Auto Industry Briefing — week ending 26th January 2020

Not enough money to go around; Mercedes EQC news is good and bad; and cars that last a really long time. Please enjoy our auto industry and mobility briefing for 20th January to 26th January 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Too Many Broken Hearts — The Hydrogen Council (backed by lots of big-name OEMs) want $70 billion spent on hydrogen, forecasting costs will fall by 50%. The thing is… many of the same group are complaining about the low investment in electric vehicle charging infrastructure. So why ask for even more money to be spent on something else?

- I’ll be There — Some say that Mercedes is having problems getting enough batteries for the EQC, and it is hindering production. Others say that everything is just hunky dory and Mercedes will sell 50,000 units this year. That would be Tesla Model X volume territory. What would the Tesla fanbase make of one of their beloved products being beaten in the sales charts? Popcorn anyone?

- Old Before I Die — GM’s Cruise unveiled the Origin, a small shuttle developed with Honda. They put the vehicle lifespan at a million miles. Sounds reasonable, since taxis in New York and London routinely make it to 500,000. But if this vision of the future is correct, won’t that mean far fewer registrations?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart Of The Week

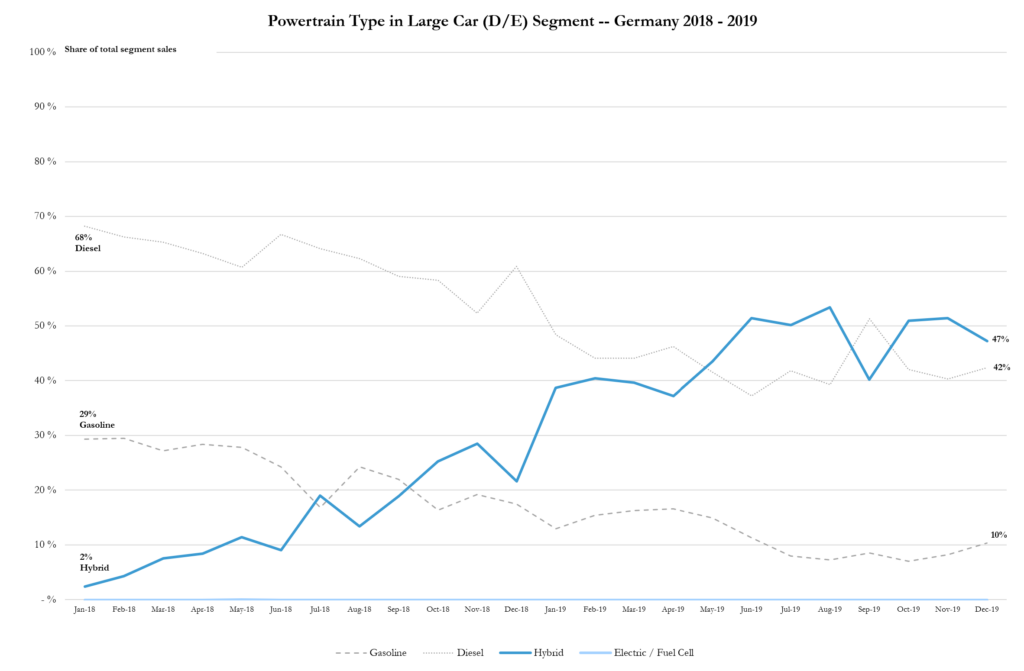

Okay, so this isn’t something that we normally do, but I thought this was a cool chart. OEMs in Europe need to significantly increase sales of all-electric and plug-in hybrid vehicles in 2020 and 2021 and there is so much opinion flying around about whether customers will embrace or resist the change.

So, here is some real data… it’s from Germany; richer than most countries but also approximately 80 million people, so a decent sample size. In the large car segment (what I think of as D/E size, e.g. Audi A6, BMW 5-Series, Mercedes E-Class), hybrids went from 2% of registrations at the beginning of 2018 to 47% by the end of 2019. Maybe customers aren’t so averse after all if they like the overall product? Here’s the chart:

News about the major automakers

- Invested in electric motor developer Software Motor Companyas part of a $25 million round. (SMC)

- Issued another profit warning, saying it would make €1.1 billion – €1.5 billion less because of losses from fines and court cases relating to diesel engine performance. The van division will make a whopping €(2.4) billion loss. (Daimler)

- Reportedly dealing with substantial constraints on battery supply for the EQC, resulting from problems at the supplier (LG Chem) and high reject rates at Daimler’s own battery module plant. (Manager Magazin) Daimler said that it would make about 50,000 EQC in 2020, as planned. (Reuters)

- Daimler and BYD are putting around $100 million in fresh funds into all-electric JV Denza. (Deal Street Asia)

- Working with UBQ Materials to find possible uses for “climate positive” thermoplastics. (Green Car Congress)

- Foxconn reckons the first shipments of electric vehicles produced in partnership with FCA will start in 2022. (Nikkei)

- Dutch authorities say that FCA and Suzuki vehicles (all equipped with FCA diesel engines) have breached emissions rules because of defeat devices. (Reuters)

- Updates in a spare parts database by over-eager analysts suggested that Ford’s next generation Mondeo will launch in 2021. (Autocar)

- Ford executives said the all-electric Mustang Mach-E will be profitable immediately. (Business Insider)

Geely (includes Volvo) (history)

- Expects that 20% of Volvo’s cars sold in EU markets this year will be plug-in hybrids and says that paying fines “shouldn’t be in the equation”, because the money is better spent investing in new products. (Bloomberg)

- Warned that the UK line-up could be pared back if local market rules started to deviate considerably from EU-wide standards. (FT)

- Volvo has received thousands of firm orders for the all-electric version of the XC40. (Volvo)

- Unveiled the Cruise Origin, a collaboration with Honda, a driverless vehicle with room for six. GM says the car can last one million miles — albeit with some refurbishment and upgrades — and will cost half as much as a conventional electric SUV (a somewhat fuzzy definition that spans a range of $30,000 – $100,000). (GM) The vehicle will apparently be built at the Detroit-Hamtramck, USA, plant as part of a $2.2 billion investment to turn the plant into an electric-only facility. (GM)

- Opening a new technical centre in Charlottle, USA, near to lots of NASCAR teams. (GM)

- Hyundai reported Q4 2019 revenue of 27.9 trillion KRW (about $23.7 billion), up 10.5% on a year-over-year basis. Operating income of 1.2 trillion KRW (about $1.1 billion) more than doubled. Full year revenue of 106 trillion KRW (about $90 billion) rose 9.3% from 2018, with operating income of 3.7 trillion KRW (about $3.1 billion). (Hyundai)

- Kia’s Q4 2019 revenue of 16.1 trillion KRW (about $13.7 billion), up 16.5% on a year-over-year basis. Operating profit of 591 trillion KRW (about $500 million) was 55% higher. Full year revenue of 58 trillion KRW (about $49 billion) rose 7.3% from 2018, with operating profit of 2.0 trillion KRW (about $1.7 billion). (Kia)

- Released renderings previewing a forthcoming compact SUV for emerging markets. (Kia)

- Activist shareholder Elliott has reportedly sold off its entire stake in Hyundai after failing to get its restructuring plan accepted. (Reuters)

- Kia is increasing production of the Telluride SUV thanks to high demand, and reportedly aims to sell 100,000 per year. (CNET)

Nissan and Mitsubishi (history)

- Carlos Ghosn reportedly predicted that Nissan would go bust by 2022, according to someone who interviewed him for a book (before he became a world-renowned escape artist). (Bloomberg)

- German regulators are investigating whether Mitsubishi diesel engines contained defeat devices. (Reuters)

- Nissan and Renault’s top engineering executives are planning a feelgood session to reignite shared projects (Reuters) or, Nissan is angling for a sell-down of the cross-shareholding. (Bloomberg) You decide.

- Vauxhall’s MD confirmed that there will be a next generation Insignia (but that doesn’t mean it will be anything more than a badge-engineered Peugeot). (Autocar)

- Despite PSA’s insistence that Opel and Vauxhall will retain distinct brand identities from the rest of the PSA stable, the design team is reportedly set to shed 40% of its workforce (about 160 people). (Handelsblatt)

- Doesn’t know whether it supplied the Mitsubishi engines under investigation by German regulators for defeat devices. (Reuters)

- Conducting a series of experiments over a four-year period to look at technologies for electric vehicle charging and the customer reception to them. (Renault)

- VW’s CEO said ex-SEAT boss Luca de Meo is in talks with Renault about the CEO job. (Les Echos)

- Renault Samsung workers are staging partial strikes whilst negotiations over wages continue. (Yonhap)

- Nissan and Renault’s top engineering executives are planning a feelgood session to reignite shared projects (Reuters) or, Nissan is angling for a sell-down of the cross-shareholding. (Bloomberg)

Suzuki

- All EU-bound cars from Suzuki’s Hungarian factory will have hybrid engines. (Budapest Business Journal)

- Dutch authorities said some diesel-engined Suzuki cars (the engines were supplied by FCA) breached emissions regulations and the firm has until mid-February to respond. (Reuters)

- Tata Motors says it will offer the safest cars (as measured by NCAP) in their class. (Autocar)

- Making around 500 staff at the Halewood, UK, factory redundant. JLR says it is because the plant is becoming more efficient, not because of falling volumes. (Autocar)

- Tata’s research suggests that Indian customers can be persuaded to upgrade to an all-electric car if the price is within 25% of the conventionally powered version. (Times of India)

- Toyota’s Japanese union will reportedly seek a $92 per month wage increase in 2020, lower than 2019. (Reuters)

- Moody’s changed the outlook for Toyota’s rating to negative. (Moody’s)

- Formed a joint venture with Aeris, called Ventic, to develop connected vehicle services in North America. (Aeris)

- Any second model added to Bugatti’s portfolio won’t share any platform with other VW group products and would have lifetime volume targets “in the low thousands”, but nothing has been approved by the board (indicating that any launch would be post-2022 at the earliest. (Autocar)

- Porsche’s CEO says half of (all-electric sports car) Taycan buyers are new to the brand. (Bloomberg)

- VW’s works council will approve the sale of the Renk heavy truck engine unit, provided they are happy with the buyer. (Reuters)

- CEO Diess said he backed a higher CO2 tax in Germany. (Handelsblatt)

- Canadian regulators fined $150 million for diesel emissions irregularities. (Reuters)

Other

- Aston Martin is exiting the German DTM touring car championship after a single season. (Motorsport)

- Indian electronics brand Detel intends to launch an electric vehicle. (Economic Times of India)

- TVR’s new Griffith looks like it has been further delayed because of problems with the factory. (CarBuzz)

- Lucid opened reservations for European customers, saying deliveries will begin in 2021. (Lucid)

- Nio is aiming to build 200 new dealerships this year. (NBD)

- Rivian says its new pick-up truck will be cheaper than previously announced. (Reuters)

- Subaru showed off a model of an unnamed electric SUV. (Auto Express)

News about other companies and trends

Economic / Political News

- Full year 2019 sales of commercial vehicles in Europe of 2.635 million units rose 2.5% on a year-over-year basis. Most of the market (2.2 million units) is in vehicles of 3.5 tonnes or less. (ACEA)

- The European

car making trade body issued a list of emission reduction talking points. In addition

to urging caution about mandates for certain technologies types (i.e. electric

vehicles), the manufacturers want future rules to give them credit for replacing

older vehicles with newer, lower emitting ones (despite this improvement being

an implicit part of current targets). (ACEA)

- Significance: Although billed as a “plan”, there are few concrete proposals, none of which have clear cost/benefit assessments, and the list reads as an attempt to draw politicians and other industries into the quagmire of emissions reduction.

- Russia is increasing the fee it charges manufacturers to register vehicles assembled locally, to $2,500 per unit and making it harder to claim back money for recycling vehicles. (Automotive Logistics)

Suppliers

- Tata AutoComp signed a joint venture agreement with Prestolite Electric to produce motors and power electronics. (Autocar)

- Bridgestone reported Q3 2019/20 revenue of 891 billion JPY (about $8.2 billion) and operating income of 92 billion JPY (about $840 million). (Bridgestone)

- Eaton’s hydraulics business is being sold to Danfoss for $3.3 billion. (Eaton)

- Mitsui and Teco Electric are setting up a joint venture plant in India to make electric motors. (Nikkei)

- Bosch is upping its stake in fuel cell developer Ceres Power from 3.9% to 18%. (Bosch)

Ride-Hailing, Car Sharing & Rental (history)

- Uber sold its Indian food delivery unit to Zomato, taking a 9.99% stake in the enlarged business return. (Uber)

- Zoomcar raised $30 million from investors including Sony. (Deal Street Asia)

Driverless / Autonomy (history)

- AutoX raised “tens of millions” shortly after closing a $100 million Series A round. (Deal Street Asia)

- Aurora monitors progress based on a self-generated

series of priorities for improving the ability of its self-driving AI (such as

being able to push into slow moving traffic). The firm accepts that its current

explanations are a bit vague plans to expand on them soon. (Aurora)

- Significance: The beginning of 2020 has seen a drumbeat of developers questioning the value of monitoring disengagements. However, they agree far less on what is an improvement. There is also a growing emphasis on virtual testing without confronting the two main shortcomings: (1) the reaction of other participants in the simulation is itself simulation (comprehensive multiple driver-in-the-loop simulations — which no one seems to be doing — aside) so the value in predicting and dealing with real life human behaviour is open to question; (2) part of the real world problem is that incomplete or noisy sensor data makes object detection and identification hard, whilst all simulations on show present the AI with a clearly identifiable object. If the real-world sensors cannot be so exact, why is it correct to simulate them as such?

- GM and Honda unveiled the Cruise Origin, a collaboration with Honda, a driverless vehicle with room for six. GM says the car can last one million miles — albeit with some refurbishment and upgrades — and will cost half as much as a conventional electric SUV (a somewhat fuzzy definition that spans a range of $30,000 – $100,000). (GM)

- Battery developer Oxis Energy claims it is “close to” an energy density of 500 Wh / kg (today’s best is around half that or less) from a solid-state lithium-sulphur chemistry. (Oxis)

- Total will install 20,000 charging points in the Netherlands. (Total)

- The cost of Hydrogen could fall by 50%, if only $70 billion is invested in it. (Hydrogen Council)

- Hyundai says modern vehicle batteries will last 1,000 cycles if they are fully discharged and recharged every time and, taking Hyundai’s view of a more realistic use case, if 20% of the capacity is used and topped up each day then they will be good for 22 years. (Hyundai)

- Electric motor developer Software Motor Company raised $25 million from investors including BMW. (SMC)

Connectivity

- VW formed a North American connected vehicle services joint venture with Aeris, called Ventic. (Aeris)

- Zenuity will use Hewlett Packard’s infrastructure to run its self-driving and advanced driver assistance AI. (HPE)

Other

- Indian parking app Park+ raised $11 million. (Deal Street Asia)

- Electric scooter rental firm Bird is reportedly in talks to buy smaller German service Circ. (FT)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 19th January 2020

Facing up to reality in Europe; too little money to go around; and the benefits of getting the basics right. Please enjoy our auto industry and mobility briefing for 13th January to 19th January 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- I Have Seen — VW says that by 2030 at least 40% of the vehicles mass market producers sell in Europe will need substantial electrification (plug-in hybrid or full-electric) to comply with EU CO2 rules at that time. This shows companies clearly understand how their sales portfolio will need to evolve in the next ten years. Are they being honest about their financial outlook?

- Destiny — Mahindra and Mahindra’s Ssangyong brand needs more money, NIO needs more money, Aston Martin is talking to people about more money and Sono Motors just raised some money, but will soon need more. Rewind to 2018 and the stuff seemed to be growing on trees. Will everybody make it?

- Home — GM says the high-end AT4 trim level on GMC vehicles is going great guns, providing a useful foil to the sleek high-end Denali trim. It all sounds a bit boring in these days of electrification, connectivity and self-driving but good choices that drive revenue up are the mainstay of the business and worth big bucks when you get it right. How many companies will trip themselves up chasing the future and forgetting the basics?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Selling its Colombian light vehicle parts and distribution arm to dealer Inchcape. (Daimler)

- In discussions with Foxconn / Hon Hai about developing and manufacturing all-electric vehicles in China. (FCA)

- Issued a press release to ensure it received proper credit for improving the sales experience around electric vehicles. FCA had added a button to their website that links to an Amazon page where you can buy wall chargers. (FCA)

- Investing €42 million in the Valencia, Spain, factory to produce battery packs for hybrids and update assembly lines for hybrid and 48V variants of the Kuga, S-MAX and Galaxy. (Ford)

- Investing $82 million to increase capacity in Vietnam. (Reuters)

- Will implement V2V communication in European vehicles so that drivers are warned of obstacles ahead that other cars have already had to avoid or crashed into. The service will be free for the first year. (Ford)

Geely (includes Volvo) (history)

- Fengshang (formerly known as Kandi) unveiled its first vehicle, an electric SUV called the Maple 30X. (Kandi)

- Volvo is working with China Unicom to develop 5G communications and V2X. (Volvo)

- GM executives say GMC’s AT4 trim level is outperforming expectations and achieving pricing within $2,000 – $3,000 of the Denali top of the line models with (GM says) minimal cannibalisation. GMC “doesn’t know where the ceiling is” for price or unit sales. (CNBC)

- Hourly workers at some US sites are complaining that since the strike they have been on mandatory seven day weeks to recover the shortfall. (Detroit Free Press)

- Engineers found themselves in hot water after police caught them racing prototype Corvettes on public roads. (CNN)

- Following the UAW agreement, GM has converted 1,350 temporary employees to permanent contracts. (GM)

- Confirmed the sale of the Talegaon, India, plant to Great Wall. (Great Wall)

- GM’s

Cruise division published a blog questioning the value of disengagements as a

metric for the competency of self-driving systems, accusing start-ups and media

of over-hyping the significance (but without reflecting on the benefit to

Cruise of its longstanding position as second only to Waymo on this basis). Cruise

argues that in busy environments, it is impossible to stop safety drivers

instinctively taking control. (GM)

- Significance: GM’s argument isn’t entirely satisfactory since the firm’s much-vaunted modelling could be compared to actual disengagements to determine how necessary they were and the company could (if it wished) report this extra detail as a memo to its California DMV report if it wished (the report format is largely left up to the issuing company).

- Announced a partnership with Isuzu to develop fuel cells for heavy vehicles. (Honda)

- Kia announced an updated cycle plan, dubbed Plan S, that calls for 11 battery electric vehicles by 2025, selling a collective 500,000 units per year. In total, Kia wants 25% of vehicle sales to come from fully electric and electrified models by 2025. (Kia)

- By implementing Plan S, Kia is targeting a 6% operating profit and 10.6% return on equity in return for $25 billion of investment spending between 2020 – 2025. (Kia)

- Hyundai and Kia made a €100 million investment in UK/Russian electric vehicle firm Arrival in a deal that values the start-up at €3 billion. The intention is for Hyundai and Kia to use Arrival’s platform for electric vehicles. (Hyundai)

Nissan and Mitsubishi (history)

- Revealed the 10,000 hours has been spent investigating compensation and other payments stemming from Carlos Ghosn’s ouster, with several others found to have benefitted (but kept anonymous). Amongst actions Nissan is taking to improve corporate governance, the practice of retaining former senior executives as consultants will be ended, meaning that outgoing CEO Saikawa will leave the company for good when he steps down. (Bloomberg)

- PSA sold 3.489 million units in 2019, a (6.6)% drop on a year-over-year basis. (PSA)

- Two of PSA’s senior executives — the leaders of the DS and Citroën brands — have gone on special assignments, one to look at how to improve synergies between brands and one to look at how to preserve brand integrity even as product is shared. They are both being replaced. (PSA)

- Opel announced an extension of the involuntary redundancy freeze until 2025 (from 2023) and confirmed rumours from April that the Rüsselsheim, Germany, plant will produce the Astra. In return, Opel is looking for 2,100 employees to take voluntary separation. (Opel)

- Expects to comply with EU CO2 rules for 2020 and avoid paying fines (PSA had previously expressed confidence that this would be the case). (PSA)

- Opel’s head of sales for the German market has been moved sideways after less than a year in the job. (Handelsblatt)

- Opel will sell electric vehicles in Russia — IF the state agrees to provide subsidies — and says that 5% market share is the minimum level for viability in the market. PSA believes that some level of exports will be required for sustainable profitability, but the changing regulations mean it hasn’t decided a firm plan. (TASS)

- Renault sold 3.75 million vehicles in 2019, down (3.4)% on a year-over-year basis, more than explained by declines in Iran, Argentina and Turkey. Renault said it was working on pricing more than chasing volume. (Renault)

Subaru

- Announced a series of longer term targets for the electrification of the portfolio: by 2030 at least 40% of sales will be BEVs or (P)HEVs; by the mid-2030s all Subaru vehicles will have an electrification option; by 2050 fleet average emissions will be 90% lower than 2010 levels. (Subaru)

- TomTom will provide all of Subaru’s mapping in the USA. (TomTom)

- Future high end JLR cars will have special seats that stimulate the bottom and thighs so drivers and passengers can stay in great shape even as they sit still. No word yet on whether there is a version that does six packs. (JLR)

- Suffered a dramatic drop in registrations in California during Q4 2019, prompting investor concern that the brand was going off the boil. Tesla has already released global Q4 figures. (Reuters)

- Recalling 696,000 cars to fix problems with fuel pumps. (Toyota)

- Will build a yet-to-be-revealed new small SUV for the European market at the Valenciennes, France, plant. (Toyota)

- Launching the Kinto brand in Europe. Car sharing and carpooling services will be offered, alongside all-inclusive leasing (in both multi-year and short term — often called subscription — variations). (Toyota)

- Invested $394 million in (existing investment) flying taxi developer Joby Aviation as part of a $590 million round. A Toyota executive will join Joby’s board and the company will lend manufacturing expertise. (Toyota)

- Reshuffling product allocation at some North American plants. Although the moves will see overall capacities remain the same, media seized on the news that the Tacoma pick-up will be made in Mexico instead of the USA (it is currently made in both countries). (Toyota)

- Across all brands, VW Group sold 10.974 million vehicles in 2019, up 1.3% on a year-over-year basis. (VW)

- Says a sales mix of 40% electric cars (which includes plug-in hybrids) is required to meet the 2030 EU targets for fleet average CO2. The company expects subsidies for electric cars to be phased out (the specific discussion was around Germany) and has written off hydrogen as a realistic fuel source until after 2030. (Handelsblatt)

- CEO Diess gave a speech saying he wants VW to transform from a car company to a tech firm. He thinks that in the future, people will spend more time in the car and foresees an average of two hours per day rather than about one now. He warned the Bentley brand that although he was pleased with sales of over 10,000 units, he would be more impressed with a return greater than zero and would prefer sales of 5,000 units with a return of 20% to the current state. (Handelsblatt)

- In talks with Chinese battery manufacturer Guoxuan about a strategic cooperation (something that was rumoured in August). (Handelsblatt)

- The next generation Golf can detect whether voice commands are being given by the driver or passenger and responds accordingly. (VW)

- SEAT is using trucks that tow two full size trailers to reduce logistics costs and reduce CO2. The trailers can only be used on highways, so aren’t suitable for all supply runs. (SEAT)

- Lamborghini says all future sports cars will have hybrid variants. The brand has now produced 350 track-only Huracán, an indication of the interest level for motorsport-focused variants (with the right supporting infrastructure and events). (Lamborghini)

- Audi is spending €100 million to install 4,500 charging points at its factories. Since most of the units will be relatively bog standard 22 kW chargers, it isn’t clear how they are costing an average of €22,000 each. (Audi)

- Audi has given Cromodora a ten-year supply agreement for alloy wheels, enough to justify the latter company building an entire plant at an undisclosed Eastern European location. (Audi)

- Apparently, the version of the VW ID3 with the biggest battery (77 kWh) will only be a four seater. (Inside EVs)

Other

- Lightyear hopes to bring a second, more affordable, solar powered car to market by 2023 and sees demand of more than 100,000 units per year for the model. (Inside EVs)

- Xpeng’s co-founder says the Chinese market for electric vehicles will bounce back in 2020, partly because of excitement created by Tesla’s locally manufactured cars. (Nikkei) The company published some statistics gathered by the cars it has sold: adaptive cruise control users on average enable the feature for 1.8 km at a time and one third of voice commands were for setting up a destination in the navigation function. The data appears to include XPeng’s own test vehicles (since one car was reported to have driven over 600,000km in a single year). (XPeng)

- W Motors started construction of a new factory in Dubai. (The National)

- Roadster Salon is selling an updated 1960s Fiat 124 with all electric drive. It’s not cheap. (Roadster Salon)

- Mahindra and Mahindra are reportedly contemplating asking the South Korean authorities to stump up some financial support for Ssangyong. (Yonhap)

- Nio confirmed it was in talks with Guangzhou (GAC) about financing and collaboration. (Nio)

- Sono Motors met its fund-raising goal of €50 million to

continue industrial development (the company has already said this will NOT be

enough to start mass production). The money still needs to be collected. (Sono)

- Significance: The crowdfunding model is used sure to be studied by others, although an extension to the originally planned deadline and existing investors stumping up extra cash to meet the target indicate it wasn’t plain sailing.

News about other companies and trends

Economic / Political News

- December passenger car registrations in Europe of 1.26 million rose 21.4% over prior year. Full year sales of 15.8 million cars was just 1.2% better. (ACEA)

Suppliers

- Meritor purchased electric drivetrain specialist TransPower. (Meritor)

- Magna announced its outlook for 2020 – 2022. The firm expects sales of $40.5 billion – $43.5 billion by 2022 and for EBIT margin in the range 7.6% – 8.0%. The firm is also breaking off its self-driving relationship with Lyft, saying the two will still collaborate a bit. (Magna)

- Mapping supplier HERE has a new CFO, a recruit from Daimler. (HERE)

- Lidar developer Quanergy’s CEO stepped down. (Quanergy)

- CK Birla acquired Kinex Bearings. (Deal Street Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Ride hailing firm Bolt raised €50 million in debt. (TechCrunch)

- On demand bus app Shuttl raised $8 million. (Deal Street Asia)

- Chinese ride hailing firm Dida (not a typo), backed by Nio, reportedly hopes to raise $300 million. (Technode)

- Cargo, a company that provided in-car vending machines for ride hailing drivers, has pivoted into advertising instead. Participating drivers get a screen to put on their car roof. (Mashable)

Driverless / Autonomy (history)

- Comma.ai declared itself ready to develop self-driving software on an open source basis. New code will be subjected to an undefined test program. The opinion of regulators is unknown. (Comma.ai)

- Aurora says its cars can now navigate busy intersections “seamlessly”. (Aurora)

- Indoor mapping company NextNav raised $120 million. (TechCrunch)

- VW thinks that in the future, people will spend more time in the car and foresees an average of two hours per day rather than about one now. (Handelsblatt)

- GM’s Cruise division published a blog questioning the value of disengagements as a metric for the competency of self-driving systems, accusing start-ups and media of over-hyping the significance (but without reflecting on the benefit to Cruise of its longstanding position as second only to Waymo on this basis). Cruise argues that in busy environments, it is impossible to stop safety drivers instinctively taking control. (GM)

- Magna is breaking off its self-driving relationship with Lyft, saying the two will still collaborate a bit. (Magna)

- GKN is teaming up with Delta Electronics to offer integrated electric motors that also house the transmission and some power electronics). (GKN)

- The UK city of Nottingham is trialling taxi ranks with wireless charging. (Telegraph)

- Lightyear hopes to bring a second, more affordable, solar powered car to market by 2023 and sees demand of more than 100,000 units per year for the model. (Inside EVs)

- VW says a sales mix of 40% electric cars (which includes plug-in hybrids) is required to meet the 2030 EU targets for fleet average CO2. The company expects subsidies for electric cars to be phased out (the specific discussion was around Germany) and has written off hydrogen as a realistic fuel source until after 2030. (Handelsblatt)

- VW is in talks with Chinese battery manufacturer Guoxuan about a strategic cooperation (something that was rumoured in August). (Handelsblatt)

- FCA and Foxconn / Hon Hai are considering developing and manufacturing all-electric vehicles in China. (FCA)

- Apparently, the version of the VW ID3 with the biggest battery (77 kWh) will only be a four seater. (Inside EVs)

Connectivity

- LG and voice recognition expert Cerence (ex Nuance) will collaborate on infotainment. (LG)

- Ford will implement V2V communication in European vehicles so that drivers are warned of obstacles ahead that other cars have already had to avoid or crashed into. The service will be free for the first year. (Ford)

Other

- Flying taxi developer Joby Aviation raised $590 million in a round led by Toyota. (Toyota)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 12th January 2020

A car company worth its weight in gold; early days for electric cars in Europe; and a worrying sign for self-driving enthusiasts. Please enjoy our auto industry and mobility briefing for 6th January to 12th January 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Rise — Tesla’s share price went up, up and away, even eclipsing the combined value of Ford and GM. Discussions about fair value aside, this seems like a good opportunity for Tesla to issue some stock and raise some cash to build its warchest. But will it and what will it do with it if it does?

- Ready For It? — Faraday Future says it will avoid the European markets at first because customers there aren’t ready for electric vehicles yet. But isn’t Europe the same place where everyone is talking about the death of internal combustion engines as we know it by 2030? Are Faraday Future correct or just trying to make a polite excuse for concentrating on the USA and China?

- A Different Point Of View — VW says the sensor set for an autonomous car costs $100,000; PSA says it costs somewhere around €20,000. These are two of the largest companies around, both spending hundreds of millions, if not billions of dollars per year on self-driving technology. If they can’t even agree on how much the bolt on bits cost, what does that say about the maturity of the discipline?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Sold 2.52 million cars in 2019, up 1.2% on 2018. (BMW)

- Rolls-Royce’s CEO peppered journalists with statistics about the brand’s customer base: 20% of them are celebrities (using a broad definition); only 25% of the cars it now sells are chauffeur driven; one third of customers visit the factory and; 80% of Cullinan sales are to customers new to the brand. (Telegraph) The CEO appears set to stay for at least another two years, following a contract extension, despite nearing the normal retirement age for BMW executives. (Telegraph)

- Invested in machine vision firm Alltheon’s $15 million funding round. (FINSMES)

- Sold 2.46 million Mercedes and Smart branded cars in 2019, up 0.7% on prior year. (Daimler)

- Daimler and Geely formally created the joint venture that will develop and sell cars under the Smart brand in future. Geely will take over most of the engineering responsibility. (Daimler)

- Daimler unveiled a concept car called the Vision AVTR, created in partnership with the makers of the movie Avatar. It isn’t entirely clear whether the vehicle contains any ideas that Daimler hopes will make it into production, or it is purely an artistic endeavour. (Daimler)

- CEO Källenius said Daimler now supports a universal CO2 tax across industries. (Korea Times)

- Idling two plants in the USA and Canada making minivans and Jeep Cherokees for two weeks because of softening demand. (Detroit News)

- Chrysler took a concept called the Airflow Vision to CES. (Top Gear)

- Sold 2.42 million vehicles in the US during 2019, down (3)% on a year-over-year basis. Improvements in truck sales failed to offset falls in cars and SUVs. (Ford) In China Ford sold 567,854 vehicles, down (26.1)%. The company said it was all down to macroeconomic factors. (Ford)

- Garmin will provide the mapping for Ford’s next-generation infotainment. (Garmin)

Geely (includes Volvo) (history)

- Daimler and Geely formally created the joint venture that will develop and sell cars under the Smart brand in future. Geely will take over most of the engineering responsibility. (Daimler)

- Volvo sold 705,452 cars in 2019, up 9.8% on 2018. (Volvo)

- Taxi brand LEVC sold 2,507 cabs in 2019. (LEVC)

- Rumoured to be in talks to buy a stake in Aston Martin. (Reuters)

- Sold 3.09 million units in China, more than the 2.9 million in the USA, a year-over-year drop of (15)%. (GM)

- Rumours resurfaced that GM is planning to relaunch Hummer as an all-electric brand. (The Guardian)

- Will hold a capital markets day on 5th February. (GM)

- Honda released a video — part of its CES display — showing short snippets of different customer experiences in the year 2035. The AI in the video seems obsessed with birthday cake. (Honda)

- Honda has reportedly told the brand’s European arm to ensure that it complies with EU emissions rules and avoids paying any fines. (Clean Technica)

- Hyundai showed off an air taxi called the S-A1 and says it will partner with Uber to put it into service. (Hyundai)

- Hyundai is taking air taxis so seriously that it has hired the entire team from consultancy Ascension Global to develop the strategy. (Hyundai)

- Hyundai Mobis wants to distance itself from Hyundai and Kia, targeting sales from 3rd parties to rise to 40% of revenues by 2025 (up from 10% today). (Korea Herald)

- Hyundai

has a vision of a modular vehicle architecture with omni-directional wheels

(think of the Audi in I, Robot if you’ve seen it) that can be built to fulfil

passenger and cargo carrying roles. (Hyundai)

- Significance: Whilst others have shown concepts based on a flexible moving platform with interchangeable tops, Hyundai appears more convinced in the benefits of purpose-built vehicles, but with modularity that lowers costs.

Nissan and Mitsubishi (history)

- Nissan is reportedly making contingency plans to go it alone in engineering and manufacturing in the eventuality of a complete split with Renault. (FT)

- After Carlos Ghosn held a press conference accusing Nissan executives and unnamed Japanese government officials of orchestrating his downfall, his former Nissan colleagues said the claims were predictable. Ghosn said that the root of the issue was the need to find a scapegoat for Nissan’s performance, and moves by the French state to deny Nissan what the Japanese company saw as a fair say in Renault’s governance. Ghosn also said that he had been about to retire before the board persuaded him otherwise and now wishes he hadn’t listened. (Bloomberg) / (CNBC)

- Using smart glasses so that plant quality inspectors can flag issues to PSA’s central staff and get quicker feedback on the correct next steps. (Autocar)

- The head of the Peugeot family’s investment vehicle confirmed the intention to increase its stake in a merged PSA and FCA and expects the French state to exit its investment in time. (Reuters)

- Opel is reportedly planning to cut up to 4,100 jobs in the coming years. (Bloomberg)

- PSA’s opinion is that the sensor set and computing kit for an autonomous car costs between €15,000 – €20,000 per vehicle. (Fleet Europe)

- Hired Gilles Le Borgne, formerly of PSA, as the new head of engineering. (Renault)

- Carlos Ghosn said he had been in negotiations to bring FCA into the alliance before his arrest but missed the key go-no go meeting because he had been arrested. (Nasdaq)

- Nissan is reportedly making contingency plans to go it alone in engineering and manufacturing in the eventuality of a complete split with Renault. (FT)

- JLR reported 2019 retail sales of 557,706 cars, down (5.9)% versus 2018 but focused on the performance in Q4 and December 2019, both of which improved over prior year, mainly driven by China and the USA. (JLR)

- JLR’s huge new £300 million UK warehouse will be owned by a South Korean investment firm. (Telegraph)

- Tesla’s

share price soared to a level surpassing the combined value of GM and Ford. (Reuters)

- Significance: By rights, if Tesla is correctly valued, then a similarly large concern (for instance, VW Group’s electric vehicle unit c. 2022) will also be worth tens of billions (concerns of the cash-generating legacy side of the business notwithstanding). Tesla has already previously chosen to use increases in the stock price as opportunities to issue equity, and therefore raise cash. Will something similar happen this time?

- CEO Musk said at the official opening of the Shanghai factory that he hopes to create a Chinese-designed car for export to global markets. It was unclear how much the comments were for the benefit of the local audience, rather than a serious undertaking. (Electrek)

- The VW brand sold 6.278 million cars in 2019, up 0.5% on a year-over-year basis. (VW)

- Audi sold 1.85 million cars in 2019, up 1.8% versus 2018. (Audi)

- SEAT delivered 547,100 cars, up 10.9% on 2018’s level. (SEAT)

- Now collecting detailed data on real world driving habits from a stretch of German motorway, to better inform research and simulation for automated driving. (VW)

- SEAT’s CEO (a rumoured candidate for the Renault CEO job) stepped down from his role at the brand, although he remains a VW Group employee. (VW)

- Bentley sold just over 11,000 cars in 2019, saying it had returned to profitability. (Bentley)

- Bought out the remaining shareholders in software development firm diconium (VW previously held 49%), citing the opportunity to quickly beef up VW’s software organisation. (VW)

- VW’s head

of autonomous mobility says a cutting-edge sensor set costs $100,000 today, but

forecasts that prices will drop to only $10,000 by 2030. (SAE)

- Significance: If the cost forecast is correct, this would put autonomy beyond the means of almost all retail consumers, whilst commercial owners who could dispense with the driver, or otherwise improve their utilisation on other duties, would find the feature affordable.

Other

- Aston Martin issued a profit warning, after selling 5,809 cars in 2019 (excluding specials) down (7)% from 2018. The company is in discussions with potential strategic investors, believed to include Geely (AML) On the bright side, the firm has 1,800 orders for DBX — which opens up $100 million of dearly-needed funding — and announced another limited-edition supercar; 88 V12-powered speedsters are planned, with production to begin in 2021. (AML)

- Aston Martin has reportedly cancelled the all-electric RapidE. (Autocar)

- Electric car start-up E.Go reportedly needed a €100 million bailout at the end of 2019 to stay in business. So far, the company has made about 500 cars. (Manager Magazin)

- FAW’s Hongqi (Red Flag) brand is aiming for annual sales of one million units by 2030. (South China Morning Post)

- Fisker says the Ocean SUV will be built in China, the USA and Europe, but the partner(s) won’t be announced until the Geneva Motor Show. Amongst a series of announcements about the intended brand experience is that all servicing will include home collection and drop off. (Fisker)

- Neuron EV announced another new product; an all-electric mid-sized SUV called Vega. (Neuron)

- Nio delivered 8,224 cars in Q4 2019. Whilst the company was pleased with its highest ever quarterly sales, they were up only 3% on a year-over-year basis, despite the addition of a second model. (Nio)

- Faraday Future said the FF91 is production ready. The firm is aiming for an IPO in 12-15 months. (Faraday) Initially it will give the European market a miss because customers “are not really prepared for electric and connected cars”. (Autocar)

- Rinspeed’s latest people mover, the MetroSnap features extensive use of 3D printing. (3D Printing Industry)

News about other companies and trends

Economic / Political News

- The new head of the European Commission said it would be impossible to reach a full fat UK-EU trade deal covering goods and services by the expiry of the post-Brexit transition period (December 31st) and that a bare bones deal around priorities, which could be augmented in future, was more likely than no deal at all. (BBC)

- Chinese officials said that incentives for electrified vehicles would not be cut in July, as some feared. (Reuters)

- Industry observers think that the German market showed signs of a December rush to register high emitting vehicles before they start to count for more stringent EU fleet CO2 levels in 2020. (FT)

Suppliers

- Sony brought its own concept car to CES. Dubbed the Vision S, it appears more as a demonstrator for new technologies Sony has to offer than a intent to enter the market. (Sony)

- Lidar maker Velodyne has a new CEO. (Velodyne)

- Intel’s Mobileye will develop crowd-sourced maps with SAIC. (Mobileye)

- Lear is investing in a VC fund run by Autotech Ventures. (Lear)

- Panasonic will offer in car audio carrying the posh Klipsch brand. (Panasonic)

- Continental thinks that speakerless audio technology could reduce the weight of the system by 90%. (Continental)

Ride-Hailing, Car Sharing & Rental (history)

- Uber will shutter operations in Colombia after a court ruling that it was anti-competitive. (Reuters)

- Car sharing firm Getaround is shedding staff but says everything is going well. (Getaround)

- Hyundai showed off an air taxi called the S-A1 and says it will partner with Uber to put it into service. (Hyundai)

Driverless / Autonomy (history)

- Waymo says it has now logged 20 million miles of self-driving. (Fortune)

- Intel’s Mobileye is developing a camera-only self-driving system separately from a lidar and radar based one to build redundancy. The company shared a video of a test drive — the machine vision appears to have a range of below 50m in terms of when it identifies an object (the sensor range will be greater), making it suitable for low speed, fair weather driving at this stage (even if all the decision-making kinks were worked out). (Intel)

- Hella is using software developed by Oculii — a firm it recently invested in — to improve the performance of radar chips for automated driving. (Hella)

- Lidar developer Hesai Technology raised $173 million. (Robot Report)

- VW’s head of autonomous mobility says a cutting-edge sensor set costs $100,000 today, but forecasts that prices will drop to only $10,000 by 2030. (Electrek)

- PSA’s opinion is that the sensor set and computing kit for an autonomous car costs between €15,000 – €20,000 per vehicle. (Fleet Europe)

- VW is now collecting detailed data on real world driving habits from a stretch of German motorway, to better inform research and simulation for automated driving. (VW)

- Rumours resurfaced that GM is planning to relaunch Hummer as an all-electric brand. (The Guardian)

Connectivity

- Mitsubishi will use Otonomo to provide connected car services. (Otonomo)

Other

- Motorbike rental start-up Bounce raised $97 million. (Deal Street Asia)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 5th January 2020

Plug-in hybrids with serious range; solar roofs for all; and counterfeit cars. Please enjoy our auto industry and mobility briefing for 23rd December 2019 to 5th January 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Travelogue — BMW’s next generation of plug-in hybrids will have electric-only ranges of 80km – 120km, way beyond the 50km that is becoming so common. At that level, plus fleet mixes rising to 25% by 2030, according to BMW, the path to meet EU 2025 and 2030 CO2 targets for premium OEMs looks clearer.

- Sunday — Hyundai says the latest solar roofs can save almost 15 g / km of CO2 and the production cost is somewhere below $1,000. The simple maths — and the fact that solar charging is an off-cycle test contribution muddies this somewhat — puts the cost of the CO2 reduction at below the $75 g / km that many OEMs have been using as a rule of thumb to justify electrification changes. Will we see this technology becoming far more widespread?

- Copycat — Russian Tesla fans have made their own Cybertruck homage and say it only cost them a couple of thousand dollars, thanks to the humble Lada donor vehicle. The car isn’t quite finished to OEM standards but passes more than a passing resemblance — serious counterfeiters could do better. The upside of the vehicle’s simple styling is that it could be easily made, but also easily copied. If this becomes a trend, might manufacturers need to rethink the way that they release products?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- BMW thinks it has chosen the right path by developing platforms that can accommodate conventional and electric powertrains but admits that dedicated architectures would be better if all-electric vehicles dominate. Improvements in battery energy density have wildly exceeded BMW’s expectations and the next generation of plug-in hybrids from the company will have zero emission ranges of 80 – 120 km. The firm believes that, in Europe, a decent charging network “is coming” and that this will support a plug-in hybrid sales mix of 25% by 2030. Although a current fuel cell costs ten times that of a battery electric system, BMW expects costs to converge by 2025. (Automotive News)

- Will cease production of the 1.5 I3 diesel engine and the highest power derivatives but thinks that internal combustion engines will continue for decades — at least 20 years for diesel and 30 for gasoline. (Automotive News)

- The US SEC is investigating BMW’s sales reporting practices. (NYT)

- Won an appeal against fines levied in South Korea for vehicles sold with improper emissions certification. BMW isn’t exonerated, but the penalties have been reduced. (Korea Herald)

- CEO Källenius says the personnel cost reduction target is €1.4 billion by 2022. (Economic Times of India)

- Rumoured to be in talks with Geely’s Volvo unit about combustion engine sharing. (Reuters)

- Investing about $19 million to expand a test track in Brazil. (Autocar)

- Recalling 744,000 cars in the USA because the sunroof glass might come away. (Reuters)

- Sold 2.2 million vehicles in the USA during 2019, down (1)% on a year-over-year basis as improvements at Ram almost offset declines in every other brand. FCA’s press release didn’t even mention the Chrysler, Fiat and Alfa Romeo brands. (FCA)

- The Peugeot and Agnelli (Exor) families are reportedly discussing a formal pact that would control around 23% of the merged PSA-FCA’s shares (and could have double strength if maintained in the long term). (Il Sole 24)

- Ford executives hinted that the line-up of electric vehicles intended for production from VW’s MEB platform will include a smaller sibling of the Mach-E SUV. (Auto Express)

- The next Focus RS is rumoured to have a 48V gasoline engine and a plug-in hybrid that will drive the rear wheels. Such a setup would be expected to have considerable CO2 benefits over the current model. (CAR)

- Declared reservations for the first edition of the Mach E to be full. Despite the attention-grabbing headline, plenty of vehicles are available. (Ford)

- Ford bought a pair of humanoid robots to perform experiments with commercial vehicles. (Ford)

Geely (includes Volvo) (history)

- Geely sold 1.36 million vehicles in 2019 (including Lynk&Co), marginally beating the sales target but down (9)% on a year-over-year basis. In 2020 Geely aims to sell about 1.41 million units, back to 2018’s level. Lynk&Co sold 128,000 units, improved versus the 120,000 vehicles in 2018, but indicative of stalling sales growth since 2019 has been a full year with a three car portfolio, whereas until June 2018 there was only a single model on sale. (Geely)

- Kandi signed an additional cooperation agreement with Chinese group Jiangsu, selling part of the vehicle division (which in turn owns a 22% in the joint venture with Geely) and establishing a joint ride hailing firm. (Kandi)

- Volvo is rumoured to be in talks with Daimler about combustion engine sharing. (Reuters)

- Sold 2,887,046 vehicles in the USA during 2019, a (2.3)% drop on a year-over-year basis, explained by falling Chevrolet sales partially offset by slight improvements at GMC and Cadillac. GM blamed the UAW strike and pointed to low dealer inventories, hinting it will stuff them full of new product in 2020 rather than take the opportunity to run a leaner build to order system. (GM)

- Hyundai sold 4,422,644 units in 2019, a (3.6)% drop versus 2018. The company blamed emerging markets but hopes that in 2020 it will be back at the 2018 level. (Hyundai)

- Hyundai’s CEO reiterated electrification goals of 44 models across Hyundai and Kia by 2025, and slightly revised the declared timeline for autonomous cars. Having previously talked about a solution from the JV with Aptiv being on the road by 2022, the plan is now: develop the system by 2022, rollout in company fleets in 2023, then sale to 3rd parties in the second half of 2024. (Hyundai)

- Kia’s rule of thumb is that an electric car costs €8,000 – €9,000 more than an entry-level gasoline model. The brand’s European arm says it cannot make cars that compete with VW’s ID3 on price but that it will sell some electric cars because paying fines “is a no-go at a Korean company”. It is highly confident of selling 40,000 all-electric models in 2020, predicting that most will go to retail customers, rather than fleets. (Automotive News)

- Hyundai’s

tests have shown that the charging rate from a solar roof is fairly reliable,

with only (3)% – (10)% performance degradation if the panel is dirty or has

debris on it and that the CO2 benefit is approximately 9g / mile

(based on tests recognised be the US regulator). (Hyundai)

- Significance: If Hyundai’s maths are right (and European regulators agree), at $1,100, solar roofs would have a CO2 reduction cost below $75 / g per km (unless it is lossmaking) — competitive with many electrification measures being implemented.

Mazda

- Defended

the 35 kWh battery size, smaller than most peers, of the forthcoming MX-30 BEV

on the basis of data suggesting it is enough for the real-world requirements of

most drivers and saying that the negative emissions of manufacturing larger

batteries outweigh their benefits. (Autocar)

- Significance: It remains to be seen whether the lifetime CO2 argument can be resurrected and win support from consumers or politicians. Since it rests on a key assumption that power grid energy generation continues to rely on fossil fuels (something which varies by country anyway), this might be difficult.

Nissan and Mitsubishi (history)

- Nissan’s number three executive resigned to take up a post at supplier Nidec. (Reuters)

- Mitsubishi

has reportedly decided not to design any new diesel engines, although it will

continue development of existing architectures. (Nikkei)

- Significance: Existing engines can still be improved considerably, even without starting afresh. The application of 48V significantly reduces fuel consumption and emissions. So, whilst this move is a shift in emphasis, it doesn’t necessarily mean the range dropping diesel altogether anytime soon.

- Ex-CEO Ghosn fled pre-trial detention in Japan, saying things were taking too long and offering to give his side of the story. Journalists were more interested in how he escaped. (Nikkei)

- Both PSA and Changan said they were selling their joint venture to Baoneng. (Economic Times of India)

- The Peugeot and Agnelli (Exor) families are reportedly discussing a formal pact that would control around 23% of the merged PSA-FCA’s shares (and could have double strength if maintained in the long term). (Il Sole 24)

- Won’t launch any more diesel vehicles in India and will have an EV in the market by 2021. (Autocar)

- Deposed chairman Cyrus Mistry says that although he won a court ruling, he isn’t trying to get his old job back, but does want a seat on the board. (Economic Times of India)

- Tesla’s Q4 deliveries totalled 112,000 cars, up 23% on a year-over-year basis, thanks to Model 3. In the full year, 367,200 cars were delivered, up almost 50% versus 2018. (Tesla)

- Delivered the first Model 3 cars from the new Shanghai factory. (BBC) Tesla said the factory has already produced 1,000 units and has reached a run rate of 3,000 cars per week. (Tesla)

- Russian

Tesla enthusiasts can already get hold of a Cybertruck replica for about

$11,000, the low price is helped by the humble Lada underpinnings. (Ars

Technica)

- Significance: As we discussed at the time of the Cybertruck’s launch, the simple design is an asset in terms of the ease with which it can be built. This goes two ways however… if this becomes a styling trend it also makes the design far easier to copy and companies could be leaving themselves open to IP theft.

- Elon Musk’s mother shared the secret of her family’s success. (CNBC)

- Received a fine of $13 million in China for telling Lexus dealers not to discount too much. The fine was based on annual sales in the affected Chinese province (2% of 2016FY). (Nikkei)

- Building a “city of the future” powered by fuel cells in Japan. Toyota hopes it will gain insights into connected homes and cars through the project. (Toyota)

- German media were up in arms over VW’s decision to (modestly) compensate Austrian police for vehicles affected by the diesel scandal, whilst continuing to deny German customers similar satisfaction. VW said there was no inconsistency because it was the importer that paid up. (Handelsblatt) It then transpired that VW had begun talks with representatives of a German diesel scandal class-action lawsuit covering around 440,000 owners. (The Guardian)

- Showed a concept video for a mobile charging station based in a car park. The system is made up of two elements, a battery pack on wheels that is put next to the car to charge the car’s battery and a robot tug that tows it from the charging station to the car and back again. The use of an animated video and dimensions of the battery pack suggest this is not something VW have yet mastered. (VW)

- The VW brand is so pleased with the rollout of electric vehicles that the company upped its production forecast. It now expects to pass the one million mark by 2023 and make 1.5 million units in 2025 (memo: the VW group target is about double this). (VW)

- Bentley’s CEO repeated earlier comments that 2025 is the earliest that the brand could have a credible all-electric car and is keeping his fingers crossed that solid state batteries are ready by then so as to save weight. He implied that the car might be the next generation of an existing nameplate, rather than an all-new model (previous rumours were of an all-electric two seater). Bentley is likely to use the VW Group’s PPE electric platform as the brand is leading development of some component areas — which ones is a secret. (Automotive News)

- Porsche’s works council representatives want a ten-year hiring commitment pointing to continued hiring, even as the brand’s electric vehicle portfolio is being rolled out, as evidence of the brand’s exceptionalism. (Manager Magazin)

- Audi hinted that high performance RS-badged variants of all-electric models will begin rolling out in 2021. (Autocar)

Other

- Nio released financial results for Q3 2019. The firm sold 4,799 cars, an improvement over prior quarters, but losses continued to mount; $(337) million operational loss on $257 million of revenue. Nio unveiled the EC6, a sporty all-electric SUV and announced a minor refresh for the ES8. The cash and equivalents balance of $274 million dropped $(229) million in the quarter. (Nio)

- Although Nio is cash poor, its investment vehicle Nio Capital raised over $200 million. (Deal Street Asia)

- A Turkish consortium unveiled the TOGG brand, an attempt to create a domestic champion along the lines of Proton in Malaysia. The first vehicle will be an SUV and the government has pledged to help by buying 30,000 cars by 2035. (The National)

- Chinese all-electric brand Lixiang Automotive (also known as CHJ Automotive) hopes to raise $500 million in a forthcoming IPO. (Reuters)

- Rivian’s forthcoming pick-up truck can perform a complete turn in little more than the vehicle’s own length. The feature, dubbed tank turning, appears to work by independently controlling the electric motors on each wheel. The demonstration video is on dirt — it is unclear if the method works well on tarmac. (Rivian)

- Byton received investment from Marubeni. The Japanese trading house apparently hopes the deal will secure a supply of Byton’s used batteries that can be put into service as stationary storage. (Nikkei)

- Chinese firm Youxia Motors is reportedly in financial trouble (despite previously claiming it had raised hundreds of million of dollars) and the regional government is contemplating a takeover. (China Money Network)

- Two firms that were collaborating to produce an electric homage to the three wheeled Isetta have parted ways. Artega and Micro-Mobility will now produce their own, probably nearly identical, vehicles. (Inside EVs)

- Fisker has decided that it will sell, rather than simply lease, the Ocean SUV after all. The brand intends to produce 1 million vehicles between 2022 – 2027. (Fisker)

- Aston Martin appears set to introduce digital rear and wing mirrors after showing some prototypes developed with help from supplier Gentex. (Autocar)

News about other companies and trends

Economic / Political News

- US light vehicle SAAR in December of 16.7 million units fell (4.6)% on a year-over-year basis. (Wards)

- German passenger car registrations in December of 283,380 units rose 19.5% on a year-over-year basis. In the full year, 3.6 million cars were sold. (KBA)

- Passenger car sales in the UK of 148,997 units in December rose 3.4% versus prior year. In the full year, 2.3 million cars were sold, (2.4)% worse than 2018. (SMMT)

- Spanish passenger car registrations of 105,853 units in December, up 6.6% from a year earlier. In the full year, 1.2 million cars were sold. (ANFAC)

- Italian December passenger car registrations of 140,075 units rose 12.5% from prior year. Full year sales of 1.9 million units rose 0.3%. (UNRAE)

- French passenger car registrations in December of 211,194 units rose 27.7% versus a year earlier. In the full year, 2.2 million units were sold, up 1.9% on 2018. (CCFA)

Suppliers

- Koito acquired full control of the India Japan Lighting JV from Lucas TVS. (Deal Street Asia)

- Eaton sold off its fluid conveyance division. (Eaton)

- Veoneer said it had fewer confirmed orders than originally forecast but remains convinced that things will come good, blaming deferments by customers. (Veoneer)

- Grupo Antolin will use Eyesight’s driver monitoring system in its interior products. (Autocar)

- Bosch showed off the latest sun visor technology; a transparent digital screen that can turn dark in exactly the right place to cast a shadow on the driver’s face. Given the low cost of a conventional sun visor, it is uncertain whether the idea will ever become a production reality. (Engadget)

Dealers

- Indian car repair firm GoMechanic raised $15 million and aims to expand its network of affiliated garages from 215 to 1,000 by year-end 2021. (Deal Street Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Uber completed the takeover of Careem, although it hasn’t yet received approval in some smaller markets so these have been packaged into a subsequent deal. Uber says the Careem brand will remain in service. (Uber)

- Uber’s co-founder and ex-CEO Travis Kalanick exited stage left and left the board. (Uber)

- A judge struck down rules in New York limiting the idling time of ride hailing drivers (caps on total fleet size and minimum wages for drivers are unaffected). (Reuters)

- The mayor of Los Angeles threatened to make ride hailing fleets go all-electric. (FT)

- HERE’s mobility arm said 2.5 million vehicles are signed up to its platform. (HERE)

Driverless / Autonomy (history)

- Uber is rumoured to be building a 600 acre autonomous vehicle test site near Pittsburgh, USA. (Business Insider)

- Bosch entered the lidar game, saying it had the first long-range sensor suitable for automotive applications. No other details were given, and Bosch’s claim appears based on their subjective interpretation of “long-range”, since other companies (e.g. IBEO) already supply production vehicles. (Bosch)

- Robosense is selling its entry level lidar for $1,898. The previously stated production cost target is $200. (Robosense)

- Tata Elxsi and AEye are collaborating on a robotaxi system. (Tata)

- Yandex’s fleet has logged 1.5 million miles of autonomous driving. (BBC)

- Hyundai’s CEO slightly revised the declared timeline for autonomous cars. Having previously talked about a solution from the JV with Aptiv being on the road by 2022, the plan is now: develop the system by 2022, rollout in company fleets in 2023, then sale to 3rd parties in the second half of 2024. (Hyundai)

- South Korean charging network Daeyoung Chaevi received a “large” investment from Kakao. (ET News)

- Californian authorities said charging networks could no longer charge by the minute. They will still be able to charge extra fees if people remain parked in the space once the vehicle has been charged. (Electrek)

- Nemanska Lithium filed for bankruptcy protection after price falls left the business case for its new Quebecois mine in tatters. (FT)

- Battery developer ProLogium keeps saying in its marketing materials that conventional lithium ion batteries are unstable and at high risk of fires. No statistics accompany the claims. (ProLogium)

- Byton received investment from Marubeni. The

Japanese trading house apparently hopes the deal will secure a supply of

Byton’s used batteries that can be put into service as stationary storage. (Nikkei)

- Significance: The deal implies that whilst automakers are fretting about how to organise second life of vehicle batteries, specialist investors are prepared to take a long term view, and could make useful partners.

- VW showed a concept video for a mobile charging station based in a car park. The system is made up of two elements, a battery pack on wheels that is put next to the car to charge the car’s battery and a robot tug that tows it from the charging station to the car and back again. The use of an animated video and dimensions of the battery pack suggest this is not something VW have yet mastered. (VW)

- Hyundai’s tests have shown that the charging rate from a solar roof is fairly reliable, with only (3)% – (10)% performance degradation if the panel is dirty or has debris on it and that the CO2 benefit is approximately 9g / mile (based on tests recognised be the US regulator). (Hyundai)

- BMW thinks it has chosen the right path by developing platforms that can accommodate conventional and electric powertrains but admits that dedicated architectures would be better if all-electric vehicles dominate. Improvements in battery energy density have wildly exceeded BMW’s expectations and the next generation of plug-in hybrids from the company will have zero emission ranges of 80 – 120 km. The firm believes that, in Europe, a decent charging network “is coming” and that this will support a plug-in hybrid sales mix of 25% by 2030. Although a current fuel cell costs ten times that of a battery electric system, BMW expects costs to converge by 2025. (Automotive News)

Connectivity

- Software firm Pivotal, a provider of connected car infrastructure for major OEMs and in which Ford had invested, was acquired by VMware. (VMware)

Other

- Bicycle rental firm Mobike said it lost 205,600 bikes due to vandalism or theft during 2019. (Tech In Asia)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.