Auto Industry Briefing — week ending 29th March 2020

Tata’s mysterious reorganisation; carmakers begging for mercy; a glass is half full view of Coronavirus. Please enjoy our auto industry and mobility briefing for23rd March to 29th March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Separate Ways (World’s Apart) — Separate Ways (World’s Apart) — Tata Motors is separating its passenger car and commercial vehicle arms. The firm hopes that this will help it land some strategic alliances. But you don’t need a different capital structure to do some platform sharing deals with someone, even joint venture plants are easy enough. Unless… this (hypothetically French speaking) admirer might want to buy into the business? If such a deal was to be had, would it have ramifications for Jaguar Land Rover?

- Give Me A Reason To Love You — European carmakers wrote a letter to officials asking nicely for the continent’s CO2 regulations to be somehow relaxed. They explained that because they haven’t had anyone in work for the past couple of weeks, development of new vehicles has been impossibly derailed. It will be a masterstroke of lobbying if they win over sceptical eurocrats, perhaps they should point to Formula 1’s example, or to the blue skies overhear showing that CO2 reduction targets have surely been achieved just by making everyone stay at home?

- Blue Skies — VW thinks that the German market will recover by the summer whilst Ford hopes to have some North American factories up and running by April. Bullish stuff indeed. But if everything is so rosy, why is everyone trying to raise new credit lines and boasting about them to the market (apart from Mahindra’s boss, who reckons we’re on for a massive recession)? And what does “recovery” mean anyway? Do we resume our prior run rate with the intervening months simply lost in the sands of time, or does demand go crazy in late 2020 as every buyer who has been forced to sit out March, April (and beyond) comes barrelling into the showroom demanding a new motor?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Confirmed that the iNext SUV will be offered with a fuel cell powertrain, as well as an all-electric model. (BMW)

- The Smart brand is apparently readying an all-electric SUV for launch in 2022. (Manager Magazin)

- Still believes that traditional auto shows have a useful role to play. (Autocar)

- CEO Källenius doesn’t intend to apply for aid from the German government (apart from paying the wages of furloughed staff), carrying on with the dividend and says all its suppliers have enough cash to stay in business. Although Daimler has heard rumours of manufacturers asking for the EU’s 2020 CO2 rules to be watered down, Daimler isn’t one of them. (Handelsblatt)

- Reportedly trying to arrange an €11 billion credit line. (Bloomberg)

- Declared that production would resume at several US plants beginning 14th April. (Detroit Free Press)

- Aims to make 1 million face masks per month for use in North America. (FCA)

- Moody’s placed FCA’s credit rating under review. (FCA)

- Negotiated an incremental €3.5 billion credit facility, taking the total to €11.2 billion. FCA has started drawing on the first €1.5 billion. (FCA)

Ferrari

- Believes it can restart production on 14th April. (Ferrari)

- Told US workers that it might reduce their pay whilst operations are suspended. In solidarity, Ford’s top 300 executives will see part of their salaries deferred. (Detroit Free Press)

- The yet-to-be launched Bronco Sport SUV (a more rugged version of the Kuga / Escape) features a mystery option called “roof conversion – low opening”. (Fox News)

- Recalling 268,000 cars to fix door locks that might not keep the door closed, 54,000 cars for a problem with the brakes and 3,500 for fragile wiring harnesses. (Ford)

- Plans to resume production in Mexico on 6th April and several US plants on 14th April. (Ford)

- Fitch downgraded Ford’s rating to BBB- saying the company could burn $14 billion in cash if there is a severe recession. (Detroit News)

Geely (includes Volvo) (history)

- Volvo said that customers in China were returning, making it confident of a recovery in the market and although it isn’t sure about 2020 results it will go ahead with a dividend based on 2019’s results. (Volvo)

- Volvo announced an executive reorganisation

that will see four areas reporting into the CEO: sales and marketing; manufacturing,

logistics and procurement; product creation; and back office functions (excluding

legal and finance teams, which will remain independent). (Volvo)

- Significance: The reorganisation appears linked to the impending merger with Geely’s Chinese operations.

- Drawing $16 billion of credit lines to weather coronavirus. (GM)

- Will reduce the pay of US salaried staff by 20% to help with cash, but promises to pay back the money, with interest, later in 2020 (or early 2021). (Detroit News)

- Reached a settlement worth $120 million with owners of vehicles with defective ignition switches. (Reuters)

- Ended up in Donald Trump’s crosshairs over problems with an emergency plan to build ventilators. Frustrated by an apparently slow ramp up and high prices, he invoked a US law to compel GM to do what the company said it was going to do anyway. (Detroit Free Press)

- Finally reached an agreement with South Korean unions on pay changes for 2019. Workers won’t get a raise, but will receive vouchers with extra-large discounts on GM vehicles. (Yonhap)

- Reckons it can make 100,000 surgical masks per day at a shuttered US factory. (Detroit News)

- Undergoing a slight reorganisation in China that will see the Honda Automobile (China) factory absorbed into the main GAC-Honda joint venture (which owned it anyway). (Honda)

- Kia appointed a new president, Ho-sung, Song, the former head of global operations. (Kia)

Nissan and Mitsubishi (history)

- Mitsubishi could reportedly take a stake in Renault as part of a bid to strengthen the alliance. (Reuters)

- PSA’s attempt to restart limited production in

France was shot down by unions. Intended additional precautions such as

distancing between workers, increased washing of workstations and leaving

components for three hours before anyone else could touch them. (Reuters)

- Significance: Regardless of how poorly received they are now, such measures point the way towards likely working methods when production resumes — lower productivity is inevitable if they are in force.

- Mitsubishi could reportedly take a stake in Renault as part of a bid to strengthen the alliance. (Reuters)

Suzuki

- Will open a new factory in Myanmar in 2021. (Suzuki)

- Plans to separate the commercial and passenger vehicle arms of Tata Motors sometime in 2021, although certain back office functions will still be shared. The aim is to enable as-yet unspecified plans for strategic alliances with other carmakers. (Tata)

- Moody’s placed Tata Motors credit rating under review for downgrade. (Nikkei)

- CEO Musk wants to reopen facilities as soon as possible, hoping to produce ventilators. (Reuters)

- Will develop a Hino-badged fuel cell powered heavy truck. (Toyota)

- Toyota Tsusho invested in multimodal app Velocia. (Toyota Tsusho)

- Reportedly seeking a 1 trillion JPY (about $9.2 billion) credit line. (Reuters)

- Reportedly preparing for a court battle with Gett (in which VW has a 20% stake) over the mobility startup’s claims for a three-digit million euro sum over VW’s failure to stump up further investment that Gett needed, and because VW used experience from its cooperation with Get to launch similar services. (Handelsblatt)

- Giving dealers an increased credit line, covering 270 days, and allowing them to take payment holidays. (VW)

- CEO Diess said VW is spending about €2 billion per week on fixed costs, but it hasn’t yet drawn on any credit lines and hopes not to need state aid (although VW’s definition excludes subsidies for laid off workers). (Autoblog)

- Expects the German car market to recover by the summer. (Reuters)

Other

- Mahindra’s chairman says we can look forward to an impending global mega-recession. (Autocar)

- Aston Martin released some details of the forthcoming V6 engine which will have its first application in the Valhalla. The firm also appeared to push back the car’s launch to 2022 (from late 2021). Over time the powertrain is expected to supplant the Daimler-supplied V8. (AML)

- Pininfarina’s CEO has left. (Autocar)

News about other companies and trends

Economic / Political News

Economic / Political News

- European carmakers asked for relief from incoming CO2 rules because the coronavirus was causing problems with developing new vehicles. (ACEA)

- The Detroit auto show was cancelled so that the venue can be used as a hospital. (Engadget)

- The US administration is reportedly set to unveil fuel emission standards to 2026. The rumour is that they will be easier for manufacturers to meet than Obama-era rules, but still require improvements from today. (Reuters)

Suppliers

- EDAG says it has developed an aluminium alloy that can be 3D printed and is suitable for crash structures. (Autocar)

- ZF reported 2019 FY revenue of €36.5 billion and adjusted EBIT of €1.5 billion. Although the declined to offer a forecast for 2020 results, the takeover of Wabco will go ahead as planned. (ZF)

- LG Chem received a €480 million loan from the European Investment Bank to build a new (previously announced) battery factory in Poland. (Yonhap)

- Nexteer reported 2019 FY revenue of $3.6 billion and profit of $232 million. (Nexteer)

Dealers

- As a result of coronavirus, the Indian arm of MG has completely digitised the sales process so that customers don’t have to step into a dealership, or even meet another human being, to buy a car. They can specify, order and pay for the vehicle online and then have it delivered to their doorstep. (India Today)

- Used car trader Cazoo raised £100 million. (TechCrunch)

- Group 1 will lay off 2,800 staff in the UK and 3,000 in the USA due to falling sales. (Reuters)

Ride-Hailing, Car Sharing & Rental (history)

- White label ride sharing technology firm Wunder Mobility acquired Australian rival KEAZ. (Wunder)

- Peer to peer car rental firm Getaround is reportedly casting around for a buyer. (Bloomberg)

Driverless / Autonomy (history)

- Lidar developer Blickfeld closed an unspecified investment from Continental (who also have their own inhouse lidar capability) and others, saying the cash will help the firm scale up production. (Blickfeld)

- SoftBank is reportedly on the verge of investing $300 million in Didi’s self-driving unit. (The Information)

- Self-driving car simulation firm Helm.ai raised $13 million. (TechCrunch)

- BYD says its new “blade” design of battery cell can improve pack space utilization (but not necessarily density) by 50% over conventional designs and is better in crashes. (BYD)

- Researchers looking into the CO2 emissions of different powertrain types say that electric cars have lower emissions than conventionally powered cars in all but the most coal-dependent nations. (BBC)

- Battery management software firm Twaice raised €11 million. (TechCrunch)

Other

- Air taxi developer Lilium raised $240 million. (Deal Street Asia)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 22nd March 2020

Coronavirus puts everything else in the shade. Please enjoy our auto industry and mobility briefing for 16th March to 22nd March 2020. A PDF version can be found here.

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Says that half of conventional powertrain variants will be phased out from 2021 onwards (although since it will add electrified models, there might not be much of a change in the bottom line). BMW called its commitment to meet EU CO2 targets “unequivocal”. (BMW)

- Expects that coronavirus will result in a 2% – 4% EBIT margin in 2020. (BMW)

- BMW has defined geofenced electric-only modes for 80 European cities (58 of them are in Germany). (BMW)

- BMW’s CEO showed no interest in buying the firm’s rivals, even if their share prices go down. (Seeking Alpha)

- Daimler and VW are rumoured to be in discussions to share software. (Manager Magazin)

- Received a €300 million loan from the European Investment Bank, ostensibly for electric car production. (FCA)

- Drew $15.4 billion of credit lines and suspended the dividend to cope with coronavirus losses. (Ford)

- Will give US customers a three month payment holiday, and discounts covering an additional three months of leasing payments. (Ford)

Geely (includes Volvo) (history)

- Volvo is recalling 750,000 cars to fix problems where the emergency braking didn’t kick in. (Autocar)

- Announced a series of executive moves including a new CTO and head of China operations. (GM)

- Hyundai Mobis has developed a new system for monitoring occupant vital signs, including blood flow, using radar and hopes that OEMs will see it as the next big thing. (Hyundai Mobis)

Nissan and Mitsubishi (history)

- Plans to close the Purwakarta, Indonesia factory as part of a global recovery effort. Nissan will probably re-badge vehicles built at Mitsubishi’s nearby plants to maintain a market presence. Insiders hinted that production cuts in Russia are next on the list. (Manichi)

- Renault’s Chairman hopes the French government is prepared to provide some financial guarantees to overcome coronavirus losses but won’t take the money if it could lead to renationalisation. (Reuters)

- A series of trials has convinced Toyota that blockchain is a great idea and it intends to apply the technology in areas including supply chain and mobility services. (Toyota)

- Partnering with Momenta for high definition mapping. (Reuters)

- Reported full year 2019 revenue of €253 billion, up 7.1% versus prior year, and PBT of €18.4 billion, up 12.8%. VW said that coronavirus would depress 2020 margins, and probably by more than the company’s initial estimates. (VW)

- The VW brand’s first performance electric cars will be SUV variants, rather than the recently launched ID3 hatchback, because development bosses reckon four-wheel drive will be a big asset. (Autocar)

- Will drop the takeover offer for Navistar if the move, combined with the effects of coronavirus, threatens group liquidity. (Reuters)

- Bentley’s styling team is “experimenting” with the design of a future electric car and is on a path to create a product with very different proportions to conventionally powered cars. (Autocar)

- Daimler and VW are rumoured to be in discussions to share software. (Manager Magazin)

- Porsche will begin offering individually contoured bucket seats, for owners wishing to be at one with their car, from 2021 onwards. The scheme will utilise 3D printing and seems likely to carry a hefty price tag. (Porsche)

Other

- Changan unveiled a new model, the UNI-T, that the company says will be upgraded to a level 3 self-driving capability, once Chinese authorities give the okay. (Changan)

- McLaren raised £300 million in new equity and appointed a new executive chairman. (McLaren)

- Nio released full year 2019 financial results. Revenue of $1.12 billion rose 58% versus prior year but losses also rose (and were greater than revenue), with a net loss of $(1.62) billion. The company admitted “substantial doubt” about its ability to continue as a going concern. (Nio)

- Apollo (Gumpert’s successor) announced that a group of Chinese and Hong Kong investors was taking an 86% stake in the sports car maker. (Apollo)

News about other companies and trends

Economic / Political News

- European passenger car sales in February of 1.067 million units fell (7.3)% versus prior year. (ACEA)

- Coronavirus saw widespread plant closures in Europe. We’ve stopped reporting them on an individual basis, but have a file with the details listed, if anyone is interested.

- Michelin believes that global passenger car production (as measured by tyre sales) is down (9)% on a year-to-date basis. (Michelin)

Suppliers

- Tenneco appointed re-hired a former CFO on an interim basis. (Tenneco)

Dealers

- Indian on-demand servicing provider Pitstop raised $2.5 million. (Autocar)

- Indian online parts retailer Boodmo raised $2 million. (Autocar)

Ride-Hailing, Car Sharing & Rental (history)

- Gojek raised $1.2 billion. (Tech In Asia)

Driverless / Autonomy (history)

- Autonomous driving developer Starksy Robotics closed, saying that investors had been put off by underwhelming results from its peers and didn’t properly appreciate the scale of the challenge. (Starsky)

- Waymo offered researchers cash prizes if they can develop new techniques to correctly label and track objects using test data it supplies. (Waymo)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 15th March 2020

Bad news for in-house technology funds; overly familiar digital assistants and; question marks over scenario planning. Please enjoy our auto industry and mobility briefing for 9th March to 15th March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Believe — Nissan and Mitsubishi have reportedly decided to stop investing in the technology venture fund shared with Renault and VinFast’s owner has scrapped a similar scheme. It seems that the cash-strapped Japanese firms are looking for ways to save and decided they weren’t getting value for money. It has been fashionable for carmakers to run VC-like teams for nearly a decade now. Is this presaging a reversal of that trend, or can boards be convinced that they are paying their way?

- That’s Not My Name — The Mercedes Me digital assistant is being reprogrammed to start using the informal “you” instead of the formal version it has used until now. Although a concept alien to purely English speakers, for many this carries important connotations of social status. Will customers approve of their car getting friendly with them, or regard it as insulting?

- All Around The World — European carmakers have been completely caught out by coronavirus. After over a month of treating it as a supply base issue, they started last week thinking that a hefty dose of hand sanitiser and plans to send home any infected employees would be enough. Less than seven days later, many announced widespread plant closures. It raises myriad questions about their scenario planning: have they got contingency plans for closures that last five weeks or more (as in China)? And is how deeply have they considered the knock-on effects (e.g. if UK-EU trade negotiators can’t meet then the chances of having a completed deal by year end look slim)?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- BMW’s Q4 2019 automotive revenue of €26.8 billion was 15.6% higher than 2018, automotive EBIT of €1.8 billion was 25.7% up on prior year. Full year automotive revenue of €91.7 billion rose 6.8% on a year-over-year basis (group revenue was €104 billion). Automotive EBIT of €4.5 billion fell (27)% (group EBIT was €7.4 billion). (BMW)

- Won’t offer the all-electric iX3 in the USA, but will sell the iNext and i4 (from 2021 onwards). (Detroit News)

- The Mercedes Me personal assistant will soon begin addressing customers speaking languages including German, Spanish, Italian and Portuguese with the informal form of “you”. It remains to be seen whether people will take well to a form of address they sometimes scold children for using (French seems intentionally missing). (Daimler)

- On 9th March FCA said it would be strict with visitors and employee cleanliness standards; then on 11th March said it would make temporary plant closures in Italian plants “where necessary”. On 16th March, FCA announced closures to plants in Italy, Poland and Serbia until at least the end of March. (FCA)

- Workers at the Windsor, Canada, plant walked out, ostensibly over concerns about coronavirus. The factory has fragile labour relations due to a shift reduction currently underway. (CNBC)

- Suggested to employees that they should work from home. (Detroit Free Press)

Ferrari

- Illustrating the pace of changes to coronavirus measures: on 9th March Ferrari announced measures to comply with government quarantine rules whilst continuing production; on 14th March the company told anyone who could work at home to do so; and then on 14th March a two week closure of the factory was announced. (Ferrari)

- Newly appointed COO Farley has a clause that will pay out $2.5 million if he doesn’t become COO. (Detroit News)

- Recalling around 6,000 Ranger pickup trucks to fix faulty parts used to fix an earlier problem. (Ford)

- COO Farley reportedly told dealers about a new small pickup (Fox) and rumours of a Bronco-badged crossover (possibly to be called Bronco Sport) and pickup persist. (Reuters)

- Told as many employees as possible to work from home. (Ford)

Geely (includes Volvo) (history)

- LEVC plans on selling 14,000 of the new VN5 taxi-derived van each year. (LEVC)

- Kandi is selling its factory to the local government and moving to a lower cost location in a deal that will net the electric vehicle maker around $120 million. (Kandi)

- Told as many employees as possible to work from home. (GM)

- Launched a job loss protection program in the USA, a throwback to the credit crunch, offering to cover six months of financing payments — if the loan is made through Hyundai’s inhouse bank. (Hyundai) Customers of the more expensive Genesis brand will receive a similar scheme. (Hyundai)

- Plans to offer battery leases to customers in South Korea, and will introduce a taxi derivative of the Kona all-electric SUV. (ET News)

Nissan and Mitsubishi (history)

- Nissan and Mitsubishi are reportedly planning to stop contributions (previously set at up to $200 million per year) to the Alliance Ventures investment vehicle. (Reuters)

- Chairman Gallois agreed to postpone his retirement and stay until the merger with FCA is competed. (PSA)

- Moving the Ellesmere Port, UK, plant to a four day week with extended hours, leaving capacity unchanged. (Reuters)

- Closing all European plants until 27th March. (Auto Express)

- Nissan and Mitsubishi are reportedly planning to stop contributions (previously set at up to $200 million per year) to the Alliance Ventures investment vehicle. (Reuters)

- CEO Musk wants to build the Cybertruck and some Model Ys in a new factory located in “central USA” (earlier press releases had previewed a new US site), leading some to speculate about a Texan factory, or perhaps one in Tennessee. (Reuters)

- Chinese authorities told Tesla off after the company fitted some lower-grade driver assistance hardware to Chinese-made vehicles to overcome supplier shortages. Tesla had already promised to upgrade affected vehicles. (Reuters)

- Developed a new type of paint gun that uses static electricity rather than air to apply the paint. The result is 95% of paint sticking to the body, up from 60% – 70% for contemporary systems (according to Toyota). The innovation could result in manufacturing CO2 emissions drop by a whopping 7% through lower paint and energy use. (Toyota)

- Denied union requests for a pay rise for Japanese workers. (Nikkei)

- CEO Diess rebuffed claims by the works council that the next generation Golf’s launch was anything less than a complete success. The union representatives contended that the vehicle was too complicated and that a recovery plan had severely limited customer choice, threatening sales success. (Handelsblatt)

- The MAN bus division reportedly plans to cut 6,000 jobs and is contemplating closing the Steyr, Austria, plant. The company said redundancies would be significant but wouldn’t confirm a figure. (Manager Magazin)

- SEAT’s plant in Barcelona, Spain may close for six weeks because of coronavirus. (Reuters)

- VW’s maths says that by 2030 its cars will have the potential to store more electricity than all the World’s hydroelectric power stations. (Reuters)

Other

- Faraday Future is partnering with US Hybrid to offer retrofit electric powertrains for heavy vehicles. (Autocar)

- Apex unveiled the all-electric AP-0 sportscar, saying it plans to build 500 per year in the UK. (Autocar)

- Aspark is developing a second model to follow the limited-edition Owl supercar. (Aspark)

- Aston Martin decided to raise an additional £36 million. The move will see the consortium led by Lawrence Stroll take a 25% stake. (Reuters)

- Italian coachbuilder MAT is planning a V8-powered sportscar using an engine from GM. (Autoblog)

- VinFast’s owner VinGroup has abandoned plans for a $100 million fund for technology start-ups. (Deal Street Asia)

- BYD has turned its hand to face masks and hand sanitiser, turning out 5 million masks and 300,000 bottles of sanitiser daily. GM and SAIC’s joint venture is making 2 million masks daily. (Reuters)

- Workhorse announced a $(37) million loss in 2019 and hopes to sell 400 cars in 2020. (Workhorse)

News about other companies and trends

Economic / Political News

- As many carmakers closed plants for around two weeks to combat coronavirus, Chinese plant re-openings suggested that this could be optimistic, having been out of action for around 50 days. (China Economic Net)

Suppliers

- Schaeffler reported 2019 revenue of €14.4 billion and EBIT of €790 million. (Schaeffler)

- Donkervoort is spinning off its Ex-Core Technologies carbon fibre making arm. (Donkervoort)

- BASF reckons it has developed a new catalytic converter that uses more platinum and less palladium. (Reuters)

- ZF officially formed a joint venture with Wolong to make electric motors. (ZF)

Dealers

- UK dealer group Lookers delayed its 2019 financial report because of a potential fraud. (This is Money)

Ride-Hailing, Car Sharing & Rental (history)

- Mobility data collector Ride Report raised $10 million. (TechCrunch)

- Brazilian rental firm Vai.Car raised $85 million and hopes to increase its fleet to 25,000 cars. (Auto Rental)

Driverless / Autonomy (history)

- Self-driving developer Neolix raised $29 million. CHJ Automotive led the round. (Deal Street Asia)

- Navya’s self-driving vehicles will continue to use lidar units from Velodyne. (Velodyne)

- Toyota believes that by fusing satellite imagery with photographs taken by cars, maps with accuracy of better than 50cm can be automatically created, and says TomTom and HERE agree. (Toyota)

- Bollinger has designed its flexible all-electric rolling chassis for battery sizes up to 180 kWh. (Bollinger)

- VW’s maths says that by 2030 its cars will have the potential to store more electricity than all the World’s hydroelectric power stations. (Reuters)

Other

- The UK government has begun consultations into legalising the use of electric stand on scooters (as beloved by firms such as Bird and Lime). (The Verge)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 8th March 2020

Electric cars for all (who can afford them); science fiction sensor capabilities and; supercars that don’t push the envelope. Please enjoy our auto industry and mobility briefing for 2nd March to 8th March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Everyday People — GM invited investors and the press to marvel at its battery technology. The intended message was that GM is best placed to bring electric cars to the masses and that they have been super-smart about the design so they won’t get caught out by technology changes. So far so cool, but if they have really cracked the problem, why do most of the cars they are rolling out look like they will end up with a six-figure price tag?

- Distance And Time — Waymo raised $2.3 billion and released some details of the sensors it has been working on. The company reckons it has lidar with 300m+ of range, cameras that can see more than 500m and as for radar, they just gave up counting and called a great distance. The figures are impressive; nearly good enough for motorway speeds, depending on weather and the speed of making decisions. But are they real? Are they reliable? And can Waymo’s AI handle that much information without grinding to a halt?

- Never Ever — Koenigsegg unveiled a new model called the Gemera. According to the Swedish firm it will be so scarily fast that they daren’t do the maths in case the numbers give them a heart attack. In fact, they are so bruised by the experience that they are pledging to hold back on all future cars so this one is never bettered. I know I’m not your typical hypercar buyer, but is that the sort of brand message they will buy into when Koenigsegg make the car after this one?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart of the week

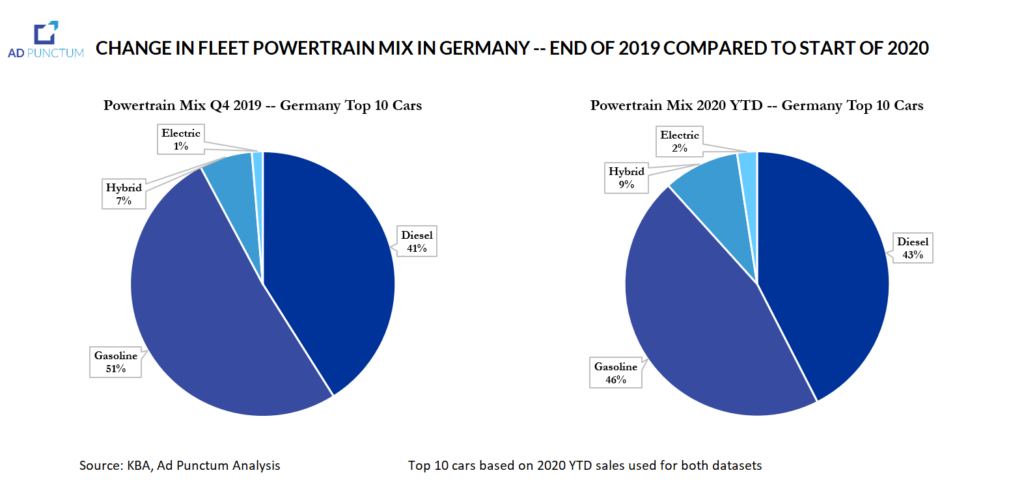

Long suffering readers will have seen me write many times about how, contrary to much of the news flow, European CO2 regulations are unlikely to result in fines. Mainly since the cost of adding technology to the car is cheaper than paying the fines (albeit still harmful to profits).

I think this chart it is an interesting example of manufacturers successfully encouraging customers to buy the engine types that suit the brand’s overall goals. The pie charts cover the (same) ten best-selling vehicles (e.g. VW Golf, Audi A4). The left-hand side shows the final three months of 2019, the right-hand side is 2020 so far. Despite no major product introductions, hybrid and electric share from went from 8% to 11% and diesel has seen increases too. In just two months. An aberration? Seasonality? Or just good old mix management? You decide.

News about the major automakers

- Unveiled a car called the Concept i4 that CEO Zipse promised is “quite close” to the production version. (BMW)

- The recent spate of senior departures from the ranks of Daimler’s financial team are reportedly the result of a turf war between newish CFO Wilhelm and the insiders that he beat to the job. (Handelsblatt)

- Unveiled the facelift for the E-Class. (Daimler)

- Plans on culling models, platforms and engines as part of an efficiency drive but the only action it will confirm publicly is that the next generation SL will be on a shared platform. (Reuters)

- Investing $400 million to convert a US transmissions factory to build engines instead. (FCA)

- FCA’s head of US sales stepped down (he previously filed a whistle-blower suit against FCA’s sales reporting practices). (FCA)

- Unveiled the all-electric variant of the new Fiat 500. Specifications and performance look reasonable; less clear is whether Fiat will find many takers given the £30,000 asking price. (FCA)

- Confirmed that two employees had contracted coronavirus and launched a travel clampdown reminiscent of the actions the company normally employees when under pressure to improve financial results. (Detroit Free Press)

- Confirmed plans to produce an all-electric Transit van. (Ford)

Geely (includes Volvo) (history)

- Geely is going into the satellite business, building a new plant in China. (Autocar)

- Lotus says there are enough orders for the Evija supercar to fill the 2020 production plan, but it isn’t clear how many of the planned 130 cars this represents. (Autocar)

- Presented its plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

- Is producing 550 different combinations of internal combustion engine type, output and transmission and says that with electric motors that figure can be reduced to 19 battery and motor sets. (GM)

- Said that coronavirus won’t affect production plans until the end of March at the earliest. (Reuters) GM has also instigated travel restrictions for employees. (Detroit Free Press)

- Offering European customers electricity from renewable sources for their vehicle charging under a scheme called e:PROGRESS run with help from Moixa and Vattenfall. (Honda)

- Said that coronavirus was causing some production problems in Japan and that plants were using the parts they had around them, even if these weren’t the trim levels in the original schedule. (Reuters)

- Hyundai unveiled the all-electric Prophecy concept car, a sleek sedan that appears to draw many styling cues from Tesla and Porsche. (Hyundai)

Nissan and Mitsubishi (history)

- Nissan’s Russian factory will go to a one shift pattern (from two today) until the market has recovered. The company said the move was unrelated to coronavirus. (TASS)

- CEO Tavares suggested that the British government would have to compensate his firm for any tariffs payable if the UK and EU fail to agree a trade deal, and it wants to keep the Ellesmere Port plant open. (The Guardian)

- PSA stands ready to drop Huawei as a partner for its connected vehicle network if US authorities made it a condition of the FCA-PSA merger. (Reuters)

- CEO Tavares says the combined strategies of PSA and FCA in China will require a post-merger rethink. (Reuters) He also has a point of view about electric cars in Europe believing that at present, only “green addicts” are buying them.

- Unveiled the Morphoz concept, a car that can expand and contract thanks to embedded electric motors. Renault said the car was previewing the design of a new line of electric vehicles, likely to be the next generation models of the Koleos and Kadjar. (Renault)

- Took the wraps off the Dacia Spring, a budget electric car based on the China market City K-ZE. (Renault)

Subaru

- Announced an executive reshuffle and reorganised the audit and quality departments. (Subaru)

- JLR was accused of not doing enough to properly classify workers under a new British law that seeks to tax captive workers as if they were employees regardless of the legal structure of the arrangement (many contract via companies that they own). JLR said it had done everything correctly and there was nothing to worry about. (FT)

- Announced a senior executive shake-up, with several of the top brass departing, and a new CFO. (Toyota)

- Expanded a recall for faulty fuel pumps to now cover 3.2 million units globally. (Bloomberg)

- Will drop natural gas powered models from the line-up, probably by 2025, citing low demand levels. (Handelsblatt)

- VW’s seat making subsidiary Sitech is closing a factory in Hanover, Germany, with the loss of 450 jobs after the plant lost production contracts to Faurecia. (Handelsblatt)

- Porsche executives poured cold water on any idea of an all-electric 911 before 2030 and suggested a hybrid was unlikely in the lifespan of the current model. (Autocar) The CEO was categorical that a 911 would always be available with an internal combustion engine. (Porsche) Officials also suggested that an all-electric hypercar was unlikely because they are concerned that there is too little opportunity for differentiation. (Autocar)

- Temporarily reduced Skoda Rapid production in Kaluga, Russia due to a shortage of tail lamps. (TASS)

- Audi unveiled the fourth generation A3. (Audi)

- Announced a joint venture with consulting firm Capgemini to create a cloud software unit. (Audi)

- Set up a team to work on securing green financing (which often conveniently happens to be cheaper than the regular sort) for VW’s future product plans. (VW)

- Bentley unveiled the limited edition Bacalar open top GT. (Bentley)

Other

- Aston Martin’s CEO says the main reason the company is developing a new V6 engine for entry models is that current V8 supplier Daimler is moving towards engines he considers too small for sportscars. He is leaving the door open for manual transmissions but implied there are none in the cycle plan for future products. (Car and Driver)

- Aston Martin unveiled the already announced limited edition V12 Speedster. The firm says that the car, a new exterior design built from a parts bin of other models, took 12 months to develop to “production intent” (with deliveries no starting until early 2021 there is some more development to do). (Aston Martin)

- McLaren’s boss complained about UK government plans to ban sales of all cars without plug-in capability by 2035, believing that hybrids should be given more time (the new rules wouldn’t preclude plug-in hybrids, only the sort that function purely through regenerative braking and scavenging from the engine). (Autocar)

- Bristol Cars was put into liquidation, scuppering hopes of a revival. (Autocar)

- Pininfarina said that it had sold more than 50% of the all-electric Battista supercars it intends to build for the USA and Europe and thinks that when the car is available for test drives, the remainder of the orders will flow smoothly in. The company also suggested that Rivian has been directed by Amazon not to licence its electric chassis to anyone who isn’t a shareholder (i.e. themselves and Ford). (Autocar)

- Fuel cell truck maker Nikola announced plans to list with a valuation of $3.3 billion. (Nikola)

- Yet to launch any products, Neuron EV has begun development of mobile quarantine facilities. (Neuron EV)

- Koenigsegg unveiled the Gemera, a hybrid four-seater limited to 300 cars. (Koenigsegg) It also has a new version of the Jesko available and says the Absolut version is the fastest car it has ever made (they claim to not even know its ultimate performance) and it won’t ever try to beat it. (Koenigsegg)

- Morgan has a new car, with the BMW-powered Plus Four replacing the Plus 4. (Morgan)

- McLaren unveiled a new high performance car, the 765LT. (McLaren)

- Nio raised $235 million in short term debt with zero interest. (Nio)

- Isuzu set a series of environmental targets for 2050: zero greenhouse gas emissions; and 100% recycling of waste and old vehicles. (Isuzu)

- Micro says it has 17,000 orders for the Microlino city car. (Micro)

News about other companies and trends

Economic / Political News

- US light vehicle SAAR of 16.83 million units rose 1.8% year-over-year. (Wards)

- German registrations of 239,943 passenger cars in February fell (10.8)% from the same period in 2019. (KBA)

- February passenger car sales in the UK of 79,594 units dropped (2.9)% on a year-over-year basis. (SMMT)

- French sales of 167,784 passenger cars in February were (2.7)% lower than a year earlier. (CCFA)

- February’s Spanish passenger car registrations totalled 94,620 units, down (6)% on prior year. (ANFAC)

- Italian passenger car sales of 162,793 units in February fell (8.8)% from 2019. (UNRAE)

- The former head of the UAW was charged with corruption and US officials floated the idea of a federal takeover of the union to rid it of bad practices. (CNBC)

Suppliers

- STMicroelectronics acquired a majority stake in Exagon to improve its power electronics offering. (STM)

- LG Chem bought a television factory in Poland to repurpose into one for batteries. (Yonhap)

- Martinrea reported full year 2019 revenue of $3.86 billion and operating income of $266 million. (Martinrea) The company also completed the takeover of Metalsa’s automotive assets. (Martinrea)

- Grammer issued a profit warning for Q1 2020. (Grammer)

- Goodyear is developing a tyre containing capsules of liquid that restore some of the tread, and prolong the life of the tyre. (Goodyear)

- Continental’s 2019 full year revenue was €44.5 billion, there was a €(1.2) billion net loss. (Continental)

- Adient is selling its automotive fabrics division to a unit of Asahi Kasei. (Adient)

Dealers

- Used car website Spinny raised $44 million. (Tech In Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Chinese on-demand service Meituan Dianping invested in agricultural products distributor Wangjiahuan in a $87 million round. (Deal Street Asia)

- JLR-backed ride hailing firm Havn has declared its pilot scheme to be a success and is expanding. (JLR)

- Uber is happy to have driverless cars from other suppliers on its network provided “the tech is safe enough” (unsurprisingly, how that will be decided remains unclear). (Reuters)

- French courts ruled that Uber drivers are employees. (Reuters)

Driverless / Autonomy (history)

- UK-based Five(AI) raised $41 million to further develop self-driving technology, saying that it no longer planned to develop its own vehicles or run a ride hailing service and instead wants to sell technology. (TechCrunch)

- Waymo raised $2.25 billion from investors including Magna and dealer AutoNation. (Waymo)

- Waymo claims that its lidar sensors have a range of over 300 metres and the camera vision can read traffic signs more than 500 metres away. The radar recognises objects over “great distances”. (Waymo)

- Lidar developer SiLC raised $12 million from investors including Dell. (Robotics Business Review)

- Finnish self-driving vehicle start-up Sensible 4 raised $7 million. (Sensible 4)

- Chinese driverless vehicle developer Neolix says its products have been pressed into service to combat coronavirus, carrying out tasks such as ferrying supplies and cleaning streets. The firm has booked 200 orders in the last two weeks on the back of this success. (Deal Street Asia)

- GM presented plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

Other

- Scooter rental firm Bolt is reportedly close to raising $30 million. (FINSMES)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 1st March 2020

Cool cars for cool kids; 3D printing keeps getting better and; Deutsche Post loses patience with StreetScooter. Please enjoy our auto industry and mobility briefing for 24th February to 1st March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- He Ain’t Heavy, He’s My Brother — Citroën released a new city car, the AMI. The inspiration appears to have come from the question, what do you get if you cross a Smart ForTwo with a Renault Twizy? And the answer is a tiny, cheap as chips electric car that can’t go very far, or fast, and can be driven by teenagers. Not everyone’s cup of tea perhaps but making intelligent compromises on performance (i.e. making a city car that can’t leave the city) seems sensible if it saves big money. What will Greta Thunberg et al think?

- Bend Me, Shape Me — VW says 3D printing is good enough to make engine blocks. The only problem is that it takes 12 days (on a very expensive machine). Nowhere near mass manufacturing pace, but intriguing for prototype and small series runs. Twenty years ago 3D printing was only good for making models of blocks, so this is great progress. How far away are we from this technology being taken seriously and used with some imagination?

- Money For Nothing — Electric delivery van pioneer StreetScooter is shutting down. After years of complaining about high costs, owner Deutsche Post has finally decided to pull the plug and says there is no hope of finding a buyer. On paper the brand had everything it needed: anchor customer? Check; no competition? Check; make job specific electric vehicle tailored to a price point? Check. Where did it all go wrong (obviously cost) and how should people following a similar strategy (but are yet to launch) change their approach?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Electric bus maker Proterra is teaming up with Daimler’s Freightliner unit to develop an electric truck. (Proterra)

- Argo AI’s CEO confirmed that Ford’s initial plans for self-driving cars still exclude all-electric vehicles (Ford has earlier talked about plug-in hybrids). He had two reasons for pursuing the course, even as rivals choose all-electric vehicles, or at least hedge their bets: that electric vehicles cost more so profitability is harder and; that fast charging the battery to keep the vehicle in use would reduce its life expectancy too much. (The Verge)

- Recalling about 250,000 F-150 trucks to fix problems with auxiliary heaters and headlamps. (Ford)

- Ford’s Spin electric scooter rental subsidiary is starting operations in Europe with plans to launch is Germany and France (it would like to be in the UK too if the law changes). (Ford)

- Aston Martin will produce its own V12 engines from 2021 onwards, creating a (small) surplus labour problem at Ford’s Cologne factory. (AML)

Geely (includes Volvo) (history)

- Polestar unveiled the Precept concept car, it what looks like a preview of a Model 3 fighter. (Polestar)

- Volvo reportedly told dealers about two new products: a sleek coupe-ish SUV (dubbed the C40) and a massive SUV given the working title of XC100 (although the sequence XC40, XC60, XC90, XC100 feels odd). (Automotive News)

- Adding shifts at two Michigan, USA plants to meet increased demand for SUVs and Cadillac cars. (GM)

- VinFast implied an interest in the design and testing facilities GM will vacate when it closes Holden’s operations in Australia. (Motoring)

- Sold the Turin powertrain engineering centre to Punch Group. (GM)

- Recalling 193,000 cars in the USA to fix leaking fuel hoses, (Detroit News)

- Suspended production in Ulsan, South Korea (Hyundai’s main plant) because a worker tested positive for Coronavirus. (Nasdaq)

- In the process of deciding where to locate a fuel cell plant capable of supporting 100,000 vehicles per year. (Reuters)

- Reported 2019 full year revenue of €74.7 billion, up 1% on a year-over-year basis. Automotive revenue of €58.9 billion improved 0.7% YoY. Operating income of €4.7 billion rose 6% YoY. Automotive adjusted operating income was €5.0 billion with PSA claiming an 8.5% margin. The year over year performance was more than explained by positive mix and cost reductions. PSA says its European breakeven point (a somewhat fuzzy measure since pricing often deteriorates with industry weakness) is now 1.8 million units, 2019 European sales were 3 million units. (PSA)

- CEO Tavares is contemplating an all-electric platform, but thinks it won’t be worthwhile until 2024. (Seeking Alpha)

- Citroën unveiled the AMI all-electric city car. Seemingly sprung of a

desire to merge the philosophies behind the Smart ForTwo, Bolloré Blucar and Renault Twizy, the AMI is a two-seat

quadricycle (which means that in France 14 year-olds can drive it) with a low

price — €6,000 — and citybound range (70km). (PSA)

- Significance: Citroën has taken a brave approach to marrying the two seemingly incompatible needs of future city cars: to be small and cheap whilst accommodating an (assumed to be expensive) electric drive system. Citroën’s answer had been to create a decidedly no-frills, performance compromised (outside the city) car, but counterbalance that with great inner city practicality and expand the potential customer base by making it as a quadricycle. Where the windowless Twizy (I know you could get ill-fitting fixed panels) was perhaps too revolutionary, this might be the right mix.

- Renault’s wholly owned European dealer group is slightly downsizing, offloading ten sites. (Renault)

- Stressed that a recovery plan (with headline targets if €2 billion in structural cost savings) was still under development and firm decisions wouldn’t be taken until just before the plan is announced in May. (Renault)

Subaru

- Spending $158 million to add a transmission and spare parts warehouse at the Lafayette, USA, plant. (AP)

- Supplier AAM said the all-electric I-Pace was selling only half of Jaguar’s initial forecasts. (Bloomberg)

- Looking to sell off wholly owned Indian dealer group Concorde Motors. (Livemint)

- US regulators complained that Tesla had been less cooperative than rival carmakers in implementing their recommendations to risk the risk of drivers becoming overly reliant on driver assistance features. (CNBC)

- Panasonic is pulling out of Tesla’s solar panel factory but says it has no impact on the partnership to build batteries for cars. (Reuters)

- Investing $400 million in Chinese self-driving developer Pony.ai. (Pony.ai)

- Rebranded the recently acquired fleet leasing arm of Inchcape as Kinto. (Toyota)

- Toyota Tsusho invested in emerging market multimodal developer WhereIsMyTransport. (EU Startups)

- Reported full year 2019 group revenue of €252.6 billion, up 7.1% on a year-over-year basis. Earnings before tax of €18.4 billion rose 17.3%. VW will release detailed financial results in mid-March. (VW)

- Will buy out Audi’s minority shareholders (0.36% of the Audi’s shares), after this is completed, Audi’s legal entity status won’t change and it will remain as a stock corporation at the behest of unions who feel it is protection against the brand’s independence being eroded. (VW)

- Truck making unit Traton will buy up the remaining 5.64% of MAN’s stock that it doesn’t own. (VW)

- Porsche has been testing low speed camera-based autonomous driving to move vehicles around workshop areas. Longtime observers of ponderous self-parking technologies and laidback garage mechanics will wonder whether there is any real world benefit to be achieved. Slightly more interesting is Porsche’s belief that it could be a rich source of training data for on the road driverless applications. (Porsche)

- Škoda is very pleased with the initial results from its BeRider electric scooter rental scheme and is expanding the fleet to 700 units, to be scattered across Prague, Czech Republic. (Škoda)

- Audi is working on a way for shopfloor personnel to create special 3D-printed tools without having to create CAD models manually, saving time and reducing the skill level required to implement new ideas. Detail on how this is accomplished is thin on the ground and photos show staff carefully examining… CAD models. (Audi)

- VW has 60 different types of authority to approve funds, with 25 levels of secondary signature. To make things easier it has created a website to guide users but might want to work on the bureaucracy itself. It seems managers are not even trusted to approve their own travelcards (they can do so for others, but not themselves). Since this example is selected by VW, more ludicrous ones almost certainly abound. (VW page 2)

- Although VW is impressed by the high finishing standards of modern 3D printing, the company doesn’t see the technology as cost effective for mass production yet — with cylinder blocks taking 12 days to print — but has plenty of potential for prototype and small series runs. (VW Page 4)

- An employee at VW’s ItalDesign subsidiary contracted coronavirus, shutting operations there for three days (although diligent staff worked from home). (VW)

- CEO Diess is looking to shake things up by hiring a climate change activist to speak truth to power and “aggressively” challenge the company’s plans for improving its environmental impact. (FT)

- Reached an agreement with German consumers that will see VW pay €830 million in compensation for losses suffered as a result of the diesel scandal. (VW)

- Porsche

unveiled the next step in personalisation. A customer’s fingerprint can be

painted onto the bonnet (would-be identity thieves will sadly have to stick to

applying blusher to the door handles as the image appears to cover too small a

surface area to unlock a smartphone). The cost? A cool €7,500. Porsche haven’t

said how the next owner can get rid of it. (Porsche)

- Significance: Although having your fingerprint on the front of your car seems gauche, the application of specially painted personalisation is notable, albeit at a price point few will probably find bearable.

Other

- Aston Martin reported full year 2019 results. Sales of 5,862 cars, down (9)% year-over-year, resulted in revenues of £997 million, also down (9)%. A profit warning had presaged the operating loss of £(37) million, down from £73 million in 2018. The CFO will step down in April. Aston Martin’s outgoing Chairwoman said the company had suffered from an “unexpectedly large downside risk of underperformance”. The company expects 2020 to be tough, with the new DBX coming at the same time as a reduction in sportscar sales, but wouldn’t be drawn on roughly how many cars it hopes to sell. (AML)

- Aston Martin will produce V12 engines in the UK from 2021, relocating production from Ford’s Cologne site. It wasn’t clear where the factory will be and whether Aston Martin is planning to machine the main components, or buy them in. (AML)

- Nio received a boost by agreeing a deal with the local government in Hefei, China that will see Nio relocate its headquarters there in exchange for funding (said to be almost $1.5 billion). (Nio)

- Lucid will use battery cells sourced from LG Chem. (Lucid)

- Polish consortium ElectroMobility Poland plans on having two vehicles in production by 2023. (BBJ)

- Deutsche Post

announced that it was

shutting electric van maker StreetScooter and was no longer looking for

a buyer. Although the brand is relatively young, the shutdown is ultimately expected

to cost €300 million to €400 million – some of which may be vehicles in

inventory. (Handelsblatt)

- Significance: The closure of StreetScooter raises a number of difficult questions for emerging electric vehicle makers: how big does an anchor customer need to be to ensure viability (since Deutsche Post ordered thousands of vans)? Is the delivery vehicle market less lucrative than many think? If the IP of a company with several years of production experience was considered worthless, what is the value of their assets?

News about other companies and trends

Economic / Political News

- The Geneva show was cancelled as the Swiss government banned events with more than 1,000 people. Many manufacturers announced plans to use online reveals of new products instead. (The Guardian)

Suppliers

- Plastics supplier OK Play is selling its automotive business to Lumax. (Autocar)

- Gestamp reported 2019 revenue of €9.1 billion and EBIT of €504 million. (Gestamp)

- Grammer agreed a series of new loans to expand its credit line and fund the final payment for the acquisition of TMD (which took place in 2018). (Grammer)

- CATL is hoping to raise $2.85 billion for new battery factories. (Reuters)

- Kongsberg reported full year 2019 revenue of €1.16 billion and PBT of €43.5 million. (Kongsberg)

- Bosch invested in internet of things software developer FogHorn. (FINSMES)

- Magna held an investor day. Despite a weak outlook for industry growth in North America and Europe (Magna thinks Europe will be slightly higher by 2022), Magna expects all business units except completed vehicles to see revenue and EBIT margin improvements. (Magna)

Ride-Hailing, Car Sharing & Rental (history)

- Uber is reportedly planning to pay drivers who put an advertising screen on top of their car a $300 one-off fee, plus $100 per week (if they are on the road for 20 hours or more). The firm plans to offer advertisers intelligent swarms of screens which can show the same messages as nearby fixed display boards. (Business Insider)

- Chinese ride hailing company Shouqi Limousine is trying to reassure coronavirus-obsessed customers by installing ultraviolet air purifiers in its cars. (Shouqi)

- Grab and Gojek denied that they were in merger talks but journalists, urged on by their sources, remain convinced that something is afoot. (TechCrunch)

Driverless / Autonomy (history)

- Zoox promises to show everyone “what we’ve been up to” this year, less clear is whether this will be before or after a hoped-for mega fundraising round. (Axios)

- US regulators suspended all passenger services using EasyMile vehicles after a passenger was hurt during an emergency stop. (Reuters)

- Bosch invested in UISEE, a Chinese developer of autonomous off-highway products. (Bosch)

- A research team is experimenting with ground penetrating radar to help drive in poor conditions. The unit is presently far too expensive and large for production vehicles and it is unclear what benefit it offers if a vehicle is already equipped with frequently updated maps because the sensor’s primary purpose seems to be detection of the road surface, rather than creating any useful semantic understanding of driving conditions (partly because the sensor is located so close to the vehicle). (ZDNet)

- Idriverplus, a developer of self-driving vehicles ranging from street sweepers to cars said it will use Velodyne lidar sensors. (Velodyne)

- California released self-driving statistics for 2019, this time in a database file, rather than electronic copies of the detailed reports. (CA DMV)

- Toyota is investing $400 million in Chinese self-driving developer Pony.ai. (Pony.ai)

- Argo AI’s CEO confirmed that Ford’s initial plans for self-driving cars still exclude all-electric vehicles (Ford has earlier talked about plug-in hybrids). He had two reasons for pursuing the course, even as rivals choose all-electric vehicles, or at least hedge their bets: that electric vehicles cost more so profitability is harder and; that fast charging the battery to keep the vehicle in use would reduce its life expectancy too much. (The Verge)

- Porsche has been testing low speed camera-based autonomous driving to move vehicles around workshop areas. Longtime observers of ponderous self-parking technologies and laidback garage mechanics will wonder whether there is any real world benefit to be achieved. Slightly more interesting is Porsche’s belief that it could be a rich source of training data for on the road driverless applications. (Porsche)

- Magna says that next generation electric drives, transmissions and ancillaries could boost electric vehicle range by up to 120km over today’s models. (Magna)

Connectivity

- Driverless car developer Oxbotica and communications infrastructure provider Cisco are undertaking a pilot project to explore the practicalities of using a network of wifi hotspots for data exchange between vehicles instead of relying on onboard modems. (The Engineer)

Other

- Electric moped rental start-up CityScoot is raising €24 million. (TechCrunch)

- Electric scooter rental firm Vogo raised an additional $19 million. (Deal Street Asia)

- Flush with new cash, Tier has acquired the physical assets of shuttered moped rental firm Coup. (TechCrunch)

- Mobile servicing service RepairSmith acquired rival CarDash. (Tech Startups)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.