Aston Martin’s independence; the difference between electric winners and losers; and secret emissions trading is a thing. Please enjoy our auto industry and mobility briefing for 27th January to 2nd February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Lady In Red — Aston Martin is set for £500 million in fresh funds, thanks to the intervention of billionaire F1 team owner Lawrence Stroll (and chums) who will end up controlling 20% of the business. Mr Stroll just so happens to be a massive Ferrari fan, participating in their exclusive track-only models (FXX and so on). Might he prefer owning a smaller stake of Ferrari-AML in future?

- Big Calm — GM’s president says the main reason the company’s forthcoming electric cars will be profitable is because of the scale benefit. He also appeared dismissive of companies with only one or two electric cars in their portfolio. Will companies that haven’t committed to higher volumes find themselves struggling for cost competitiveness against more earnest rivals?

- Share My World — Renault, Nissan and Mitsubishi will pool their fleets for the purposes of measuring CO2 in Europe and Geely’s taxi unit LEVC subtly signalled that it is open to letting someone benefit from the net benefit of its fleet of plug-in hybrids. Taken together with earlier moves by FCA-Tesla and Toyota-Mazda, are car companies starting to get the hang of creating proprietary CO2 trading schemes? If so, who’s next?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart Of The Week

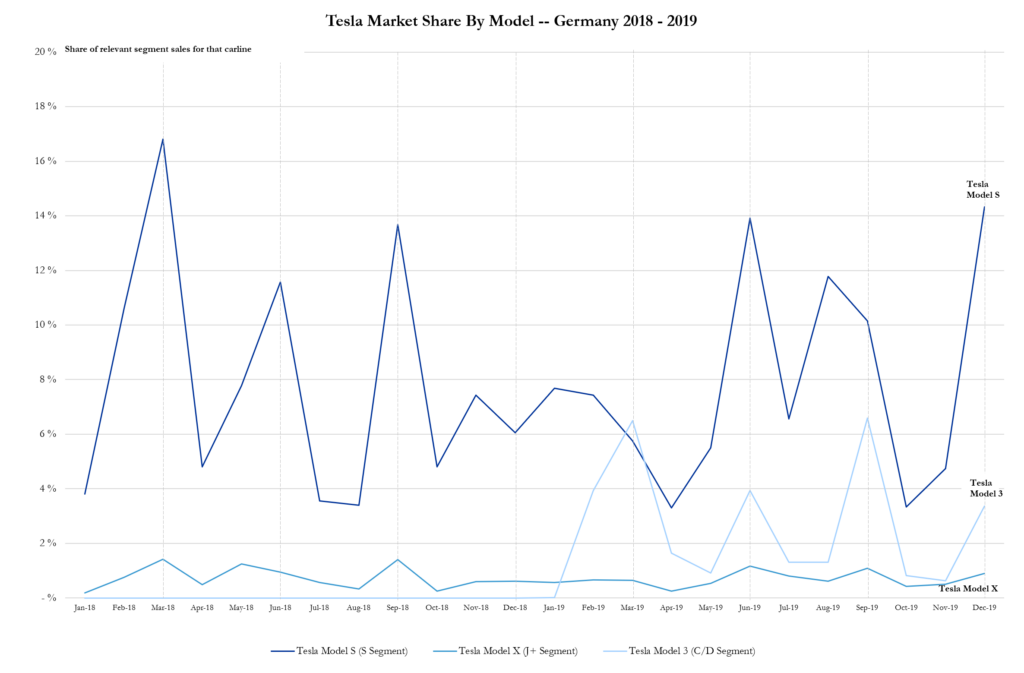

Last week’s chart got some interest, so I thought I would try another. If you read a lot of the pro-electric vehicle websites (as I do) then you will be familiar with articles like this one that trumpet the sales performance of Tesla cars compared to the conventionally powered competition in any given month. I went and looked at some German data and found something rather strange.

Now, I’m not suggesting this is anything other than coincidence but there seems to be a pattern where Tesla’s market share (of the relevant segment for each of Model 3 / S / X) jumps in the final month of the quarter. Remember this is share, not volume, so seasonality shouldn’t be much of a factor. Here’s the chart:

News about the major automakers

- Delayed the next-generation Mini, partly to save money by extending the current car’s lifespan, and partly in the hope that it will know the final outcome of a UK-EU trade deal before it has to decide the production footprint. (Reuters)

- Not interested in making BMW-badged products in the same segment as Mini, preferring to have distinct brands that do not compete with one another. (Autocar)

- Trialling the use of blockchain technology provided by Circulor to track CO2 emissions in the supply chain. (Autocar)

- Recruited sellside analyst Max Warburton as head of special projects, reporting to the CEO. (Daimler)

- Launched the next generation infotainment system called Uconnect 5. FCA reckons it is more user friendly than competitor products and well futureproofed. (FCA) TomTom will be the mapping supplier. (TomTom)

- Announced a further period of idling at the Belvedere, USA, plant. (Bloomberg)

- Confirmed that a forthcoming Lincoln battery electric vehicle will be built off Rivian’s platform. (Ford)

- Experimenting with 3D-printed locking wheel nuts that are unique for each vehicle. (Ford)

- Completed the sale of its former UK administrative HQ for £40 million. (EssexLive)

Geely (includes Volvo) (history)

- Taxi

maker LEVC is open to joining a pool that could benefit from its low CO2

per vehicle. It has issued a request for an open pool via the EU’s system.

Presumably inviting partners in return for financial reward. (EU)

- Significance: The open pool declaration implies that Volvo is on track meet EU fleet average CO2 levels

- GM’s president doesn’t think there is an inflection point for EV adoption believing that they have already entered the mainstream and that the rate of take-up is now in the hands of customers. In echoing previous statements that the next generation of all-electric cars would be profitable, scale was highlighted as a major factor in the business case. He also said that battery packs didn’t need to increase in size from the current generation, but GM will be able to squeeze out more performance thanks to a better understanding of how the battery is used in the real world. (Electrek)

- Confirmed rumours that Hummer will be resurrected as an all-electric model. The vehicle won’t be revealed until May and GM didn’t elaborate on the bodystyle (expected to be an SUV and a pick-up variant). The new Hummer won’t be a standalone brand however, it will be a model within the GMC portfolio. The new truck boasts an impressive specification: 1,000 hp and 0-60 in 3 seconds. (GM)

- Cadillac will roll out a new driver assistance system, called enhanced super cruise, that will enable hands-off highway driving, including lane changes. (GM)

- Honda produced 5.17 million vehicles in 2019, down (3.5)% on the prior year. (Honda)

- Says bottlenecks in production of the Hyundai Kona BEV for European markets have been reduced, in part by the start of production in the Czech Republic. (Autocar)

- Claims the new Genesis GV80 SUV will differentiate itself by providing an adaptive cruise control system that learns driver preferences. (Detroit Free Press)

- The Genesis GV80 has electronically controlled suspension that uses cameras to see features such as speed bumps and pot holes on the road ahead and adjust settings before the vehicle hits them. (Hyundai)

- Says it will now offer US customer complimentary maintenance for three years on new cars. On closer inspection however, the services included only extend to oil changes, filter changes and tyre rotation. (Hyundai)

Nissan and Mitsubishi (history)

- Rumoured to be planning further spending cuts (on top of the summer 2109 turnaround plan) by cutting 4,300 salaried staff globally (e.g. some US sales and marketing offices) and closing two (unidentified) factories. The global line-up will be pared to 62 models, but average aim will be reduced to 2.5 years (from 5 today). (Reuters)

- Reportedly

prepared a plan for a hard Brexit that would see Nissan plants on mainland

Europe closed and an attempt to capitalise on the lack of homegrown UK

production by taking market share from competitors who would be subject to higher

tariffs than Nissan (~3% vs 10% of material cost). (FT)

- Significance: Ad Punctum’s own Brexit analysis (published in 2017 but still relevant now) pointed out the disparity in tariff costs for UK-produced cars versus those built in Continental Europe under default WTO terms. Producers with footprints in Britain would gain a cost advantage of around £1,000 even on cheaper models (although they would still lose ground to vehicles that are imported from outside the EU today so already bear the higher tariff levels).

- Will prioritise the Nissan brand in India (over Datsun), including for designed / made in India products, calling into question Datsun’s market positioning. (Autocar)

- Nissan, Renault and Mitsubishi announced a series of measures to deepen integration. Nissan will lead engineering on models for China; Mitsubishi for Southeast Asia and Renault in Europe. Engineering of components will also be shared out, although no details were given. The three brands also plan to pool their collective fleet average CO2 in Europe, starting in 2020. (Mitsubishi)

- Mitsubishi’s Q4 2019 revenue (fiscal Q3) of 1.67 trillion yen (about $15.3 billion), down (7)% versus the same period in 2018. Operating profit of 3.6 billion yen (about $33 million) fell (96)% from prior year. (Mitsubishi)

- Said the diesel engines subject to investigation by German authorities for emissions cheating were supplied by PSA and denied the existence of any defeat devices. (Mitsubishi)

- PSA and Total’s Saft division announced a plan to create two battery plants, one in France and one at Opel’s Kaiserslautern site in Germany. The €5 billion investment (€1.3 billion coming from public funds) will lead to a combined 48 GWh of capacity by 2030, good for one million vehicles per year by their maths. Over time PSA’s share in the JV will go from 50% to 67%. (PSA)

- To no one’s surprise, Renault confirmed former SEAT executive Luca de Meo as CEO from July 2020. (Renault)

- Nissan, Renault and Mitsubishi announced a series of measures to deepen integration. Nissan will lead engineering on models for China; Mitsubishi for Southeast Asia and Renault in Europe. Engineering of components will also be shared out, although no details were given. The three brands also plan to pool their collective fleet average CO2 in Europe, starting in 2020. (Mitsubishi)

Subaru

- Produced 987,283 vehicles in 2019, (3.1)% down on prior year. (Subaru)

- Tata Motors (including JLR) reported Q4 2019 (fiscal Q3) revenue of 716.8 billion INR (about $10.1 billion), down (7)% on a year-over-year basis. Volumes fell (12)% to 275,907 units. Happily, EBIT of 16.8 billion INR (about $240 million) was much improved from a prior year loss as improvements at JLR more than offset losses on Tata-branded vehicles. (Tata)

- JLR reported Q4 2019 (fiscal year Q3) revenues of £6.4 billion, up 2.8% on a year-over-year basis and PBT of £318 million, from a loss in the prior year. The company credited its “Project Charge” program for delivering cost savings and said it will now enact “Project Charge +” to save even more. (JLR)

- JLR CEO Ralph Speth will step down in September 2020. (JLR)

- Reported Q4 2019 automotive revenue of $6.4 billion, up 1% on a year-over-year basis, and PBT of $132 million, down (25)% YoY. In the full year, automotive revenue of $20.8 billion rose 12% versus 2018 and PBT of $(665) million improved $(1.0) billion in 2018. Investors were cheered by a third consecutive quarter of free cash flow and Tesla’s bullish outlook for deliveries in 2020. The firm says it is already producing Model Ys for customers in the USA, will deliver a few Semis in 2020 and everything is going great guns in China. (Tesla)

- On the earnings call Tesla ruled out a capital raise, despite the rocketing share price, saying positive cash flow met funding needs. The company will likely host a day of presentations about battery technology in April, with Musk promising exciting news arising from the acquisition of Maxwell. (Seeking Alpha)

- CEO Musk thinks that battery modules are just a holdover from a time when lower cell manufacturing and management performance required a capability to swap out failed cells without chucking away the entire pack. He now wants to dispense with Tesla’s module engineering team entirely. (Clean Technica)

- Elon Musk re-framed his definition of “feature complete” self-driving, saying that this meant it would be possible for the car to drive a journey itself sometimes but “doesn’t mean the features are working well”. (Business Insider)

- Chinese owners are getting free supercharging during the coronavirus outbreak. (Clean Technica)

- Toyota Tsusho invested in Kenyan on-demand logistics company Sendy as part of a $20 million round. (FINSMES)

- The battery-making joint venture between Toyota and Panasonic will be called Prime Planet. (Toyota)

- Truck division Traton launched a takeover offer for US-focused truck maker Navistar. (VW)

- Agreed to sell 76% of the Renk heavy engine division to Triton in a €530 million deal. (VW)

- Audi says employee suggestions saved at €100 million at two German factories. (VW)

- Porsche’s CEO sidesteps the question of whether electric vehicles are truly the most environmentally friendly transport solution (considering the manufacturing) by calling it the “most marketable” technology and that the brand will be “well below” EU CO2 fleet targets. (Porsche)

Other

- Aston Martin announced a £500 million financing plan that

includes £182 million from a consortium led by F1 team owner Lawrence Stroll

(who will become executive chairman) in return for a stake that is intended to

eventually become 20%. Despite being short on cash, part of the plan is for Mr

Stroll’s F1 team to be re-branded as Aston Martin from the 2021 season onwards.

The relationship with Red Bull technologies will end after delivery of the Valkyrie

— the two firms originally planned to collaborate on a further range of

supercars. The company also confirmed it won’t release any electric cars until

2025 at the earliest, calling into question plans for the Lagonda brand (which

was to be all-electric) (AML)

- Significance: Since Mr Stroll is well known for his collection of Ferraris, it seems a more than reasonable guess that as time passes, the two storied brands might discuss collaboration opportunities (and more).

- Arrival has received an order for 10,000 all-electric delivery vans for delivery between 2020 – 2024 (with an option for a further 10,000) from UPS in a €400 million deal. (The Guardian)

- Karma intends to make an SUV and pick-up using an all-new platform. (Bloomberg)

- VinFast says it has 17,000 orders for its new line-up of cars. (Vietnam+)

- Lordstown Motors is hoping for $200 million loan to build its new pick-up, which it will unveil at the Detroit motor show. (Reuters)

News about other companies and trends

Economic / Political News

- The Coronavirus caused many OEMs to suspend production (due to Chinese New Year, a shorter break was always planned). Amongst them were Tesla, Toyota, Honda, Ford, Renault and VW. Supplier FTech is relocating some production to the Philippines because its plant is in Wuhan. Hyundai and SSangyong said production in South Korea was affected because of parts shortages.

- TomTom says Bangalore, India is the world’s most congested city. (TomTom)

Suppliers

- Bosch reported preliminary 2019 sales of €77.9 billion and profits of €3 billion. Bosch says worldwide automotive production will shrink in 2020 and thinks it might never recover. The company intends to review capacity. (Bosch)

- BorgWarner agreed to acquire Delphi in an all-stock deal. (BW) BorgWarner reported preliminary FY 2019 revenu of $10.2 billion and operating income of $1.3 billion. (BW) Delphi reported preliminary FY 2019 revenue of $4.4 billion and operating income of $315 million. (Delphi)

- Nidec thinks revenue will more than triple off the back of increased electric vehicle production. (Reuters)

- Autoliv reported FY 2019 revenue of $8.5 billion and operating income of $726 million. (Autoliv)

- Lear’s FY 2019 revenue was $4.8 billion and net income was $126 million. (Lear)

- Denso’s Q4 2019 (fiscal Q3) revenue was $35.5 billion and operating profit was $1.5 billion. (Denso)

- Meritor reported Q4 2019 (Fiscal Q1) revenue of $901 million and net income for $39 million. (Meritor)

- Aptiv reported FY 2019 revenue of $14.4 billion and net income of $990 million. (Aptiv)

- Veoneer has now exited the brake systems joint venture it owned with Honda and Nissin Kogyo. (Veoneer)

- WABCO is selling the RH Sheppard steering division to Knorr Bremse ahead of ZF’s takeover. (WABCO)

- Adient reported Q4 2019 (fiscal Q1) revenue of $3.9 billio and EBIT loss of $(42) million. (Adient) The firm is exiting the interior trim joint venture with Yanfeng in a $379 million deal and the pair have extended the JV for seating and altered arrangements for their mechanisms JV. (Adient)

Ride-Hailing, Car Sharing & Rental (history)

- GoJek has suspended several drivers after it discovered they were using modified versions of its app that allowed them to see more information about passengers and reject trips. (Tech In Asia)

- Lyft’s restructuring made the headlines, but it only affects about 90 people. (NYT)

Driverless / Autonomy (history)

- Automated truck developer Embark said it wouldn’t publish a 2019 disengagement report but was happy to say it hadn’t had any crashes. (Embark)

- Postal firm UPS will test autonomous technology in cooperation with Waymo. (Reuters)

- Uber is reportedly investigating different ways of

financing a fleet of driverless cars — internal proposals apparently include

bundling vehicles into structured trusts that would pay out a set rate using

the cash from ride. (FT)

- Significance: Although this article rightly points out the difficulty of financing cars in the same way as buildings, due to depreciation, existing leasing models for aircraft and rolling stock (where unit volume is lower but value is far higher) suggest that this is not an insurmountable problem.

- Comma.ai says, following the launch of its latest smartphone-based driving assistant, it is profitable. The company hopes to achieve a mean distance between disengagements of 100 miles during 2020. It says that this cannot be compared to most self-driving firms because it does not always test in the same location (although the relatively low number of users would imply it isn’t that different). (Comma)

- Tesla’s Elon Musk re-framed his definition of “feature complete” self-driving, saying that this meant “some chance” the car could drive a journey itself but “doesn’t mean the features are working well”. (Business Insider)

- Cadillac will roll out a new driver assistance system, called enhanced super cruise, that will enable hands-off highway driving, including lane changes. (GM)

- Indian tariffs for electric vehicles have been hiked — at the same time as those for conventional engines — to 40%. The previous (favourable to EV) difference in tariff between electric and conventional powertrain has been eliminated. The government says it simply wants more local manufacturing. (Economic Times of India) It also believes that within three years, EVs will be cheaper than those with combustion engines. (Economic Times of India)

- India is plotting a 12-lane, 1,300km electrified highway, to be completed by the start of 2024. It would have fixed overhead lines for trucks and buses and charging service stations for light vehicles. (Economic Times of India)

- Tesla’s Elon Musk thinks that battery modules are just a holdover from a time when lower cell manufacturing and management performance required a capability to swap out failed cells without chucking away the entire pack. He now wants to dispense with Tesla’s module engineering team entirely. (Clean Technica)

- Aston Martin confirmed it won’t release any electric cars until 2025 at the earliest, calling into question plans for the Lagonda brand (which was to be all-electric) (AML)

- GM’s president doesn’t think there is an inflection point for EV adoption believing that they have already entered the mainstream and that the rate of take-up is now in the hands of customers. In echoing previous statements that the next generation of all-electric cars would be profitable, scale was highlighted as a major factor in the business case. He also said that battery packs didn’t need to increase in size from the current generation, but GM will be able to squeeze out more performance thanks to a better understanding of how the battery is used in the real world. (Electrek)

- The battery-making joint venture between Toyota and Panasonic will be called Prime Planet. (Toyota)

Connectivity

- TomTom is the mapping supplier for FCA’s upgraded infotainment system. (TomTom)

Other

- In a sign that large automotive companies might be losing interest in bright ideas that will change the future, the Techstars Detroit incubator is closing. (TechCrunch)

- Truck maker Volvo reported 2019 full year revenue of 432 billion SEK (about $44.8 billion) and adjusted operating income of 47.9 billion SEK (about $5.0 billion). (Volvo)

- Scooter rental firm Bird confirmed a deal to acquire Circ and raised a further $75 million. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.