Much uncertainty remains about how the United Kingdom (UK) will exit the European Union (EU) and the nature of their ongoing bi-lateral relationship. Nevertheless, it is already possible to assess some of the impacts on the UK automotive industry. Overall, it doesn’t look positive.

We’ve written an in-depth report which can be found here. The key issues are as follows:

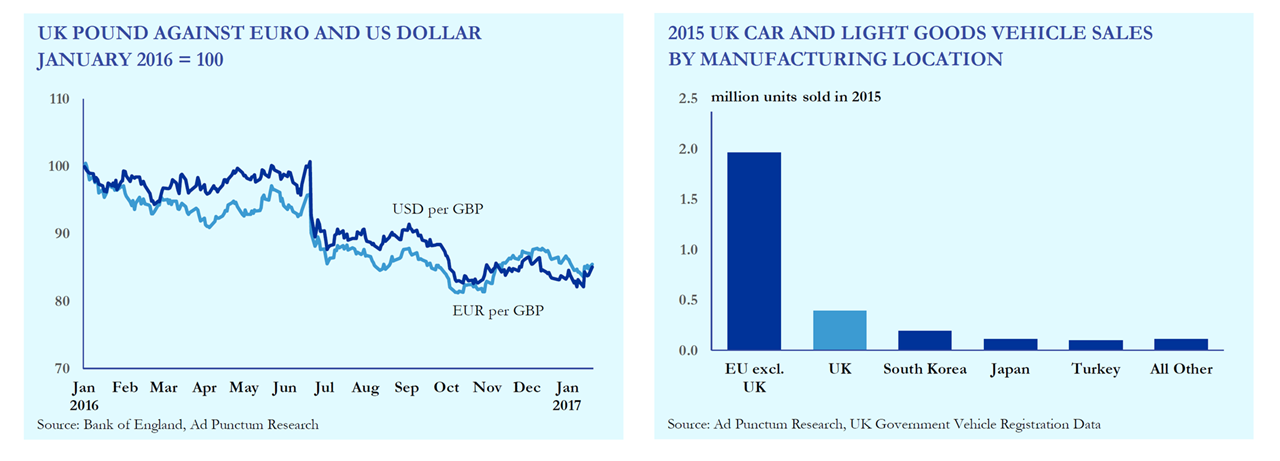

Sterling devaluation has already depressed profit margins

Irrespective of speculation around the actual form of Brexit, profitability has already taken a substantial hit from sterling depreciation. As these two charts show, the pound has lost about 15% of its value versus the euro and dollar since January 2016 and most of the new vehicles sold in the UK are imported. This devaluation is set to cost the likes of GM, Ford and PSA more than $400 million annually.

Tariff barriers expose most OEMs to considerable cost risks and the industry isn’t structurally able to satisfy UK demand from UK factories

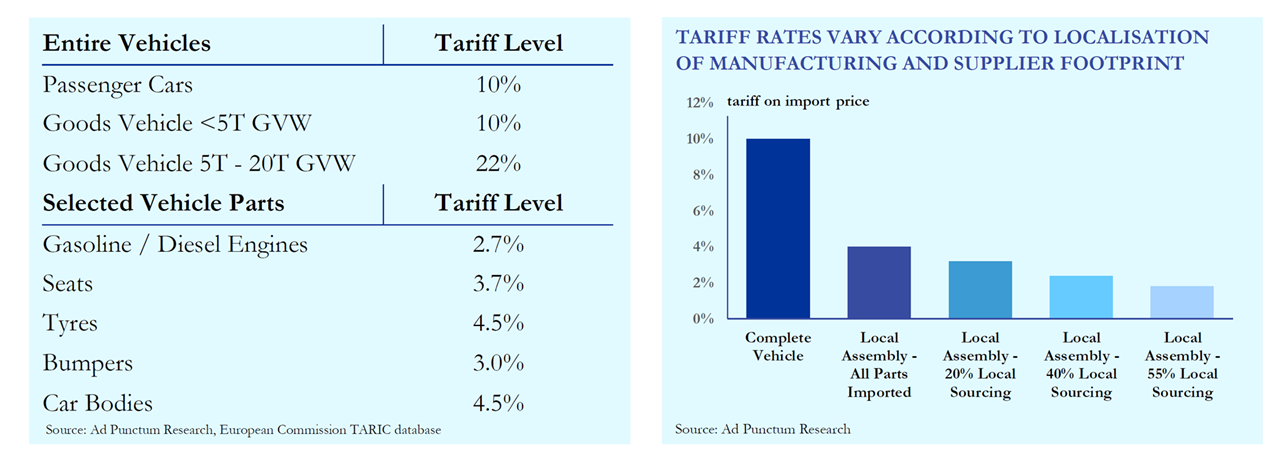

Although the imposition of tariffs is by no means certain – and isn’t the UK government’s preferred option – their impact is so severe that the risk needs to be taken seriously now. The left-hand chart below shows the level of tariffs that OEMs would pay if the UK adopted the EU’s applied tariffs on imports from the continent.

As the right-hand chart below shows, since the supply base for vehicles is spread across Europe (and indeed the world), all volume OEMs would be subject to some degree of tariff cost. Currently, the high-volume product with the greatest amount of local sourcing still imports 45% of the vehicle parts (by value).

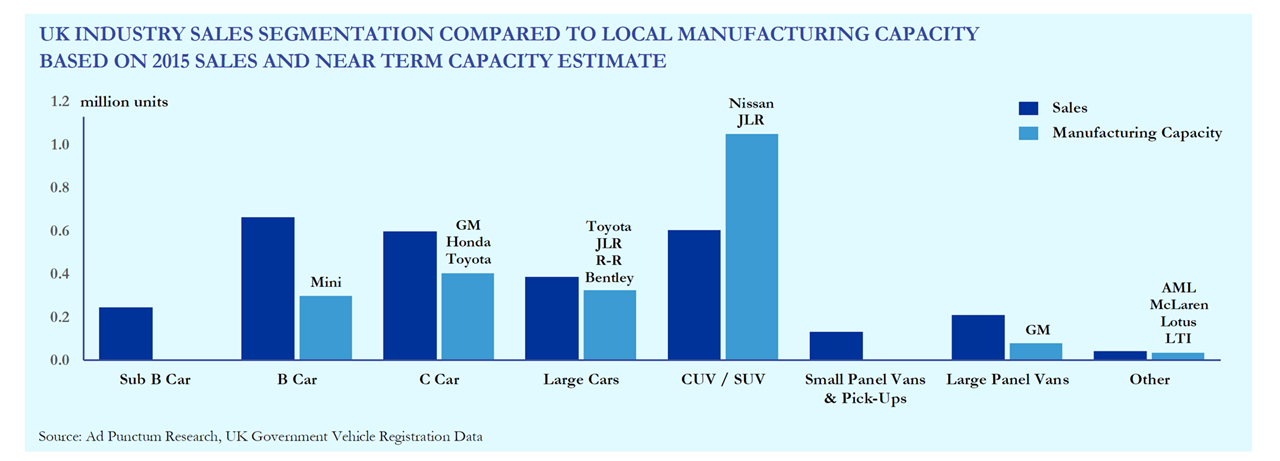

There is an imbalance of supply and demand. The supply is too small to cover demand and produces the wrong type of vehicles. It will not be a simple or quick task to minimise tariffs by better aligning local production with demand.

There is an imbalance of supply and demand. The supply is too small to cover demand and produces the wrong type of vehicles. It will not be a simple or quick task to minimise tariffs by better aligning local production with demand.

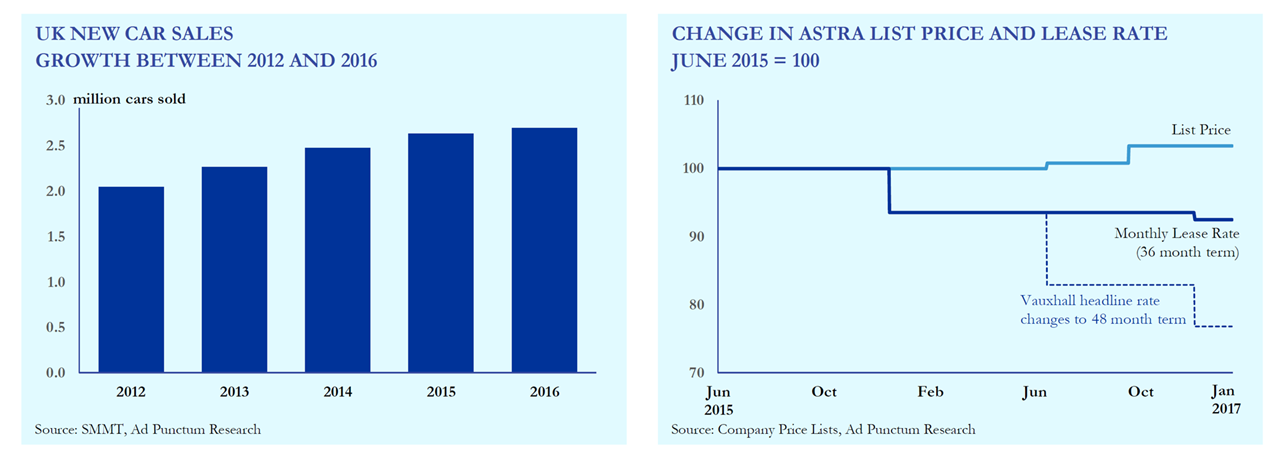

Recovering profitability seamlessly through pricing may be impossible

From the charts below we can see that despite the growth of the UK market in recent years, monthly leasing cost is falling (the right-hand chart uses Vauxhall Astra as an example). The small increases in list price are academic in an industry where almost 90% of sales are financed (see next section). If OEMs are struggling to price in these market conditions, we believe it is unlikely that they will be able to swiftly recover exchange and / or tariff losses.

Some OEM captive finance arms will need restructuring if passporting rights are lost

Some OEM captive finance arms will need restructuring if passporting rights are lost

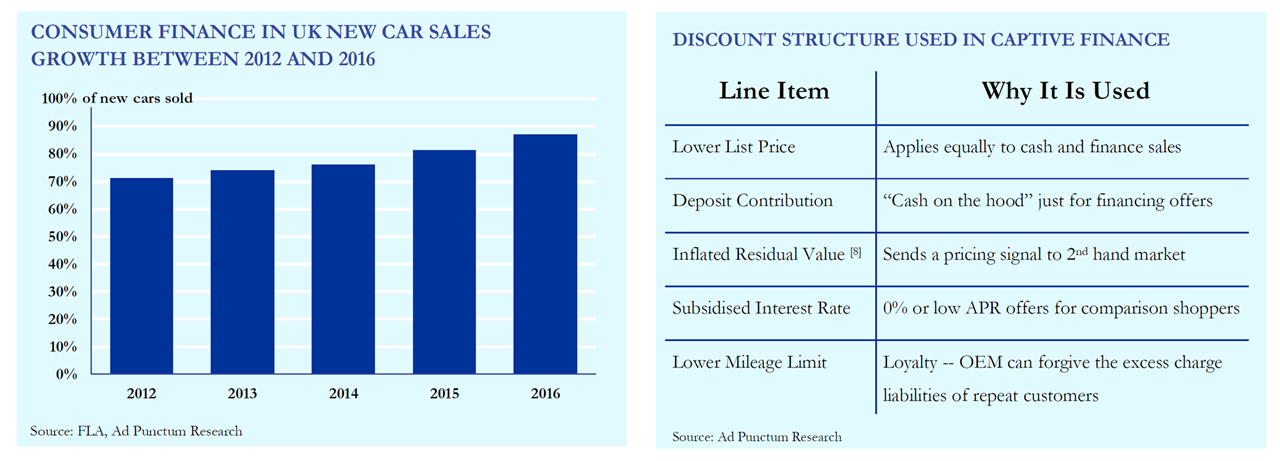

The charts below show that consumer finance is now used in almost all new car sales and how the manufacturers use finance offerings to apply incentives. Although most OEMs have structures in place for their captive finance arms that will be unaffected by Brexit, VW, Renault, Ford and Toyota have some businesses which will require either closure or restructuring.

Day to day operations will be impacted by a range of further potential changes

Day to day operations will be impacted by a range of further potential changes

Each of these is minor in financial terms when compared to the impact of Sterling weakness and threat of tariff barriers but it will require management time and energy to overcome risks such as insufficient data protection standards or fleet emission target lapses.

What should OEMs do next?

If they haven’t already started, a full assessment of their businesses against the factors above using conditions that range from the UK government’s negotiating aspirations to a “no deal” Brexit. Some will then face a choice between doing nothing and facing severe financial consequences, or planning significant changes in resource allocation.

Given the scale of the investments required, most OEMs will likely adopt a wait and see attitude, keep their fingers crossed, and absorb near-term financial impacts rather than commit to costly changes in their structure that would prove unnecessary in the event of an agreement on free movement of goods.

(This post can also be found on LinkedIn here.)

Article Image: Vorotnikova Alyona / Shutterstock