Not enough money to go around; Mercedes EQC news is good and bad; and cars that last a really long time. Please enjoy our auto industry and mobility briefing for 20th January to 26th January 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Too Many Broken Hearts — The Hydrogen Council (backed by lots of big-name OEMs) want $70 billion spent on hydrogen, forecasting costs will fall by 50%. The thing is… many of the same group are complaining about the low investment in electric vehicle charging infrastructure. So why ask for even more money to be spent on something else?

- I’ll be There — Some say that Mercedes is having problems getting enough batteries for the EQC, and it is hindering production. Others say that everything is just hunky dory and Mercedes will sell 50,000 units this year. That would be Tesla Model X volume territory. What would the Tesla fanbase make of one of their beloved products being beaten in the sales charts? Popcorn anyone?

- Old Before I Die — GM’s Cruise unveiled the Origin, a small shuttle developed with Honda. They put the vehicle lifespan at a million miles. Sounds reasonable, since taxis in New York and London routinely make it to 500,000. But if this vision of the future is correct, won’t that mean far fewer registrations?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart Of The Week

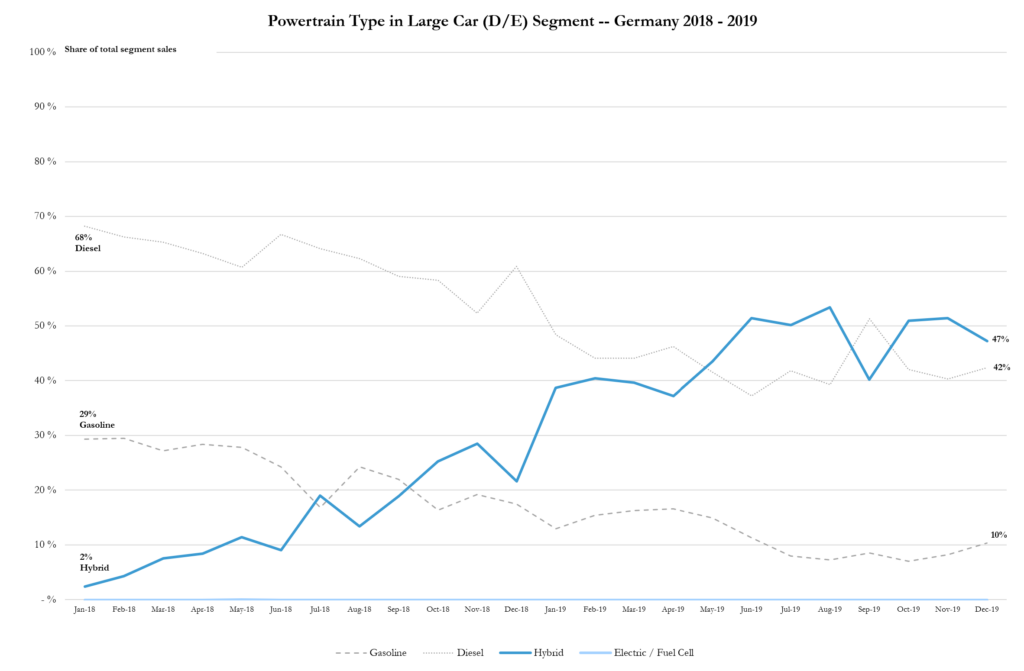

Okay, so this isn’t something that we normally do, but I thought this was a cool chart. OEMs in Europe need to significantly increase sales of all-electric and plug-in hybrid vehicles in 2020 and 2021 and there is so much opinion flying around about whether customers will embrace or resist the change.

So, here is some real data… it’s from Germany; richer than most countries but also approximately 80 million people, so a decent sample size. In the large car segment (what I think of as D/E size, e.g. Audi A6, BMW 5-Series, Mercedes E-Class), hybrids went from 2% of registrations at the beginning of 2018 to 47% by the end of 2019. Maybe customers aren’t so averse after all if they like the overall product? Here’s the chart:

News about the major automakers

- Invested in electric motor developer Software Motor Companyas part of a $25 million round. (SMC)

- Issued another profit warning, saying it would make €1.1 billion – €1.5 billion less because of losses from fines and court cases relating to diesel engine performance. The van division will make a whopping €(2.4) billion loss. (Daimler)

- Reportedly dealing with substantial constraints on battery supply for the EQC, resulting from problems at the supplier (LG Chem) and high reject rates at Daimler’s own battery module plant. (Manager Magazin) Daimler said that it would make about 50,000 EQC in 2020, as planned. (Reuters)

- Daimler and BYD are putting around $100 million in fresh funds into all-electric JV Denza. (Deal Street Asia)

- Working with UBQ Materials to find possible uses for “climate positive” thermoplastics. (Green Car Congress)

- Foxconn reckons the first shipments of electric vehicles produced in partnership with FCA will start in 2022. (Nikkei)

- Dutch authorities say that FCA and Suzuki vehicles (all equipped with FCA diesel engines) have breached emissions rules because of defeat devices. (Reuters)

- Updates in a spare parts database by over-eager analysts suggested that Ford’s next generation Mondeo will launch in 2021. (Autocar)

- Ford executives said the all-electric Mustang Mach-E will be profitable immediately. (Business Insider)

Geely (includes Volvo) (history)

- Expects that 20% of Volvo’s cars sold in EU markets this year will be plug-in hybrids and says that paying fines “shouldn’t be in the equation”, because the money is better spent investing in new products. (Bloomberg)

- Warned that the UK line-up could be pared back if local market rules started to deviate considerably from EU-wide standards. (FT)

- Volvo has received thousands of firm orders for the all-electric version of the XC40. (Volvo)

- Unveiled the Cruise Origin, a collaboration with Honda, a driverless vehicle with room for six. GM says the car can last one million miles — albeit with some refurbishment and upgrades — and will cost half as much as a conventional electric SUV (a somewhat fuzzy definition that spans a range of $30,000 – $100,000). (GM) The vehicle will apparently be built at the Detroit-Hamtramck, USA, plant as part of a $2.2 billion investment to turn the plant into an electric-only facility. (GM)

- Opening a new technical centre in Charlottle, USA, near to lots of NASCAR teams. (GM)

- Hyundai reported Q4 2019 revenue of 27.9 trillion KRW (about $23.7 billion), up 10.5% on a year-over-year basis. Operating income of 1.2 trillion KRW (about $1.1 billion) more than doubled. Full year revenue of 106 trillion KRW (about $90 billion) rose 9.3% from 2018, with operating income of 3.7 trillion KRW (about $3.1 billion). (Hyundai)

- Kia’s Q4 2019 revenue of 16.1 trillion KRW (about $13.7 billion), up 16.5% on a year-over-year basis. Operating profit of 591 trillion KRW (about $500 million) was 55% higher. Full year revenue of 58 trillion KRW (about $49 billion) rose 7.3% from 2018, with operating profit of 2.0 trillion KRW (about $1.7 billion). (Kia)

- Released renderings previewing a forthcoming compact SUV for emerging markets. (Kia)

- Activist shareholder Elliott has reportedly sold off its entire stake in Hyundai after failing to get its restructuring plan accepted. (Reuters)

- Kia is increasing production of the Telluride SUV thanks to high demand, and reportedly aims to sell 100,000 per year. (CNET)

Nissan and Mitsubishi (history)

- Carlos Ghosn reportedly predicted that Nissan would go bust by 2022, according to someone who interviewed him for a book (before he became a world-renowned escape artist). (Bloomberg)

- German regulators are investigating whether Mitsubishi diesel engines contained defeat devices. (Reuters)

- Nissan and Renault’s top engineering executives are planning a feelgood session to reignite shared projects (Reuters) or, Nissan is angling for a sell-down of the cross-shareholding. (Bloomberg) You decide.

- Vauxhall’s MD confirmed that there will be a next generation Insignia (but that doesn’t mean it will be anything more than a badge-engineered Peugeot). (Autocar)

- Despite PSA’s insistence that Opel and Vauxhall will retain distinct brand identities from the rest of the PSA stable, the design team is reportedly set to shed 40% of its workforce (about 160 people). (Handelsblatt)

- Doesn’t know whether it supplied the Mitsubishi engines under investigation by German regulators for defeat devices. (Reuters)

- Conducting a series of experiments over a four-year period to look at technologies for electric vehicle charging and the customer reception to them. (Renault)

- VW’s CEO said ex-SEAT boss Luca de Meo is in talks with Renault about the CEO job. (Les Echos)

- Renault Samsung workers are staging partial strikes whilst negotiations over wages continue. (Yonhap)

- Nissan and Renault’s top engineering executives are planning a feelgood session to reignite shared projects (Reuters) or, Nissan is angling for a sell-down of the cross-shareholding. (Bloomberg)

Suzuki

- All EU-bound cars from Suzuki’s Hungarian factory will have hybrid engines. (Budapest Business Journal)

- Dutch authorities said some diesel-engined Suzuki cars (the engines were supplied by FCA) breached emissions regulations and the firm has until mid-February to respond. (Reuters)

- Tata Motors says it will offer the safest cars (as measured by NCAP) in their class. (Autocar)

- Making around 500 staff at the Halewood, UK, factory redundant. JLR says it is because the plant is becoming more efficient, not because of falling volumes. (Autocar)

- Tata’s research suggests that Indian customers can be persuaded to upgrade to an all-electric car if the price is within 25% of the conventionally powered version. (Times of India)

- Toyota’s Japanese union will reportedly seek a $92 per month wage increase in 2020, lower than 2019. (Reuters)

- Moody’s changed the outlook for Toyota’s rating to negative. (Moody’s)

- Formed a joint venture with Aeris, called Ventic, to develop connected vehicle services in North America. (Aeris)

- Any second model added to Bugatti’s portfolio won’t share any platform with other VW group products and would have lifetime volume targets “in the low thousands”, but nothing has been approved by the board (indicating that any launch would be post-2022 at the earliest. (Autocar)

- Porsche’s CEO says half of (all-electric sports car) Taycan buyers are new to the brand. (Bloomberg)

- VW’s works council will approve the sale of the Renk heavy truck engine unit, provided they are happy with the buyer. (Reuters)

- CEO Diess said he backed a higher CO2 tax in Germany. (Handelsblatt)

- Canadian regulators fined $150 million for diesel emissions irregularities. (Reuters)

Other

- Aston Martin is exiting the German DTM touring car championship after a single season. (Motorsport)

- Indian electronics brand Detel intends to launch an electric vehicle. (Economic Times of India)

- TVR’s new Griffith looks like it has been further delayed because of problems with the factory. (CarBuzz)

- Lucid opened reservations for European customers, saying deliveries will begin in 2021. (Lucid)

- Nio is aiming to build 200 new dealerships this year. (NBD)

- Rivian says its new pick-up truck will be cheaper than previously announced. (Reuters)

- Subaru showed off a model of an unnamed electric SUV. (Auto Express)

News about other companies and trends

Economic / Political News

- Full year 2019 sales of commercial vehicles in Europe of 2.635 million units rose 2.5% on a year-over-year basis. Most of the market (2.2 million units) is in vehicles of 3.5 tonnes or less. (ACEA)

- The European

car making trade body issued a list of emission reduction talking points. In addition

to urging caution about mandates for certain technologies types (i.e. electric

vehicles), the manufacturers want future rules to give them credit for replacing

older vehicles with newer, lower emitting ones (despite this improvement being

an implicit part of current targets). (ACEA)

- Significance: Although billed as a “plan”, there are few concrete proposals, none of which have clear cost/benefit assessments, and the list reads as an attempt to draw politicians and other industries into the quagmire of emissions reduction.

- Russia is increasing the fee it charges manufacturers to register vehicles assembled locally, to $2,500 per unit and making it harder to claim back money for recycling vehicles. (Automotive Logistics)

Suppliers

- Tata AutoComp signed a joint venture agreement with Prestolite Electric to produce motors and power electronics. (Autocar)

- Bridgestone reported Q3 2019/20 revenue of 891 billion JPY (about $8.2 billion) and operating income of 92 billion JPY (about $840 million). (Bridgestone)

- Eaton’s hydraulics business is being sold to Danfoss for $3.3 billion. (Eaton)

- Mitsui and Teco Electric are setting up a joint venture plant in India to make electric motors. (Nikkei)

- Bosch is upping its stake in fuel cell developer Ceres Power from 3.9% to 18%. (Bosch)

Ride-Hailing, Car Sharing & Rental (history)

- Uber sold its Indian food delivery unit to Zomato, taking a 9.99% stake in the enlarged business return. (Uber)

- Zoomcar raised $30 million from investors including Sony. (Deal Street Asia)

Driverless / Autonomy (history)

- AutoX raised “tens of millions” shortly after closing a $100 million Series A round. (Deal Street Asia)

- Aurora monitors progress based on a self-generated

series of priorities for improving the ability of its self-driving AI (such as

being able to push into slow moving traffic). The firm accepts that its current

explanations are a bit vague plans to expand on them soon. (Aurora)

- Significance: The beginning of 2020 has seen a drumbeat of developers questioning the value of monitoring disengagements. However, they agree far less on what is an improvement. There is also a growing emphasis on virtual testing without confronting the two main shortcomings: (1) the reaction of other participants in the simulation is itself simulation (comprehensive multiple driver-in-the-loop simulations — which no one seems to be doing — aside) so the value in predicting and dealing with real life human behaviour is open to question; (2) part of the real world problem is that incomplete or noisy sensor data makes object detection and identification hard, whilst all simulations on show present the AI with a clearly identifiable object. If the real-world sensors cannot be so exact, why is it correct to simulate them as such?

- GM and Honda unveiled the Cruise Origin, a collaboration with Honda, a driverless vehicle with room for six. GM says the car can last one million miles — albeit with some refurbishment and upgrades — and will cost half as much as a conventional electric SUV (a somewhat fuzzy definition that spans a range of $30,000 – $100,000). (GM)

- Battery developer Oxis Energy claims it is “close to” an energy density of 500 Wh / kg (today’s best is around half that or less) from a solid-state lithium-sulphur chemistry. (Oxis)

- Total will install 20,000 charging points in the Netherlands. (Total)

- The cost of Hydrogen could fall by 50%, if only $70 billion is invested in it. (Hydrogen Council)

- Hyundai says modern vehicle batteries will last 1,000 cycles if they are fully discharged and recharged every time and, taking Hyundai’s view of a more realistic use case, if 20% of the capacity is used and topped up each day then they will be good for 22 years. (Hyundai)

- Electric motor developer Software Motor Company raised $25 million from investors including BMW. (SMC)

Connectivity

- VW formed a North American connected vehicle services joint venture with Aeris, called Ventic. (Aeris)

- Zenuity will use Hewlett Packard’s infrastructure to run its self-driving and advanced driver assistance AI. (HPE)

Other

- Indian parking app Park+ raised $11 million. (Deal Street Asia)

- Electric scooter rental firm Bird is reportedly in talks to buy smaller German service Circ. (FT)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.