). Private car ownership persists apparently, but why (btw, he says here @ 17:00 that PSA “isn’t afraid” of that happening)?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Confirmed plans to take a majority share of its Chinese joint venture with Brilliance. Under a new agreement that extends to 2040, BMW will see its stake rise to 75%, local production capacity will rise to 650,000 units annually and the two partners will invest €3 billion “in the coming years”. (BMW)

- Sold 1,834,810 units globally in Q3 2018, a 1.3% increase on a year earlier. (BMW)

- BMW’s greater joint venture share will cost the company €3.6 billion and the deal will close in 2022. (Reuters)

- Concluded the formation of its 51% software joint venture with Critical Software based in Portugal. (BMW)

- Sold 1,715,087 units in Q3 2018, down (0.1)% on Q3 2017. (Daimler)

- Reportedly in talks with Geely to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

- Italian unions are becoming increasingly alarmed about repeated down days at plants in Turin. (Torino Oggi)

- Ended production of diesel powered Pandas. (Fleet Europe)

- Reportedly part of a yet-to-be-announced German battery consortium that will be supported by €1 billion of government cash and is set to be officially launched on 13th (Reuters)

- Said that the previously reported assembly of pure electric Transit vans in Germany employed 180 employees working in two shifts, for a capacity of 3,500 vehicles per year. (Ford)

- Recalling around 200 GTs to correct problems that can cause fires. (Ford)

- Kanye West stopped by the White House to tell Donald Trump that Ford needed to have “the highest design” and the “flyest, freshest, most amazing car” but declined to elaborate on how to do so. Ford’s spokesman replied “like we always say, you can’t spell fresh, fly and dope without Ford”. (Detroit Free Press)

- CEO Hackett said no one was ahead of Ford in developing autonomous vehicles. (Axios)

Geely (includes Volvo) (history)

- Launched production of Geely vehicles at its factory in Tunisia. (Xinhua)

- Reportedly in talks with Daimler to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

- Looking at an expansion of the Care by Volvo subscription service to include used vehicles. (CNET)

- Workers in South Korea may go on strike over the company’s moves to separate its R&D operations there from the plants. Unions said the restructuring “appears to be a move to sell its car plants”. (Yonhap)

- GM executives think some people turn down ride hailing if the driver has an Infiniti QX60 rather than a Chevrolet Suburban. (Digital Trends)

- Hyundai’s Cradle VC unit invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Hyundai)

Nissan (includes Mitsubishi) (history)

- The Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Delayed pay talks with UK unions until 2019, awaiting the outcome of Brexit negotiations. (Sky News)

PSA (includes Opel/Vauxhall) (history)

- Confirmed already rumoured changes to the Opel /Vauxhall line-up, saying that Adam, Karl/Viva and Cascada will be dropped by the end of 2019, mainly because of poor CO2 In 2020, Opel / Vauxhall vehicles will cover 80% of “mainstream market volume”. (PSA)

- CEO Tavares sent a letter from the year 2038 where he lives in a world of 230 kmh autonomous sports cars, where L5 capability counts for 25% of sales and ride hailing services that match him with other motorsport nuts. He declined to say who was Formula 1 world champion the prior year, presumably having watched Back To The Future II before writing. His main message was that stakeholders needed to come together to accept revolutionary change should not stand in the way of progress, even though automotive employment accounts for around 6% of the European total. (Les Echos)

- Will finalise the strategy to enter the US market by spring 2019. (Automotive News)

- Started offering Opel vehicles under Free2Move branded lease deals. (Opel)

- The Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Signed cooperation agreements with three major European energy companies — EDF, Enel and Total — to establish electrical charging infrastructure. (Renault)

Suzuki

- Proceeding with land acquisition for production of a second plant in Gujarat, India, 35km from an existing factory. Construction will begin once capacity increases at other plants are in place. (Economic Times of India)

- Reportedly considering ending all conventionally powered Jaguar vehicles within the next five to seven years (e.g. at the end of the current model cycle, including the yet-to-be launched but heavily rumoured J-Pace). Internal forecasts are that a four to five car line-up could sell 300,000 units annually. (Autocar)

- Planning a major revamp of Indian dealers from 2019 onwards. (Live Mint)

- A letter to agency staff said the Solihull shutdown was due to a backlog of 25,000 unsold units. (Birmingham Mail)

- Rumoured to be considering buying V8 engines from BMW to replace high power units currently sourced from Ford for the next generation F-Type. (CAR)

- Customers in the US wishing to qualify for a full fat federal tax credit had to order cars by the 15th (Reuters)

- Reportedly struggling to maintain production of Model 5,000 units per week. (CNBC)

- CEO Musk denied that James Murdoch was in the running to replace him as Chairman. (Bloomberg)

- Registered trademarks for a Tesla-branded Tequila. (Business Insider)

- Implication: Tesla once again upends industry convention that drinking and driving should never be associated by laying plans to put it’s brand on a bottle. In a world where beer companies pay Formula 1 drivers to appear in adverts turning down their product at parties, it’s a bold move.

- Toyota AI Ventures invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Toyota)

- CEO Diess said a 40% reduction in CO2 levels by 2030 would mean losing “around a quarter of the jobs in our factories” — 100,000 by his estimate. He wants a slower transition to full electric vehicles to avoid a “painful revolution”. (VW)

- Implication: Despite having a more bullish EV forecast than most OEMs, VW is concerned about a pace of change that is probably beyond its control. OEMs need to do more to prepare themselves for the uncertainty of a transition to electrification. Finding ways to stop developing unique models for pure electric vehicles would be a good start.

- VW Group sales in Q3 were 2,611,300 units, a drop of (1.5)% on the prior year. (VW)

- Having a 20-day shutdown at its Taubaté, Brazil plant because of weak Argentinian sales. (Reuters)

- Audi’s interim CEO is lobbying to have the job on a permanent basis. (Handelsblatt)

- Launched production of the Audi A1 at SEAT’s Martorell plant. (VW)

Other

- Bollinger announced an all-electric pick-up truck version of the SUV it has been developing. (Bollinger)

- VinFast agreed a $950 million credit line to by manufacturing equipment from German companies (Vietnam News). Unfortunately, VinFast’s parent had its credit rating outlook downgraded because of its carmaking plans. (VnExpress)

- Electric car start-up e.Go says that changes in supplier controls have delayed the start of production but it now has a roadmap to make vehicles from April 2019 onwards. (Golem)

- RBW is offering all-electric MGBs with powertrain from Zytek. (Green Car Reports)

- Lamborghini might be calling their lawyers in Tehran about a Hyundai-powered Murcielago-clone. (Russia Today)

News about other companies and trends

Economic / Political News

- The UK is reducing the generosity of its EV incentives and “focusing its attention” on BEVs. (Reuters) The industry body said it was putting the transition to electrification “at risk”. (SMMT)

- EU governments backed a proposal for passenger car CO2 emissions to be reduced by 35% from 2021 levels. That is lower than the European Parliament’s 40% threshold but higher than the original suggestion of 30%. (Reuters)

- Israel intends to stop sale of new gasoline or diesel-powered cars by 2030, insisting that by then vehicles must either be electric or powered by natural gas. (Reuters)

- Germany’s diesel fund which OEMs and the government funded in a bid to see off actions to ban diesels from cities hasn’t dispersed all the money, so VW, Daimler and BMW will get millions back. (Manager Magazin)

Suppliers

- Continental was forced by its unions to say there would be no plant closures in Germany and executive calls for improved efficiency were aimed at global operations. (Handelsblatt)

- Borg Warner opened a new plant for electric vehicle motors and drive system components in Wuhan, China on the site of a former Remy factory (acquired by Borg Warner last year). (Borg Warner)

- Denso took a small stake in software developer eSol. (Autocar)

- Bosch says diesel is still a “pillar” of its business and that it will continue to invest in the technology. The company also believes that although some OEMs are announcing in-house production of electric motors, they are doing it “for reasons of jobs” and that ultimately it will become a supplier business. (Les Echos)

- Magna opened a seating plant in the Czech Republic to serve BMW. (Magna)

- Volvo will use NVIDIA chips in its future cars. (Volvo)

Dealers

- The head of the Indian dealer association expects consolidation, saying dealerships are under stress. (Autocar)

- Mobile car repair service YourMechanic raised $10.1 million. (FINSMES)

- Consumers say UK dealers need to provide more parking spaces and coffee machines, indicating that there are many who aren’t yet convinced by an online purchasing experience. (Motor Trader)

Ride-Hailing, Car Sharing & Rental (history)

- Microsoft made a strategic investment in Grab. (Microsoft)

- Ola is reportedly courting a $100 million investment from a private investor. (Economic Times of India)

- UK Uber drivers staged a strike to protest for higher fares. (TechCrunch)

- Careem says employees can have as much holiday as they want. (Careem)

- Bosch is starting a battery electric van rental business in Germany. (Reuters)

- Renault-Nissan-Mitsubishi’s Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Daimler and Geely are reportedly in talks to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

Driverless / Autonomy (history)

- Lidar developer RoboSense announced $45 million in funding. (RoboSense)

- Uber sponsored a study by RAND into safe testing of autonomous vehicles. (RAND)

- Waymo’s fleet passed 10 million miles of testing on public roads and said it was racking up 10 million virtual miles each day. (Waymo)

- Hyundai’s Cradle VC unit and Toyota AI Ventures invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Hyundai) (Toyota)

- Bollinger announced an all-electric pick-up truck version of the SUV it has been developing. (Bollinger)

- Ford and Varta are reportedly part of a yet-to-be-announced German battery consortium that will be supported by €1 billion of government cash and is set to be officially launched on 13th (Reuters)

Other

- Lime lost its case to enact a restraining order on San Francisco’s scheme to limit the number of scooter companies allowed to operate in the city. (Engadget)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 7th October 2018

How driverless vehicles can thrive today; GM and Honda’s recipe for self-driving success; and is Ford really getting fitter? Please enjoy our auto industry and mobility briefing for 1st October to 7th October. A PDF version can be found here.

Favourite stories of the past week…?

- Airportman — Autonomous pod maker Navya is working with a maker of airport vehicles to develop a self-driving vehicle to haul luggage. Smart move. Airports look like a great location to implement this type of product: it is a closed course; there isn’t much traffic; and there are humans close by if the system stops working properly. Roll on savings…

- Cruisin’ — Honda are buying a $750 million stake in GM’s Cruise and will spend a further $2 billion over ten years. The deal establishes that GM are interested in sharing the technology and would prefer a well-funded effort that works to proprietary knowledge that is slow to develop. Choosing Honda also indicates GM prefers regionally disparate partners. The door could be open to a European OEM. It also shows that GM understands capital allocation and return on investment. As ridiculous as the Cruise acquisition looked a few years ago, and despite the vehicles not working properly and the rationale behind building a new ride hailing network being unclear, it has been turned into something that has real value.

- You Talk Too Much — Ford’s US management team have made the business fitter by starting a new day-long meeting each week that sees the top team journey around a series of product specific war rooms. Journalists were told that the process helped executives decide to stop making big SUVs with tiny screens because customers didn’t want them — something a build to order system would have done in a far simpler way. Is this really what “operational fitness” looks like in 2018?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Confirmed that the i4 will launch in 2021. (BMW)

- Falling orders from BMW have led Nedcar to cut 1,000 of the 7,000 staff at the plant. (Dutch News)

- Dropping the i3 range extender from the line-up, citing the improved range of the upgraded battery version and lower sales. (Autocar)

- Said “there may be some news” in 2019 about extra partners for its autonomy collaborative. (Reuters)

- Would allocate more Mini production to the Netherlands in the event of Brexit. (Reuters)

- Daimler’s CFO will leave by the end of 2019, having chosen not to renew his contract. (Daimler)

- Started construction of its previously announced battery plant in Alabama, USA. (Daimler)

- Reportedly intends to recall Jeep Wranglers to fix faulty welds. (LiveMint)

- Told salaried employees it is in “the early stages of an organizational redesign of the global salaried workforce” and that some redundancies should be expected but there was no firm target. (Bloomberg)

- Ford’s North American management team have adopted a new process where they (20 executives) spend one entire day per week reviewing a series of 13 war rooms containing information on different models. Despite the management time, the only example of progress they were prepared to offer was a decision to increase production of cars with large infotainment screens and drop a less capable system. (Automotive News)

- Implication: By the way, this is the sort of thing that building to order, rather than scheduling vehicles months in advance, would overcome without the need for expensive executive analysis.

- PSA said it will not “develop more evolutions of diesel technology” unless it can see a clear future market demand. The company has apparently decided that a mix of 5% or lower by 2023 would see diesel discontinued. It is unclear whether Ford shares the same view. If not, it will impact their diesel collaboration. (Autocar)

- Idling Transit production in Kansas City for two weeks, citing the variability of fleet orders. (Detroit Free Press)

- Using quantum computing to create efficient route planning for diesel vehicles. Ford says that doing such work on traditional computers does not scale properly. (Ford)

- Invested in weather forecasting start-up ClimaCcell as part of a $45 million round. (ClimaCell)

Geely (includes Volvo) (history)

- Buying two Geely-affiliated engine plants in China from local holding companies. (Reuters)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Implication: GM accomplished two things with this deal: 1) it sent a signal to other carmakers that Cruise is truly open for business, although it probably prefers to share with those that are regionally disparate from GM’s core operations (any European-centric OEMs interested in partnering? Looking at you, JLR and PSA); 2) GM is using Cruise as a case in point on capital allocation by inviting others to jointly fund research and trumpeting the increase in value since taking over the start-up.

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- CEO Barra said US regulators needed to set rules for self-driving vehicles, calling new legislation “essential”. (Axios)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- Honda’s long-running talks on a cooperation with Waymo reportedly feel flat because Waymo would not share technical details of its self-driving technology and wanted Honda to focus solely on delivering a donor vehicle. By contrast, GM apparently invited Honda engineers for in-depth technical reviews before the Cruise investment, including multiple tests and code analysis. (Bloomberg)

- Launched a pilot in Ohio, USA to test V2X communications and gantry-mounted object recognition. (Honda)

- US magazine Consumer Reports said there were problem with 1.5 litre engines in the CR-V that could cause stalls. Honda argued that the issue was small in nature and not safety critical. (CNN)

Mazda

- Will deploy “some form” of electrification in all vehicles by 2030, forecasting 95% of sales will be hybrid and 5% BEV by that time. Mazda includes range-extender vehicles, for which it is developing a new rotary engine, in its BEV mix forecast. (Mazda)

Nissan (includes Mitsubishi) (history)

- Increasing production capacity of the Xpander from 160,000 to 200,000 units annually. (Mitsubishi)

- Carlos Ghosn said Renault-Nissan-Mitsubishi may extend its cooperation with Daimler to include battery technology, autonomy and mobility services. (Reuters)

PSA (includes Opel/Vauxhall) (history)

- Will not “develop more evolutions of diesel technology” unless it can see a clear future market demand. The company has apparently decided that a mix of 5% or lower by 2023 would see diesel discontinued. (Autocar)

- Implication: It isn’t totally clear what PSA’s view of what constitutes an “evolution”. Are they saying the investment would fall to zero or simply commenting that they have ruled out new ground-up engines? The statement leaves questions around PSA’s commercial vehicle business since this is almost 100% diesel and primarily uses engines developed for cars.

- Unveiled more details of its already-announced CMP platform for smaller vehicles. PSA said that Chinese partner (and minority shareholder) Dongfeng paid 50% of the development cost. The platform can accommodate ICE, PHEV and BEV powertrains. (PSA)

- CEO Tavares said Opel was only around one third of the way through its efficiency plan, saying that laws forcing the involvement of unions had made progress “very difficult”. (FAZ)

- CEO Tavares cautioned that “what everyone needs to realise is that clean mobility is like organic food — it is more expensive”. He may find his comments less profound after reading the various EU technical documents on electric vehicles and lower CO2 which state very clearly that this is absolutely the EU’s expectation. (Reuters)

- Unveiled the K-ZE small electric crossover. Renault said the vehicle will be “affordable” and launch in China in 2019, with other global markets following. The company also confirmed plans for hybrid and plug-in versions of the Captur, Clio and Megane in Europe. (Renault)

- Executives said Renault wanted to add a C-sized electric car to its line-up, potentially with SUV-styling and a real world range of 310 miles by 2022. (Autocar)

- Invested in directional sound specialist Akoustic Arts. (Renault)

- CEO Ghosn said Renault-Nissan-Mitsubishi may extend its cooperation with Daimler to include battery technology, autonomy and mobility services. (Reuters)

- CEO Ghosn said diesel is “condemned” because of policymakers. (Financial Times)

- Executives said Renault was unsure whether to continue with the Scenic at the end of the current cycle. (Autocar)

- JLR said it had spent in the low double digit millions of pounds on Brexit preparation. (Bloomberg)

- Planning a two week shutdown in Solihull during October, blaming falling demand in China. (BBC)

- Defender prototypes have been spotted around JLR’s engineering facilities, their camouflage and decoy bodywork seemingly undermined by uncharacteristic hashtag branding across several surfaces. (Sunday Times)

- Reported Q3 deliveries of 83,500 vehicles. Model 3 shipped 55,840 units and 53,239 vehicles were made during the quarter. There were 14,470 Model S and 13,190 Model X vehicles delivered, indicating that demand for both has plateaued. The firm complained about its cost disadvantage in China. (Tesla)

- CEO Musk ranted about shortsellers and the investors who lend them shares to short, saying there was “no rational basis for a long holder to lend their stock”. (CNBC)

- Implication: Ad Punctum has heard a different point of view from long only investors, being told something along the lines of “short selling goes on, my investment hypothesis takes account of short selling, so why not profit even more by letting them use my stock to do the shorting I’ve already taken into account?”. Although Musk took aim at index tracking funds, the same argument still applies in the context of the overall index.

- Published its safety report for Q3 2018. The data was very vague, specifying only per mile occurrence rather than gross figures for fleet mileage or accidents. Tesla say their driver assistance systems reduced the likelihood of accidents by almost half but comparison to average statistics was made more difficult by Tesla recording, but not separately reporting “crash-like” events (i.e. where there wasn’t actually a crash). (Tesla)

- An article highlighted stocks of Teslas at various distribution points across the USA, suggesting the numbers pointed to unacknowledged problems. More likely, they are simply appropriate for the volume of Model 3 being produced and Tesla’s lack of third-party inventory. (New York Times)

- Model 3 received standout crash test results from US agency NHTSA. For some reason, Tesla chose comparison videos for older competitor cars to highlight the relative performance gap (for instance a 2016MY Lexus ES when there is a new car for the 2019MY). (Tesla)

- Created a joint venture with Softbank called Monet, in which Toyota will have 49.75%, aiming to jointly develop on-demand mobility services and uses for Toyota’s e-Palette autonomous vehicle platform. (Toyota)

- Recalling 2.4 million cars built between 2008 and 2014 to because of a condition where the vehicle can stall at high speed. The same cars have already been recalled once but it seems not all problems were fixed. (Times of India)

- Škoda’s CEO said the brand needs a further 400,000 units of annual capacity. (Times of India)

- Bugatti CEO said the brand “is ready for more” and might launch a crossover or SUV. (Bloomberg)

- Porsche will produce 1,948 examples of the 911 Speedster shown in Paris, with sales starting in 2019. (Autocar)

- It wasn’t an April fools’ joke. VW T-Roc cabriolets have been spotted out and about. (Autocar)

Other

- Aston Martin’s IPO didn’t go well with the stock immediately dropping. (The Guardian)

- VinFast executives said the group was prepared to spend $3.5 billion on launching the company. (Reuters)

- Faraday Future’s founder is in dispute with the company he apparently agreed to sell a 45% stake in the electric vehicle start-up to. (Reuters)

- The Aspark Owl order book opened with a non-refundable deposit of $1.15 million being requested to secure one of the 50 $3.6 million electric supercars. Tesla Roadster launch editions look cheap by comparison. (Jalopnik)

News about other companies and trends

Economic / Political News

- The EU Parliament voted for harsher CO2 reduction targets than previously recommended — a 20% reduction from 2021 levels by 2025 and a 40% reduction against the same reference by 2030. In addition, quotas for sales of low and zero emission vehicles (in effect PHEVs and BEVs) would be set at 20% by 2025 and 35% by 2030. (EU Europa) The European trade body pleaded for national governments to “bring some realism to the table” before the targets are fixed. (ACEA)

- German politicians tabled a plan to retrofit older diesels but it met with mixed reaction from carmakers. VW said it would pay some of the costs whilst BMW and PSA said the solution made little sense and baulked at the idea of paying to change a vehicle that was legal at the point of sale. (DW)

- US SAAR of 17.4 million units in September was down (5.8)% versus a year earlier. (Wards)

- UK passenger car registrations of 338,834 units dropped (20.5)% on the September 2017. (SMMT)

- Passenger car registrations in Spain of 69,129 unit in September were down (17)% versus prior year. (ANFAC)

- Italian passenger car registrations of 125,963 units in September dropped (25.5)% on prior year. (UNRAE)

- September passenger car registrations in France of 148,752 units were down (12.8)% on a year earlier. (CCFA)

Suppliers

- Delphi issued a 2018 profit warning and that CEO Butterworth would be stepping down, appointing Hari Nair as CEO on an interim basis. (Delphi)

- ThyssenKrupp will split into two separate entities. The automotive division will be part of a business called ThyssenKrupp Industrials, along with elevators and plant machinery. (ThyssenKrupp)

- Magna and Altran will establish a 50/50 joint venture engineering centre in Casablanca, Morocco. (Autocar)

Dealers

- Online automobile marketplace Droom raised $30 million for international expansion. (Economic Times of India)

Ride-Hailing, Car Sharing & Rental (history)

- Moovel will launch on-demand services in North America through a pilot in Los Angeles. (Moovel)

- Daimler will launch car sharing in Paris with 400 Smart EVs, and Toyota might join in. (Bloomberg)

- Toyota created a joint venture with Softbank called Monet, in which Toyota will have 49.75%, aiming to jointly develop on-demand mobility services and uses for Toyota’s e-Palette autonomous vehicle platform. (Toyota)

Driverless / Autonomy (history)

- US transport regulator NHTSA published draft guidelines for autonomous vehicles. It promised to be proactive and to reinterpret rules written for human drivers to include self-driving vehicles, but also stressed that it would prioritise safety. This is something of a mixed bag for self-driving proponents since although reliable autonomous cars are expected to have less accidents that human-driven ones, there is nothing even approaching a consensus on how to do this without driving billions of miles. (NHTSA)

- US magazine Consumer Reports said that GM’s Supercruise driver assistance system was the best on the market, with Tesla’s Autopilot also being commended. Tesla critics portrayed it as a loss for the brand. (USA Today)

- Self-driving truck start-up Ike emerged from stealth mode saying it planned to run trucks that would never have to leave the US highway system, instead transferring loads at hubs. The company has licenced Nuro’s autonomous driving technology. (Wired)

- Sensor developer Aeva announced $45 million in new funding. (Venture Beat)

- Navya announced a cooperation with Charlatte Manutention to develop autonomous vehicles for use in closed-course settings, such as airport baggage delivery. (Navya)

- Implication: We think this is a smart move as airport vehicles have several characteristics making them suitable for early application of autonomy: 1) they operate continuously in the same environment, so building local knowledge is easy; 2) other traffic can be controlled (and is relatively sparse anyway); 3) there are lots of humans around to help out if the vehicles get stuck for some reason.

- Ford called on self-driving vehicle developers to adopt a common standard for communicating intent to other road users, e.g. whether a vehicle has decided to slow down and give another road user right of way. (Ford)

- Waymo had a significant portion of its lidar patents struck off following a challenge. (Ars Technica)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- Xing Mobility is developing a modular kit that it believes will be useful for retrofitting existing combustion-powered products. (Clean Technica)

Connectivity

- Vayyar Imaging will supply Valeo with in-car sensors to monitor human occupants. (Autocar)

- TomTom will supply maps to PSA “beyond 2020” (TomTom) and also to BMW. (TomTom)

- Honda launched a pilot in Ohio, USA to test V2X communications and gantry-mounted object recognition. (Honda)

- Molex Electronics Technologies acquired Laird’s connected vehicles business. (Autocar)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 30th September 2018

Executives without insurance; the impact of infrastructure; and the difficulty of predicting consumer demand. Please enjoy our auto industry and mobility briefing for 24th September to 30th September. A PDF version can be found here.

Favourite stories of the past week…?

- Falling Into You — McLaren’s CEO said what many automotive executives are thinking when expressing concern that spending “a fortune” on Brexit contingency planning could prove to be a “waste of time”. But isn’t that what insurance is… in hindsight?

- Tell Me Why — ABB executives say the Indian market won’t support battery swapping, citing the complexity of charging the batteries. But surely, if infrastructure isn’t much good, it’s easier to get it working at a central location rather than everywhere?

- Don’t Dream It’s Over — FCA delighted in saying officials planning US fuel economy measures in 2012 failed to anticipate the market shift into SUVs. Isn’t this the same firm that has deemed the same market shift to be a one way street (and pulled products out of the cycle plan accordingly)? What will FCA executives of 2024 think?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Announced a profit warning, primarily blaming, extra incentives in Europe from competitors who were pushing cars into the marketplace ahead of the WLTP cut-off; volatile international trade tariffs; and adjustments to goodwill and warranty reserves. (BMW)

- BMW’s German dealers threatened to not sign revised five-year contracts with the brand, jeopardising sales in October as the situation could theoretically result in a sales stoppage. They relented at the last minute. (Reuters)

- Upgraded the i3’s battery, it now has 42.2 kWh capacity. (Autocar)

- Announced that Ola Källenius will become CEO and head of Mercedes-Benz cars in 2019 with Dieter Zetsche taking a two year “cooling off” period and then returning as chairman in 2021. (Daimler)

- Daimler’s new CEO elect is not in the habit of hugging people. (Handelsblatt)

- Made a series of executive changes, including new leaders for Europe and Maserati. (FCA)

- Executives said the impact of model mix shifting from cars to SUVs in the US was a “wake-up call” for officials setting fuel economy targets. (Reuters)

- FCA’s Michigan plants are suffering a worrying spate of vehicle thefts. (Detroit Free Press)

- Admitted low customer interest (apart from users who would otherwise have opted for rental vehicles) in its Canvas subscription program meant a rethink was needed. (CNET)

- Chairman Bill Ford likes salsa dancing (probably) but detests gyrations in trade negotiations. Although he called for certainty, he declined to say what Ford wants. (Reuters)

- Argo AI’s CEO said Ford’s driverless car program will involve up to 100,000 vehicles. (Bloomberg)