Auto Industry Briefing — week ending 25th May 2020

Broadband providers charging cars; a slightly random battery milestone; and a cheap and cheerful way to delight buyers. Please enjoy our auto industry and mobility briefing for 18th May to 25th May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Pack The Pipe — Media company Liberty Global is launching a charging network in the UK based around supplying electricity from its broadband telecoms infrastructure. Way back (!) in 2017, Deutsche Telekom tested the water with something similar. Across the world, companies with pipes or cables in the ground are realising that they might be just as well-placed as traditional utilities to supply charging points. When will utilities start taking this threat seriously?

- A Million Dreams — GM says it is on the cusp of a battery that lasts a million miles, following similar claims by Tesla. Everyone got very excited, but I’m still trying to figure out what this really means. If it means that the battery stays at automotive standard for one million miles (i.e. it can hold an extremely high state of charge compared to original capacity over that time), doesn’t that make it over-engineered when cars typically last well below 500,000 miles?

- Girls On Film — Porsche has put up some cameras in its factory to take pictures of the cars as they pass along on the conveyor (a bit like the log flume at a theme park) in various stages of build. The shots are then forwarded on to the expectant owners-to-be, making them feel embedded in the process. Total set-up cost? Probably about £500. Seems like a cheap way to build brand loyalty. Why isn’t everyone doing this?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Mercedes’s design chief says the all-electric EQS will look radically different to the forthcoming next-generation S-Class with which it shares many of its parts. He says that the brand’s production intent concept cars (such as the EQS) always herald 80% to 90% of the road-going design. (Autocar)

- Mercedes does not believe that synthetic fuels are viable in the medium term and, if it does become a reality, the fuel will become widespread in aviation before it reaches the mass market for vehicles. (Autocar)

- A cybersecurity researcher said he had downloaded the source code used for the Mercedes Van connectivity suite. In a classis blunder, Daimler’s software team were using an online tool to store and check code and although people needed to register to access the code, access was automatically granted without checks. (ZDNet)

- Reportedly plans to invest in battery developer Farasis Energy’s impeding IPO. (Reuters)

- Geely wants to explore deeper collaborations with Daimler. (Reuters)

- FCA’s chairman brushed off suggestions that the intended special dividend payment to shareholders might be at risk, given the large sum the company hopes to borrow from the Italian taxpayer. (Reuters) Government ministers said FCA would need to invest more in Italy to fully justify the money. (Reuters)

Ferrari

- Raised €650 million in debt at an interest rate that will make Ferrari the envy of automotive treasurers. (Ferrari)

Geely (includes Volvo) (history)

- Geely has commissioned a new design centre in Sweden dubbed the “chamber of secrets” by its architects. New cars can be viewed in natural light via a rooftop courtyard, safe from prying eyes boast the designers, unless would-be spies are equipped with low-cost drones. (Deezen)

- Volvo raised around $1.3 billion in new credit lines, net of extensions. (Volvo)

- Volvo has now implemented the unilateral 180 km/h speed restriction for all cars in production. (Volvo)

- Geely wants to explore deeper collaborations with Daimler. (Reuters)

- GM says that its engineers stand on the cusp of a million-mile battery. (Reuters)

- Honda’s Chinese vehicles will use an infotainment and connectivity suite developed with Tencent. (Nikkei)

Nissan and Mitsubishi (history)

- Mitsubishi reported financial results for the fiscal year ended March 2020. Net sales of 2.27 trillion JPY (about $21 billion), down (9.7)% on a year-over-year basis. Operating Income of 13 billion JPY (about $120 million), down (89)% versus prior year. (Mitsubishi)

- American officials arrested two men in connection with Carlos Ghosn’s flight from Japan (which is seeking their extradition). It isn’t clear whether the move will affect Ghosn himself. (Economic Times of India)

- Unveiled the production version of the limited-edition GT-R 50, produced with ItalDesign. (ItalDesign)

- Further rumours of Nissan’s turnaround plan emerged; 20,000 jobs will apparently be lost. (Reuters)

- Spanish authorities reckon it would cost Nissan €1 billion to close the Barcelona factory. (Reuters)

- France’s finance minister worried that Renault might “disappear” without state help. He desperately wants for the firm to improve productivity, provided it doesn’t affect French jobs. (Reuters)

- Rumours swirled that Renault’s restructuring plan will see the closure of three small plants and that the recently unveiled Mégane won’t be replaced. The future of the Flins plant supposedly hangs in the balance. (Autocar)

- Jaguar’s one-make electric I-Pace racing series (which supports Formula E) will stop at the end of 2020, one year earlier than planned. (The Verge)

- Reportedly hoping to receive a loan of around £1 billion from the UK government. (Sky News)

- Expects that the Shanghai factory will reach output of 4,000 vehicles per week by the end of June, implying an installed capacity of around 185,000 units — higher than the 150,000 announce by Tesla. (Xinhua)

- Panasonic said it was in talks with Tesla to expand capacity at the Nevada Gigafactory. (Reuters)

- Recalling 9,500 RAV4 SUVs in the USA because the suspension arms might break. (Toyota)

- Unveiled the all-new Sienna minivan (for North American markets) (Toyota) and Venza crossover. (Toyota)

- PAVE published a Toyota-sponsored study into attitudes about autonomous vehicles. The main takeaway was, that with no mature examples of autonomous vehicles on the road, respondents are scared of them. (Toyota)

- Found itself at the centre of a social media storm over an Instagram advert that carried several racist cues. After initially prevaricating, VW apologised and withdrew the offending video. (Handelsblatt)

- Porsche has installed some cameras in non-sensitive areas of the factory so that anxious owners can receive a theme park-style photograph of their car in various stages of production. (Porsche)

- Porsche says that publicity from the online launch of the 911 Turbo S (arranged instead of the Geneva show) was far higher than products using press conferences at the show received in 2019. (Porsche)

- Agreed terms with German dealers for the launch of VW sales: dealers will get a flat commission, regardless of whether they or VW found the customer and VW will set all transaction prices and arrange all financing. The brand also appears to have granted infinite floorplan financing. (VW)

- A German court ruled that VW will have to pay damages over dieselgate in a case that was separate to the recently concluded class action suit. (Reuters)

Other

- Aston Martin’s CEO Palmer is leaving with immediate effect, to be replaced at the beginning of August by Tobias Moers, a recruit from Mercedes’s AMG division.

- McLaren’s recovery efforts hit a problem when existing bond holders complained that assets underpinning a proposed new debt issue was already security for their loans. (FT) The firm subsequently announced 1,200 job losses across the car making and racing divisions. (Sky)

- Faraday Future’s founder agreed a bankruptcy plan that saw him hand over his stake in the company to creditors, a move the firm hopes will help it raise further funding. (Faraday Future) Faraday’s CEO says the firm is in talk with several car makers about sharing technology. (Bloomberg)

News about other companies and trends

Economic / Political News

- European passenger car registrations in April of 1.345 million vehicles fell (78)% versus prior year. (ACEA)

- A leaked document purporting to outline a massive EU stimulus programme — with up to €80 billion targeted at clean mobility (split between vehicle purchases and grants) — set tongues wagging. (EURACTIV)

- The UK government set out proposed tariffs on imports to apply after the transition period with the EU ceases at the end of 2020. It confirmed that cars will attract a 10% tariff, the same as non-EU imports without a trade deal attract today. Tariffs for parts are still present, although reduced in some cases. The parts attracting zero tariffs (e.g. wing mirrors) suggest a degree of industry lobbying has been considered. (UK Government)

- Significance: Although the government said it was protecting the automotive sector, the mix of vehicles produced locally (mainly luxury cars) doesn’t reflect the wider market, so the tariffs, if they came into force on EU imports, would be likely to have a distorting effect on sales. The published tariffs suggest a producer of vehicles using knock-down kits would save ~7% of the vehicle value over importers. Contact us for more details.

Suppliers

- Benteler reckons that plans by many European OEMs to have output at pre-lockdown levels by the summer are “ambitious”. (Autocar)

- Battery producer Exide entered Chapter 11 bankruptcy. (Exide)

- Gestamp reported Q1 2020 revenue of €2.17 billion and EBIT of €110 million. (Gestamp)

Ride-Hailing, Car Sharing & Rental (history)

- Hertz filed for chapter 11 bankruptcy after lenders would not agree to extend re-payment deadlines. (Detroit News)

- Uber cut a further 3,000 jobs, brining the total to almost 7,000 in the last few weeks (about 25% of the global workforce). The CEO says the firm needs to become profitable and will withdraw from non-core activities, without fully describing what they are. (Business Insider)

- Ride hailing operator Ola cut 1,400 jobs, saying revenue fell (95)% in the last two months. (TechCrunch)

- Ride hailing service Bolt raised €100 million. (Reuters)

- The owner of ride hailing firm Tada raised around $5 million. (Deal Street Asia)

Driverless / Autonomy (history)

- The CEO of Intel’s Mobileye reckons there will be massive consolidation amongst companies developing self-driving technology because (he thinks) specialists will find it too hard to collaborate. (Reuters)

- Lumotive says it will have a new lidar sensor in customer’s hands by the end of 2020. With a range of around 120 metres — far less than some boast — the main selling point will be “competitive” cost. (Lumotive)

- Labelling company Scale AI and lidar developer Hesai launched an open source dataset of lidar traces that can be used to train systems on object recognition. (TechCrunch)

- Autonomous technology developer Hongjing Drive said it had raised millions of dollars. (TechNode)

- British battery start-ups AMTE Power and Britishvolt want to build a factory with a capacity of 30 GWh (or more), which would make it one of the World’s largest facilities. The scheme appears to have government backing. (AMTE)

- SVOLT says 2021 will see the debut of its cobalt-free batteries in vehicles made by Great Wall. (Autocar)

- Suspension supplier KYB signed a deal with in-wheel motor developer REE, enabling REE to develop packages incorporating wheel hub, power, braking and suspension. (REE)

- InoBat acquired a site in Slovakia for a low-volume battery production line and R&D centre, with plans to expand to a 10 GWh facility by mid-decade. (Green Car Congress)

- Media behemoth Liberty Global plans to start a high speed charging network in the UK using power from the kerbside cabinets that house its broadband equipment. (Bloomberg)

Connectivity

- HERE signed deals with address database Loqate and parking provider APCOA to embed its maps in other software (HERE) and map out European parking lots. (HERE)

- Alpine and Telenav are launching a usb stick that will upgrade an infotainment unit with smartphone integration so that it can access media streaming services and send vehicle data to the cloud. The device sounds in principle like a smartphone without a screen. (Telenav)

Other

- University researchers in Japan are trialling an inflatable electric scooter which bears a passing resemblance to a child’s Trunki rideable suitcase. Although the prototype has several drawbacks, the idea could develop into something that would be suitable for integration into a vehicle’s boot space. (IEEE Spectrum)

- Electric rickshaw developer Euler Motors raised an additional 20 Cr INR (about $2.7 million). (Autocar)

- Electric scooter rental service Tier has launched foldable helmets stored within the scooter. (Tier)

- By Miles, a mileage-based insurance company backed by JLR’s InMotion VC fund raised £15 million, but JLR did not participate. (By Miles)

- Autonomous drone developer Xwing raised $10 million. (Alven)

- A majority stake in bicycle rental service CityBike was sold to a private equity firm. (PE News)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 17th May 2020

Remote working converts; fighting water with water; and a dent in the limited edition bubble? Please enjoy our auto industry and mobility briefing for 11th May to 17th May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Sofa Song — PSA say that coronavirus has proved that teleworking is the way forward. In the near future, staff will only spend one and a half days in the office, and all the time they spend there will be a constant whirlwind of high-energy creative meetings. By implementing these measures, PSA hopes to save on office space, and money. Clearly, PSA executives believe they have cracked communication problems often associated with remote working on this scale. How should we interpret the silence of their competitors?

- November Rain — VW’s ItalDesign unit is working on a safety system to reduce aquaplaning. It sounds hard to believe, but the idea is to clear the water by spraying a jet of… water… at the ground. It remains to be seen how reliable the feature could be but it demonstrates the kind of innovation that could be feasible for frequently serviced autonomous vehicles but which would never work in a world of privately owned cars where owners often run out of fuel, not to mention ancillary water tanks. Are we underestimating the potential safety improvements?

- Pop Goes The Weasel — Aston Martin admitted that there had been cancellations for some of the highly-priced “special” cars the firm relies on for so much of its (ahem) profits. In the same breath, company representatives reassured investors by saying waitlisted customers had immediately taken the newly vacated slots, but it indicates a weakness for these must-have products. Is this the normal ebb and flow of product ordering and nobody normally asks about it, or is there a softening of demand?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- BMW’s CEO is expecting several large markets to be “very slow” to recover and believes that the Chinese market might not be a good guide to consumer confidence elsewhere. (BMW)

- Says that plans to commission a new plant in Debrecen, Hungary, are unaffected by coronavirus. (BBJ)

- PSA and FCA jointly decided not to issue any ordinary dividends in 2020. (PSA)

- Working on a credit facility backed by the Italian government that would be open to FCA and Italian automotive suppliers, worth up to €6.3 billion. (FCA)

- The breakdown of a deal by major FCA shareholder Exor to sell an insurance unit, after the prospective buyer tried to negotiate a price reduction, was seen by some as a warning to PSA not to re-open the merger valuation. (Reuters)

- Confirmed that over the air updates for the forthcoming all-electric Mustang Mach-E will be capable of upgrading “nearly all” of the software on the vehicle, and extend far beyond the infotainment-only upgrade functionality that some brands are touting. (Ford)

Geely (includes Volvo) (history)

- Lotus chose UK utility Centrica to provide electricity for owners. Unusually, the partners say that their aim is to establish global infrastructure — such deals normally only cover a country or region. (Centrica)

- Believes that lessons learned from the recent UAW strike will help it ramp up North American factories to full capacity within four weeks of returning, demand permitting. (Detroit Free Press)

- Shut down the Ariv electric bicycle project. (The Verge)

- Laid off about 8% of staff at the Cruise self-driving unit, despite indicating that spending would be ring-fenced. GM’s CEO said the cuts were “prudent”, focused on non-technical areas and called the company’s commitment to the business “unwavering”. (Reuters)

- Reported financial results for the fiscal year ended March 2020. Sales of 4.8 million automobiles fell (10)% on a year-over-year basis. Automotive revenue of 10 trillion JPY (about $93 billion) fell (8)% net of currency effects (group revenue was 14.9 trillion JPY). Automotive operating profit of 153 billion JPY (about $1.4 billion) fell (27)% (group profit was 634 billion JPY). (Honda)

Mazda

- Reported full fiscal year (April 2019 to March 2020) financial results. Net sales of 3.4 trillion JPY (about $32 billion) fell (3.8)% on a year-over-year basis. Operating income dropped (47)% to 43.6 billion JPY (about $405 million). Mazda’s cash balance dropped about $(1.2) billion during the year, despite the relative stability and the company refused to provide guidance for the current year. (Mazda)

- Significance: Toyota already holds significant stakes in Mazda and Subaru with a full takeover a likely response to severe financial distress by either brand.

Nissan and Mitsubishi (history)

- Ahead of Nissan’s announcement of its new strategy (set for 28th May), details reportedly leaked: the Barcelona plant is set for closure; Nissan will make Renault products (said to be Captur and Kadjar — sister vehicles of the Juke and Qashqai) at the Sunderland, UK, factory. (Nikkei) Datsun will be chopped entirely, rather than being scaled down, according to some as part of moves to save $2.8 billion annually. (Bloomberg) Nissan didn’t deny any specific points but said the plan was still in progress. (Nissan)

- Looking to raise up to $4.7 billion in bonds to fund restructuring. (Nikkei)

- PSA and FCA jointly decided not to issue any ordinary dividends in 2020. (PSA)

- Implementing widespread teleworking in response to coronavirus has convinced PSA that this is the way forward. Staff can expect to spend around 1 – 1.5 days per week in the office, with the remainder working from home. As a by-product, PSA expects to reduce floorspace thereby cutting carbon emissions (oh and cost too). (PSA)

- The breakdown of a deal by major FCA shareholder Exor to sell an insurance unit, after the prospective buyer tried to negotiate a price reduction, was seen by some as a warning to PSA not to re-open the merger valuation. (Reuters)

- Renault’s forthcoming all-electric SUVs will be sleeker than conventionally powered vehicles because the brand hopes to harness aerodynamics to improve range. (Autocar)

- Reportedly taking an axe to the large car product plan with replacements for the Espace, Tailsman and Scénic apparently cancelled with only one or two years to go until launch. (Reuters)

Subaru

- Subaru reported full fiscal year revenue of 3.3 trillion JPY (about $31 billion), up 6% versus prior year on sales of 1.03 million units, up 3.3%. Operating profit of 210 billion JPY (about $2 billion) rose 15.7%. Subaru is expecting a bumpy year ahead and refused to provide guidance. (Subaru)

- CATL’s CEO says Tesla has a firm plan to make its own batteries. (Inside EVs)

- Reported full year (April 2019 to March 2020) financial results. Sales of 8.958 million units was a whisker below the prior year. Revenue of 30 trillion JPY (about $274 billion) dropped (1)% versus prior year whilst operating income of 2.4 trillion JPY (about $22 billion) was also (1)% worse than prior year. Although the results weren’t much affected by coronavirus, Toyota thinks the current fiscal year will be much worse, predicting that sales will fall by almost 2 million units to around 7 million. (Toyota)

- Announced a series of down days at plants in Japan in response to falling demand. (Toyota)

- Toyota AI Ventures invested in animation company Ziva Dynamics. (FINSMES)

- Suffering problems launching the Golf 8 (and some sister products) because of faults with the equipment used to send notifications to emergency services when the vehicle has an accident. (Handelsblatt)

- VW’s China team say customers are returning to market more quickly than they initially expected but also believe that many domestic brands will fall by the wayside as the industry recovers. (China Daily)

- It sounds like an April Fool’s joke; VW’s ItalDesign is working with Bosch and a company called EasyRain to develop a system that combats aquaplaning in wet weather by squirting water from the car at the water on the road thereby clearing some of the road surface and enabling the vehicle to grip better. (ItalDesign)

Other

- The British government reportedly told McLaren to try harder to raise money rather than asking for aid (beyond the furlough scheme). The company appears willing to mortgage many of its most high-profile assets. (Sky News)

- Mahindra’s Ssangyong brand reported Q1 2020 revenue of €649 billion KRW (about $530 million) and an operating loss of (98.6) billion KRW (about $(80) million), excluding around $(60) million of asset impairments. (Ssangyong)

- Henrik Fisker thinks most electric vehicle start-ups will go bust in two to three years (statistically correct), pointing to likely manufacturing and quality problems and a likely lack of patience from customers for such errors. He did not explain why his, eponymous, firm would be different. (Business Insider)

- Dyson showed off the electric car it had worked so hard on before canning the project last year. The 5 metre long, 7 seat SUV would have put the company squarely up against the likes of Range Rover. A business case that apparently needed (wholesale) revenue of £150,000 per unit would suggest volumes in the low thousands. (Engadget)

- WM Motor unveiled an all-electric concept car called Maven. (Inside EVs)

- Aston Martin reported Q1 2020 financial results. Sales of 578 units dropped (45)% on a year-over-year basis with massive declines in all regions apart from the UK. Aston Martin said this was a conscious effort to reduce dealer stocks and move to build to order. Revenue of £79 million was smaller than the before tax loss of £(119) million. In the earnings call, Aston Martin confirmed that there had been some cancellations for the brand’s limited series, very expensive, “specials”. Although company representatives quickly pointed out that the cancellations had been swiftly placed with other customers, it may be an early indication of softening in this hitherto highly profitable segment. (Aston Martin)

News about other companies and trends

- China light vehicle sales in April of 2.07 million units rose 4.4% year over year with a 31.6% increase in commercial vehicles offsetting a small drop in passenger cars. (CAAM)

- European sales of battery electric and plug-in hybrid vehicles in Q1 2020 represented 6.8% of all passenger cars, up from only 2.5% in the prior year. (ACEA)

Suppliers

- Administrators were called into the UK operations of supplier Arlington Automotive. (BBC)

- Experts believe that hygiene is the next frontier in automotive interior technologies, with UV lights and disinfectants mentioned as potential advances. (Detroit Free Press)

- Martinrea reported Q1 2020 revenue of $873 million and operating income of $49 million. (Martinrea)

Dealers

- Over 40% of UK dealers responding to a survey said they had already made redundancies, in addition to furloughing staff. (Automotive Manager)

Ride-Hailing, Car Sharing & Rental (history)

- Chinese ride hailing firm Shouqi Limousine says it is profitable (on a gross profit basis) in China overall and in several different cities. The company expects positive EBITDA by the end of the year. (Shouqi)

- Lyft is raising $650 million – $750 million of unsecured debt. (Lyft)

- Uber raised $900 million of debt. (Uber)

- Hertz reported a net loss of $(356) million in Q1 2020 and confirmed that it was reliant on the patience of debt holders to remain afloat. (Hertz)

- Uber is reportedly looking to acquire food delivery firm GrubHub. (WSJ)

Driverless / Autonomy (history)

- Waymo’s massive funding round continued to gain momentum: the self-driving developer got its hands on another $750 million, taking the total to $3 billion. (Reuters)

- GM laid off about 8% of staff at the Cruise self-driving unit, despite indicating that spending would be ring-fenced. GM’s CEO said the cuts were “prudent”, focused on non-technical areas and called the company’s commitment to the business “unwavering”. (Reuters)

- Electric powertrain supplier IRP Systems raised $17 million. (IRP)

- Kia will offer electric cars with either 400V (standard today) or 800V (Porsche Taycan) charging capability. The model-by-model decision will be based on Kia’s view of the usage profile. (Kia)

- Charging company Wallbox raised an additional $13 million. (Wallbox)

- Triggo’s forthcoming electric quadricycle can retract the front wheels to make it narrower. (Triggo)

- Lordstown Motors licenced the in-wheel motor technology of Elaphe for inhouse manufacture. (Detroit News)

Connectivity

- European manufacturers’ body ACEA is worried that draft rules about data privacy for connected cars could be overly restrictive around data gathering, especially information from sensors looking outside the cabin. (ACEA)

Other

- Electrically assisted bicycle maker VanMoof raised €12.5 million. (EU Startups)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 10th May 2020

Rental companies confirm they aren’t buying; FCA’s rotten performance; and upper or lower for lidar? Please enjoy our auto industry and mobility briefing for 4th May to 10th May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Get Get Down — Rental firms are slamming the brakes on new vehicle purchases. I know I raised similar questions last week, but now there are more specifics: Hertz have said they have enough stock to last the rest of 2020 and US OEMs are reportedly trying to reallocate units that rental companies had already agreed to buy. A poorly-kept industry secret is that rental companies often buy more cars and vans than they need because manufacturers give them such massive incentives. Why? For no better reason than it helps underpin market shares, especially when you need to sell lots of cars in a hurry to meet your monthly sales target. Can automakers cope with rental demand dwindling or is it about to blow a hole in production forecasts?

- Bad Apple!! — Fiat Chrysler’s latest financial results hit the headlines due to the €(1.7) billion net loss but the detail hid plenty of scary detail. Specifically, the operations outside of the Americas have cumulatively lost money since Q3 2017. In a world where GM is showing the benefits of brutally culling underperforming areas and we are staring a recession in the face, will big cuts in these regions be the price FCA has to pay to maintain its merger valuation with PSA?

- Up On The Roof — Volvo announced that it will soon be making cars with lidar fitted into the roof, just above the windscreen. The arrangement looks neat, although aerodynamicists might initially have reservations. It is a philosophical departure from the design advanced with Audi where it was mounted in the grille. Are we about to witness a battle between uppers and lowers about which execution is best?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Released financial results for Q1 2020. Automotive revenue of €18.0 billion fell (6.4)% versus Q1 2019 (group revenue rose slightly, thanks to financial services) whilst EBIT of €229 million was much improved versus a loss in the prior year. Although BMW refused to provide a detailed outlook for 2020, the firm still expects for the automotive division to be profitable on an EBIT basis (somewhere between 0% to 3% margin). (BMW)

- Says it will save over €1.7 billion in capital expenditures this year and is confident of meeting European CO2 targets regardless of how the economic situation develops. (BMW)

- Reported Q1 2020 revenue of €20.6 billion, down (16)% year-over-year, and a net loss of €(1.7) billion from continuing operations (which included €643 million of asset impairments). Even using FCA’s preferred “adjusted” EBIT measure, operations outside the America’s have cumulatively lost over €(200) million since Q3 2017. Maserati’s €(444) million of losses in the last 12 months — a stonking (32)% of revenue — raise questions over FCA’s earlier financial allocation methods that made the brand’s performance look so rosy. (FCA)

- Significance: The weak performance in Europe and Asia highlight how much FCA needs the PSA deal to pass. Without it, a politically unpalatable restructuring beckons.

Ferrari

- Ferrari shipped 2,738 units in Q1 2020, up 5% on prior year despite closing the factory in the middle of March. Revenue of €932 million fell (1)%, blamed mostly on F1, whilst EBIT of €220 million fell (5)%. (Ferrari)

- Proclaimed itself “back at full capacity” as of 8th May. (Ferrari)

- Ford’s COO purchased $1 million of Ford stock, in an apparent show of confidence in the recovery. Cynics suggested it was a move aimed at chairman Bill Ford rather than the stock market and that the executive’s pay would soon be increased to refund the move. (AutoExtremist)

- Releasing a package of data collected from self-driving test vehicles roaming the streets of Michigan, USA. Ford says the information is notable because it centres on the same routes over time and therefore allows third party researchers to explore the effects of changes in the local environment, and even sensor crossover when one or more of the cars was in the same location. (Ford)

Geely (includes Volvo) (history)

- Volvo will use a roof mounted Luminar lidar on forthcoming SAE L3 to L4 self-driving features (“fully autonomous highway driving”). Volvo provided an image of how such an integrated system might look, without commenting on possible aerodynamic drawbacks that have led to others mounting similar units in the grille. Volvo has an option to increase its stake in Luminar and expressed a vague aspiration to fit lidar as standard to vehicles on its next-generation platform (implying a ~2025 timeframe and lower specification unit). (Volvo)

- Reported Q1 2020 revenue of $32.7 billion, down (6.2)% on a year-over-year basis, and net income of $294 million, down (86.7)% versus 2019. The company said it was imposing cost cuts, whilst protecting spending on “key franchises”, GM-speak for high margin SUVs and future state bets (electric cars and autonomy). (GM)

- Raised another $4 billion in secured debt and expects a further $2 billion credit facility to be formalised soon. GM is paying an interest rate of 5.4% – 6.8%, much lower than Ford’s recent, similar, offering. (GM)

- Hyundai appears over-pleased with its in-house transmission engineering expertise, claiming (wrongly) that it is uncommon for car manufacturers to make their own and using language that suggests the business still views the product as a significant competitive advantage. (Hyundai)

- Significance: As long-time readers will recall seeing on many occasions, Ad Punctum’s analysis is that many manufacturers are already in a position where commoditising the transmission (and the engine) by sharing with third parties is an overdue step. The transmission is especially vulnerable because even if the world adopts plug-in hybrids more readily than fully electric vehicles, these use a transmission different to most conventional vehicles (and for series hybrids, it can be far simpler). Thus, transmission assets are likely to become a millstone around the neck of manufacturers who persevere with them.

Nissan and Mitsubishi (history)

- Nissan reportedly plans to focus only on Japan, North America and China, with slimmed-down portfolios in European markets. (Reuters)

- Opel lost a series of employment cases brought by disgruntled German engineers who had refused to switch to engineering services provider Segula when Opel offloaded much of its Rüsselsheim product development centre to the French firm. (FAZ)

- Moves to restart production at the Sandouville, France, plant hit trouble when unions won a court judgement saying that safety measures were unclear. (Reuters)

- JLR’s InMotion VC team shared their thoughts on how investments by OEMs can help reduce the environmental impacts of the cars they build. (JLR)

- CEO Musk said, because of local government rules forcing Tesla’s Fremont factory to stay closed, he would move the businesses headquarters and future programs to locations in Texas and Nevada “immediately” and that the site’s future was in peril. It was not clear how the company would carry out such a move logistically, or whether this was a board-approved tweet. (BBC)

- Škoda’s new Enyaq all-electric SUV was unveiled (in camouflage at least). (Škoda)

- Škoda says that it lost 100,000 vehicles in Q1 2020 because of coronavirus. (Škoda)

- Volkswagen is going to own the buildings used by the battery-making joint venture the company has formed with Northvolt. (VW)

- Audi plans to train all sales and service staff about the new A3 using digital tools, foregoing the normal method of delivering train-the-trainer sessions in person. (Audi)

- Audi says it cannot get SAE L3 self-driving features working in the A8, despite saying at the car’s launch that it was only a matter of time until legislative problems were resolved. (Automotive News)

News about other companies and trends

Economic / Political News

- April US light vehicle SAAR of 8.58 million units fell (48)% from prior year. (Wards)

- French passenger car registrations of 20,997 units fell (89)% versus 2019. (CCFA)

- German registrations of 120,840 passenger cars in April, down (61)% versus prior year. (KBA)

- Italian passenger car sales of 4,279 units in April fell (98)% on a year-over-year basis. (UNRAE)

- Spanish passenger car registrations in April of 4,163 units dropped (97)% year-over-year. (ANFAC)

- UK April passenger car sales of 4,321 units fell (97)% from prior year. (SMMT)

- Russia’s government plans to pull forward vehicle purchases planned for 2021 and 2022 to support the local automobile industry. (TASS)

- A UK consumer survey suggests plenty of (retail) customers are still planning to buy a car when dealers reopen, with government advice to drive rather than use public transport reckoned to be a big plus. (Motor Trader)

Suppliers

- Lear reported Q1 2020 revenue of $4.5 billion and net income of $76 million. (Lear)

- Delphi’s Q1 2020 revenue was $945 million, with an operating loss of $(20) million. The company said it was on track to be acquired by BorgWarner after resolving a disagreement over Delphi’s use of a credit line. (Delphi)

- BorgWarner reported Q1 2020 revenue of $2.3 billion and EBIT of $186 million. (BorgWarner)

- Adient reported definitive financial results for Q1 2020 (after making a preliminary filing in April). Revenue was $3.5 billion with EBIT of $66 million. (Adient)

- American Axle (AAM) reported Q1 2020 sales of $1.34 billion and a net loss of $(501) million, more than explained by a goodwill impairment of $510 million. (AAM)

- Aptiv reported Q1 2020 revenue of $3.2 billion and adjusted net income of $173 million (excluding the effect of the autonomous technology JV with Hyundai). (Aptiv)

- Tenneco reported Q1 2020 revenue of $3.8 billion and an adjusted net loss of $(26) million. (Tenneco)

- Yazaki is shedding 20% of its Mexican workforce (about 14,500 jobs), suggesting it doesn’t share the rosier predictions for a recovery. (Reuters)

- Magna reported Q1 2020 revenue of $8.7 billion and net income of $261 million. (Magna) The company’s CEO expects consolidation in the supply base but is waiting to see how well the restart goes before making any big moves. Around 200 suppliers are under intensive monitoring because of concerns they are in financial distress. (Motley Fool)

Dealers

- Chinese new and used car sales website Cheheoduo (formerly Guazi.com) raised $200 million. (Deal Street Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Uber reported Q1 2020 financial results. With gross bookings of $15.8 billion, Uber’s take was $3.5 billion, up 14% on a year-over-year basis. The net loss was $(2.9) billion although Uber claims that on an “adjusted EBITDA” basis ride hailing made $581 million in the quarter. The rate of cash burn suggests that, despite a bump in the stock price, Uber needs to do something drastic soon to remain financially stable. (Uber)

- Lyft reported Q1 2020 revenue of $956 million, up 23%, and a net loss of $(398) million. (Lyft)

- Rental firm Hertz is teetering on the edge of bankruptcy, winning a short reprieve for loan repayments due in late April to late May. The company now says it does not think it will need any new cars in 2020. (Reuters)

- Rental businesses in the USA have reportedly slammed the brakes on new car purchases with various OEMs rumoured to be trying to reallocate stock, with FCA apparently hawking a list of 30,000 vehicles. (Bloomberg)

- Confirming earlier rumours, Intel bought Moovit for $900 million. (Intel)

- Uber invested in scooter rental firm Lime’s $170 million round, handing over Jump (Lime’s smaller rival owned by Uber). Although the move to shed scooter services might appear contrary to Uber’s earlier praise of the vehicles, it would be explained by a reportedly secret pact giving Uber an option to buy Lime. (TechCrunch)

- Investors are betting that massive increases in unemployment will see more people turning their hand to driving using apps like Lyft and Uber with the resulting supply increases allowing the companies to scale down on expensive driver incentives, whilst increasing revenue. It remains unclear whether this view is consistent with existing complaints by full time drivers that revenues in mature markets were barely keeping pace with costs. (Reuters)

- As rumoured, Uber announced plans to make 3,700 employees redundant, with about one third of the job losses coming in Egypt and Dubai (Careem). (Reuters)

Driverless / Autonomy (history)

- Continental says that deferring investments in autonomous technology by a few months won’t hurt. (Reuters)

- Magna’s CEO thinks car companies will reduce spending on SAE L3 to L5 autonomous features but investment in driver assistance (up to L2) will be unaffected. He also implied that Magna and Waymo have held substantive discussions about making complete (white label) vehicles for the self-driving company (Motley Fool)

- Ford is releasing a package of data collected from self-driving test vehicles roaming the streets of Michigan, USA. Ford says the information is notable because it centres on the same routes over time and therefore allows third party researchers to explore the effects of changes in the local environment, and even sensor crossover when one or more of the cars was in the same location. (Ford)

- Volvo will use a roof mounted Luminar lidar on forthcoming SAE L3 to L4 self-driving features (“fully autonomous highway driving”). Volvo provided an image of how such an integrated system might look, without commenting on possible aerodynamic drawbacks that have led to others mounting similar units in the grille. Volvo has an option to increase its stake in Luminar and expressed a vague aspiration to fit lidar as standard to vehicles on its next-generation platform (suggesting a ~2025 timeframe and lower specification unit). (Volvo)

- Audi says it cannot get SAE L3 self-driving features working in the A8, despite saying at the car’s launch that it was only a matter of time until legislative problems were resolved. (Automotive News)

Other

- Google pulled the plug on a plan to build smart technology into a neighbourhood in Toronto, Canada, that is being redeveloped. (Reuters)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 3rd May 2020

A good time for bad news; big spenders tightening their belts; and capital allocation choices looming. Please enjoy our auto industry and mobility briefing for 27th April to 3rd May 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Wrecking Ball — Volvo is slashing salaried staff. Although the company suggests that the cuts were planned, and maybe they were, it reinforces the impression that the coronavirus hiatus (albeit minimised in Sweden) affords the opportunity to make big moves with less downside than might usually be seen. Which other manufacturers will be telling people they don’t need to bother returning to work?

- We Can’t Stop — After Hertz announced a round of layoffs last week, Enterprise, Lyft and (probably) Uber are doing the same. If the companies that, directly or otherwise, drive lots of new car sales are shedding staff, and therefore capacity, what makes manufacturers expect a quick rebound in demand?

- The Climb — The head of VW’s Traton truck unit thinks investments in self-driving will be the first to be thrown overboard as companies clamp down on spending. It makes sense in a way: the pay-off is probably further away than other deserving projects. But there could be a big flaw, and it’s the same one that started the splurge in the first place; if Google (Waymo) can afford to keep spending, those without a serious skin in the game risk being left behind. Does everyone know enough to decide how to trim spending?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart of the week

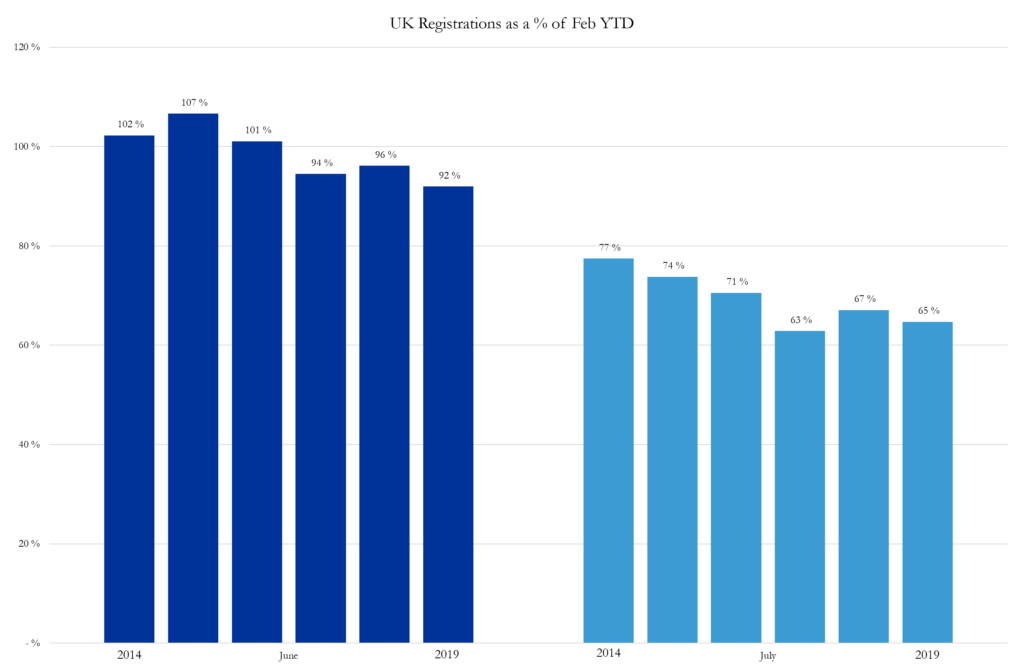

A (unsurprisingly) common theme in discussions we’ve had recently is what consumer reaction we can expect to relaxation of quarantine measures. This particular talking point has been getting good traction so I thought we would share a little insight: Sales in the UK are highly seasonal — reliably higher or lower than other months — driven by the two number plate changes in March and September (where the different number on the plate highlights that the car is brand new).

The chart below shows the recent trend of sales in June and July versus the combined January and February sales in the same year. Not an exact science, but it does provide some idea of a “normal” range when service resumes. If you do the rest of the maths it suggests a June figure in the range 210,000 – 240,000 and July registrations of 145,000 – 175,000 would be consistent with industry recovery. Our key belief is that future state scenarios need to be supplemented by early indicators to enable fine tuning of plans.

News about the major automakers

- Although most of BMW’s workforce buzzed off once coronavirus set in, the bees at Rolls-Royce remained hard at work and managers say they are set for bumper volumes. No word yet on whether Bentley’s hives at Crewe have been similarly unaffected. (Rolls-Royce)

- Reported Q1 2020 revenue of €37.2 billion, down (6)% on a year-over-year basis. EBIT of €617 million fell (78)% from prior year. The 2020 full year outlook amounted to not much more than an expectation to burn cash. (Daimler)

- Reported Q1 2020 financial results. Wholesales of 1,126 units fell (21)% on a year-over-year basis. Automotive revenue of $31.3 billion fell (16)% and there was an EBIT loss of $(177) million. Ford now thinks it has enough money to last to the end of the year, even if it doesn’t sell any more vehicles. The CFO still isn’t confident enough of the financial environment to give a view on full year results but said the company will lose around $(5) billion in the second quarter. Ford Credit made massive reserves for additional expected credit losses and sees residual values dropping towards the end of the year. (Ford)

- Ford has pushed back the launch of self-driving vehicles to 2022. (Ford)

- On the earnings call, Ford’s CFO said he thinks that it will be difficult to trust US used vehicle auction prices for some time after they re-open because of low volumes. (Ford)

- The joint program for a Lincoln vehicle based on Rivian’s platform has been cancelled. (Ford)

- Issued a recall for a small number of US vehicles after dealers, anxious to fix vehicles quickly in the face of a supply backlog, ordered grey market headlamp parts that don’t comply with US regulations. (Ford)

- Ford’s board seat at Rivian was taken by Chairman Bill Ford’s daughter (a director in the corporate strategy department). (Detroit Free Press)

- Significance: The appointment would usually be some way above her (current) pay grade, and points to a desire to quickly accrue experience. Memo: her father became company chairman in his early 40s.

Geely (includes Volvo) (history)

- Sacking 1,300 non-manufacturing staff in Sweden as part of Volvo’s cost-cutting drive. The firm says that the move is in line with existing plans but coronavirus increased the “pertinence” of the steps. (Volvo)

- Kandi Technologies reported full year 2019 revenue of $136 million and operating income of $0.9 million. (Kandi)

- Says that the (limited hands-off driving assistance system) SuperCruise-enabled fleet logs around 70,000 miles per week. (Detroit Free Press)

- Produced 950,393 cars in Q1 2020, down (29)% versus the same period in 2019. (Honda)

- Invested in glass technology developer Gauzy. (i24)

Mazda

- Sold 313,116 cars in Q1 2020, down (20)% year-over-year. (Mazda)

Nissan and Mitsubishi (history)

- Nissan issued a profit warning saying its fiscal full year net loss could be $885 million and that it was delaying financial reporting until late May, at which time it will also announce a recovery plan. (Nissan)

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

- Renault reportedly hopes that thinning the heard of contracted engineering services will save €100 million to €200 million per year with a mooted cut from around 15 major suppliers to four or five on the cards. (Reuters)

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

- The EU cleared a plan for France to give Renault a €5 billion loan guarantee. (Reuters)

Subaru

- Global production of 270,535 cars rose 19.2% on a year-over-year basis. (Subaru)

Suzuki

- Sold 691,801 units in Q1 2020 (including Maruti-Suzuki in India), (18)% down on 2019. (Suzuki)

- Reported Q1 2020 financial results. Automotive revenue of $5.1 billion rose 38% versus prior year whilst the operating profit of $283 million substantially improved on a loss of $(522) million in 2019. (Tesla)

- Tesla codebreaking sleuths reckon that the latest software updates include a facility for full self-driving to be activated on a pay-as-you-go basis. (CleanTechnica) CEO Musk said in the earnings call that subscription will be an option. (Seeking Alpha)

- Manufacturing costs in China are already below those of the Fremont, USA, factory, per CFO Kirkhorn. Tesla also said that Model Y was already profitable (on the company’s chosen measure of gross margin). (Seeking Alpha)

- CEO Musk tweeted that the share price was too high, sending it lower. (Wired)

- Applied for a licence to sell electricity in the UK, prompting speculation that plans for a large battery installation could be in the works. (BBC)

- Sold 1.7 million vehicles in Q1 2020 (including the Daihatsu and Hino brands), down (12.4)% versus 2019. (Toyota)

- Restructuring the Chinese joint venture with FAW to simplify reporting relationships. (Toyota)

- Announced a series of management changes, primarily reflecting the hand over of the electronics components business to Denso. (Toyota)

- VW Group’s Q1 2020 revenue of €55 billion fell (8.3)% versus prior year and operating profit of €0.9 billion was (81.4)% worse. Deliveries of 2.0 million units fell (25)%. The firm says that it will still make a profit in 2020 even though revenue will be way down over prior year and will probably be cashflow negative. (VW)

- Bentley’s boss says there have been very few cancellations because of coronavirus and production will start at a 50% rate so that there are sufficient gaps between workstations. (Autocar)

- Audi said that a period of coronavirus-enforced reflection has led it to the conclusion that it should pull out of German touring cars to concentrate on the all-electric Formula E series. (Audi)

- The head of the Traton truck unit reckons investments in autonomous technology will be first on the chopping block as companies look to defer spending. (Reuters)

- Significance: Whilst autonomous driving may seem an obvious candidate for spending reductions, given the payoff is longer term, one competitor looks set to continue unabated: Google / Waymo.

Other

- Nio announced a plan to sell 24% of its Chinese business to an assortment of regional government investment vehicles in return for a cash injection of 7 billion RMB (almost $1 billion). (Nio)

- Kenon sold 12% of Qoros (it kept the same amount) to Baoneng (which now holds 63%). (Kenon)

News about other companies and trends

Suppliers

- Visteon reported Q1 2020 revenue of $643 million and a net loss of $(35) million. (Visteon)

- Michelin reported Q1 2020 revenue of €5.3 billion (of which automotive €2.6 billion). (Michelin)

- Continental reported better Q1 2020 financial results than its profit warning suggested. (Continental) The firm won’t be pressing ahead with the spin-off of powertrain arm Vitesco just yet. (Continental)

- Meritor reported Q1 2020 revenue of $871 million and adjusted income of $56 million. (Meritor)

- Goodyear’s Q1 2020 revenue was $3.1 billion, the firm had a net loss of $(619) million. (Goodyear)

- Eaton’s revenue for Q1 2020 was $4.8 billion, and operating profit was $758 million. (Eaton)

- LG’s vehicle electronics division reported Q1 2020 revenue of $1.1 billion and an operating loss of $82 million. (LG)

- LG Chem’s battery business revenue fell quarter over quarter but the company still expects full year increases as industry growth offsets coronavirus-related production losses. (LG Chem)

- Nidec reported full year (April 2019 – March 2020) revenue of 1.5 trillion JPY (about $14.4 billion). Operating profit was 110 billion JPY (about $1 billion). (Nidec)

- Denso reported fiscal full year revenue of $47.6 billion and operating profit of $564 million. (Denso)

Dealers

- A UK survey of potential car buyers found that although 82% were still planning to go ahead with a deal, 76% do not want to go to a dealership in person but only 7% were happy with buying online. (Motor Trader)

- Auto Service Finance, a white label provider of loans for car servicing raised £14 million. (FINSMES)

- Companies such as Morgan (Morgan), Tata (Tata) and VW (VW) announced that warranties would be extended by three months for customers affected by coronavirus shutdowns.

Ride-Hailing, Car Sharing & Rental (history)

- Intel is rumoured to be about to buy multi-modal app Moovit. (Reuters)

- Lyft is shedding 17% of its workforce. (Lyft)

- Uber is rumoured to be mulling a plan to cut 20% of its workforce. (The Information)

- Following in Hertz’s footsteps, Enterprise laid off 2,000 employees in a move the company “expects” will be permanent. (Auto Rental News)

Driverless / Autonomy (history)

- Machine learning firm Tecton.ai, founded by three Uber alumni, raised $20 million. (TechCrunch)

- Self-driving truck start-up Inceptio raised $100 million. (Reuters)

- The head of VW’s Traton truck unit reckons investments in autonomous technology will be first on the chopping block as companies look to defer spending. (Reuters)

- Ford has pushed back the launch of self-driving vehicles to 2022. (Ford)

- Charging network Amply Power raised $13 million. (TechCrunch)

- Battery developer ZAF Energy Systems raised $22 million. (FINSMES)

Connectivity

- Connected services company Automatic, makers of a cheap dongle containing a modem that plugged into a car’s OBDII port and transferred location and other data to the cloud, said it was closing. (Automatic)

- Significance: Since the company’s offering was pretty cheap, yet capable, Automatic’s failure calls into question OEM hopes of monetising similar services, implying that margins are unsustainably thin. Equally, if companies really believe in the value of data then Automatic’s husk could provide rich pickings at a cheap price.

- Connected vehicle data company Otonomo raised $46 million from investors including the Renault-Nissan-Mitsubishi VC unit. (Otonomo)

Other

- Road quality monitoring service Nexar raised $52 million. (Fortune)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.