Electric cars for all (who can afford them); science fiction sensor capabilities and; supercars that don’t push the envelope. Please enjoy our auto industry and mobility briefing for 2nd March to 8th March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Everyday People — GM invited investors and the press to marvel at its battery technology. The intended message was that GM is best placed to bring electric cars to the masses and that they have been super-smart about the design so they won’t get caught out by technology changes. So far so cool, but if they have really cracked the problem, why do most of the cars they are rolling out look like they will end up with a six-figure price tag?

- Distance And Time — Waymo raised $2.3 billion and released some details of the sensors it has been working on. The company reckons it has lidar with 300m+ of range, cameras that can see more than 500m and as for radar, they just gave up counting and called a great distance. The figures are impressive; nearly good enough for motorway speeds, depending on weather and the speed of making decisions. But are they real? Are they reliable? And can Waymo’s AI handle that much information without grinding to a halt?

- Never Ever — Koenigsegg unveiled a new model called the Gemera. According to the Swedish firm it will be so scarily fast that they daren’t do the maths in case the numbers give them a heart attack. In fact, they are so bruised by the experience that they are pledging to hold back on all future cars so this one is never bettered. I know I’m not your typical hypercar buyer, but is that the sort of brand message they will buy into when Koenigsegg make the car after this one?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

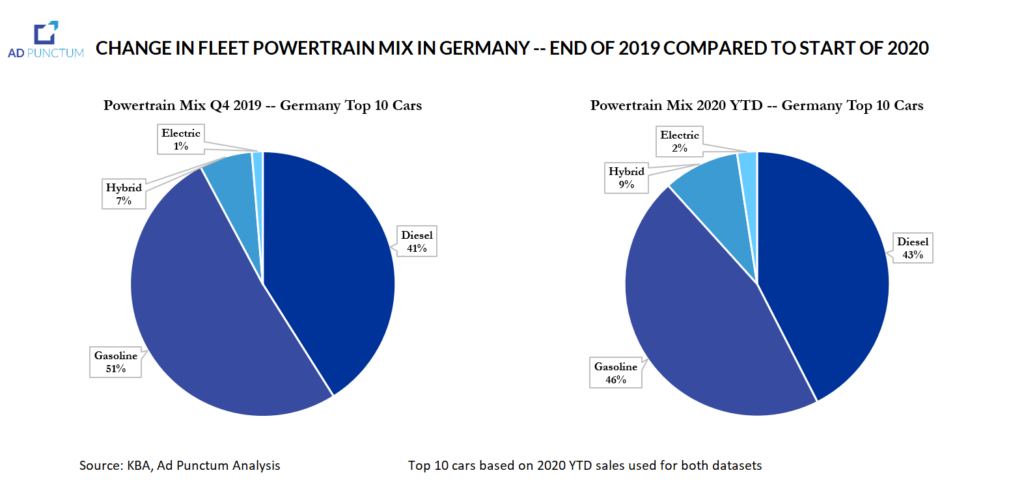

Chart of the week

Long suffering readers will have seen me write many times about how, contrary to much of the news flow, European CO2 regulations are unlikely to result in fines. Mainly since the cost of adding technology to the car is cheaper than paying the fines (albeit still harmful to profits).

I think this chart it is an interesting example of manufacturers successfully encouraging customers to buy the engine types that suit the brand’s overall goals. The pie charts cover the (same) ten best-selling vehicles (e.g. VW Golf, Audi A4). The left-hand side shows the final three months of 2019, the right-hand side is 2020 so far. Despite no major product introductions, hybrid and electric share from went from 8% to 11% and diesel has seen increases too. In just two months. An aberration? Seasonality? Or just good old mix management? You decide.

News about the major automakers

- Unveiled a car called the Concept i4 that CEO Zipse promised is “quite close” to the production version. (BMW)

- The recent spate of senior departures from the ranks of Daimler’s financial team are reportedly the result of a turf war between newish CFO Wilhelm and the insiders that he beat to the job. (Handelsblatt)

- Unveiled the facelift for the E-Class. (Daimler)

- Plans on culling models, platforms and engines as part of an efficiency drive but the only action it will confirm publicly is that the next generation SL will be on a shared platform. (Reuters)

- Investing $400 million to convert a US transmissions factory to build engines instead. (FCA)

- FCA’s head of US sales stepped down (he previously filed a whistle-blower suit against FCA’s sales reporting practices). (FCA)

- Unveiled the all-electric variant of the new Fiat 500. Specifications and performance look reasonable; less clear is whether Fiat will find many takers given the £30,000 asking price. (FCA)

- Confirmed that two employees had contracted coronavirus and launched a travel clampdown reminiscent of the actions the company normally employees when under pressure to improve financial results. (Detroit Free Press)

- Confirmed plans to produce an all-electric Transit van. (Ford)

Geely (includes Volvo) (history)

- Geely is going into the satellite business, building a new plant in China. (Autocar)

- Lotus says there are enough orders for the Evija supercar to fill the 2020 production plan, but it isn’t clear how many of the planned 130 cars this represents. (Autocar)

- Presented its plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

- Is producing 550 different combinations of internal combustion engine type, output and transmission and says that with electric motors that figure can be reduced to 19 battery and motor sets. (GM)

- Said that coronavirus won’t affect production plans until the end of March at the earliest. (Reuters) GM has also instigated travel restrictions for employees. (Detroit Free Press)

- Offering European customers electricity from renewable sources for their vehicle charging under a scheme called e:PROGRESS run with help from Moixa and Vattenfall. (Honda)

- Said that coronavirus was causing some production problems in Japan and that plants were using the parts they had around them, even if these weren’t the trim levels in the original schedule. (Reuters)

- Hyundai unveiled the all-electric Prophecy concept car, a sleek sedan that appears to draw many styling cues from Tesla and Porsche. (Hyundai)

Nissan and Mitsubishi (history)

- Nissan’s Russian factory will go to a one shift pattern (from two today) until the market has recovered. The company said the move was unrelated to coronavirus. (TASS)

- CEO Tavares suggested that the British government would have to compensate his firm for any tariffs payable if the UK and EU fail to agree a trade deal, and it wants to keep the Ellesmere Port plant open. (The Guardian)

- PSA stands ready to drop Huawei as a partner for its connected vehicle network if US authorities made it a condition of the FCA-PSA merger. (Reuters)

- CEO Tavares says the combined strategies of PSA and FCA in China will require a post-merger rethink. (Reuters) He also has a point of view about electric cars in Europe believing that at present, only “green addicts” are buying them.

- Unveiled the Morphoz concept, a car that can expand and contract thanks to embedded electric motors. Renault said the car was previewing the design of a new line of electric vehicles, likely to be the next generation models of the Koleos and Kadjar. (Renault)

- Took the wraps off the Dacia Spring, a budget electric car based on the China market City K-ZE. (Renault)

Subaru

- Announced an executive reshuffle and reorganised the audit and quality departments. (Subaru)

- JLR was accused of not doing enough to properly classify workers under a new British law that seeks to tax captive workers as if they were employees regardless of the legal structure of the arrangement (many contract via companies that they own). JLR said it had done everything correctly and there was nothing to worry about. (FT)

- Announced a senior executive shake-up, with several of the top brass departing, and a new CFO. (Toyota)

- Expanded a recall for faulty fuel pumps to now cover 3.2 million units globally. (Bloomberg)

- Will drop natural gas powered models from the line-up, probably by 2025, citing low demand levels. (Handelsblatt)

- VW’s seat making subsidiary Sitech is closing a factory in Hanover, Germany, with the loss of 450 jobs after the plant lost production contracts to Faurecia. (Handelsblatt)

- Porsche executives poured cold water on any idea of an all-electric 911 before 2030 and suggested a hybrid was unlikely in the lifespan of the current model. (Autocar) The CEO was categorical that a 911 would always be available with an internal combustion engine. (Porsche) Officials also suggested that an all-electric hypercar was unlikely because they are concerned that there is too little opportunity for differentiation. (Autocar)

- Temporarily reduced Skoda Rapid production in Kaluga, Russia due to a shortage of tail lamps. (TASS)

- Audi unveiled the fourth generation A3. (Audi)

- Announced a joint venture with consulting firm Capgemini to create a cloud software unit. (Audi)

- Set up a team to work on securing green financing (which often conveniently happens to be cheaper than the regular sort) for VW’s future product plans. (VW)

- Bentley unveiled the limited edition Bacalar open top GT. (Bentley)

Other

- Aston Martin’s CEO says the main reason the company is developing a new V6 engine for entry models is that current V8 supplier Daimler is moving towards engines he considers too small for sportscars. He is leaving the door open for manual transmissions but implied there are none in the cycle plan for future products. (Car and Driver)

- Aston Martin unveiled the already announced limited edition V12 Speedster. The firm says that the car, a new exterior design built from a parts bin of other models, took 12 months to develop to “production intent” (with deliveries no starting until early 2021 there is some more development to do). (Aston Martin)

- McLaren’s boss complained about UK government plans to ban sales of all cars without plug-in capability by 2035, believing that hybrids should be given more time (the new rules wouldn’t preclude plug-in hybrids, only the sort that function purely through regenerative braking and scavenging from the engine). (Autocar)

- Bristol Cars was put into liquidation, scuppering hopes of a revival. (Autocar)

- Pininfarina said that it had sold more than 50% of the all-electric Battista supercars it intends to build for the USA and Europe and thinks that when the car is available for test drives, the remainder of the orders will flow smoothly in. The company also suggested that Rivian has been directed by Amazon not to licence its electric chassis to anyone who isn’t a shareholder (i.e. themselves and Ford). (Autocar)

- Fuel cell truck maker Nikola announced plans to list with a valuation of $3.3 billion. (Nikola)

- Yet to launch any products, Neuron EV has begun development of mobile quarantine facilities. (Neuron EV)

- Koenigsegg unveiled the Gemera, a hybrid four-seater limited to 300 cars. (Koenigsegg) It also has a new version of the Jesko available and says the Absolut version is the fastest car it has ever made (they claim to not even know its ultimate performance) and it won’t ever try to beat it. (Koenigsegg)

- Morgan has a new car, with the BMW-powered Plus Four replacing the Plus 4. (Morgan)

- McLaren unveiled a new high performance car, the 765LT. (McLaren)

- Nio raised $235 million in short term debt with zero interest. (Nio)

- Isuzu set a series of environmental targets for 2050: zero greenhouse gas emissions; and 100% recycling of waste and old vehicles. (Isuzu)

- Micro says it has 17,000 orders for the Microlino city car. (Micro)

News about other companies and trends

Economic / Political News

- US light vehicle SAAR of 16.83 million units rose 1.8% year-over-year. (Wards)

- German registrations of 239,943 passenger cars in February fell (10.8)% from the same period in 2019. (KBA)

- February passenger car sales in the UK of 79,594 units dropped (2.9)% on a year-over-year basis. (SMMT)

- French sales of 167,784 passenger cars in February were (2.7)% lower than a year earlier. (CCFA)

- February’s Spanish passenger car registrations totalled 94,620 units, down (6)% on prior year. (ANFAC)

- Italian passenger car sales of 162,793 units in February fell (8.8)% from 2019. (UNRAE)

- The former head of the UAW was charged with corruption and US officials floated the idea of a federal takeover of the union to rid it of bad practices. (CNBC)

Suppliers

- STMicroelectronics acquired a majority stake in Exagon to improve its power electronics offering. (STM)

- LG Chem bought a television factory in Poland to repurpose into one for batteries. (Yonhap)

- Martinrea reported full year 2019 revenue of $3.86 billion and operating income of $266 million. (Martinrea) The company also completed the takeover of Metalsa’s automotive assets. (Martinrea)

- Grammer issued a profit warning for Q1 2020. (Grammer)

- Goodyear is developing a tyre containing capsules of liquid that restore some of the tread, and prolong the life of the tyre. (Goodyear)

- Continental’s 2019 full year revenue was €44.5 billion, there was a €(1.2) billion net loss. (Continental)

- Adient is selling its automotive fabrics division to a unit of Asahi Kasei. (Adient)

Dealers

- Used car website Spinny raised $44 million. (Tech In Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Chinese on-demand service Meituan Dianping invested in agricultural products distributor Wangjiahuan in a $87 million round. (Deal Street Asia)

- JLR-backed ride hailing firm Havn has declared its pilot scheme to be a success and is expanding. (JLR)

- Uber is happy to have driverless cars from other suppliers on its network provided “the tech is safe enough” (unsurprisingly, how that will be decided remains unclear). (Reuters)

- French courts ruled that Uber drivers are employees. (Reuters)

Driverless / Autonomy (history)

- UK-based Five(AI) raised $41 million to further develop self-driving technology, saying that it no longer planned to develop its own vehicles or run a ride hailing service and instead wants to sell technology. (TechCrunch)

- Waymo raised $2.25 billion from investors including Magna and dealer AutoNation. (Waymo)

- Waymo claims that its lidar sensors have a range of over 300 metres and the camera vision can read traffic signs more than 500 metres away. The radar recognises objects over “great distances”. (Waymo)

- Lidar developer SiLC raised $12 million from investors including Dell. (Robotics Business Review)

- Finnish self-driving vehicle start-up Sensible 4 raised $7 million. (Sensible 4)

- Chinese driverless vehicle developer Neolix says its products have been pressed into service to combat coronavirus, carrying out tasks such as ferrying supplies and cleaning streets. The firm has booked 200 orders in the last two weeks on the back of this success. (Deal Street Asia)

- GM presented plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

Other

- Scooter rental firm Bolt is reportedly close to raising $30 million. (FINSMES)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.