Auto Industry Briefing — week ending 21st October 2018

Tesla shrinks into the crowd; weak carmakers lose influence with politicians; and making public transport free for all. Please enjoy our auto industry and mobility briefing for 15th October to 21st October. A PDF version can be found here.

Favourite stories of the past week…?

- I Hate You So Much Right Now — A group of cross-party UK politicians want new sales of internal combustion engine powered vehicles to be banned by 2032, pouring scorn on the government’s current (unlegislated) timeline of 2040. Carmakers should be concerned. The opportunity cost for politicians to pull forward what they are expecting to be technological inevitability by a few years is very low compared to the potential kudos of environmental leadership. By complaining too much about the pace of regulatory change, manufacturers are losing credibility and might find themselves unable to properly influence decisions where politics is trumping environmental and economic concerns.

- All Right Now — The French town of Dunkirk has made all travel on local buses free for residents. The council says that it had to subsidise 90% of the costs anyway, so why not go the whole hog? After a month, usage is up by 50% and left-leaning groups are crowing about its success. But isn’t a 50% increase when you made something FREE a compelling case against route-based public transport? The council’s circa €50 million annual budget could pay for a lot of on-demand pooled rides…

- Lookin’ For A Leader — Tesla has removed the option to pre-purchase full sell driving because, apparently, it’s “confusing” customers that it isn’t nearly ready yet. Although the change is understandable, is it a worrying sign that Tesla has lost its bravado? The company’s brand is built on being a technology leader that commits to new capabilities earlier than it probably should do. Can it maintain cachet while playing it safe?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Created a joint venture with Northvolt and Umicore to improve recycling of used electric car batteries. (BMW)

- Unveiled the production version of the X7. (BMW)

- Recalling charging cords for electric vehicles in the US. (Green Car Reports)

- Released preliminary financial results for Q3 2018 because profits were lower than expected (about €1 billion lower than the prior year). The blame was placed on lower than expected sales of vans, potential recall costs over air conditioning refrigerants and “governmental proceedings and measures” related to diesel vehicles. (Daimler)

- Investing in Soul Machines, a developer of digital avatars. (Reseller)

- Agreed a deal to sell Magneti Marelli to KKR-backed Calsonic Kansei for €6.2 billion and expects the transaction to close in the first half of 2019. (FCA)

- Maserati will reportedly use an 800 volt electric drive developed by Ferrari. (Autocar)

Ferrari

- Maserati will reportedly use an 800 volt electric drive developed by Ferrari. (Autocar)

- Implication: Since Maserati’s first electric cars will be launched in the early 2020s and Ferrari have yet to confirm any product plans (silent development mules notwithstanding), either we can expect a similar launch window for the Ferrari hybrids or there has been an unusual decision to let Maserati launch first.

- Ford promised US dealers that it will cut delivery times for new orders from 82 to 38 days. (Reuters)

- Signed collaboration agreement with Mahindra and Mahindra that will see the Indian firm build a small engine for Ford’s Indian vehicles and a jointly shared telematics platform. (Mahindra)

- Dealers complained that Ford was not giving them enough information about future plans and the amount of exposure to senior leaders had fallen. (Automotive News)

- Increasing lifetime production of the GT to 1,350 units. (Ford)

- Incensed French politicians and unions by refusing a takeover offer from Belgian company Punch Powerglide for the Bordeaux transmissions plant, saying that it would instead proceed with a closure. Although politicians said Ford’s position was incomprehensible, it turns out that the new supplier’s plan had demanded Ford guarantee orders until 2021 (when it wants to stop taking products from 2019) and would only save half the jobs. (Sud Ouest)

- The US safety regulator opened an investigation into F-Series power tailgates that open unexpectedly when the vehicle is in motion. (Detroit News)

- Released a new series of adverts in the USA featuring the “built Ford proud” strapline. In one expensively produced slot Brian Cranston talks down the hot air from the competition (presumably with Tesla in their sights). (Ford)

- Implication: If only the people involved had looked at the script with a slightly more critical eye they might have thought better of including shots of Ford’s bulldozed Dagenham foundry whilst talking about how well Ford prepares for the future (they perhaps mistook it for the Rouge) and been slightly less conceited given that Elon Musk is still on his first car company when it took Henry Ford three tries to get the formula right.

Geely (includes Volvo) (history)

- Hoping to raise €950 million to refinance debt resulting from the its Volvo AB stake. (Reuters)

- Says that 50% of the Care by Volvo subscription users bought the service using their mobile phones. (Engadget)

- Will work with Engie and Air Liquide to boost hydrogen infrastructure for fuel cells. (Yonhap)

Nissan (includes Mitsubishi) (history)

- Mitsubishi commenced production at its new engine plant in China, a joint venture with GAC. (Mitsubishi)

- Nissan created a new business unit to cover Latin American markets. (Nissan)

- Nissan now offers a range of aftermarket option packs aimed at fleet. Nissan says the products can increase residual values and fleets will benefit from discounts and the availability of dealers to fit the accessories. (Nissan)

PSA (includes Opel/Vauxhall) (history)

- German investigators raided Opel’s office and said the firm would need to recall around 100,000 Cascada, Insignia and Zafira cars. Opel said it would challenge any recall order. (Reuters)

- Opel / Vauxhall will continue to use GEFCO for its logistics. (Autocar)

- Withdrawing from rally competitions because it thinks that without electrified vehicles the sport will lose relevance, or it wants to save on marketing spending; whichever version you want to believe. (PSA)

- Opel will offer German customers up to €8,000 to trade in older diesel vehicles for a new car. (Opel)

- Renault’s JV with Brilliance will create a new factory in Liaoning, China to make electric light commercial vehicles. There will be three new, as yet unspecified, models. (Renault)

- CEO Musk said the company will begin installing a new driver assistance chip in about six months. Buyers who have already pre-paid for “self-driving” will receive the chip free of charge. For anyone else, it will cost $5,000 to have the upgrade (presumably including software updates). (Reuters)

- Launched a derivative of the Model 3 with a smaller battery and a $45,000 starting price. (Wired)

- Purchased the land for its new factory in Shanghai, China. (CNBC)

- CEO Musk said he had just realised there were major gaps in the servicing coverage for customers in North America, promising to sort the problem out within 3 to 6 months. (Clean Technica)

- Removed the ability to pre-order “full self-driving” on cars, despite having announced an improved driver assistance chip. Elon Musk said the option was causing too much confusion. (The Verge)

- Implication: Apart from the obvious questions about Tesla’s ability to deliver on its promises, the move also tarnishes Tesla’s technology leadership crown and leaves a space for other companies to claim.

- The head of Toyota’s self-driving program in the US said the safety argument for robotaxis was flawed because the gains were insufficiently large over human drivers. (IEEE Spectrum)

- Ran an advertising pilot that claimed a 21% improvement in performance from using blockchain to verify that real users had been shown advertisements. The press release was heavy on mentions of blockchain but light on explanation. (Lucidity)

- Porsche’s CFO said that if VW were to spin off its luxury brands, they could reach a collective valuation of between €60 billion and €70 billion but the company quickly rowed back on the comments. (CNBC)

- CEO Diess told suppliers there would be a €50 billion to €60 billion market for battery cells in Europe soon, and the opportunity could even rise to €100 billion. He also believes that German carmakers have a 50:50 chance of retaining their competitive advance in 10 years. Diess once again took the opportunity to complain about CO2 regulations in Europe and said that with the current mix of electricity generation in Germany (lots of coal), electric vehicles were not that clean. (VW)

- Announced a new factory in Anting, China in partnership with SAIC that will be purpose built to produce electric cars on the MEB platform. The plant will produce up to 300,000 units annually. (VW)

- Audi will pay a €800 million fine to German prosecutors for its part in the diesel scandal. (Audi)

- Launched a big marketing program for diesel owners in Germany, with discounts of between €4,000 to €8,000 depending on the combination of new and traded in vehicle. VW is also offering incremental discounts to buyers in 14 areas with the worst emissions. (VW)

- The Audi etron battery electric SUV is suffering launch delays of several weeks caused by software issues. (Reuters)

- Porsche wants to price the Taycan (Mission E as was) between the Cayenne and Panamera, indicating a starting price around €80,000. There could be performance versions priced as high as €200,000, with a Taycan Turbo S nameplate mooted — confusing since there wouldn’t be a turbo in sight. (Automotive News)

- To nobody’s surprise, Porsche confirmed the Mission E Cross Turismo had been approved for series production. The 300 jobs the firm says will be created indicate and expected annual volume of around 5,000 units. (Porsche)

- Executives said Porsche would have an all-electric “big SUV” by 2022, thought to be a new vehicle in the line-up beyond the Taycan Cross Turismo since “the Taycan derivatives have already been showcased”. (Autocar)

- Sharing the development costs for the forthcoming PPE platform between Porsche and Audi will reportedly save both brands 30% versus going it alone. (Porsche)

- Started production of the SEAT Tarraco at the Wolfsburg plant. (VW)

- Audi says it will implement a new type of panel quality checking system in its press shops. It will replace a camera system that uses image recognition specific to the type of panel being made with one that can recognise defects in all kinds of parts. Although Audi had to spend lots of time teaching the new system, the company says it will be worth it when it can introduce new parts with less effort. (Audi)

- Škoda’s next c-car will be called the Scala, with the Rapid nameplate being retired. (Autocar)

- Implication: Rapid, Rapide are on the way out. Vitesse seems permanently confined to the dustbin. Veloster soldiers on. Superfast and Speedster are brand new. What does this mean for velocity-related nameplates?

Other

- Aston Martin trademarked the “Valhalla” name and seems set to use it in either its forthcoming hypercar or mid-engined sportscar. The former is more likely. (Motor 1)

- ATS will make 12 McLaren-based GTs with an advertised price of €740,000. (EVO)

- NIO had delivered 3,368 cars by the end of September. It is aiming for 10,000 by the end of the year. (NIO)

- Foton said it wanted to sell up to 67% of Borgward to help the brand grow. (China Daily)

News about other companies and trends

Economic / Political News

- European passenger car registrations in September of 1.12 million were down (23.4)% on the same period a year earlier. On a year to date basis, sales are up 2.3%. (ACEA)

- A cross-party group of UK politicians called for a ban on gasoline and diesel vehicles by 2032. (The Guardian)

- EU politicians want a 35% decrease in CO2 from commercial vehicles from 2021 levels, mirroring the improvements earlier proposed for passenger cars. (Auto Blog)

Suppliers

- Michelin announced Q3 financial results. Revenue was down year-on-year, and full year profit outlook was “refined” (Michelin-speak for downgraded). (Michelin)

- ZF is working on augmented safety systems using interior cameras to detect interior cabin arrangements, such as whether the seats are reclined, to tailor crash setting and improve survivability. (ZF)

- Adient reported preliminary Q3 20018 and full year financial results. (Adient)

- Denso released its annual report and announced the firm’s “second founding” as a mobility company. (Denso)

- Sundaram-Clayton opened a new foundry in Chennai, India. (Autocar)

- ZF purchased a 35% stake in engineering services provider ASAP for an undisclosed sum. (ZF)

- FCA agreed a deal to sell Magneti Marelli to KKR-backed Calsonic Kansei for €6.2 billion and expects the transaction to close in the first half of 2019. (FCA)

Dealers

- Chinese used car online sales platform Chehaoduo raised $162 million. (Shine)

- Start-up LotBlok will launch a blockchain-based car sales platform. (LotBlok)

Ride-Hailing, Car Sharing & Rental (history)

- Uber is reportedly seeking a $120 billion valuation for its IPO (The Guardian) and recently raised $2 billion in debt to tide it over until that mega payday. (CNBC)

- Electric car sharing firm Scoot launched services in Chile. (Scoot)

- The French town of Dunkirk made all its bus services free for residents, saying that fares only covered 10% of the operating costs anyway. One month after the scheme was implemented, usage had risen by 50%. (The Guardian)

- Uber is creating a business leasing trailers for heavy goods vehicles. (Uber)

- Careem announced $200 million of a hoped-for $500 million fund raising round. (Careem)

- Ride hailing start-up Alto raised $13 million and will soon start operations in Texas. (Dallas Innovates)

- Ford’s Chariot service will start offering private bookings. It isn’t clear how the utilisation will be sufficiently high to make the service cheaper than existing options. (Ford)

- Uber studied 1.5 million rides to determine the best way of apologising to customers (and found out it is by giving them a $5 discount). (Business Insider) the firm is also studying a short term staffing business. (TechCrunch)

Driverless / Autonomy (history)

- Lidar firm SOS Lab raised $6 million. (Optics)

- Autonomous driving developer Momenta raised $46 million in a round valuing it at over $1 billion. (Momenta)

- Self-driving simulation company Cognata raised $18.5 million. (Reuters)

- Lidar developer Leddartech recently opened new development sites, in Austria and Canada. (Leddartech)

- UK Taxi firm Addison Lee and autonomous vehicle developer Oxbotica announced a plan to commence services with self-driving taxis in London by 2021. (The Guardian)

- Uber has reportedly been receiving unsolicited bids for its self-driving arm. (Financial Times)

- An article suggested that Google’s initial self-driving cars had a worse safety record than official documents show, because of the cavalier attitude of some of the developers. (New Yorker)

- Rinspeed unveiled a new, smaller, version of its skateboard concept called the MicroSNAP. (Car Scoops)

- Sensor fusion company Vayavision raised $8 million. They claim that through processing, their technology can dramatically upscale lidar and radar inputs. (PE Hub)

- The head of Toyota’s self-driving program in the US said the safety argument for robotaxis was flawed because the gains were insufficiently large over human drivers. (IEEE Spectrum)

- US lawmakers proposed to remove the cap on federal rebates for zero emission vehicles. Under current rules, once a carmaker sells 200,000 units the $7,500 tax credit starts to drop. Tesla and GM would be the primary beneficiaries since they are already near or over the limit. (Yahoo)

- Researchers think they have cracked the problem of high-power wireless charging. In a laboratory they demonstrated a 120 kW system (only slightly lower power than Tesla superchargers) working at 97% efficiency. (Inside EVs)

- Workhorse launched the NGEN-1000 light commercial vehicle saying it had opted for a 100-mile range with a smaller battery to better compere on cost with diesel vehicles. (Workhorse)

- Implication: Since the received wisdom is that greater range is better and commercial operators feel constrained by shorter range (although plenty of use cases are satisfied by the specifications). It will be interesting to see whether Workhorse’s logic works.

- BMW, Northvolt and Umicore created a joint venture to improve recycling of used electric car batteries. (BMW)

Connectivity

- Intel and Simacan are creating the infrastructure for trucks to platoon on high traffic routes in Germany. (Intel)

- Ford will use technology from Wind River to manage over the air updates. (Telematics News)

- TomTom lost its contract to supply Volvo with in-built mapping. (Reuters)

Other

- Geely-owned flying car firm Terrafugia started taking orders but hasn’t yet announced pricing. (Automotive News)

- The Bloodhound supersonic car program went into administration, needing £25 million to complete the program objectives. Executives appeared bullish on the prospects for a recovery. (Autocar)

- Volvo Trucks said it would have to recall some trucks because degradation of components could cause vehicles to exceed emissions regulations as they aged. (Reuters)

- Bicycle sharing start-up Zoov uses electrically-assisted bikes with a non-traditional rack for charging. Although the bicycles have to be docked, they do not use locks. (Engadget)

- Electric scooter rental firm Grin raised $45 million to expand in South and Central America. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 14th October 2018

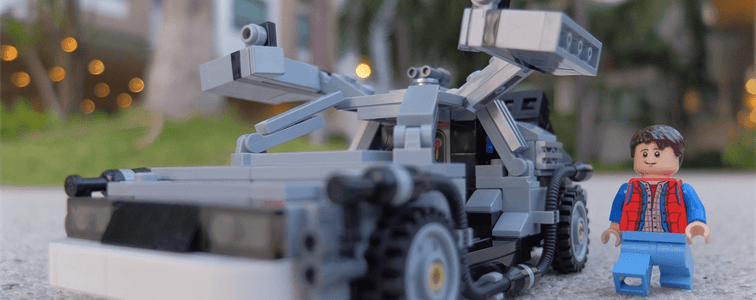

Verifying the safety of driverless vehicles; Executives and politicians play pass the parcel; and move over Marty McFly. Please enjoy our auto industry and mobility briefing for 8th October to 14th October. A PDF version can be found here.

Favourite stories of the past week…?

- Paperback Writer — Uber commissioned a report about measuring autonomous safety from RAND. It makes for interesting reading although it raises more questions than it answers. RAND say they weren’t seeking to determine a way forward, just point out considerations, but their inability to identify a clear path forward suggests governments need to get their thinking caps on and talk to each other.

- Angry Again — VW’s CEO went on a bit of a rampage criticising EU politicians for setting emissions targets that will cause “a painful revolution instead of a transition”. VW believes that to meet new emissions targets (likely to be 35% lower by 2030 than 2021) would mean nearly half of vehicles would have to be fully electric (our maths is VERY different). But can the industry really complain that 12 years isn’t enough time to plan? Are automotive executives worried about unforeseen shocks, or just angry at having to confront entrenched interests they were hoping would fade away?

- Message In A Bottle — PSA’s CEO received a letter from himself in 2038. He described a world where autonomous cars speed around and ride hailing services send us on journeys with like-minded individuals who might want to discuss what we’ve seen on tv (and in-car olives? They weren’t mentioned). Private car ownership persists apparently, but why (btw, he says here @ 17:00 that PSA “isn’t afraid” of that happening)?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Confirmed plans to take a majority share of its Chinese joint venture with Brilliance. Under a new agreement that extends to 2040, BMW will see its stake rise to 75%, local production capacity will rise to 650,000 units annually and the two partners will invest €3 billion “in the coming years”. (BMW)

- Sold 1,834,810 units globally in Q3 2018, a 1.3% increase on a year earlier. (BMW)

- BMW’s greater joint venture share will cost the company €3.6 billion and the deal will close in 2022. (Reuters)

- Concluded the formation of its 51% software joint venture with Critical Software based in Portugal. (BMW)

- Sold 1,715,087 units in Q3 2018, down (0.1)% on Q3 2017. (Daimler)

- Reportedly in talks with Geely to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

- Italian unions are becoming increasingly alarmed about repeated down days at plants in Turin. (Torino Oggi)

- Ended production of diesel powered Pandas. (Fleet Europe)

- Reportedly part of a yet-to-be-announced German battery consortium that will be supported by €1 billion of government cash and is set to be officially launched on 13th (Reuters)

- Said that the previously reported assembly of pure electric Transit vans in Germany employed 180 employees working in two shifts, for a capacity of 3,500 vehicles per year. (Ford)

- Recalling around 200 GTs to correct problems that can cause fires. (Ford)

- Kanye West stopped by the White House to tell Donald Trump that Ford needed to have “the highest design” and the “flyest, freshest, most amazing car” but declined to elaborate on how to do so. Ford’s spokesman replied “like we always say, you can’t spell fresh, fly and dope without Ford”. (Detroit Free Press)

- CEO Hackett said no one was ahead of Ford in developing autonomous vehicles. (Axios)

Geely (includes Volvo) (history)

- Launched production of Geely vehicles at its factory in Tunisia. (Xinhua)

- Reportedly in talks with Daimler to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

- Looking at an expansion of the Care by Volvo subscription service to include used vehicles. (CNET)

- Workers in South Korea may go on strike over the company’s moves to separate its R&D operations there from the plants. Unions said the restructuring “appears to be a move to sell its car plants”. (Yonhap)

- GM executives think some people turn down ride hailing if the driver has an Infiniti QX60 rather than a Chevrolet Suburban. (Digital Trends)

- Hyundai’s Cradle VC unit invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Hyundai)

Nissan (includes Mitsubishi) (history)

- The Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Delayed pay talks with UK unions until 2019, awaiting the outcome of Brexit negotiations. (Sky News)

PSA (includes Opel/Vauxhall) (history)

- Confirmed already rumoured changes to the Opel /Vauxhall line-up, saying that Adam, Karl/Viva and Cascada will be dropped by the end of 2019, mainly because of poor CO2 In 2020, Opel / Vauxhall vehicles will cover 80% of “mainstream market volume”. (PSA)

- CEO Tavares sent a letter from the year 2038 where he lives in a world of 230 kmh autonomous sports cars, where L5 capability counts for 25% of sales and ride hailing services that match him with other motorsport nuts. He declined to say who was Formula 1 world champion the prior year, presumably having watched Back To The Future II before writing. His main message was that stakeholders needed to come together to accept revolutionary change should not stand in the way of progress, even though automotive employment accounts for around 6% of the European total. (Les Echos)

- Will finalise the strategy to enter the US market by spring 2019. (Automotive News)

- Started offering Opel vehicles under Free2Move branded lease deals. (Opel)

- The Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Signed cooperation agreements with three major European energy companies — EDF, Enel and Total — to establish electrical charging infrastructure. (Renault)

Suzuki

- Proceeding with land acquisition for production of a second plant in Gujarat, India, 35km from an existing factory. Construction will begin once capacity increases at other plants are in place. (Economic Times of India)

- Reportedly considering ending all conventionally powered Jaguar vehicles within the next five to seven years (e.g. at the end of the current model cycle, including the yet-to-be launched but heavily rumoured J-Pace). Internal forecasts are that a four to five car line-up could sell 300,000 units annually. (Autocar)

- Planning a major revamp of Indian dealers from 2019 onwards. (Live Mint)

- A letter to agency staff said the Solihull shutdown was due to a backlog of 25,000 unsold units. (Birmingham Mail)

- Rumoured to be considering buying V8 engines from BMW to replace high power units currently sourced from Ford for the next generation F-Type. (CAR)

- Customers in the US wishing to qualify for a full fat federal tax credit had to order cars by the 15th (Reuters)

- Reportedly struggling to maintain production of Model 5,000 units per week. (CNBC)

- CEO Musk denied that James Murdoch was in the running to replace him as Chairman. (Bloomberg)

- Registered trademarks for a Tesla-branded Tequila. (Business Insider)

- Implication: Tesla once again upends industry convention that drinking and driving should never be associated by laying plans to put it’s brand on a bottle. In a world where beer companies pay Formula 1 drivers to appear in adverts turning down their product at parties, it’s a bold move.

- Toyota AI Ventures invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Toyota)

- CEO Diess said a 40% reduction in CO2 levels by 2030 would mean losing “around a quarter of the jobs in our factories” — 100,000 by his estimate. He wants a slower transition to full electric vehicles to avoid a “painful revolution”. (VW)

- Implication: Despite having a more bullish EV forecast than most OEMs, VW is concerned about a pace of change that is probably beyond its control. OEMs need to do more to prepare themselves for the uncertainty of a transition to electrification. Finding ways to stop developing unique models for pure electric vehicles would be a good start.

- VW Group sales in Q3 were 2,611,300 units, a drop of (1.5)% on the prior year. (VW)

- Having a 20-day shutdown at its Taubaté, Brazil plant because of weak Argentinian sales. (Reuters)

- Audi’s interim CEO is lobbying to have the job on a permanent basis. (Handelsblatt)

- Launched production of the Audi A1 at SEAT’s Martorell plant. (VW)

Other

- Bollinger announced an all-electric pick-up truck version of the SUV it has been developing. (Bollinger)

- VinFast agreed a $950 million credit line to by manufacturing equipment from German companies (Vietnam News). Unfortunately, VinFast’s parent had its credit rating outlook downgraded because of its carmaking plans. (VnExpress)

- Electric car start-up e.Go says that changes in supplier controls have delayed the start of production but it now has a roadmap to make vehicles from April 2019 onwards. (Golem)

- RBW is offering all-electric MGBs with powertrain from Zytek. (Green Car Reports)

- Lamborghini might be calling their lawyers in Tehran about a Hyundai-powered Murcielago-clone. (Russia Today)

News about other companies and trends

Economic / Political News

- The UK is reducing the generosity of its EV incentives and “focusing its attention” on BEVs. (Reuters) The industry body said it was putting the transition to electrification “at risk”. (SMMT)

- EU governments backed a proposal for passenger car CO2 emissions to be reduced by 35% from 2021 levels. That is lower than the European Parliament’s 40% threshold but higher than the original suggestion of 30%. (Reuters)

- Israel intends to stop sale of new gasoline or diesel-powered cars by 2030, insisting that by then vehicles must either be electric or powered by natural gas. (Reuters)

- Germany’s diesel fund which OEMs and the government funded in a bid to see off actions to ban diesels from cities hasn’t dispersed all the money, so VW, Daimler and BMW will get millions back. (Manager Magazin)

Suppliers

- Continental was forced by its unions to say there would be no plant closures in Germany and executive calls for improved efficiency were aimed at global operations. (Handelsblatt)

- Borg Warner opened a new plant for electric vehicle motors and drive system components in Wuhan, China on the site of a former Remy factory (acquired by Borg Warner last year). (Borg Warner)

- Denso took a small stake in software developer eSol. (Autocar)

- Bosch says diesel is still a “pillar” of its business and that it will continue to invest in the technology. The company also believes that although some OEMs are announcing in-house production of electric motors, they are doing it “for reasons of jobs” and that ultimately it will become a supplier business. (Les Echos)

- Magna opened a seating plant in the Czech Republic to serve BMW. (Magna)

- Volvo will use NVIDIA chips in its future cars. (Volvo)

Dealers

- The head of the Indian dealer association expects consolidation, saying dealerships are under stress. (Autocar)

- Mobile car repair service YourMechanic raised $10.1 million. (FINSMES)

- Consumers say UK dealers need to provide more parking spaces and coffee machines, indicating that there are many who aren’t yet convinced by an online purchasing experience. (Motor Trader)

Ride-Hailing, Car Sharing & Rental (history)

- Microsoft made a strategic investment in Grab. (Microsoft)

- Ola is reportedly courting a $100 million investment from a private investor. (Economic Times of India)

- UK Uber drivers staged a strike to protest for higher fares. (TechCrunch)

- Careem says employees can have as much holiday as they want. (Careem)

- Bosch is starting a battery electric van rental business in Germany. (Reuters)

- Renault-Nissan-Mitsubishi’s Alliance Ventures VC unit invested in mobility data company Coord. (RNA Alliance)

- Daimler and Geely are reportedly in talks to create a Chinese joint venture offering car sharing and ride hailing. (Just Auto)

Driverless / Autonomy (history)

- Lidar developer RoboSense announced $45 million in funding. (RoboSense)

- Uber sponsored a study by RAND into safe testing of autonomous vehicles. (RAND)

- Waymo’s fleet passed 10 million miles of testing on public roads and said it was racking up 10 million virtual miles each day. (Waymo)

- Hyundai’s Cradle VC unit and Toyota AI Ventures invested in Perceptive Automata, a firm developing software to predict intent of pedestrians near to self-driving cars. (Hyundai) (Toyota)

- Bollinger announced an all-electric pick-up truck version of the SUV it has been developing. (Bollinger)

- Ford and Varta are reportedly part of a yet-to-be-announced German battery consortium that will be supported by €1 billion of government cash and is set to be officially launched on 13th (Reuters)

Other

- Lime lost its case to enact a restraining order on San Francisco’s scheme to limit the number of scooter companies allowed to operate in the city. (Engadget)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 7th October 2018

How driverless vehicles can thrive today; GM and Honda’s recipe for self-driving success; and is Ford really getting fitter? Please enjoy our auto industry and mobility briefing for 1st October to 7th October. A PDF version can be found here.

Favourite stories of the past week…?

- Airportman — Autonomous pod maker Navya is working with a maker of airport vehicles to develop a self-driving vehicle to haul luggage. Smart move. Airports look like a great location to implement this type of product: it is a closed course; there isn’t much traffic; and there are humans close by if the system stops working properly. Roll on savings…

- Cruisin’ — Honda are buying a $750 million stake in GM’s Cruise and will spend a further $2 billion over ten years. The deal establishes that GM are interested in sharing the technology and would prefer a well-funded effort that works to proprietary knowledge that is slow to develop. Choosing Honda also indicates GM prefers regionally disparate partners. The door could be open to a European OEM. It also shows that GM understands capital allocation and return on investment. As ridiculous as the Cruise acquisition looked a few years ago, and despite the vehicles not working properly and the rationale behind building a new ride hailing network being unclear, it has been turned into something that has real value.

- You Talk Too Much — Ford’s US management team have made the business fitter by starting a new day-long meeting each week that sees the top team journey around a series of product specific war rooms. Journalists were told that the process helped executives decide to stop making big SUVs with tiny screens because customers didn’t want them — something a build to order system would have done in a far simpler way. Is this really what “operational fitness” looks like in 2018?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Confirmed that the i4 will launch in 2021. (BMW)

- Falling orders from BMW have led Nedcar to cut 1,000 of the 7,000 staff at the plant. (Dutch News)

- Dropping the i3 range extender from the line-up, citing the improved range of the upgraded battery version and lower sales. (Autocar)

- Said “there may be some news” in 2019 about extra partners for its autonomy collaborative. (Reuters)

- Would allocate more Mini production to the Netherlands in the event of Brexit. (Reuters)

- Daimler’s CFO will leave by the end of 2019, having chosen not to renew his contract. (Daimler)

- Started construction of its previously announced battery plant in Alabama, USA. (Daimler)

- Reportedly intends to recall Jeep Wranglers to fix faulty welds. (LiveMint)

- Told salaried employees it is in “the early stages of an organizational redesign of the global salaried workforce” and that some redundancies should be expected but there was no firm target. (Bloomberg)

- Ford’s North American management team have adopted a new process where they (20 executives) spend one entire day per week reviewing a series of 13 war rooms containing information on different models. Despite the management time, the only example of progress they were prepared to offer was a decision to increase production of cars with large infotainment screens and drop a less capable system. (Automotive News)

- Implication: By the way, this is the sort of thing that building to order, rather than scheduling vehicles months in advance, would overcome without the need for expensive executive analysis.

- PSA said it will not “develop more evolutions of diesel technology” unless it can see a clear future market demand. The company has apparently decided that a mix of 5% or lower by 2023 would see diesel discontinued. It is unclear whether Ford shares the same view. If not, it will impact their diesel collaboration. (Autocar)

- Idling Transit production in Kansas City for two weeks, citing the variability of fleet orders. (Detroit Free Press)

- Using quantum computing to create efficient route planning for diesel vehicles. Ford says that doing such work on traditional computers does not scale properly. (Ford)

- Invested in weather forecasting start-up ClimaCcell as part of a $45 million round. (ClimaCell)

Geely (includes Volvo) (history)

- Buying two Geely-affiliated engine plants in China from local holding companies. (Reuters)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Implication: GM accomplished two things with this deal: 1) it sent a signal to other carmakers that Cruise is truly open for business, although it probably prefers to share with those that are regionally disparate from GM’s core operations (any European-centric OEMs interested in partnering? Looking at you, JLR and PSA); 2) GM is using Cruise as a case in point on capital allocation by inviting others to jointly fund research and trumpeting the increase in value since taking over the start-up.

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- CEO Barra said US regulators needed to set rules for self-driving vehicles, calling new legislation “essential”. (Axios)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- Honda’s long-running talks on a cooperation with Waymo reportedly feel flat because Waymo would not share technical details of its self-driving technology and wanted Honda to focus solely on delivering a donor vehicle. By contrast, GM apparently invited Honda engineers for in-depth technical reviews before the Cruise investment, including multiple tests and code analysis. (Bloomberg)

- Launched a pilot in Ohio, USA to test V2X communications and gantry-mounted object recognition. (Honda)

- US magazine Consumer Reports said there were problem with 1.5 litre engines in the CR-V that could cause stalls. Honda argued that the issue was small in nature and not safety critical. (CNN)

Mazda

- Will deploy “some form” of electrification in all vehicles by 2030, forecasting 95% of sales will be hybrid and 5% BEV by that time. Mazda includes range-extender vehicles, for which it is developing a new rotary engine, in its BEV mix forecast. (Mazda)

Nissan (includes Mitsubishi) (history)

- Increasing production capacity of the Xpander from 160,000 to 200,000 units annually. (Mitsubishi)

- Carlos Ghosn said Renault-Nissan-Mitsubishi may extend its cooperation with Daimler to include battery technology, autonomy and mobility services. (Reuters)

PSA (includes Opel/Vauxhall) (history)

- Will not “develop more evolutions of diesel technology” unless it can see a clear future market demand. The company has apparently decided that a mix of 5% or lower by 2023 would see diesel discontinued. (Autocar)

- Implication: It isn’t totally clear what PSA’s view of what constitutes an “evolution”. Are they saying the investment would fall to zero or simply commenting that they have ruled out new ground-up engines? The statement leaves questions around PSA’s commercial vehicle business since this is almost 100% diesel and primarily uses engines developed for cars.

- Unveiled more details of its already-announced CMP platform for smaller vehicles. PSA said that Chinese partner (and minority shareholder) Dongfeng paid 50% of the development cost. The platform can accommodate ICE, PHEV and BEV powertrains. (PSA)

- CEO Tavares said Opel was only around one third of the way through its efficiency plan, saying that laws forcing the involvement of unions had made progress “very difficult”. (FAZ)

- CEO Tavares cautioned that “what everyone needs to realise is that clean mobility is like organic food — it is more expensive”. He may find his comments less profound after reading the various EU technical documents on electric vehicles and lower CO2 which state very clearly that this is absolutely the EU’s expectation. (Reuters)

- Unveiled the K-ZE small electric crossover. Renault said the vehicle will be “affordable” and launch in China in 2019, with other global markets following. The company also confirmed plans for hybrid and plug-in versions of the Captur, Clio and Megane in Europe. (Renault)

- Executives said Renault wanted to add a C-sized electric car to its line-up, potentially with SUV-styling and a real world range of 310 miles by 2022. (Autocar)

- Invested in directional sound specialist Akoustic Arts. (Renault)

- CEO Ghosn said Renault-Nissan-Mitsubishi may extend its cooperation with Daimler to include battery technology, autonomy and mobility services. (Reuters)

- CEO Ghosn said diesel is “condemned” because of policymakers. (Financial Times)

- Executives said Renault was unsure whether to continue with the Scenic at the end of the current cycle. (Autocar)

- JLR said it had spent in the low double digit millions of pounds on Brexit preparation. (Bloomberg)

- Planning a two week shutdown in Solihull during October, blaming falling demand in China. (BBC)

- Defender prototypes have been spotted around JLR’s engineering facilities, their camouflage and decoy bodywork seemingly undermined by uncharacteristic hashtag branding across several surfaces. (Sunday Times)

- Reported Q3 deliveries of 83,500 vehicles. Model 3 shipped 55,840 units and 53,239 vehicles were made during the quarter. There were 14,470 Model S and 13,190 Model X vehicles delivered, indicating that demand for both has plateaued. The firm complained about its cost disadvantage in China. (Tesla)

- CEO Musk ranted about shortsellers and the investors who lend them shares to short, saying there was “no rational basis for a long holder to lend their stock”. (CNBC)

- Implication: Ad Punctum has heard a different point of view from long only investors, being told something along the lines of “short selling goes on, my investment hypothesis takes account of short selling, so why not profit even more by letting them use my stock to do the shorting I’ve already taken into account?”. Although Musk took aim at index tracking funds, the same argument still applies in the context of the overall index.

- Published its safety report for Q3 2018. The data was very vague, specifying only per mile occurrence rather than gross figures for fleet mileage or accidents. Tesla say their driver assistance systems reduced the likelihood of accidents by almost half but comparison to average statistics was made more difficult by Tesla recording, but not separately reporting “crash-like” events (i.e. where there wasn’t actually a crash). (Tesla)

- An article highlighted stocks of Teslas at various distribution points across the USA, suggesting the numbers pointed to unacknowledged problems. More likely, they are simply appropriate for the volume of Model 3 being produced and Tesla’s lack of third-party inventory. (New York Times)

- Model 3 received standout crash test results from US agency NHTSA. For some reason, Tesla chose comparison videos for older competitor cars to highlight the relative performance gap (for instance a 2016MY Lexus ES when there is a new car for the 2019MY). (Tesla)

- Created a joint venture with Softbank called Monet, in which Toyota will have 49.75%, aiming to jointly develop on-demand mobility services and uses for Toyota’s e-Palette autonomous vehicle platform. (Toyota)

- Recalling 2.4 million cars built between 2008 and 2014 to because of a condition where the vehicle can stall at high speed. The same cars have already been recalled once but it seems not all problems were fixed. (Times of India)

- Škoda’s CEO said the brand needs a further 400,000 units of annual capacity. (Times of India)

- Bugatti CEO said the brand “is ready for more” and might launch a crossover or SUV. (Bloomberg)

- Porsche will produce 1,948 examples of the 911 Speedster shown in Paris, with sales starting in 2019. (Autocar)

- It wasn’t an April fools’ joke. VW T-Roc cabriolets have been spotted out and about. (Autocar)

Other

- Aston Martin’s IPO didn’t go well with the stock immediately dropping. (The Guardian)

- VinFast executives said the group was prepared to spend $3.5 billion on launching the company. (Reuters)

- Faraday Future’s founder is in dispute with the company he apparently agreed to sell a 45% stake in the electric vehicle start-up to. (Reuters)

- The Aspark Owl order book opened with a non-refundable deposit of $1.15 million being requested to secure one of the 50 $3.6 million electric supercars. Tesla Roadster launch editions look cheap by comparison. (Jalopnik)

News about other companies and trends

Economic / Political News

- The EU Parliament voted for harsher CO2 reduction targets than previously recommended — a 20% reduction from 2021 levels by 2025 and a 40% reduction against the same reference by 2030. In addition, quotas for sales of low and zero emission vehicles (in effect PHEVs and BEVs) would be set at 20% by 2025 and 35% by 2030. (EU Europa) The European trade body pleaded for national governments to “bring some realism to the table” before the targets are fixed. (ACEA)

- German politicians tabled a plan to retrofit older diesels but it met with mixed reaction from carmakers. VW said it would pay some of the costs whilst BMW and PSA said the solution made little sense and baulked at the idea of paying to change a vehicle that was legal at the point of sale. (DW)

- US SAAR of 17.4 million units in September was down (5.8)% versus a year earlier. (Wards)

- UK passenger car registrations of 338,834 units dropped (20.5)% on the September 2017. (SMMT)

- Passenger car registrations in Spain of 69,129 unit in September were down (17)% versus prior year. (ANFAC)

- Italian passenger car registrations of 125,963 units in September dropped (25.5)% on prior year. (UNRAE)

- September passenger car registrations in France of 148,752 units were down (12.8)% on a year earlier. (CCFA)

Suppliers

- Delphi issued a 2018 profit warning and that CEO Butterworth would be stepping down, appointing Hari Nair as CEO on an interim basis. (Delphi)

- ThyssenKrupp will split into two separate entities. The automotive division will be part of a business called ThyssenKrupp Industrials, along with elevators and plant machinery. (ThyssenKrupp)

- Magna and Altran will establish a 50/50 joint venture engineering centre in Casablanca, Morocco. (Autocar)

Dealers

- Online automobile marketplace Droom raised $30 million for international expansion. (Economic Times of India)

Ride-Hailing, Car Sharing & Rental (history)

- Moovel will launch on-demand services in North America through a pilot in Los Angeles. (Moovel)

- Daimler will launch car sharing in Paris with 400 Smart EVs, and Toyota might join in. (Bloomberg)

- Toyota created a joint venture with Softbank called Monet, in which Toyota will have 49.75%, aiming to jointly develop on-demand mobility services and uses for Toyota’s e-Palette autonomous vehicle platform. (Toyota)

Driverless / Autonomy (history)

- US transport regulator NHTSA published draft guidelines for autonomous vehicles. It promised to be proactive and to reinterpret rules written for human drivers to include self-driving vehicles, but also stressed that it would prioritise safety. This is something of a mixed bag for self-driving proponents since although reliable autonomous cars are expected to have less accidents that human-driven ones, there is nothing even approaching a consensus on how to do this without driving billions of miles. (NHTSA)

- US magazine Consumer Reports said that GM’s Supercruise driver assistance system was the best on the market, with Tesla’s Autopilot also being commended. Tesla critics portrayed it as a loss for the brand. (USA Today)

- Self-driving truck start-up Ike emerged from stealth mode saying it planned to run trucks that would never have to leave the US highway system, instead transferring loads at hubs. The company has licenced Nuro’s autonomous driving technology. (Wired)

- Sensor developer Aeva announced $45 million in new funding. (Venture Beat)

- Navya announced a cooperation with Charlatte Manutention to develop autonomous vehicles for use in closed-course settings, such as airport baggage delivery. (Navya)

- Implication: We think this is a smart move as airport vehicles have several characteristics making them suitable for early application of autonomy: 1) they operate continuously in the same environment, so building local knowledge is easy; 2) other traffic can be controlled (and is relatively sparse anyway); 3) there are lots of humans around to help out if the vehicles get stuck for some reason.

- Ford called on self-driving vehicle developers to adopt a common standard for communicating intent to other road users, e.g. whether a vehicle has decided to slow down and give another road user right of way. (Ford)

- Waymo had a significant portion of its lidar patents struck off following a challenge. (Ars Technica)

- Honda will invest $750 million in a 5.7% share in GM’s Cruise self-driving unit and has agreed to a further $2 billion of spending over the next 10 years. (GM)

- Honda and GM are developing a purpose-built shared autonomous vehicle built on Cruise’s technology. The teaser image in a blog post by Cruise’s CEO suggests it looks something like VW’s Sedric concept. (GM)

- Xing Mobility is developing a modular kit that it believes will be useful for retrofitting existing combustion-powered products. (Clean Technica)

Connectivity

- Vayyar Imaging will supply Valeo with in-car sensors to monitor human occupants. (Autocar)

- TomTom will supply maps to PSA “beyond 2020” (TomTom) and also to BMW. (TomTom)

- Honda launched a pilot in Ohio, USA to test V2X communications and gantry-mounted object recognition. (Honda)

- Molex Electronics Technologies acquired Laird’s connected vehicles business. (Autocar)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 30th September 2018

Executives without insurance; the impact of infrastructure; and the difficulty of predicting consumer demand. Please enjoy our auto industry and mobility briefing for 24th September to 30th September. A PDF version can be found here.

Favourite stories of the past week…?

- Falling Into You — McLaren’s CEO said what many automotive executives are thinking when expressing concern that spending “a fortune” on Brexit contingency planning could prove to be a “waste of time”. But isn’t that what insurance is… in hindsight?

- Tell Me Why — ABB executives say the Indian market won’t support battery swapping, citing the complexity of charging the batteries. But surely, if infrastructure isn’t much good, it’s easier to get it working at a central location rather than everywhere?

- Don’t Dream It’s Over — FCA delighted in saying officials planning US fuel economy measures in 2012 failed to anticipate the market shift into SUVs. Isn’t this the same firm that has deemed the same market shift to be a one way street (and pulled products out of the cycle plan accordingly)? What will FCA executives of 2024 think?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Announced a profit warning, primarily blaming, extra incentives in Europe from competitors who were pushing cars into the marketplace ahead of the WLTP cut-off; volatile international trade tariffs; and adjustments to goodwill and warranty reserves. (BMW)

- BMW’s German dealers threatened to not sign revised five-year contracts with the brand, jeopardising sales in October as the situation could theoretically result in a sales stoppage. They relented at the last minute. (Reuters)

- Upgraded the i3’s battery, it now has 42.2 kWh capacity. (Autocar)

- Announced that Ola Källenius will become CEO and head of Mercedes-Benz cars in 2019 with Dieter Zetsche taking a two year “cooling off” period and then returning as chairman in 2021. (Daimler)

- Daimler’s new CEO elect is not in the habit of hugging people. (Handelsblatt)

- Made a series of executive changes, including new leaders for Europe and Maserati. (FCA)

- Executives said the impact of model mix shifting from cars to SUVs in the US was a “wake-up call” for officials setting fuel economy targets. (Reuters)

- FCA’s Michigan plants are suffering a worrying spate of vehicle thefts. (Detroit Free Press)

- Admitted low customer interest (apart from users who would otherwise have opted for rental vehicles) in its Canvas subscription program meant a rethink was needed. (CNET)

- Chairman Bill Ford likes salsa dancing (probably) but detests gyrations in trade negotiations. Although he called for certainty, he declined to say what Ford wants. (Reuters)

- Argo AI’s CEO said Ford’s driverless car program will involve up to 100,000 vehicles. (Bloomberg)

- Ford sources suggested the scope of collaboration with VW had been expanded to explore whether Ford vehicles should be manufactured at VW plants in South America and Europe, allowing Ford to trim capacity. (Reuters)

- Agreed to pay more compensation to UK Ford owners who have experienced engine failures. (BBC)

- Will stop making the Focus in Argentina from 2019 at the end of the current model cycle. (Reuters)

Geely (includes Volvo) (history)

- Lotus is overhauling its headquarters. (Autocar)

- Unveiled the cross country version of the V60 estate car. (Volvo)

- Moving the Cadillac brand headquarters back to Michigan from New York. (WJLA)

- Recalling over 3.3 million vehicles in China to correct suspension problems. (Reuters)

- Reportedly in talks to sell its Pune, India plant to JSW Energy. (Mint)

- Recalling about 255,000 vehicles globally because of problems rear camera’s software. (Times of India)

Nissan (includes Mitsubishi) (history)

- Launched production of the all-new Altima at the Canton, USA plant. (Nissan)

- Infiniti has now dropped all hybrid models from its US line-up. (Green Car Reports)

PSA (includes Opel/Vauxhall) (history)

- Will create a joint venture with Punch to manufacture electrified dual clutch gearboxes at PSA’s plant in Metz. The 600,000 capacity line will use designs developed by Punch. Combined with a 48V system, PSA expect a 15% fuel economy saving in urban conditions. (PSA)

- CEO Tavares said PSA was an “ardent supporter” of creating a European battery champion. (France3)

- Carlos Ghosn said the Renault-Nissan-Mitsubishi alliance partners will clarify everything about the future state of the relationship within the first half of his term as Renault CEO (i.e. by 2020). (Bloomberg)

- Building 60MWh of stationary storage in Europe by 2020. Located across three sites (two Renault factories and a former German coal mine), the project will require 2,000 vehicle batteries, a mix of used batteries and those ready for aftermarket sales will be employed. (Renault)

- Launched the Moov’in Paris car share scheme with no subscription and rental charges of ~€23 per hour. (Renault)

- Elon Musk agreed to step down as Tesla’s chairman for three years and pay a $20 million fine, Tesla will pay a matching sum after the SEC claimed his statements about secured funding had been “false and misleading”. The regulator had initially threatened to make Musk step down from all board roles at publicly traded companies. (BBC)

- Reportedly has requested 100 company employees as volunteers for full self driving versions of the Autopilot software. The program will run until the end of 2019, suggesting no retail launch before then. (The Verge)

- According to internal emails, profitability in Q3 is within reach, but it all depended on a really great performance on Sunday 30th (Business Insider)

- CEO Musk said Tesla is building its own car carrying trailers because of an extreme shortage. (Business Insider)

- Implication: After an earlier scheme to build its own servicing vehicles, Tesla strays ever deeper into non-core activities whilst struggling with problems executing its programs.

- Said it would be impossible to hold more than one day’s supply of inventory at its Burnaston plant. (BBC)

- Reportedly preparing a shake-up of Japanese dealer operations that will replace the current four mass market channels with a single network by the mid-2020s. (Japan Times)

- Announced a productivity improvement plan, seeking 30% better utilisation by 2025. The firm says there is €2.6 billion in “efficiency potential”. Explaining the targets to senior production managers, VW said €1.5 billion could be cut through systemic standardisation. (VW)

- VW will base its connected car data platform on Microsoft’s Azure. The two companies will partner to build apps that VW’s cars can use and VW will build a development centre near Microsoft in the USA. (VW)

- The CEO of Traton, VW’s truck division, said an IPO would not take place “at any cost”, citing international trade conditions as an issue that could scupper the plan. He also said that shared powertrain was the focus of sharing efforts since it is 60% of the vehicle’s value (including ancillaries such as exhaust, axles and electronics). He also discussed the balance between sharing the dealerships used for VW vans (more like the truck division customers) and developing the vehicles (more like the car division activities). (Handelsblatt)

- Off the record sources said VW would support retrofitting of older diesel vehicles in Germany. (Reuters)

- Audi confirmed the E-tron GT will have 350kW charging capability. (Inside EVs)

- Contracted Unipart to run the logistics for its UK parts operations. About 450 employees will transfer to Unipart as a result of the agreement. (Motor Trader)

- Claimed to have developed a new prototype fuel cell that uses far less precious metals. (VW)

- Lamborghini said India will be one of the top ten markets for luxury sportscars within five years. (Times of India)

- Ending the Audi on demand service in San Francisco directing customers to Silvercar instead. (Auto Rental News)

- Reportedly planning a Maybach fighting super Audi A8 under the Hoch sub-brand. (Autocar)

- Audi will work with Valtech to create a design team that will develop products and services for autonomous vehicles. The team will contain over 200 people. (Challenges)

Other

- McLaren’s CEO summed up the mood amongst automotive executives who are doing the minimum possible to plan for a no deal Brexit saying “what you don’t want to do is go spend a fortune and then find it’s actually a complete waste of time”. Unfortunately, that’s what insurance often is…. (Reuters)

- Chery launched a design and development centre in Frankfurt, Germany, aiming to hire around 50 staff. (Autocar)

- Ineos is still undecided about a production location but has ruled out Scotland, following clashes with the national government over other business projects. (The Times)

- Elio Motors signed a powertrain supply deal with an unnamed large OEM. The appointment of Roush to do the powertrain integration provides a possible clue. The firm says it saved a $120 million R&D bill by not developing its own engines. (Elio Motors)

- Pininfarina will base its car program in Munich, Germany and will use Rimac’s (Pininfarina)

- Strom Motors said it has secured funding to start production of its electric mini car. (Times of India)

News about other companies and trends

Economic / Political News

- Germany’s government is confident it will soon have a way to improve emissions of older diesel vehicles and prevent city bans. (Reuters)

- The US and Canadian governments reached an agreement over a revised trade pact. NAFTA will be reframed as USMC and sees content requirements for locally made vehicles increase. (BBC)

Suppliers

- Continental awarded their CEO a new five year contract. (Handelsblatt)

- Castings supplier Busche Performance Group raised $150 million in debt. (BPG)

- Plastics supplier Lanxess is building a new plant in Germany. (Autocar)

- Denso and NRI created a joint venture called NDIAS to offer cyber security products for cars. (Denso)

- Neue Halburg Guss said already anticipated job losses will be brought forward. (Manager Magazin)

- Federal Mogul and Yura Tech established a 51/49 joint venture for spark plugs aimed at supplying South Korean OEMs. (Federal Mogul)

Ride-Hailing, Car Sharing & Rental (history)

- Careem announced the acquisition of on-demand bus operator Commut and promptly offloaded the operations part of the business to Shuttl. (Careem)

- Didi said it could no singlehandedly service the needs of the Chinese ride hailing market and that whilst it was dominant, it did not want to become a monopoly. (Technode)

- Uber will pay $148 million to US drivers who had their information stolen by hackers. (Business Insider)

- Uber is going to spend $10 million on lobbying for ideas that are in the “long-term public interest”. This includes congestion pricing. (Uber)

- Bangladeshi ride hailing firm Shohoz raised $15 million. (TechCrunch)

- Grab may sell a stake in its Thai business. (Reuters)

- Renault launched a Paris car share scheme with no subscription and rental charges of ~€23 per hour. (Renault)

Driverless / Autonomy (history)

- Robosense will offer its new low-cost 64 line lidar unit with an algorithm called “gaze” that focuses on objects detected after broad sweeps have taken place, in order to get a more detailed perception. (Robosense)

- A US survey found owners overestimated the abilities of their driver assistance systems; 29% were confident enough with their adaptive cruise control to be distracted at the wheel. (CNBC)

- Argo AI’s CEO said Ford’s driverless car program will involve up to 100,000 vehicles. (Bloomberg)

- Volvo Trucks said it will start selling electric trucks in California from 2020 onwards. (Volvo Trucks)

- Lucid will use (VW-owned) Electrify America’s charging infrastructure. (Lucid)

- Lucid believes that its competitive advantage lies in the ability to shrink the size of the powertrain and offer greater interior package than rivals. (CNN)

- eMotorWerks is using 6,000 chargers installed in homes across California to provide a 30 MW virtual battery on the state’s energy markets. Charging station owners receive up to $80 per year to participate. (eMotorWerks)

- Battery developer Lionano raised $22 million. (Lionano)

- ABB doesn’t think battery swapping will work in India because the charging of the battery adds an extra layer of complexity. (Economic Times of India)

- VW claimed to have developed a new prototype fuel cell that uses far less precious metals. (VW)

- Caetanobus will use Toyota’s fuel cells for demonstrator vehicles it is making. (Toyota)

Connectivity

- Denso and NRI created a joint venture called NDIAS to offer cyber security products for cars. (Denso)

- Harman launched an OBD II plug in dongle called Spark for US customers. (Autocar)

- TomTom said that it might sell its telematics operations to concentrate on the core business of mapping as competition with Google (Reuters)

- Ford, Lyft and Uber announced a scheme to share road traffic data with local governments. (Auto Rental News)

Other

- Rotary engine developer Freedom Motors started a crowdfunding campaign. (Freedom Motors)

- In-car retailing platform Cargo raised $22 million. (FINSMES)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 23rd September 2018

Sensible planning for a hard Brexit; difficult to understand cryptocurrencies; and the promise of decent in-car infotainment. Please enjoy our auto industry and mobility briefing for 17th September to 23rd September. A PDF version can be found here.

Favourite stories of the past week…?

- Holiday — BMW have decided to re-schedule the annual shutdown for the Mini plant so it takes place immediately after the official Brexit date. Looks like a smart, low cost, way to sit out any no-deal related chaos for a few weeks and create some thinking space without the pressure keeping the plant running. How many others will now announce similar plans?

- Ka-Ching! — Elio Motors held a pre-sale of “tokens” to fund development of a new vehicle whilst CyClean is creating a crypocurrency that will pay you to use its products (provided you chip in some hard currency first). It isn’t very clear why either company is well suited to an initial coin offering or what the benefit to consumers is. Is this a sign of desperation or is there a benefit they need to do a better job of explaining?

- Obviously — The Renault-Nissan-Mitsubishi alliance will use Google Android as the basis for a new generation of in-car infotainment. After more than ten years of seeing smartphones make car dashboards look slow and stupid, why are OEMs still going it alone? Before anyone bleats something about brand DNA being at risk, please explain: a) how Samsung manages to use Android and maintain pricing power; b) what the brand value is in having awful in-car controls that are unique to you?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Announced the UK Mini plant’s annual shutdown will take place on 1st April (just after Brexit is supposed to take force) rather than during summer so that the plant will be closed in the event of any implementation chaos. (Reuters)

- The EU launched a formal investigation into whether BMW, Daimler and VW colluded to restrict competition in emissions technology. (Economic Times of India)

- BMW’s development chief said the brand’s cars will always have steering wheels and the change to autonomy will take three decades, starting from 2005, meaning a 20 year wait “until this applies to all parts of the world”. (Autocar)

- Radar developer Lunewave raised $5 million from investors including BMW iVentures. (Lunewave)

- Published the technical specifications for the new Z4, having earlier unveiled the new car’s design. (BMW)

- Co-led a $155 million funding round in electric bus maker Proterra. BMW and GM are existing investors. (ProTerra)

- The EU launched a formal investigation into whether BMW, Daimler and VW colluded to restrict competition in emissions technology. (Economic Times of India)

- Daimler will retain its Aston Martin stake after the brand’s IPO for at least 12 months. (Aston Martin)

- Calsonic (owned by KKR) has reportedly made a €5.8 billion bid for Magneti Marelli and has already lined up financing. Previous reports said FCA wanted €6 billion for the unit and KKR had only offered €5 billion. (Reuters)

- Rumoured to be developing a new inline 6 cylinder gasoline engine based on the existing 4 cylinder GME engine. The new product is said to be earmarked for US plants. (Allpar)

- The Jeep Wrangler is such a runaway sales success that FCA might add a third shift to the Toledo plant. (The Blade)

Ferrari

- Held a capital markets day. Ferrari expects hybrids to account for 60% of its sales by 2022 and plans to create a new line of style-led limited edition models under the Icona banner. (Ferrari)

- The first two Icona models will be 1 and 2 seat versions of a roadster named Monza. Final build numbers and pricing are yet to be announced, but are expected to be “less than 500” and more than “£1 million” respectively. (Car)

- A French government minister expressed confidence that Punch Powerglide would be announced as the buyer of Ford’s Bordeaux transmissions plant by the end of October. (Reuters)

- Implication: Last time Ford sold the same plant in a government-brokered deal, it ended up taking it back a short time later, having forfeited a substantive dowry. Will it have secured the right to walk away this time?

- Ordered by a court in Thailand to pay compensation to owners of vehicles with dud transmissions. (Detroit News)

- Paid $90 million for the train station building in Detroit. (Detroit Free Press)

- Building all-electric versions of the Transit van (in collaboration with StreetScooter) at its Cologne, Germany site rather than in the Turkish factory that builds ICE powered units. A partially assembled vehicle is shipped from Turkey and then the electric powertrain, cab and cargo structure are added in Germany. (FAZ)

- Implication: Whilst rumours surround the company’s footprint reduction plans in Europe, this decision appears to be based more on its ability to utilise German labour than profit-making potential.

Geely (includes Volvo) (history)

- Polestar is hoping to have 75 dealers globally soon after launch, with 10 in the USA. (Fortune)

- Simplified its electric vehicles organisation and created a new head of innovation role. (Detroit News)

- Continued to lobby against a no deal Brexit saying it would mean tens of millions in tariffs, loads more paperwork and that border controls could play havoc with the 350 daily truck deliveries that keep its Swindon plant stocked with components. The company even made a short day in the life of a trucker video to show it was serious. (BBC)

- Hyundai invested in holographic display maker WayRay as part of an $80 million funding round. (WayRay)

- Hyundai Mobis executives said the company’s L2 ADAS solutions are four years behind those used by German OEMs and that it will take until 2025 to develop full autonomous driving. (Autocar)

Mazda

- Lost 44,000 vehicles and 23,000 CKD units in the plant shutdowns caused by flooding earlier in the year. (Mazda)

- Continuing to invest in diesel engine technology, saying it is often the “most sustainable” option. (Autocar)

Nissan (includes Mitsubishi) (history)

- The R-N-M alliance announced a collaboration with Google to use the latter’s Android system for in-car infotainment, with Google Maps providing directions from 2020. (Renault)

- Nissan will recall about 240,000 vehicles to fix problems with the brakes that could cause fires. (Detroit News)

- Undertaking a minor restructuring in Europe, eliminating around 200 posts. (Chronicle Live)

PSA (includes Opel/Vauxhall) (history)

- Called for the French government to resurrect a scheme that gave grants to buyers of plug-in vehicles, and also make it more generous (paying out €2,000 per vehicle instead of the €1,000 payout before the scheme ended). PSA said Renault wanted the same thing but Renault spokespeople declined to comment. (Economic Times of India)

- German politicians called on PSA to provide a right of return for Opel employees involved in the proposed Russelsheim technical centre sale to Segula. (FAZ)

- In addition to the previously-reported line rate drops at Opel plants, PSA is planning extensive down days with the Eisenach plant reportedly only working eight days during September. (FAZ)

- Considering whether to install new manufacturing equipment in Ellesmere Port that could make either CMP or EMP2 based vehicles. (The Times)

- The Opel / Vauxhall Grandland X has already reached 100,000 sales and the Eisenach plant will produce it from 2019 onwards. (Opel)

- The R-N-M alliance announced a collaboration with Google to use the latter’s Android system for in-car infotainment, with Google Maps providing directions from 2020. (Renault)

- Showed EZ-PRO, a concept autonomous vehicle system with “highly modular robo pods” that allow the vehicle to be configured between various jobs such as passenger and goods delivery. Renault is the third major OEM this year to put forward such a solution for high utilisation of urban fleet vehicles. (Renault)

- Launched a new round of discounts in the UK, offering £5,000 off some models. (co.uk)

- Signed a three year agreement with lithium miner Ganfeng Lithium. (Economic Times of India)

- Will invest in a 30 billion yen fund run by Sparx group that will concentrate on sources of renewable energy. (Toyota)

- Said it is on track to achieve “capital market readiness” at its truck division (recently named TRATON) by the end of 2018 and investment banking experts will soon be retained for a “potential” IPO. (VW)

- Unveiled the production version of the e-tron SUV. Some commentators were disappointed by the car’s performance figures compared to Tesla’s Model X, given the starting price of €80,000. (Audi)

- Pulling out of Iran, according to a US government official. (Bloomberg)

- Audi launched a pilot subscription service priced at $1,395 per month. Subscribers can change vehicle up to twice per month and choose from a range of A4, A5 cabriolet, Q5 and Q7. In addition, they receive 48 hours of discounted rental (Audi say it is free but taxes and fees are excluded) through Audi’s Silvercar each month. (Audi)

- Appears to have slightly altered its outlook on ID pricing to be equal to a “comparable” diesel, implying the vehicle could be more costly than initial expectations if the firm argues the comparator should be high performance. The downside is that a sales target of over 100,000 units is high in the context of high performance diesels. (VW)

- Audi’s imprisoned CEO will reportedly be removed from his post at a meeting on September 28th. (Handelsblatt)

- Porsche invested in holographic display maker WayRay as part of an $80 million funding round. (WayRay)

- The EU launched a formal investigation into whether BMW, Daimler and VW colluded to restrict competition in emissions technology. (Economic Times of India)

- Porsche released details of the modular units that make up its fast charging solution, and will presumably be used by the Ionity charging network. (Porsche)

- Seat executives said the brand would have two electric only models by 2021 and two PHEVs by 2020. (Autocar)

- Created a training program to develop software competences in-house and will run its first class in 2019. (VW)

- SEAT launched the Tarraco large SUV, with sales set for early 2019. (VW)

- Showed the ID Buzz van. Although billed as a concept, sources say it could be in production by 2021. (VW)

- TRATON signed a cooperation agreement with Hino that will create a shared procurement arm and see the two partners jointly develop electrified powertrain. (VW)

- Porsche said it had given up on diesel engines for good. Although there are no cars currently on sale with diesel engines, Porsche had implied it would offer some in future. Now it won’t. (Porsche)

Other

- Aston Martin set the price range for its IPO, valuing the firm at between £4.02 billion – £5.07 billion. (Aston Martin)

- Aston Martin will sell a limited edition of 19 pairs of cars in collaboration with Zagato. There will be a DB4 Zagato continuation model that will be track-only and a DBS Zagato that they can actually drive on the road. The price for the pair is a cool £6 million (excluding taxes). (Aston Martin)

- Aston Martin released a teaser image of a hypercar dubbed “Project 003” that will be released in late 2021 and limited to 500 examples. The company confirmed that there will be space for luggage. (Aston Martin)

- Lucid Motors announced it had received over $1 billion in investment from PIF, the same Saudi fund that invested in Tesla (and was the supposed underwriter of the infamous “funding secured” tweet). (Lucid)

- Rivian Automotive will unveil its pick-up truck and large SUV in November, saying prices will start at $90,000 but lower specification vehicles with prices of around $50,000 will be available after launch. (Fox News)

- Revolution Racecars says it will build a £100,000, 300hp, 675kg track-only two seat sportscar with 300hp. (Autocar)

- Elio Motors announced the pre-sale (a pre-ICO?) of the ElioCoin “security token”, hoping to raise $25 million in the scheme. So far it appears to have a single taker. (Elio)

- VinFast told local media that its products should be compared with Mercedes and its cars would be priced around 1 billion VND (approximately $43,000). (Vietnam Net)

News about other companies and trends

Economic / Political News

- European passenger car registrations in August were 1,171,760 units, up 29.8% on a year earlier. (ACEA)

- The German government was rumoured to be leaning towards ordering hardware retrofits for Euro 5 capable diesel vehicles to reduce pollution. (Reuters)

- The US announced a new round of tariffs on Chinese products, increasing the likelihood of retaliation. (Reuters)

- A German think tank said sales of vehicles with internal combustion engines needed to end before 2030 if the automotive industry was going to contribute enough to reductions in CO2 This is a different standard to the EU’s proposals for 2030 fleet average CO2 which would still enable conventionally powered vehicles to be on sale. (The Guardian)

- The German government are prepared to offer subsidies of one million euros to get two battery factories built in the country. (Manager Magazin)

Suppliers

- BorgWarner held an investor day. (BorgWarner)

- ZF will invest €12 billion in electrification and mobility projects over the next five years. (ZF)