Auto Industry Briefing — week ending 23rd February 2020

Making money from cyber security; customers turning their backs on clever engines and; autonomous pods have a branding problem.Please enjoy our auto industry and mobility briefing for17th February to 23rd February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Oranges And Lemons — FCA has agreed to let Mahle’s diagnostic devices access vehicle computers so that third party repairers can service their cars. The reason they can’t do so already is down to FCA’s cyber security protocols that unfortunately lock out unauthorised repairers, so you need special codes and portals to prove you are a goodie and someone needs to pay for all that. BMW do something similar. Is it just a happy coincidence that third parties must buy their way in (an extra revenue stream compared with those before), or will carmakers find themselves under fire from competition regulators arguing they are making life too hard for third parties?

- If You’re Over Me — Mazda is struggling to generate much interest in the very high tech Skyactiv-X engine. Rather than the hoped for 25% of sales, it is hovering nearer to 5%. The engine is Mazda’s bet that you can persuade customers that electric powertrain is over-hyped and on a well-to-wheel basis internal combustion is the best path. But it doesn’t seem to be working. Is this a sign for Mazda (and others) to bow to the inevitable and come up with powertrain strategies that are more clearly on a pathway to electrification?

- Aint Nothing Going On But The Rent — JLR showed off the Project Vector concept car, saying the vehicle will be used in on-road trials during 2021. The car highlights a key problem for premium brands in an autonomous world: it may be that a bland pod is exactly what Uber et al will be calling out for; it must make sense for vehicle utilisation to be improved by using the same vehicles for local delivery. The problem is that neither of these things speak to either Jaguar or Land Rover’s brand values. If local delivery is a fantastic opportunity for JLR, why not jump in now (Mercedes manage to have the three pointed star on Sprinter and S-Class)? And if it doesn’t fit the brand image now, why will things be different in a few years’ time?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

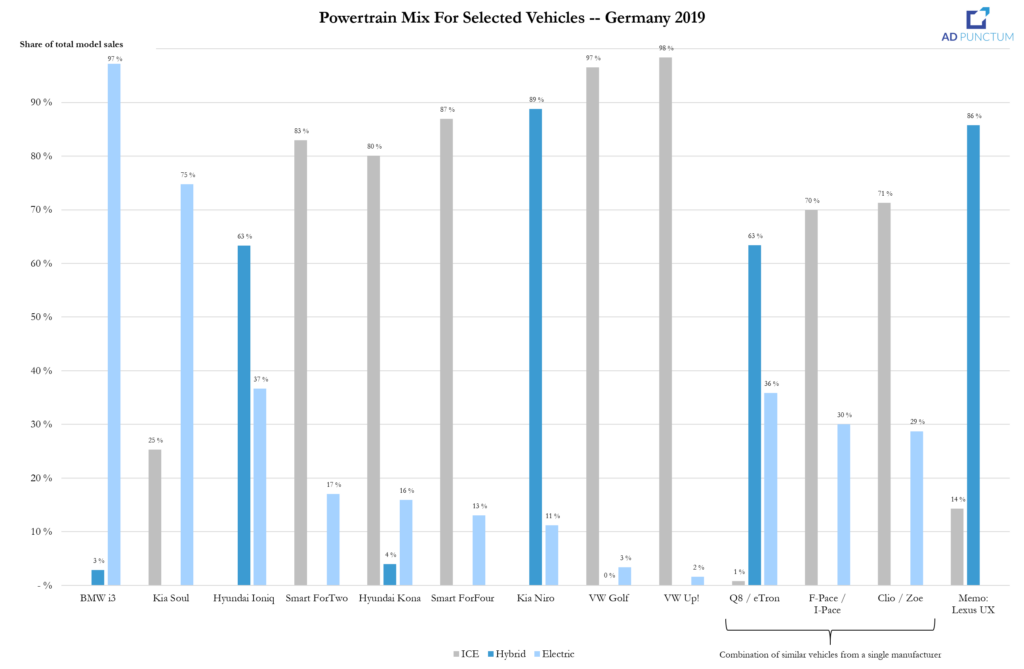

Chart of the week

Building on some of the earlier information we’ve shared about electric vehicle registrations in Germany, here’s a piece of analysis that you might find interesting. We looked at vehicles which come with a choice of powertrains: traditional, plug-in hybrid and battery electric vehicles. Because the sample size is small, we added in cars which have a sister product with a different drivetrain (e.g. Renault Zoe and Clio or Jaguar F-Pace and I-Pace).

As you can see from the graph below, VW’s vehicles are something of an outlier, with very small electric shares but those aside, all-electric shares taken upwards of 15% of sales, and in many cases above 30%. If the analysis stands up to scrutiny, these levels would almost certainly meet 2025 and 2030 CO2 targets if applied to the wider fleet. Can you argue that the all-electric share is flattered because some customers might be considering that car due to the limited competitor set when they wouldn’t be interested in the conventionally powered one? Yes. You wouldn’t necessarily have anything other than your own anecdotal objection to base it on, but yes. Here’s the chart:

News about the major automakers

- Efficiency ideas from 8,000 employees saved a claimed €62 million last year, more than half of that came from a single submission regarding the vehicle’s central computer. (BMW)

- Participated in a funding round for existing investment DSP Concepts, alongside Porsche. (Porsche)

- Announced a series of executive moves that will see Daimler’s top management take on roles in the Mercedes-Benz operational divisions and the creation of a COO position. (Daimler)

- Heycar, Daimler and VW’s joint venture for buying cars online acquired UK automotive consumer advice website Honest John, which boasts 25 million visitors. (Automotive Manager)

- Maserati’s new sports car will be called the MC20. (Detroit News)

- Agreed a deal with Mahle to sell access

to vehicle diagnostic systems, on a subscription basis, to workshops that use

Mahle’s hardware. (Auto

Service World)

- Significance: Following BMW’s lead, FCA is monetising access to vehicle systems for third parties (who can currently read diagnostics but have no editing capability). Under the banner of cyber security, manufacturers will have multiple options to control access. However, they will have to be mindful of competition rules that force openness with third party service centres and could get into hot water if a rival broke ranks and made such services available for free.

- Reportedly trimming the dealer network in the UK, historically one of Ford’s largest markets. (Motor Trader)

- Ford has begun installing McDonald’s-esque self-service digital screens in service centres so customers can avoid talking to real humans. (Ford)

Geely (includes Volvo) (history)

- LEVC expects to sell almost 4,000 vehicles in 2020, up from 2,507 in 2019. (LEVC)

- Customers in China can now buy a Geely-branded car online and have it delivered to their door without having to step inside a dealer. (Geely)

- Volvo’s financial results will only be reported every six months, rather than quarterly. (Volvo)

- Claims 30,000 orders for the Chinese market Icon small SUV. (Car Advice)

- Dealers reported that GM would offer them discounts of AUD $8,500 – AUD $17,500 (about $5,600 – $11,600) to shift outgoing Holden models as the brand is retired before the end of 2020. (The Guardian)

- Closing its factory in the Philippines. (Honda)

- Undertaking a series of changes to the legal entity structure in Japan, hoping to improve efficiency. (Honda)

- Eliminated a layer of senior management by combing the 4th and 5th tiers of the organisation. (Honda)

- Recalling around 230,000 minivans and SUVs in North America to fix a problem where moisture can enter the ABS system and cause short circuits, leading to fires. The vehicles were built from 2005 – 2009. (Yonhap)

- Continues to experience stoppages at South Korean factories because of Chinese supplier shortages. (Chosun Ilbo)

- Hyundai and Kia have developed an automatic transmission that uses real time data on weather and traffic conditions, collected via an in-car modem, to decide the best time to change gear (primarily by switching to one of a series of different maps). The primarily benefit is in fewer shifts and less braking. Despite the headlines, it isn’t yet in production. (Hyundai)

- Hyundai’s chairman is stepping down. (Reuters)

- Hyundai Capital’s European joint venture with Santander agreed to buy a 42% share in Sixt Leasing (presently a subsidiary of rental firm Sixt), and plans to take majority control. (Fleet Europe)

- A survey of UK consumers by Kia suggests that one third of them want an electric car as their next purchase. (Kia)

Mazda

- Thus far, Mazda’s high-tech Skyactiv-X gasoline engine has received a muted reception in the US market with less than 5% of customers choosing the motor, far short of hopes that it would claim 25% of sales. (Nikkei)

Nissan and Mitsubishi (history)

- Nissan’s

new CEO pleaded with shareholders to be given more time to come up with a coherent

recovery plan and said he would happily be fired if he fails. (Reuters)

- Significance: Perhaps unwittingly, CEO Uchida is channelling Carlos Ghosn, who pledged to resign if his initial turnaround plan failed.

- Trialling a short-term leasing scheme called “Switch” in Houston, USA. (Nissan)

- Will launch the Opel brand in Japan in 2021. (Opel)

- Faurecia reported 2019 full year revenue of €17.8 billion and operating income of €1.3 billion. (Faurecia)

- PSA’s retail arm plans to recruit 1,300 people in 2020. (PSA)

- Moody’s cut Renault’s debt rating to junk and Standard & Poor’s said its rating outlook was negative. (Reuters)

- France’s finance minister said the government would “play its role as shareholder” to make sure that there weren’t any job cuts in France. Looks like FCA’s trepidation about government intrusion was unwarranted. (Reuters)

- JLR unveiled Project Vector, a four-person minivan with claimed driverless

capability. 20 examples will be part of an on-road test program in 2021. JLR

says it has, in line with the latest fashion, developed a running “skateboard” chassis

that packages drivetrain and batteries beneath the floor. (JLR)

- Significance: JLR’s concept highlights the problem for premium brands in exploring low speed urban transport, namely that it is difficult to translate revenue-bearing attributes associated with private ownership into a pod. The car is co-branded yet carries no real design elements of either marque and JLR mention last mile delivery as a potential use case even though the firm has no credible entry in that space today. These uncomfortable inconsistencies with today’s brand DNA and customer base are, in part, why VW chose a newly invented name, MOIA, for similar activities.

- JLR’s CEO implied that the Project Vector chassis and technology would be made available to third parties, who could invest in the venture. (Autocar)

- Invested in online car financing provider Digital Motors. (JLR)

- JLR says it will run out of parts in the next two weeks if Chinese suppliers don’t resume production with CEO Speth claiming parts were currently being flown out in suitcases to keep factories going. (BBC)

- Reportedly decided not to pursue another bond issue after investors demanded too much interest. (Bloomberg)

- FCA’s soon-to-be-ex CEO Mike Manley is rumoured to be in the running for JLR’s next CEO. (Times of India)

- Rumoured to be switching to prismatic batteries from CATL for entry level Chinese-built Model 3s. (Reuters)

- Tesla fans tracking Cybertruck reservations reckon that more than 535,000 orders have been taken. (Forbes)

- Brazil’s government said it wants Tesla to open a factory in the country but so far it hasn’t got much further than having a video conference with someone at the US embassy. (Reuters)

- Developing batteries for hybrids in collaboration with Toyota Industries. (Toyota)

- Dealers in Germany will get a flat fee for selling ID3 and won’t have a role in negotiating prices. VW hopes that this will mean the same sales experience for the customer whether they are online or offline. What is less clear is whether the dealers will favour cars with traditional engines (and incentive structure) if a client is choosing between, for instance, an ID3 or a Golf. (VW)

- Audi e-Tron production was halted for several days due to a lack of batteries from LG Chem, the same supplier used by the Jaguar I-Pace. (Handelsblatt)

- VW is reportedly struggling with the launch of the ID3 with executives expressing doubts (off the record) that the start of deliveries will take place on schedule. (Manager Magazin)

- Porsche is so pleased with the new companies it is meeting through Startup Autobahn that it has extended the latter’s contract by a further three years. (Porsche)

- Participated in a funding round for audio software developer DSP Concepts, alongside BMW. (Porsche)

- CFO Witter reportedly plans to step down in mid-2021. (Manager Magazin)

- Heycar, Daimler and VW’s joint venture for buying cars online acquired UK automotive consumer advice website Honest John, which boasts 25 million visitors. (Automotive Manager)

- Škoda is re-entering the Sri Lankan market, using an importer model. (Škoda)

- Rumoured to be contemplating a VW-badged sports car, perhaps called the ID R. (Autocar)

- VW’s UK finance arm had its knuckles rapped for failing to tax and insure a handful of vehicles properly. VW said it was because of administrative errors. (MK Citizen)

Other

- W Motors wants to raise $100 million to finance a 500-unit run of a forthcoming all-electric supercar. (Bloomberg)

- Pininfarina will release an even more exclusive version of the Battista, only five will be made. (Pininfarina)

- The CEO of Lucid Motors said the company’s funding was healthy but that he wanted to raise more money (“a nine figure sum”) to accelerate the product development cycle. He intends to hold a demonstration drive in the coming weeks to showcase the Lucid Air’s claimed 400-mile range. (Bloomberg) Reservation numbers are reportedly in “low four figures”. (TechCrunch)

- Atlis showed off the XP “skateboard” chassis the firm hopes to sell (in addition to the XT truck built on the same platform). Using a 1.5 MW charger (which Atliss hopes it can make for under $50,000 per unit), Atlis say the battery pack can gain 500 miles of range in 15 minutes (that is fast considering the 250 kWh size of the pack). (TFLTruck) Watch a shaky version of Atlis’s presentation here.

- Czinger unveiled the 21C, a $1.7 million supercar designed to showcase 15m x 15m automated factories that use 3D printed components, each supposedly capable of making 10,000 chassis per year. (Top Gear)

News about other companies and trends

Economic / Political News

- Passenger car registrations in Europe during January of 1,135 million units fell (7.4)% from prior year. (ACEA)

Suppliers

- Magna reported 2019 full year sales of $39.4 billion and income from operations of $2.2 billion. (Magna)

- Bridgestone reported 2019 full year revenue of 3.525 trillion JPY (about $31.6 billion) and operating profit of 326 billion JPY (about $2.9 billion). (Bridgestone)

- Visteon reported full year 2019 sales of $2.945 billion and net income of $70 million. (Visteon)

- Touchscreen developer UltraSense raised $20 million from investors including Bosch and Sony. (FINSMES)

- Bosch consolidated its internet of things organisation into a single team serving all customer groups. (Bosch)

- Faurecia reported 2019 full year revenue of €17.8 billion and operating income of €1.3 billion. (Faurecia)

Dealers

- Ally Financial is buying credit card and consumer finance firm CardWorks. (Reuters)

- Automotive finance start-up MotoRefi raised $8.6 million. (FINSMES)

Ride-Hailing, Car Sharing & Rental (history)

- Lyft purchased Halo Cars, which provides advertising on car roofs. (Reuters)

- South Korean short-term car rental firm SOCAR raised $18 million. (Deal Street Asia)

- Gojek purchased a 4.3% stake in Indonesian taxi company Blue Bird. (Bloomberg)

- Cabify says it turned a $3 million profit, on an EBITDA basis, in Q4 2019. (Auto Rental News)

Driverless / Autonomy (history)

- A team of researchers working at McAfee undertook strenuous research culminating in an ability to get earlier versions of MobilEye’s forward-looking cameras to mis-classify speed signs and (on some models) feed the incorrect result to the car’s cruise control speed limiter. Although the methods used, and results achieved, seem impractical in everyday use, they highlight the problems with older sensor sets in the field. Even though MobilEye appear to have upgraded current hardware to resist such sabotage, older models were still vulnerable; even those with Tesla’s fabled over the air updates. (Autocar)

- Outrider, a firm developing autonomous trucks for shunting trailers in goods yards, raised $53 million. (TechCrunch)

- US charging start-up Electriphi raised $3.5 million. (TechCrunch)

- Tesla is rumoured to be switching to CATL’s prismatic batteries for entry level Chinese-built Model 3s. (Reuters)

- Toyota is developing batteries for hybrids in collaboration with Toyota Industries. (Toyota)

Other

- Electric scooter rental firm Tier has kept its funding round open and has raised $100 million so far. (Reuters)

- Flying taxi developer Volocopter extended its Series C round and now has €87 million. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 16th February 2020

How to meet your CO2 targets; GM exits fringe markets stage left and; mega expensive car dealerships.Please enjoy our auto industry and mobility briefing for10th February to 16th February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Milkshake — BMW and Renault both disclosed a bit more information about how they will meet 2020 EU CO2 targets. They agree that around one third of the improvement will come from improvements to internal combustion engines, with the rest through an increase in electric vehicle mix. Have they got the orders coming through?

- Cups — GM is shutting up shop in Australia, New Zealand and Thailand. The firm will still import cars but the days of purpose-built models are gone. By getting out now, GM can organise a soft landing (enabled by the appetite of Great Wall and VinFast for existing factories). Will any of their competitors regret not moving sooner or has GM’s departure left enough room for everyone?

- Lifestyles Of The Rich & Famous — A new two storey Ferrari dealership in the UK is forecast to cost a cool £9 million. Luxurious brand standards see even mass-market manufacturers demanding dealers cough up nearly £5 million for new sites. Startups have neither the footprint, nor the expensive facilities, will they get left behind in the arms race, or make the existing players look silly by doing far more with far less?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- CEO Zipse says BMW is on course to reduce EU fleet average CO2 by 20% in 2020 versus 2019 (therefore meeting regulatory targets and avoiding fines). One third will come from traditional fuel economy improvements, with the remainder from an increase in the mix of all-electric and plug-in hybrid cars. (Times of India)

- Invested in financing comparison service AutoFi. (BMW)

- Reported Q4 and full year 2019 financial results. 2019 revenue of €173 billion rose 3% on a year-over-year basis whilst EBIT fell over (60)% to €4.3 billion (Daimler’s adjusted figure was €10.3 billion). CEO Källenius declared himself dissatisfied with the company’s ability to translate strong consumer demand into weak bottom line earnings. 2020 guidance is for profits to “significantly” improve. (Daimler)

- Daimler

believes that trucks and passenger cars have “huge synergies” but when it came

to specifics, all the examples were about electrification, begging the question

about what happens when those parts are commoditised..? CEO Källenius cautioned

once again that Daimler might not meet 2020 and 2021 EU CO2 targets

if it meant heavily discounting products. (Seeking

Alpha)

- Significance: Ad Punctum continues to find the logic behind these comments troubling. Firstly, no other mainstream competitor is now talking in such terms, creating substantial reputational risk for Daimler if they pay fines whilst others don’t; secondly, the fine cost of €95 per gram CO2 missed per vehicle sold is higher than the additional product cost required to reduce emissions (especially if it pays for a plug-in hybrid), so it doesn’t seem to make business sense either.

- Renault is discussing “a whole bunch of ideas” with Daimler for future sharing. (Seeking Alpha)

- Recalling around 300,000 cars to fix wiring problems that could cause a fire. (Business Today)

- Expects South America light vehicle industry to increase by 1.5% in 2020, with Brazil growing 6%. (Reuters)

- Stopped production of the 500L in Serbia due to coronavirus-related parts shortages. The factory is a serial downtime candidate due to poor sales and FCA appeared relaxed about a timeline for restarting. (Reuters)

- Moved to a four-day week at the Cologne, Germany, factory due to reduced demand for Fiesta. The lower schedule will reportedly remaining in place until the end of the year. (Automotive News)

- Spin, the scooter rental firm owned by Ford, reckons that employing all personnel (as opposed to using contractors, the practice favoured by many rivals) is a competitive advantage because despite higher fully-fringed pay levels it has lower staff turnover and can invest more in training. (Business Insider)

- Mahindra claims that by pooling development costs for a new C-sized SUV with Ford, the two companies will save a collective 10 billion INR (about $140 million). (Economic Times of India)

- Recalling around 230,000 cars in North America to fix problems with the rear suspension. (Ford)

- Launched a travelling exhibition that will tour Europe and “de-mystify” electric vehicles for consumers. (Ford)

- Recalling recently launched Pumas to fix airbags. (Autocar)

- Ford remains committed to the Australian market, despite GM’s exit. (Mail Online)

Geely (includes Volvo) (history)

- Upgrading the filters in Chinese-market air conditioning units in response to coronavirus. The company is now researching self-cleaning interior buttons and grab handles (Geely)

- Withdrawing the Holden brand in

Australia and New

Zealand, and stopping all engineering operations by 2021. The Chevrolet brand

will also exit Thailand by 2020, with GM’s plant in the country being sold to

Great Wall (who recently purchased a GM factory in India). GM will only sell

high end imported vehicles in these markets. GM said that it couldn’t make a

business case for local production in Thailand, and without a factory Chevrolet

couldn’t be competitive. (GM)

- Significance: GM continues its course of leaving markets, and their associated facilities, which are marginal or lossmaking. The firm has become quite adept at exiting without controversial wholesale plant closures (thus retaining enough goodwill to continue sales of profitable models), showing willingness to subsidise new owners and even licence IP (e.g. with VinFast).

- Kia revealed the next-generation Sorento SUV. The design looks like an homage to Ford’s Explorer. (Kia)

- Hyundai

and Kia will use a modified version of Canoo’s (née EVelozcity) electric rolling

chassis for a series of small electric cars and autonomous pods. (Kia)

- Significance: Following recent investments in, and partnership agreements with, Rimac for sports cars and Arrival for commercial vehicles, this investment implies that Hyundai-Kia’s strategy is to licence chassis technology from third parties where the vehicle is outside the current core product portfolio. It also suggests an appetite for risk, since none of these companies have yet demonstrated the ability to produce in volume.

Mazda

- Recalling around 37,000 cars because of corrosion in the daytime running lights. (Mazda)

Nissan and Mitsubishi (history)

- Nissan reported Q4 2019 (fiscal Q3) revenue of 2.504 trillion JPY (about $22.8 billion) fell (18)% from the same period in 2018. Ordinary income was 37 billion JPY (about $337 million) but there was a net loss of (22) billion JPY (about $(200) million). The forecast for full year operating income was slashed. (Nissan)

- The Opel brand is launching in Colombia and Ecuador. (Opel)

- Reported 2019 full year financial results. Sales of 3.8 million units fell (3.4)% on a year-over-year basis. Revenue of €55.5 billion was similarly affected — down (3.3)% YoY, although Renault said that ignoring exchange it wasn’t quite as bad. Operating income was €2.1 billion, down (30)% versus 2018 and net income was a paltry €15 million. For 2020, Renault hopes that revenue will be about the same, despite expecting sales declines of (3)% – (5)% in its major markets. The Guidance implied that restructuring costs would outweigh operational free cash flow. (Renault)

- Plans to sell a 10% mix of BEV and PHEV in Europe in 2020, plus 10% LPG. The gap to CO2 target should be closed by roughly one third additional sales of BEV and PHEV, one third ICE improvement and elimination of worst performing entities and one third through application of super credits (which is really those BEV and PHEVs again). (Renault Presentation p. 36) Renault aims to sell 100,000 ZOE this year. (Seeking Alpha)

- Plans to reduce fixed costs by at least €2 billion over three years and will announce a series of actions in May within the Renault-Nissan-Mitsubishi alliance to deliver part of this but further details will wait until after the new CEO joins in July. Renault’s comments implied that cost savings from using the (brand new) CMF-B platform shared with Nissan were underwhelming because the top hats were engineered separately. (Seeking Alpha)

- Renault is

discussing “a whole bunch of ideas” with Daimler for future sharing. With LCV a

focus, but not the entire scope of the conversation. (Seeking

Alpha)

- Significance: Given the existing cooperation on the small Citan commercial vehicle, this would imply that a Trafic / Vito / Master / Sprinter tie-up could be on the cards (especially if the FCA/PSA merger means the end of the Trafic / Talento sharing).

- Suspended production of the all-electric I-Pace due to a shortage of batteries. JLR expects the stoppage to be temporary but wouldn’t comment on the root cause. (This Is Money)

- Raising $2.3 billion by issuing new stock, just days after CEO Musk said he didn’t see any need (but we all thought he was going to do it anyway). (Tesla)

- Environmental protestors won a court order forcing Tesla to stop site clearance for the new Brandenburg, Germany, factory to protect animals and woodland but work is likely to ultimately resume. (Manager Magazin)

- A “leaked” copy of Tesla’s employee handbook that reinforces the company’s preferred image of itself as a no-nonsense, go-getting, ass-kicking, world-changing machine sounded more useful as a propaganda tool than in conveying terms of employment. Also, a book seems a bit old-fashioned, shouldn’t it be an app? (Business Insider)

- Recalling around 20,000 Model X (including 3,000 in China) to fix problems with the power steering. (Reuters)

- A speech by Toyota’s boss in Canada calling for an emphasis on hybrid vehicles over battery electric ones highlighted some of the weaknesses in the company’s case: (1) Toyota’s economic rationale leans heavily on an assumption of a shortage of battery materials (hypothesised by others but not proven as a long term issue) and; (2) it offers no alternative for achieving zero tailpipe emissions (such as beefing up the relatively puny motors and batteries of conventional, non plug-in, hybrids). (Driving)

- Continued to leverage the virtues of its electrified fleet by raising a $750 million “green bond” for the captive finance company to offer leases on hybrid cars. (Toyota)

- Made a further investment in Intuition Robotics, a developer of digital companions. (FINSMES)

- Škoda’s forthcoming all-electric SUV will be called the Enyaq. (Škoda)

- German utility E.ON is installing chargers developed in partnership with VW that use batteries to enable discharging at higher rates than the local grid can support. (VW)

- Audi has started offering virtual factory visits, allowing people to tour the shop floor from the comfort of their armchairs. You still have to book a timeslot though. (Audi)

- Offered to settle a class action suit over the diesel scandal directly to the claimants and over the heads of their lawyers, who VW said wanted too fat a fee. If accepted, it will cost VW €830 million. (VW)

- Closing two coal fired power stations in Germany that supply electricity to VW’s sprawling Wolfsburg plant and wants to tear them apart, having declined offers from people hoping to rebuild them. (Reuters)

- Porsche’s motorsport boss implied that the brand is considering an electric version of the 718 sportscar, whilst playing down the idea that it could be a plug-in hybrid. (Auto Motor Und Sport)

Other

- Mahindra is looking for partners on electric vehicles aiming to “collaborate on the back end and compete on the front end”. The comments imply an interest in new partnerships beyond the joint venture with Ford. (Autocar) SoftBank has been mentioned as a potential investor in Mahindra’s electric vehicle arm. (Deal Street Asia)

- A consortium led by Gordon Murray Design unveiled the MOTIV, a small form factor vehicle ready for autonomous sensors and AI. The car is designed for city transit with a top speed of 40 mph. (GMD)

- Lordstown Motors, the Workhorse-related company that hopes to build electric trucks at an ex-GM plant, might have difficulty obtaining the US government loan that is key to its funding plan. Local lawmakers said they will ensure that it gets the money. (Detroit News)

- Nikola unveiled the Badger full size pickup. The brand plans to enter what is increasingly becoming a crowded space with entries from established players and start-ups on the horizon. Nikola’s vehicle features a somewhat unique powertrain — a high performance fuel cell combined with a massive battery. It probably won’t be cheap. (Nikola)

- Nio raised a further $100 million in short-term debt (Nio). The firm told employees that January salaries would be paid late, apparently because of coronavirus. (Bloomberg)

- Westfield reckons that, for niche car makers, all-electric variants cost around £20,000 – £25,000 more than conventionally powered models. (Telegraph)

- BYD’s president says that Chinese electric cars need to become more competitive with Western models, citing a need to improve in safety and reliability. (Yahoo)

- A sketch released by Lister suggested that the forthcoming Storm supercar will be electric. (CarBuzz)

- Pagani released a Huayra-based supercar called the Imola. (Automobile)

- Fisker released an image of a pickup truck called Alaska, then deleted it. (Car and Driver)

News about other companies and trends

Economic / Political News

- After announcing an intention to end sales of new non plug-in or zero emissions cars by 2035, a UK government minister floated the idea of bringing that forward to 2032. (BBC)

Suppliers

- Michelin reported full year 2019 revenue of €24.1 billion and operating income of €3 billion. (Michelin)

- Goodyear reported full year 2019 sales of $14.7 billion and a net loss of $(311) million. (Goodyear)

- Delphi reported 2019 revenue of $4.4 billion and operating income of $141 million. (Delphi)

- BorgWarner (which hopes to buy Delphi) had 2019 sales of $10.2 billion and operating income of $1.3 billion. (BW)

- AAM’s 2019 revenue was $6.53 billion and net loss was $(485) million. (AAM)

Dealers

- Indian omnichannel dealer Shriram Automall acquired online used car site Bluejack. (Autocar)

- Dealer standards are going mad — a new UK Ferrari showroom will cost £9 million. (Motor Trader)

- SureSale, a firm that gives used cars a clean bill of health, raised $7 million. (TechCrunch)

Ride-Hailing, Car Sharing & Rental (history)

- Lyft reported 2019 revenue of $3.6 billion and a net loss of $(2.6) billion. Even taking the highly optimistic measure of adjusted EBITDA the net loss was $(679) million. Lyft seemed pleased and hopes revenue will grow to around $4.5 billion in 2020 with the adjusted EBITDA loss under $(500) million. (Lyft)

- Lyft is buying rental car provider Flexdrive for $20 million. (TechCrunch)

- Peer to peer car rental firm Turo raised $30 million. (Phocuswire)

Driverless / Autonomy (history)

- An ex-Waymo driver took out his frustrations on one of the firm’s self-driving cars in Arizona, causing a crash. Don’t rush to call the opening shots of a new luddite rebellion though, he was sacked for poor performance, not replaced by a robot. (The Verge)

- Yandex has spent $35 million on self-driving research and is running at around $9 million per quarter. (Reuters)

- Lighting supplier Koito invested $50 million in lidar firm Cepton. (Koito)

- Indian moped rental firm Fae Bikes started a charging network. (Charzer)

- Electricity firm EDF acquired a majority stake in charging provider Pod Point. (EDF)

- Renault says that about 80% of charging by French customers is at home or at the office, with the remainder being on public facilities. The company admitted to being surprised by the high interest from rural customers, with 50% of cars going to owners outside cities. (Seeking Alpha)

- German utility E.ON is installing chargers developed

in partnership with VW that use batteries to enable discharging at

higher rates than the local grid can support. (VW)

- Significance: Although this philosophy has been employed before, the application in Germany matters because many engineers at German-based OEMs have convinced themselves that the potential for electric vehicles in the country is low because of the low power levels of the local grid. This method (albeit at a fairly large unit cost) may change their minds, and the attitude of the departments they lead.

- Hyundai and Kia will use a modified version of Canoo’s electric rolling chassis for a series of small electric cars and autonomous pods. (Kia)

- Westfield reckons that, for niche car makers, all-electric variants cost around £20,000 – £25,000 more than conventionally powered models. (Telegraph)

- BYD’s president says that Chinese electric cars need to become more competitive with Western models, citing a need to improve in safety and reliability. (Yahoo)

Other

- BP wants to be fully carbon neutral by 2050, offsetting all CO2 resulting from the oil and gas it produces. It is unclear how this will be achieved. (Reuters)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 9th February 2020

Fewer accidents on the way; the importance of ride hailing; and flip-flopping self-driving car developers. Please enjoy our auto industry and mobility briefing for 3rd February to 9th February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Ain’t No Mountain High Enough — Toyota says that a basket of driver assistance systems including emergency braking and lane departure warning reduce rear end collisions by 70% – 90%. This scale of improvement has been suggested for a while, but Toyota has collected data from 10 million vehicles to get its number. If, in future, accidents will reduce tenfold, are self-driving vehicle developers setting themselves tough enough targets by referencing today’s accident rates?

- Basket Case — Ride hailing has become so important to Indonesia’s economy that fares from the biggest location operators will go into the inflation calculation. If catching a cab can be such an important part of the transport mix there, why are so many in the West convinced that it will never catch on?

- Remember What I Told You To Forget — Just a few weeks ago GM (Cruise) was saying that using disengagements as a proxy for progress in driverless car developments was a load of old rubbish. So why are they using the same metric in their investor day presentation (p108) to provide how much progress they have made?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Expanding in-house production of electric motors and battery modules thanks to rising demand for plug-in hybrids. Staff numbers will more than triple and floor space will increase tenfold. (BMW)

- Rumoured to be about to announce 15,000 job losses. (Handelsblatt)

- Stopping production of the X-Class in May. (Autocar)

- Reported full year net revenue of €108 billion, down (2)% on a year-over-year basis. Adjusted EBIT of €6.7 billion was about in line. FCA expects things to improve slightly in 2020. (FCA)

- Reckons that European production could be affected by coronavirus within two to four weeks. (Reuters)

- Settled a tax dispute with Italian authorities over Chrysler’s value. FCA agreed to a higher taxable gain, but the availability of losses carried forward and offsets mean there is no net impact. (Reuters)

Ferrari

- Reported full year shipments of 10,131 cars, up 9.5% on 2018. Revenue of €3.8 billion rose 10.1% and EBIT of €917 million rose 11%. Ferrari upgraded the outlook for 2020. (Ferrari)

- Reported Q4 and full year financial results. In Q4 2019 revenue of $39.7 billion fell (5)% versus prior year whilst adjusted EBIT of $0.5 billion fell two thirds. Full year revenue of $155.9 billion was (3)% worse year-over-year and adjusted EBIT dropped (9)%. Q4 saw a net loss of $(1.7) billion and only just above breakeven in the full year. Ford blamed launch delays on Explorer and big bonuses to UAW workers. (Ford)

- Promoted Jim

Farley (hitherto Ford’s joint number two) to chief operating officer and

announced the “retirement” of 53-year-old Joe Hinrichs (his slightly more powerful

counterpart). Ford also beefed up the already expansive role of its product

supremo (53, but not yet ready to retire). (Ford)

- Significance: In the last two decades, Ford has only had a chief operating officer position twice: under Bill Ford when de facto CEOs couldn’t be given the title because he had claimed it for himself and; Mark Fields was COO whilst being groomed to take over from Alan Mulally. In this context, Farley appears to be a shoe-in for the top job when Hackett goes.

- A puff piece on Farley, timed to coincide with the announcement of his promotion, was long on promises of unspecified action and short on gushing quotes from underlings. It also debuted a new phraseology for improving profits: “bending the curve” of financial performance. Hopefully it won’t catch on. (Detroit Free Press) A cryptic post on LinkedIn by a former Ford marketing executive hinted at what some insiders think.

Geely (includes Volvo) (history)

- Volvo had full year 2019 revenue of 274.1 billion SEK (about $28 billion) and operating profit of 14.3 billion SEK (about $1.5 billion). (Volvo)

- Announced a project to merge Geely and Volvo with a view to a joint listing and the creation of a group that “could realise synergies”. (Geely)

- Reported Q4 2019 and full year financial results. Q4 revenue of $30.8 billion fell (20)% on a year-over-year basis, entirely due to North America (and the UAW strike). Adjusted EBIT of $105 million was (96)% worse. Full year revenue of $137 billion was (7)% down whilst adjusted EBIT of $8.4 billion dropped (29)%. (GM)

- Took the wraps off the next generation Cadillac Escalade large SUV. (GM)

- Reportedly blames an initiative to only offer downsized three-cylinder engines on some models for a slump in Chinese sales and plans to reverse course. (Reuters)

- Despite recently disparaging the measure of miles between reportable disengagements, GM used it in an investor presentation to show how much Cruise had improved. (GM – CMD presentation p108)

- Reported financial results for Q4 2019 (fiscal Q3). Revenue of 3.75 trillion JPY (about $34 billion) fell (5.7)% from a year earlier. Operating profit of 167 billion JPY (about $1.5 billion) fell (2.1)%. (Honda)

- Kia is rumoured to be considering moving its recently opened Indian factory to another part of the country in response to state-level changes to employment laws and incentives. (India Today)

- Kia unveiled the Sonet, a compact SUV due to start sales later in 2020. (Kia)

- Says that almost half of its operations (by revenue) will be impacted by coronavirus-related stoppages. (Hyundai)

Mazda

- Reported Q4 2019 (fiscal Q3) revenue of 849.7 billion JPY (about $7.7 billion), down (5)% versus prior year. Operating profit of 6.5 billion JPY (about $60 million) fell (76)%. (Mazda)

Nissan and Mitsubishi (history)

- Moving to quarterly sales reporting in the US, following the lead of GM, Ford and FCA. (Nissan)

- A UK consortium headed by Nissan completed a 230 mile “self-navigated” trip on public roads. (Nissan)

- The DS brand will be a net positive for PSA’s European fleet average CO2. (Automotive News)

- Unveiled the next generation Mégane, which includes a plug-in hybrid. (Renault)

- Renault Samsung was forced to take down days because of coronavirus-related parts shortages. (Reuters)

Subaru

- Reported Q4 2019 (fiscal Q3) revenue of 2.485 trillion yen (about $22.6 billion) rose 4% versus prior year but operating profit of 153 billion JPY (about $1.4 billion) fell (2)%. (Subaru)

Suzuki

- Reported Q4 2019 (fiscal Q3) revenue of 871 billion JPY (about $7.9 billion), down by (4.3)% on a year-over-year basis. Operating income of 52 billion JPY (about $470 million) dropped (11)%. (Suzuki)

- Building a battery recycling facility in India. (Autocar)

- Taking steps to resource components currently made by suppliers in China for Maruti Suzuki. (Reuters)

- Maruti

Suzuki is focused more on the improvement of internal combustion engines than

electric vehicles because internal forecasts are that even by 2030, only 8% of

the local industry will be electric cars. (Bloomberg)

- Significance: Whilst it is dangerous to read too much into such comments, it is worth noting that a considerable portion of contemporary fuel economy savings are coming from electrification (i.e. anything from 48V to plug-in hybrids). Therefore there is a path where electric vehicle-led improvements can benefit those with internal combustion engines.

- Tata unveiled an array of new products at the Indian Auto Expo, including the Sierra Concept, an all-electric SUV and the production version of the Gravitas. (Tata)

- JLR will reportedly take several down days at Solihull and Castle Bromwich before the end of March. (Reuters)

- Filed patents that indicate the firm is seriously considering steering wheels that contain touchscreens in future vehicle generations. (Electrek)

- Received

negative publicity after it downgraded the capabilities of a car Tesla had

offloaded to a dealer, who then re-sold it to an end customer. Although the car

had driver assistance features enabled at the time of delivery, Tesla

subsequently decided this was an error and removed them, demanding $8,000 for

reinstatement. (Business

Insider)

- Significance: Currently an isolated case, and hopefully it stays that way otherwise Tesla could find itself developing a reputation for tin-eared customer service.

- Elon Musk implied that Autopilot would create maps of features including potholes to help subsequent vehicles avoid them. If true, this further blurs Musk’s criticism of rivals in the self-driving race for relying on maps, when Tesla would be doing much the same (the subtlety may lie in the degree to which the maps decide, rather than merely influence, the vehicle’s route). (Electrek)

- Reported financial results for Q4 2019 (fiscal Q3). Revenue of 7.5 trillion JPY (about $68.7 billion) fell (3.3)% on a year-over-year basis and operating income of 654 billion JPY (about $6 billion) was also down slightly. Net income was way up, aided by gains on equities. (Toyota)

- In 2019, half of Toyota’s sales in Europe were hybrids (p4 of the competitiveness presentation). (Toyota)

- Data

collected from 10 million vehicles fitted with Toyota’s safety system comprising

emergency braking, lane departure alert and automatic high beam, says that rear

end collisions can be reduced by 70% – 90%. (Toyota)

- Significance: Although not a complete surprise, Toyota’s figures will put pressure on self-driving vehicle developers who currently assume that anything better than today’s average accident level is a threshold of safe driving at which autonomy has a business case. In short – if the new standard is a near tenfold reduction from figures they have been assuming, they need to aim higher.

- Working on an all-electric compact car powered by a battery pack that is designed for a second life — in this case, electricity storage in the home as part of a system built by 3rd parties such as Panasonic. (Nikkei)

- Has now acquired enough shares for 20% voting rights in Subaru. (Subaru)

- Škoda won’t launch a next-generation city car unless it can offer an affordable price. The company is convinced that the only way forward is fully electric, which will drive costs upward from the current model. (Autocar) The brand hopes to introduce more compact models in India, with an SUV and hatchback, both under 4 metres in length, under discussion. (Autocar)

- Porsche invested in business back office payments start-up Nitrobox. (Porsche)

- VW is dropping diesel from its small car line-up in India, saying that the next stage of emissions regulations will demand an expensive SCR system, so it is getting out whilst the going is relatively good. (Autocar)

Other

- Aston Martin’s CEO blamed a market slump for the firm’s cash shortages (which he hopes a recent investment have now laid to rest) saying the costs of the DBX SUV were “fixed in a bullish market that turned to crap”, indicating that the decision to build a new factory for the car might not be repeated if taken today. He feels comfortable with delaying an all-electric car until 2025, believing that no competitor except Porsche will have a car until then. (Autocar)

- Lucid says the production model of the Air will have a 900V system. (Electrek)

- After missing earlier targets, Ariel will reportedly unveil the Hipercar in summer 2020. (Autoblog)

- Ssangyong released full year 2019 results. Total vehicle sales were 135,235 units, down (6)% on a year-over-year basis. Revenue of 3.6 trillion KRW (about $3.1 billion) fell (2.2)% YoY and operating loss of (281) billion KRW (about $(240) million) more than quadrupled. (Ssangyong)

- Mahindra (Ssangyong’s owner) reported Q4 2019 (fiscal Q3) revenue of 121 billion INR (about $1.7 billion) down (6)% versus prior year. PBT of 3.8 billion INR (about $53 million) fell (34)%. (Mahindra)

- Nio will raise $100 million in debt. (Nio)

News about other companies and trends

Economic / Political News

- The UK government announced a plan to cease sales of all combustion engine powered new cars (including standalone hybrids but not the plug in-kind) from 2035 onwards. This is not a law, or a draft law and replaces an earlier target, also not a law, to ban internal combustion engines by 2040. (BBC) Manufacturers accused the government of “moving the goalposts” — as if their 2035 product plans were already fixed. (SMMT)

- European passenger car sales by fuel type for Q4 2019 were released. Overall, sales of battery and hybrid vehicles rose strongly on a year-over-year basis, with some exceptions. Norway, normally quoted as a poster child for electric vehicle take-up, saw battery electric vehicle sales fall (26)% versus Q4 2018. Although the market was down overall, mix still fell from 40% of sales in Q4 2018 to 34% in Q4 2019 — still high though. (ACEA)

- US light vehicle SAAR in January of 16.84 million units improved 1.4% from a year ago. (Wards)

- German passenger car registrations of 246,300 units in January were (7.3)% lower than 2019. (KBA)

- Passenger car sales in the UK during January of 149,279 units fell (7)% from a year earlier. PHEV and BEV share of total sales leapt from 2.2% in January 2019 to 5.9% last month. (SMMT)

- Sales of passenger cars in France during January fell (13.4)% on a year-over-year basis to 134,230 units. (CCFA)

- January passenger car sales in Italy of 155,528 units fell (6)% from prior year. (UNRAE)

- Spanish passenger car sales in January of 86,443 units dropped (7.6)% versus the same month last year. (ANFAC)

Suppliers

- TomTom reported full year 2019 revenue of €701 million, up 2% year-over-year. (TomTom) The fine celebrated an extension to its supply deal with PSA. (TomTom)

- Veoneer reported full year sales of $1.9 billion and an operating loss of $(460) million. (Veoneer)

- Grammer Group reported full year 2019 revenue of €2 billion and operating EBIT of €77 million. (Grammer)

- Anand Group reckons that composites are ready for use in low-cost vehicles in India and has enlisted the help of UK firm Far to help prove it. (Autocar)

- Nidec announced a stock split. (Nidec)

Ride-Hailing, Car Sharing & Rental (history)

- Uber reported full year revenue of $14.1 billion on $65 billion of gross bookings. The net loss was $(8.5) billion. The firm says it recognises that the “era of growth at all costs is now over”. (Uber)

- Fair is stopping its program of leasing to ride hailing drivers (which the company acquired from Uber), blaming insurance costs. (TechCrunch)

- Child-focused ride hailing service HopSkipDrive raised $22 million. (TechCrunch)

- Enterprising car thieves in Washington, DC, are using peer-to-peer app Getaround to identify suitable targets because they know the vehicle will contain keys. (Auto Rental News)

- Ride hailing has become so important to Indonesia’s economy that prices from Gojek and Grab are now included in the basket used to calculation inflation. (Tech In Asia)

- Didi and ThunderSoft are collaborating to produce a whitelabel fleet management system that they hope to sell to third parties. (ThunderSoft)

- Uber invested in logistics start-up ClearMetal. (FINSMES)

- ViaVan’s Berlin service, named Berlkönig, is reportedly in financial trouble with the operator and Berlin’s public transport provider arguing over who should fund it in future. (Autonomes Fahren)

Driverless / Autonomy (history)

- US authorities gave Nuro permission to test self-driving vehicles on the road. The approval contained a series of obvious, but previously unauthorised design changes from normal vehicles: there are no external mirrors (cameras are used instead); the windscreen is opaque and; the rear camera is on all the time (forbidden in passenger vehicles where it could prove distracting). (Nuro)

- Lyft’s team discussed the trade-offs between developing self-driving cars that can quickly learn how to drive well in a specific location versus creating AI that can drive in many places (“generalizing” in Lyft’s terminology). (Lyft)

- Data collected from 10 million vehicles fitted with Toyota’s safety system comprising emergency braking, lane departure alert and automatic high beam, says that rear end collisions can be reduced by 70% – 90%. (Toyota)

- Despite recently disparaging the measure of miles between reportable disengagements, GM used it in an investor presentation to show how much Cruise had improved. (GM – CMD presentation p108)

- A survey by Deloitte reckons one in ten UK customers want their next car to be electric. (Motor Trader)

- Battery developer Forever New Energy raised $20 million. (Deal Street Asia)

- Lucid says the production model of the Air will have a 900V system. (Electrek)

Connectivity

- A beta release of Apple’s updated iPhone operating system suggested that the company is working on a keyless entry app that could be used across brands. (The Verge)

Other

- Boeing-backed flying taxi start-up Wisk is going to conduct trials in New Zealand. (The Verge)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 2nd February 2020

Aston Martin’s independence; the difference between electric winners and losers; and secret emissions trading is a thing. Please enjoy our auto industry and mobility briefing for 27th January to 2nd February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Lady In Red — Aston Martin is set for £500 million in fresh funds, thanks to the intervention of billionaire F1 team owner Lawrence Stroll (and chums) who will end up controlling 20% of the business. Mr Stroll just so happens to be a massive Ferrari fan, participating in their exclusive track-only models (FXX and so on). Might he prefer owning a smaller stake of Ferrari-AML in future?

- Big Calm — GM’s president says the main reason the company’s forthcoming electric cars will be profitable is because of the scale benefit. He also appeared dismissive of companies with only one or two electric cars in their portfolio. Will companies that haven’t committed to higher volumes find themselves struggling for cost competitiveness against more earnest rivals?

- Share My World — Renault, Nissan and Mitsubishi will pool their fleets for the purposes of measuring CO2 in Europe and Geely’s taxi unit LEVC subtly signalled that it is open to letting someone benefit from the net benefit of its fleet of plug-in hybrids. Taken together with earlier moves by FCA-Tesla and Toyota-Mazda, are car companies starting to get the hang of creating proprietary CO2 trading schemes? If so, who’s next?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

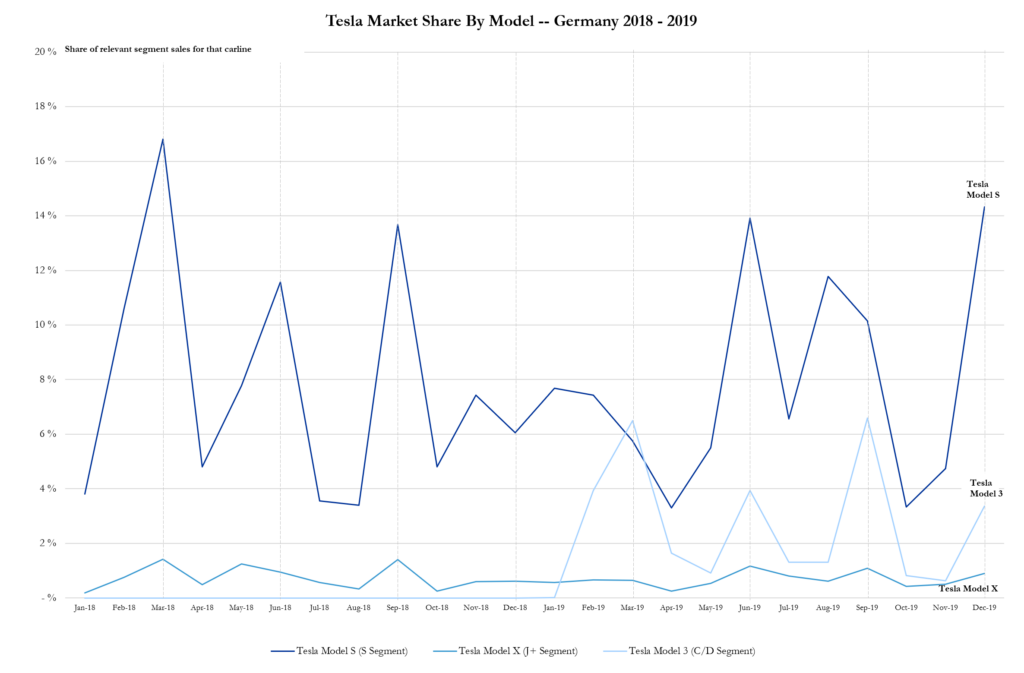

Chart Of The Week

Last week’s chart got some interest, so I thought I would try another. If you read a lot of the pro-electric vehicle websites (as I do) then you will be familiar with articles like this one that trumpet the sales performance of Tesla cars compared to the conventionally powered competition in any given month. I went and looked at some German data and found something rather strange.

Now, I’m not suggesting this is anything other than coincidence but there seems to be a pattern where Tesla’s market share (of the relevant segment for each of Model 3 / S / X) jumps in the final month of the quarter. Remember this is share, not volume, so seasonality shouldn’t be much of a factor. Here’s the chart:

News about the major automakers

- Delayed the next-generation Mini, partly to save money by extending the current car’s lifespan, and partly in the hope that it will know the final outcome of a UK-EU trade deal before it has to decide the production footprint. (Reuters)

- Not interested in making BMW-badged products in the same segment as Mini, preferring to have distinct brands that do not compete with one another. (Autocar)

- Trialling the use of blockchain technology provided by Circulor to track CO2 emissions in the supply chain. (Autocar)

- Recruited sellside analyst Max Warburton as head of special projects, reporting to the CEO. (Daimler)

- Launched the next generation infotainment system called Uconnect 5. FCA reckons it is more user friendly than competitor products and well futureproofed. (FCA) TomTom will be the mapping supplier. (TomTom)

- Announced a further period of idling at the Belvedere, USA, plant. (Bloomberg)

- Confirmed that a forthcoming Lincoln battery electric vehicle will be built off Rivian’s platform. (Ford)

- Experimenting with 3D-printed locking wheel nuts that are unique for each vehicle. (Ford)

- Completed the sale of its former UK administrative HQ for £40 million. (EssexLive)

Geely (includes Volvo) (history)

- Taxi

maker LEVC is open to joining a pool that could benefit from its low CO2

per vehicle. It has issued a request for an open pool via the EU’s system.

Presumably inviting partners in return for financial reward. (EU)

- Significance: The open pool declaration implies that Volvo is on track meet EU fleet average CO2 levels

- GM’s president doesn’t think there is an inflection point for EV adoption believing that they have already entered the mainstream and that the rate of take-up is now in the hands of customers. In echoing previous statements that the next generation of all-electric cars would be profitable, scale was highlighted as a major factor in the business case. He also said that battery packs didn’t need to increase in size from the current generation, but GM will be able to squeeze out more performance thanks to a better understanding of how the battery is used in the real world. (Electrek)

- Confirmed rumours that Hummer will be resurrected as an all-electric model. The vehicle won’t be revealed until May and GM didn’t elaborate on the bodystyle (expected to be an SUV and a pick-up variant). The new Hummer won’t be a standalone brand however, it will be a model within the GMC portfolio. The new truck boasts an impressive specification: 1,000 hp and 0-60 in 3 seconds. (GM)

- Cadillac will roll out a new driver assistance system, called enhanced super cruise, that will enable hands-off highway driving, including lane changes. (GM)

- Honda produced 5.17 million vehicles in 2019, down (3.5)% on the prior year. (Honda)

- Says bottlenecks in production of the Hyundai Kona BEV for European markets have been reduced, in part by the start of production in the Czech Republic. (Autocar)

- Claims the new Genesis GV80 SUV will differentiate itself by providing an adaptive cruise control system that learns driver preferences. (Detroit Free Press)

- The Genesis GV80 has electronically controlled suspension that uses cameras to see features such as speed bumps and pot holes on the road ahead and adjust settings before the vehicle hits them. (Hyundai)

- Says it will now offer US customer complimentary maintenance for three years on new cars. On closer inspection however, the services included only extend to oil changes, filter changes and tyre rotation. (Hyundai)

Nissan and Mitsubishi (history)

- Rumoured to be planning further spending cuts (on top of the summer 2109 turnaround plan) by cutting 4,300 salaried staff globally (e.g. some US sales and marketing offices) and closing two (unidentified) factories. The global line-up will be pared to 62 models, but average aim will be reduced to 2.5 years (from 5 today). (Reuters)

- Reportedly

prepared a plan for a hard Brexit that would see Nissan plants on mainland

Europe closed and an attempt to capitalise on the lack of homegrown UK

production by taking market share from competitors who would be subject to higher

tariffs than Nissan (~3% vs 10% of material cost). (FT)

- Significance: Ad Punctum’s own Brexit analysis (published in 2017 but still relevant now) pointed out the disparity in tariff costs for UK-produced cars versus those built in Continental Europe under default WTO terms. Producers with footprints in Britain would gain a cost advantage of around £1,000 even on cheaper models (although they would still lose ground to vehicles that are imported from outside the EU today so already bear the higher tariff levels).

- Will prioritise the Nissan brand in India (over Datsun), including for designed / made in India products, calling into question Datsun’s market positioning. (Autocar)

- Nissan, Renault and Mitsubishi announced a series of measures to deepen integration. Nissan will lead engineering on models for China; Mitsubishi for Southeast Asia and Renault in Europe. Engineering of components will also be shared out, although no details were given. The three brands also plan to pool their collective fleet average CO2 in Europe, starting in 2020. (Mitsubishi)

- Mitsubishi’s Q4 2019 revenue (fiscal Q3) of 1.67 trillion yen (about $15.3 billion), down (7)% versus the same period in 2018. Operating profit of 3.6 billion yen (about $33 million) fell (96)% from prior year. (Mitsubishi)

- Said the diesel engines subject to investigation by German authorities for emissions cheating were supplied by PSA and denied the existence of any defeat devices. (Mitsubishi)

- PSA and Total’s Saft division announced a plan to create two battery plants, one in France and one at Opel’s Kaiserslautern site in Germany. The €5 billion investment (€1.3 billion coming from public funds) will lead to a combined 48 GWh of capacity by 2030, good for one million vehicles per year by their maths. Over time PSA’s share in the JV will go from 50% to 67%. (PSA)

- To no one’s surprise, Renault confirmed former SEAT executive Luca de Meo as CEO from July 2020. (Renault)

- Nissan, Renault and Mitsubishi announced a series of measures to deepen integration. Nissan will lead engineering on models for China; Mitsubishi for Southeast Asia and Renault in Europe. Engineering of components will also be shared out, although no details were given. The three brands also plan to pool their collective fleet average CO2 in Europe, starting in 2020. (Mitsubishi)

Subaru

- Produced 987,283 vehicles in 2019, (3.1)% down on prior year. (Subaru)

- Tata Motors (including JLR) reported Q4 2019 (fiscal Q3) revenue of 716.8 billion INR (about $10.1 billion), down (7)% on a year-over-year basis. Volumes fell (12)% to 275,907 units. Happily, EBIT of 16.8 billion INR (about $240 million) was much improved from a prior year loss as improvements at JLR more than offset losses on Tata-branded vehicles. (Tata)

- JLR reported Q4 2019 (fiscal year Q3) revenues of £6.4 billion, up 2.8% on a year-over-year basis and PBT of £318 million, from a loss in the prior year. The company credited its “Project Charge” program for delivering cost savings and said it will now enact “Project Charge +” to save even more. (JLR)

- JLR CEO Ralph Speth will step down in September 2020. (JLR)

- Reported Q4 2019 automotive revenue of $6.4 billion, up 1% on a year-over-year basis, and PBT of $132 million, down (25)% YoY. In the full year, automotive revenue of $20.8 billion rose 12% versus 2018 and PBT of $(665) million improved $(1.0) billion in 2018. Investors were cheered by a third consecutive quarter of free cash flow and Tesla’s bullish outlook for deliveries in 2020. The firm says it is already producing Model Ys for customers in the USA, will deliver a few Semis in 2020 and everything is going great guns in China. (Tesla)

- On the earnings call Tesla ruled out a capital raise, despite the rocketing share price, saying positive cash flow met funding needs. The company will likely host a day of presentations about battery technology in April, with Musk promising exciting news arising from the acquisition of Maxwell. (Seeking Alpha)

- CEO Musk thinks that battery modules are just a holdover from a time when lower cell manufacturing and management performance required a capability to swap out failed cells without chucking away the entire pack. He now wants to dispense with Tesla’s module engineering team entirely. (Clean Technica)

- Elon Musk re-framed his definition of “feature complete” self-driving, saying that this meant it would be possible for the car to drive a journey itself sometimes but “doesn’t mean the features are working well”. (Business Insider)

- Chinese owners are getting free supercharging during the coronavirus outbreak. (Clean Technica)

- Toyota Tsusho invested in Kenyan on-demand logistics company Sendy as part of a $20 million round. (FINSMES)

- The battery-making joint venture between Toyota and Panasonic will be called Prime Planet. (Toyota)

- Truck division Traton launched a takeover offer for US-focused truck maker Navistar. (VW)

- Agreed to sell 76% of the Renk heavy engine division to Triton in a €530 million deal. (VW)

- Audi says employee suggestions saved at €100 million at two German factories. (VW)

- Porsche’s CEO sidesteps the question of whether electric vehicles are truly the most environmentally friendly transport solution (considering the manufacturing) by calling it the “most marketable” technology and that the brand will be “well below” EU CO2 fleet targets. (Porsche)

Other

- Aston Martin announced a £500 million financing plan that

includes £182 million from a consortium led by F1 team owner Lawrence Stroll

(who will become executive chairman) in return for a stake that is intended to

eventually become 20%. Despite being short on cash, part of the plan is for Mr

Stroll’s F1 team to be re-branded as Aston Martin from the 2021 season onwards.

The relationship with Red Bull technologies will end after delivery of the Valkyrie

— the two firms originally planned to collaborate on a further range of

supercars. The company also confirmed it won’t release any electric cars until

2025 at the earliest, calling into question plans for the Lagonda brand (which

was to be all-electric) (AML)

- Significance: Since Mr Stroll is well known for his collection of Ferraris, it seems a more than reasonable guess that as time passes, the two storied brands might discuss collaboration opportunities (and more).

- Arrival has received an order for 10,000 all-electric delivery vans for delivery between 2020 – 2024 (with an option for a further 10,000) from UPS in a €400 million deal. (The Guardian)

- Karma intends to make an SUV and pick-up using an all-new platform. (Bloomberg)

- VinFast says it has 17,000 orders for its new line-up of cars. (Vietnam+)

- Lordstown Motors is hoping for $200 million loan to build its new pick-up, which it will unveil at the Detroit motor show. (Reuters)

News about other companies and trends

Economic / Political News

- The Coronavirus caused many OEMs to suspend production (due to Chinese New Year, a shorter break was always planned). Amongst them were Tesla, Toyota, Honda, Ford, Renault and VW. Supplier FTech is relocating some production to the Philippines because its plant is in Wuhan. Hyundai and SSangyong said production in South Korea was affected because of parts shortages.

- TomTom says Bangalore, India is the world’s most congested city. (TomTom)

Suppliers

- Bosch reported preliminary 2019 sales of €77.9 billion and profits of €3 billion. Bosch says worldwide automotive production will shrink in 2020 and thinks it might never recover. The company intends to review capacity. (Bosch)

- BorgWarner agreed to acquire Delphi in an all-stock deal. (BW) BorgWarner reported preliminary FY 2019 revenu of $10.2 billion and operating income of $1.3 billion. (BW) Delphi reported preliminary FY 2019 revenue of $4.4 billion and operating income of $315 million. (Delphi)

- Nidec thinks revenue will more than triple off the back of increased electric vehicle production. (Reuters)

- Autoliv reported FY 2019 revenue of $8.5 billion and operating income of $726 million. (Autoliv)

- Lear’s FY 2019 revenue was $4.8 billion and net income was $126 million. (Lear)

- Denso’s Q4 2019 (fiscal Q3) revenue was $35.5 billion and operating profit was $1.5 billion. (Denso)

- Meritor reported Q4 2019 (Fiscal Q1) revenue of $901 million and net income for $39 million. (Meritor)

- Aptiv reported FY 2019 revenue of $14.4 billion and net income of $990 million. (Aptiv)

- Veoneer has now exited the brake systems joint venture it owned with Honda and Nissin Kogyo. (Veoneer)

- WABCO is selling the RH Sheppard steering division to Knorr Bremse ahead of ZF’s takeover. (WABCO)

- Adient reported Q4 2019 (fiscal Q1) revenue of $3.9 billio and EBIT loss of $(42) million. (Adient) The firm is exiting the interior trim joint venture with Yanfeng in a $379 million deal and the pair have extended the JV for seating and altered arrangements for their mechanisms JV. (Adient)

Ride-Hailing, Car Sharing & Rental (history)

- GoJek has suspended several drivers after it discovered they were using modified versions of its app that allowed them to see more information about passengers and reject trips. (Tech In Asia)

- Lyft’s restructuring made the headlines, but it only affects about 90 people. (NYT)

Driverless / Autonomy (history)

- Automated truck developer Embark said it wouldn’t publish a 2019 disengagement report but was happy to say it hadn’t had any crashes. (Embark)

- Postal firm UPS will test autonomous technology in cooperation with Waymo. (Reuters)

- Uber is reportedly investigating different ways of

financing a fleet of driverless cars — internal proposals apparently include

bundling vehicles into structured trusts that would pay out a set rate using

the cash from ride. (FT)

- Significance: Although this article rightly points out the difficulty of financing cars in the same way as buildings, due to depreciation, existing leasing models for aircraft and rolling stock (where unit volume is lower but value is far higher) suggest that this is not an insurmountable problem.

- Comma.ai says, following the launch of its latest smartphone-based driving assistant, it is profitable. The company hopes to achieve a mean distance between disengagements of 100 miles during 2020. It says that this cannot be compared to most self-driving firms because it does not always test in the same location (although the relatively low number of users would imply it isn’t that different). (Comma)

- Tesla’s Elon Musk re-framed his definition of “feature complete” self-driving, saying that this meant “some chance” the car could drive a journey itself but “doesn’t mean the features are working well”. (Business Insider)

- Cadillac will roll out a new driver assistance system, called enhanced super cruise, that will enable hands-off highway driving, including lane changes. (GM)

- Indian tariffs for electric vehicles have been hiked — at the same time as those for conventional engines — to 40%. The previous (favourable to EV) difference in tariff between electric and conventional powertrain has been eliminated. The government says it simply wants more local manufacturing. (Economic Times of India) It also believes that within three years, EVs will be cheaper than those with combustion engines. (Economic Times of India)

- India is plotting a 12-lane, 1,300km electrified highway, to be completed by the start of 2024. It would have fixed overhead lines for trucks and buses and charging service stations for light vehicles. (Economic Times of India)

- Tesla’s Elon Musk thinks that battery modules are just a holdover from a time when lower cell manufacturing and management performance required a capability to swap out failed cells without chucking away the entire pack. He now wants to dispense with Tesla’s module engineering team entirely. (Clean Technica)

- Aston Martin confirmed it won’t release any electric cars until 2025 at the earliest, calling into question plans for the Lagonda brand (which was to be all-electric) (AML)

- GM’s president doesn’t think there is an inflection point for EV adoption believing that they have already entered the mainstream and that the rate of take-up is now in the hands of customers. In echoing previous statements that the next generation of all-electric cars would be profitable, scale was highlighted as a major factor in the business case. He also said that battery packs didn’t need to increase in size from the current generation, but GM will be able to squeeze out more performance thanks to a better understanding of how the battery is used in the real world. (Electrek)

- The battery-making joint venture between Toyota and Panasonic will be called Prime Planet. (Toyota)

Connectivity

- TomTom is the mapping supplier for FCA’s upgraded infotainment system. (TomTom)

Other

- In a sign that large automotive companies might be losing interest in bright ideas that will change the future, the Techstars Detroit incubator is closing. (TechCrunch)

- Truck maker Volvo reported 2019 full year revenue of 432 billion SEK (about $44.8 billion) and adjusted operating income of 47.9 billion SEK (about $5.0 billion). (Volvo)

- Scooter rental firm Bird confirmed a deal to acquire Circ and raised a further $75 million. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.