Hypercars for all; jobs for the masses; and are Norwegians making everyone else look silly? Please enjoy our auto industry and mobility briefing for 1st July to 7th July 2019. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- You Wanted More — Aston Martin’s CEO says he could have sold 900 Valkyrie hypercars, and regrets limiting production to 150 units. If correct, that would be nearly 50% more than LaFerrari, despite a far higher price tag. Do enough buyers really exist? If so, can we expect to see the next Aston Martin hypercar (Valhalla) nearing four figures?

- Paper Thin — A coalition of car companies and suppliers released what they termed a framework for autonomous driving. It’s a whopping 157 pages long, but don’t hold out hope that all your questions will be answered, most of them are simply acknowledged by the report, with no firm answers provided beyond. To carry out tests, the authors recommend simulations with human drivers controlling other simulated vehicles. Thing is, if we test self-driving cars that way, lots of human will have to drive lots of computer-generated miles. Will simulated driving become the new content moderation, employing tens of thousands across the globe?

- The World’s Greatest — Almost half the cars sold in Norway over the past six months are capable of zero emission travel. Not only that, but the fleet average CO2 emissions registered 59 g / km, meaning that Norway is already compliant with 2030 European targets many are labelling as near impossible! Okay, there are incentives involved and, yes, Norway’s citizens are richer than most, but why not look on the bright side… if the Norwegians are there now — with today’s technology at today’s prices — surely other countries can get there with the technology of the future (as yet unrealised scare stories about battery raw material costs notwithstanding)?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- CEO Harald Krüger will not seek a second term as CEO (the current term was due to end in 2020). (BMW)

- German media reports on the main candidates for the CEO position speculated that senior executive departures are likely after the decision has been made. Sharp elbows have reportedly been out for months. (Handelsblatt)

- BMW and Daimler finalised an (already announced) agreement to jointly develop L4 self-driving systems (i.e. the owner doesn’t need to concentrate, but the car may only be capable in a limited number of environments). The two companies will pool a team of 1,200 development engineers and hope to launch the first products in 2024. (Daimler)

- BMW and Daimler finalised an (already announced) agreement to jointly develop L4 self-driving systems (i.e. the owner doesn’t need to concentrate, but the car may only be capable in a limited number of environments). The two companies will pool a team of 1,200 development engineers and hope to launch the first products in 2024. (Daimler)

- Spent €50 million on a new electromagnetic compatibility testing centre. (Daimler)

- Announced some changes to the team heading up Maserati. (FCA)

- Will buy 8 speed automatic transmissions from ZF. (ZF)

- Releasing a track-only version of the GT. Just 45 examples will be built, at a cost of $1.2 million each. (Ford)

- Although Ford celebrates the success of the F-150’s all-aluminium body, the experience of the next-generation Explorer, which uses the material only sparingly, suggests it is still too expensive for vehicles where manufacturers cannot claim a hefty premium for fuel economy. (Detroit Free Press)

- Highlighting the difficulty of pricing in the UK market, despite the need to recover from sterling devaluation, Ford launched a “scrappage scheme” offering customers £2,000. (Autocar)

- Sold 650,336 vehicles in the US during Q2 2019, down (4.1)% on a year-over-year basis. (Ford)

- Ford and VW are reportedly close to an overarching deal that will see Ford sell a share of self-driving unit Argo AI to VW in exchange for access to the MEB electric vehicle platform. The value of the self-driving technology is apparently lower than Ford hoped because VW reckons it won’t be commercially available in large numbers for such a long time. (Handelsblatt)

- French unions won a court judgement against the company saying it had failed in a duty to employ 1,000 workers at the site under the terms of a grant. However, the judges stopped short of condemning Ford’s decision to close the plant, saying they weren’t qualified to rule on the economic merits. (Usine Nouvelle)

Geely (includes Volvo) (history)

- The Geely and Lynk&Co brands sold 285,092 units in Q2 2019, a fall of (25)% on a year-over-year basis. (Geely)

- Volvo sold 179,506 cars in Q2 2019, a 5% increase on the same period a year earlier. (Volvo)

- Volvo has a new CFO. (Volvo)

- Lotus’s new hypercar (previously known as Type 130) will be called Evija. (Lotus)

- Reported US sales of 746,659 units in Q2 2019, a drop of (1.5)% on a year earlier. (GM)

- Developing one and two seat electric cars, believing them to be the best way to transport the elderly. (Japan Times)

- Creating a retrofit kit that will allow some features of Honda’s driver assistance suite even on older vehicles. (Honda)

- Hyundai says that continuously variable valve duration (CCVD) technology provides a 5% improvement in fuel economy. (Hyundai)

- Might enter NASCAR when new rules come into force for 2021. (Autoweek)

Mazda

- Recalling tens of thousands of Mazda 3 cars to stop their wheels falling off. (The Guardian)

Nissan (includes Mitsubishi) (history)

- Renault and Nissan might stop publishing their customary annual cost saving declaration. (Reuters)

PSA (includes Opel/Vauxhall) (history)

- Continuing the recent trend of removing national sales companies in lower volume locations, Opel announced a distributor had been selected for Ireland. (Opel)

- The EU said it would take a closer look at €20.7 million in aid from the Spanish government to support further investment in the Vigo factory. (Europa Press)

- French Police raided Renault’s headquarters apparently looking for dirt on Carlos Ghosn. (Reuters)

- Renault and Nissan might stop publishing their customary annual cost saving declaration. (Reuters)

Suzuki

- Maruti Suzuki’s woes continue with a fifth consecutive month of production cuts. (The Hindu)

- Confirmed plans for an all-electric replacement for the XJ large saloon at the Castle Bromwich, UK, factory and a “range” of other electric products. Whilst making the announcement, JLR’s CEO said that unless battery factories are built in the UK, car plants will have to be relocated to wherever they are made (JLR)

- Reported Q2 2019 deliveries of 95,200 cars, up 34% on a year-over-year basis. Tesla said orders were being placed more quickly than they could build cars but declined to provide specifics (although the balance sheet contains clues). Tesla will stop reporting the number of cars in transit inventory. Model S and X remained weak. (Tesla)

- Says that a new generation of solar panels has increased charging rate by a factor of four. Toyota has a Prius test vehicle that generates around 860 W (in Japanese sunshine), good for a claimed 44.5 km of highway driving (the old system provided just over 6km). (Toyota)

- Aims for 50% of Chinese sales to be electric vehicles by 2035. (VW)

- VW expects solid state batteries to become cost competitive in the late 2020s and says that most of the production equipment and 60% of the tooling is the same as lithium ion cells, so newly built factories won’t become obsolete even if the technology changes. (Reuters)

- Bentley’s boss wants to build an all-electric car but says that current technology (specifically the battery energy density) won’t allow him to create a vehicle with long range that isn’t too heavy, and that he might have to wait until 2025 for the right batteries to come along. (Autocar)

- Ford and VW are reportedly close to an overarching deal that will see Ford sell a share of self-driving unit Argo AI to VW in exchange for access to the MEB electric vehicle platform. The value of the self-driving technology is apparently lower than Ford hoped because VW reckons it won’t be commercially available in large numbers for such a long time. (Handelsblatt)

Other

- Borgward has lost the site of its planned factory in Bremen, Germany due to inactivity. (WirtschaftsWoche)

- Aston

Martin’s CEO says he wishes

he hadn’t limited the Valkyrie hypercar to a production run of 150 cars because

demand is so great that he could have sold 900 of them. (carsales)

- Significance: Given the £2.5 million price tag, a 900 unit run would be unprecedented (La Ferrari sold 649 cars and the relatively cheap F40 reached just over 1,300 — albeit when the addressable market was smaller). Since Ferrari’s newest special editions will only have 499 examples at €1.6 million, the remarks look like hyperbole. Aston Martin will have another chance when they release the Valkyrie’s successor.

News about other companies and trends

Economic / Political News

- US light vehicle SAAR in June of 17.29 million units was down (0.5)% on prior year. (Wards)

- German passenger car registrations for June of 325,231 units fell (4.7)% versus a year earlier. (KBA)

- French June sales of 230,965 passenger cars, dropped (8.4)% from prior year. (CCFA)

- Passenger car sales in the UK during June of 223,421 cars fell (4.9)% on a year-over-year basis. (SMMT)

- Italian passenger car registrations for June of 171,626 units, fell (2.1)% versus the prior year. (UNRAE)

- Spanish sales of passenger cars in June of 130,519 units fell (8.3)% on a year-over-year basis. (ANFAC)

- Norwegian sales of new passenger cars in the first half of 2019 reached 78,209 units. 35,200 (45)% of these were zero emission vehicles. The average CO2 emissions of passenger cars sold was 59 g/ km. (BIL)

- Bulgaria’s government reportedly plans to ban imports of diesel cars which do not meet the Euro 4 emissions standards (i.e. pre-2005 vehicles). (Novinite)

Suppliers

- Teijin is acquiring composites supplier Benet Automotive. (Teijin)

- Inzi Controls is building a $50 million battery plant in Hungary. (Budapest Business Journal)

Ride-Hailing, Car Sharing & Rental (history)

- Didi Chuxing said that it had dropped over 300,000 drivers after a safety review. (TechCrunch)

Driverless / Autonomy (history)

- Self-driving car developer Tier IV raised over $100 million from investors including Yamaha. (VentureBeat)

- Valeo said it had orders for €500 million worth of lidar sensors. (Reuters)

- Testing equipment firm AB Dynamics acquired simulation company rFpro. (Autocar)

- A

coalition of carmakers and suppliers published a shared white paper on safety

in autonomous vehicles. The paper places a heavy emphasis on the role of sensor

fusion algorithms (loosely, taking data from several sensors and combining it

into a single worldview), a catch-all term that will mean different things to

different people. It does lay down a marker by talking about a “degraded mode”

(a back-up system) and calling for a mixed sensor suite that includes lidar. (BMW)

- Significance: The study does a better job of highlighting the problems verifying the roadworthiness of self-driving systems than it does in providing clear answers about how it can be performed. For instance, whilst discussing the difficulties of simulation, about the same about of space is given to considering gravitational forces as modelling the reaction of other drivers to the car’s decisions. A driver in the loop model (e.g. use human drivers to drive the other cars, as if it is a great big computer game) is the get out of jail free card — could being a simulator driver become the next big gig — tens of thousands could be required if this is really how we are going to test self-driving cars.

- Visiblezone says it can detect pedestrians that self-driving cars aren’t able to directly see by monitoring signals from mobile phones and other electronic devices the people are carrying. (TechCrunch)

- Driver assistance developer ZongMu raised $14.5 million. (VentureBeat)

- BMW and Daimler finalised an (already announced) agreement to jointly develop L4 self-driving systems (i.e. the owner doesn’t need to concentrate, but the car may only be capable in a limited number of environments). The two companies will pool a team of 1,200 development engineers and hope to launch the first products in 2024. (Daimler)

- Continental showed off a hybrid vehicle with a 30 kW (40 PS) motor powered by a 48V system. These type of hybrid set-ups promise lower costs than (traditional) high voltage equipment. (Continental)

- Ola Electric raised $250 million from SoftBank. (Business Standard)

- Toyota says a new generation of solar panels has increased charging rate by a factor of four. Toyota has a Prius test vehicle that generates around 860 W (in Japanese sunshine), good for a claimed 44.5 km of highway driving (the old system provided just over 6km). (Toyota)

- VW expects solid state batteries to become cost competitive in the late 2020s and says that most of the production equipment and 60% of the tooling is the same as lithium ion cells, so newly built factories won’t become obsolete even if the technology changes. (Reuters)

Connectivity

- Amazon keeps customer voice recordings, transcripts and details of their discussions with Alexa devices forever, unless the user manually deletes them. (ZDNet)

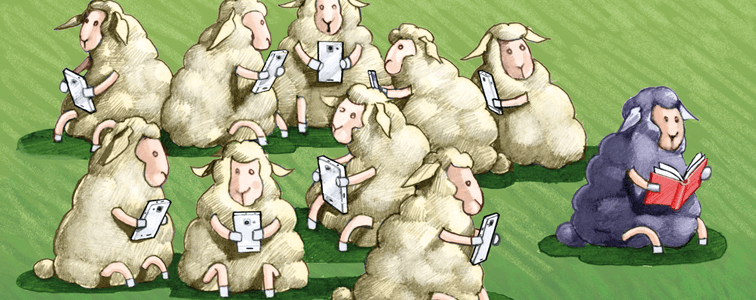

- Samsung says people won’t be using smartphones in five

years, preferring multiple displays connected wirelessly to each other instead.

(ZDNet)

- Significance: If Samsung are right (and they know a thing or two about electronics), car makers need to be thinking more seriously about how the car can interact with external devices — beyond CarPlay and Android Auto — and how customers can mount and power different screens in the car without a proliferation of ugly plastic add-ons.

Other

- Electric scooter rental service Dott raised $30 million. (TechCrunch)

- Electric bus maker Proterra is reportedly exploring an IPO. (Reuters)

- A profile of bicycle sharing firm Ofo’s failure suggested that the root cause was getting on the wrong side of too many big investors. (Technode)

- Electric scooter rental start-up Wind Mobility raised $50 million. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.