Auto Industry Briefing — week ending 8th March 2020

Electric cars for all (who can afford them); science fiction sensor capabilities and; supercars that don’t push the envelope. Please enjoy our auto industry and mobility briefing for 2nd March to 8th March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Everyday People — GM invited investors and the press to marvel at its battery technology. The intended message was that GM is best placed to bring electric cars to the masses and that they have been super-smart about the design so they won’t get caught out by technology changes. So far so cool, but if they have really cracked the problem, why do most of the cars they are rolling out look like they will end up with a six-figure price tag?

- Distance And Time — Waymo raised $2.3 billion and released some details of the sensors it has been working on. The company reckons it has lidar with 300m+ of range, cameras that can see more than 500m and as for radar, they just gave up counting and called a great distance. The figures are impressive; nearly good enough for motorway speeds, depending on weather and the speed of making decisions. But are they real? Are they reliable? And can Waymo’s AI handle that much information without grinding to a halt?

- Never Ever — Koenigsegg unveiled a new model called the Gemera. According to the Swedish firm it will be so scarily fast that they daren’t do the maths in case the numbers give them a heart attack. In fact, they are so bruised by the experience that they are pledging to hold back on all future cars so this one is never bettered. I know I’m not your typical hypercar buyer, but is that the sort of brand message they will buy into when Koenigsegg make the car after this one?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart of the week

Long suffering readers will have seen me write many times about how, contrary to much of the news flow, European CO2 regulations are unlikely to result in fines. Mainly since the cost of adding technology to the car is cheaper than paying the fines (albeit still harmful to profits).

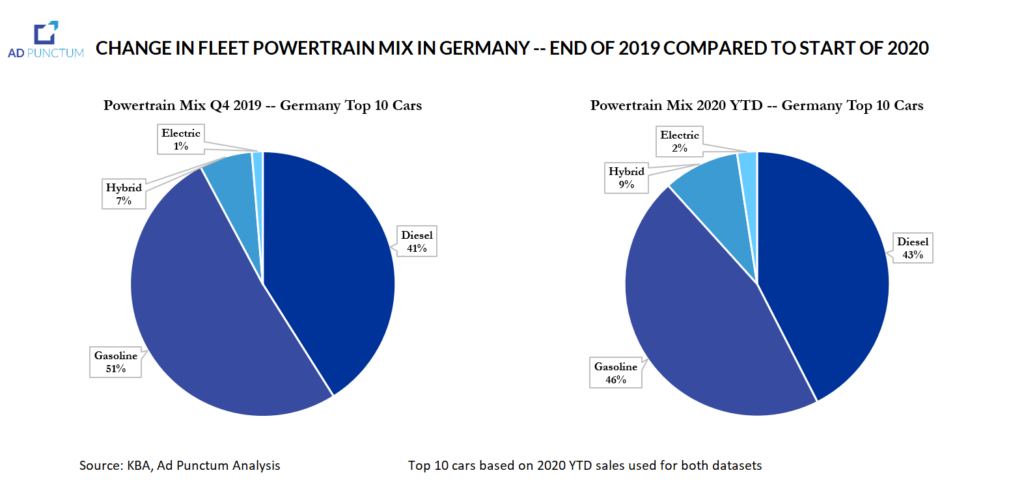

I think this chart it is an interesting example of manufacturers successfully encouraging customers to buy the engine types that suit the brand’s overall goals. The pie charts cover the (same) ten best-selling vehicles (e.g. VW Golf, Audi A4). The left-hand side shows the final three months of 2019, the right-hand side is 2020 so far. Despite no major product introductions, hybrid and electric share from went from 8% to 11% and diesel has seen increases too. In just two months. An aberration? Seasonality? Or just good old mix management? You decide.

News about the major automakers

- Unveiled a car called the Concept i4 that CEO Zipse promised is “quite close” to the production version. (BMW)

- The recent spate of senior departures from the ranks of Daimler’s financial team are reportedly the result of a turf war between newish CFO Wilhelm and the insiders that he beat to the job. (Handelsblatt)

- Unveiled the facelift for the E-Class. (Daimler)

- Plans on culling models, platforms and engines as part of an efficiency drive but the only action it will confirm publicly is that the next generation SL will be on a shared platform. (Reuters)

- Investing $400 million to convert a US transmissions factory to build engines instead. (FCA)

- FCA’s head of US sales stepped down (he previously filed a whistle-blower suit against FCA’s sales reporting practices). (FCA)

- Unveiled the all-electric variant of the new Fiat 500. Specifications and performance look reasonable; less clear is whether Fiat will find many takers given the £30,000 asking price. (FCA)

- Confirmed that two employees had contracted coronavirus and launched a travel clampdown reminiscent of the actions the company normally employees when under pressure to improve financial results. (Detroit Free Press)

- Confirmed plans to produce an all-electric Transit van. (Ford)

Geely (includes Volvo) (history)

- Geely is going into the satellite business, building a new plant in China. (Autocar)

- Lotus says there are enough orders for the Evija supercar to fill the 2020 production plan, but it isn’t clear how many of the planned 130 cars this represents. (Autocar)

- Presented its plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

- Is producing 550 different combinations of internal combustion engine type, output and transmission and says that with electric motors that figure can be reduced to 19 battery and motor sets. (GM)

- Said that coronavirus won’t affect production plans until the end of March at the earliest. (Reuters) GM has also instigated travel restrictions for employees. (Detroit Free Press)

- Offering European customers electricity from renewable sources for their vehicle charging under a scheme called e:PROGRESS run with help from Moixa and Vattenfall. (Honda)

- Said that coronavirus was causing some production problems in Japan and that plants were using the parts they had around them, even if these weren’t the trim levels in the original schedule. (Reuters)

- Hyundai unveiled the all-electric Prophecy concept car, a sleek sedan that appears to draw many styling cues from Tesla and Porsche. (Hyundai)

Nissan and Mitsubishi (history)

- Nissan’s Russian factory will go to a one shift pattern (from two today) until the market has recovered. The company said the move was unrelated to coronavirus. (TASS)

- CEO Tavares suggested that the British government would have to compensate his firm for any tariffs payable if the UK and EU fail to agree a trade deal, and it wants to keep the Ellesmere Port plant open. (The Guardian)

- PSA stands ready to drop Huawei as a partner for its connected vehicle network if US authorities made it a condition of the FCA-PSA merger. (Reuters)

- CEO Tavares says the combined strategies of PSA and FCA in China will require a post-merger rethink. (Reuters) He also has a point of view about electric cars in Europe believing that at present, only “green addicts” are buying them.

- Unveiled the Morphoz concept, a car that can expand and contract thanks to embedded electric motors. Renault said the car was previewing the design of a new line of electric vehicles, likely to be the next generation models of the Koleos and Kadjar. (Renault)

- Took the wraps off the Dacia Spring, a budget electric car based on the China market City K-ZE. (Renault)

Subaru

- Announced an executive reshuffle and reorganised the audit and quality departments. (Subaru)

- JLR was accused of not doing enough to properly classify workers under a new British law that seeks to tax captive workers as if they were employees regardless of the legal structure of the arrangement (many contract via companies that they own). JLR said it had done everything correctly and there was nothing to worry about. (FT)

- Announced a senior executive shake-up, with several of the top brass departing, and a new CFO. (Toyota)

- Expanded a recall for faulty fuel pumps to now cover 3.2 million units globally. (Bloomberg)

- Will drop natural gas powered models from the line-up, probably by 2025, citing low demand levels. (Handelsblatt)

- VW’s seat making subsidiary Sitech is closing a factory in Hanover, Germany, with the loss of 450 jobs after the plant lost production contracts to Faurecia. (Handelsblatt)

- Porsche executives poured cold water on any idea of an all-electric 911 before 2030 and suggested a hybrid was unlikely in the lifespan of the current model. (Autocar) The CEO was categorical that a 911 would always be available with an internal combustion engine. (Porsche) Officials also suggested that an all-electric hypercar was unlikely because they are concerned that there is too little opportunity for differentiation. (Autocar)

- Temporarily reduced Skoda Rapid production in Kaluga, Russia due to a shortage of tail lamps. (TASS)

- Audi unveiled the fourth generation A3. (Audi)

- Announced a joint venture with consulting firm Capgemini to create a cloud software unit. (Audi)

- Set up a team to work on securing green financing (which often conveniently happens to be cheaper than the regular sort) for VW’s future product plans. (VW)

- Bentley unveiled the limited edition Bacalar open top GT. (Bentley)

Other

- Aston Martin’s CEO says the main reason the company is developing a new V6 engine for entry models is that current V8 supplier Daimler is moving towards engines he considers too small for sportscars. He is leaving the door open for manual transmissions but implied there are none in the cycle plan for future products. (Car and Driver)

- Aston Martin unveiled the already announced limited edition V12 Speedster. The firm says that the car, a new exterior design built from a parts bin of other models, took 12 months to develop to “production intent” (with deliveries no starting until early 2021 there is some more development to do). (Aston Martin)

- McLaren’s boss complained about UK government plans to ban sales of all cars without plug-in capability by 2035, believing that hybrids should be given more time (the new rules wouldn’t preclude plug-in hybrids, only the sort that function purely through regenerative braking and scavenging from the engine). (Autocar)

- Bristol Cars was put into liquidation, scuppering hopes of a revival. (Autocar)

- Pininfarina said that it had sold more than 50% of the all-electric Battista supercars it intends to build for the USA and Europe and thinks that when the car is available for test drives, the remainder of the orders will flow smoothly in. The company also suggested that Rivian has been directed by Amazon not to licence its electric chassis to anyone who isn’t a shareholder (i.e. themselves and Ford). (Autocar)

- Fuel cell truck maker Nikola announced plans to list with a valuation of $3.3 billion. (Nikola)

- Yet to launch any products, Neuron EV has begun development of mobile quarantine facilities. (Neuron EV)

- Koenigsegg unveiled the Gemera, a hybrid four-seater limited to 300 cars. (Koenigsegg) It also has a new version of the Jesko available and says the Absolut version is the fastest car it has ever made (they claim to not even know its ultimate performance) and it won’t ever try to beat it. (Koenigsegg)

- Morgan has a new car, with the BMW-powered Plus Four replacing the Plus 4. (Morgan)

- McLaren unveiled a new high performance car, the 765LT. (McLaren)

- Nio raised $235 million in short term debt with zero interest. (Nio)

- Isuzu set a series of environmental targets for 2050: zero greenhouse gas emissions; and 100% recycling of waste and old vehicles. (Isuzu)

- Micro says it has 17,000 orders for the Microlino city car. (Micro)

News about other companies and trends

Economic / Political News

- US light vehicle SAAR of 16.83 million units rose 1.8% year-over-year. (Wards)

- German registrations of 239,943 passenger cars in February fell (10.8)% from the same period in 2019. (KBA)

- February passenger car sales in the UK of 79,594 units dropped (2.9)% on a year-over-year basis. (SMMT)

- French sales of 167,784 passenger cars in February were (2.7)% lower than a year earlier. (CCFA)

- February’s Spanish passenger car registrations totalled 94,620 units, down (6)% on prior year. (ANFAC)

- Italian passenger car sales of 162,793 units in February fell (8.8)% from 2019. (UNRAE)

- The former head of the UAW was charged with corruption and US officials floated the idea of a federal takeover of the union to rid it of bad practices. (CNBC)

Suppliers

- STMicroelectronics acquired a majority stake in Exagon to improve its power electronics offering. (STM)

- LG Chem bought a television factory in Poland to repurpose into one for batteries. (Yonhap)

- Martinrea reported full year 2019 revenue of $3.86 billion and operating income of $266 million. (Martinrea) The company also completed the takeover of Metalsa’s automotive assets. (Martinrea)

- Grammer issued a profit warning for Q1 2020. (Grammer)

- Goodyear is developing a tyre containing capsules of liquid that restore some of the tread, and prolong the life of the tyre. (Goodyear)

- Continental’s 2019 full year revenue was €44.5 billion, there was a €(1.2) billion net loss. (Continental)

- Adient is selling its automotive fabrics division to a unit of Asahi Kasei. (Adient)

Dealers

- Used car website Spinny raised $44 million. (Tech In Asia)

Ride-Hailing, Car Sharing & Rental (history)

- Chinese on-demand service Meituan Dianping invested in agricultural products distributor Wangjiahuan in a $87 million round. (Deal Street Asia)

- JLR-backed ride hailing firm Havn has declared its pilot scheme to be a success and is expanding. (JLR)

- Uber is happy to have driverless cars from other suppliers on its network provided “the tech is safe enough” (unsurprisingly, how that will be decided remains unclear). (Reuters)

- French courts ruled that Uber drivers are employees. (Reuters)

Driverless / Autonomy (history)

- UK-based Five(AI) raised $41 million to further develop self-driving technology, saying that it no longer planned to develop its own vehicles or run a ride hailing service and instead wants to sell technology. (TechCrunch)

- Waymo raised $2.25 billion from investors including Magna and dealer AutoNation. (Waymo)

- Waymo claims that its lidar sensors have a range of over 300 metres and the camera vision can read traffic signs more than 500 metres away. The radar recognises objects over “great distances”. (Waymo)

- Lidar developer SiLC raised $12 million from investors including Dell. (Robotics Business Review)

- Finnish self-driving vehicle start-up Sensible 4 raised $7 million. (Sensible 4)

- Chinese driverless vehicle developer Neolix says its products have been pressed into service to combat coronavirus, carrying out tasks such as ferrying supplies and cleaning streets. The firm has booked 200 orders in the last two weeks on the back of this success. (Deal Street Asia)

- GM presented plans for electric vehicles to investors and press. GM’s forthcoming ultium battery design will see some vehicles sporting pack sizes of 200 kWh and will be in production from late 2020 onwards. The first new product will be the next generation Chevrolet Bolt, followed by a Bolt EUV, then a new Cadillac called the Lyriq (exact timing is still unclear) and the already confirmed Hummer. GM believes that customer adoption may be faster than most forecasters are expecting. GM thinks that the new design of cells it is adopting will make them easier to fit into different shapes and sizes of vehicle; to swap out worn out units and; to be technology agnostic – both with regards to suppliers and in introducing new chemistries as they arrive. (GM)

Other

- Scooter rental firm Bolt is reportedly close to raising $30 million. (FINSMES)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 1st March 2020

Cool cars for cool kids; 3D printing keeps getting better and; Deutsche Post loses patience with StreetScooter. Please enjoy our auto industry and mobility briefing for 24th February to 1st March 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- He Ain’t Heavy, He’s My Brother — Citroën released a new city car, the AMI. The inspiration appears to have come from the question, what do you get if you cross a Smart ForTwo with a Renault Twizy? And the answer is a tiny, cheap as chips electric car that can’t go very far, or fast, and can be driven by teenagers. Not everyone’s cup of tea perhaps but making intelligent compromises on performance (i.e. making a city car that can’t leave the city) seems sensible if it saves big money. What will Greta Thunberg et al think?

- Bend Me, Shape Me — VW says 3D printing is good enough to make engine blocks. The only problem is that it takes 12 days (on a very expensive machine). Nowhere near mass manufacturing pace, but intriguing for prototype and small series runs. Twenty years ago 3D printing was only good for making models of blocks, so this is great progress. How far away are we from this technology being taken seriously and used with some imagination?

- Money For Nothing — Electric delivery van pioneer StreetScooter is shutting down. After years of complaining about high costs, owner Deutsche Post has finally decided to pull the plug and says there is no hope of finding a buyer. On paper the brand had everything it needed: anchor customer? Check; no competition? Check; make job specific electric vehicle tailored to a price point? Check. Where did it all go wrong (obviously cost) and how should people following a similar strategy (but are yet to launch) change their approach?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Electric bus maker Proterra is teaming up with Daimler’s Freightliner unit to develop an electric truck. (Proterra)

- Argo AI’s CEO confirmed that Ford’s initial plans for self-driving cars still exclude all-electric vehicles (Ford has earlier talked about plug-in hybrids). He had two reasons for pursuing the course, even as rivals choose all-electric vehicles, or at least hedge their bets: that electric vehicles cost more so profitability is harder and; that fast charging the battery to keep the vehicle in use would reduce its life expectancy too much. (The Verge)

- Recalling about 250,000 F-150 trucks to fix problems with auxiliary heaters and headlamps. (Ford)

- Ford’s Spin electric scooter rental subsidiary is starting operations in Europe with plans to launch is Germany and France (it would like to be in the UK too if the law changes). (Ford)

- Aston Martin will produce its own V12 engines from 2021 onwards, creating a (small) surplus labour problem at Ford’s Cologne factory. (AML)

Geely (includes Volvo) (history)

- Polestar unveiled the Precept concept car, it what looks like a preview of a Model 3 fighter. (Polestar)

- Volvo reportedly told dealers about two new products: a sleek coupe-ish SUV (dubbed the C40) and a massive SUV given the working title of XC100 (although the sequence XC40, XC60, XC90, XC100 feels odd). (Automotive News)

- Adding shifts at two Michigan, USA plants to meet increased demand for SUVs and Cadillac cars. (GM)

- VinFast implied an interest in the design and testing facilities GM will vacate when it closes Holden’s operations in Australia. (Motoring)

- Sold the Turin powertrain engineering centre to Punch Group. (GM)

- Recalling 193,000 cars in the USA to fix leaking fuel hoses, (Detroit News)

- Suspended production in Ulsan, South Korea (Hyundai’s main plant) because a worker tested positive for Coronavirus. (Nasdaq)

- In the process of deciding where to locate a fuel cell plant capable of supporting 100,000 vehicles per year. (Reuters)

- Reported 2019 full year revenue of €74.7 billion, up 1% on a year-over-year basis. Automotive revenue of €58.9 billion improved 0.7% YoY. Operating income of €4.7 billion rose 6% YoY. Automotive adjusted operating income was €5.0 billion with PSA claiming an 8.5% margin. The year over year performance was more than explained by positive mix and cost reductions. PSA says its European breakeven point (a somewhat fuzzy measure since pricing often deteriorates with industry weakness) is now 1.8 million units, 2019 European sales were 3 million units. (PSA)

- CEO Tavares is contemplating an all-electric platform, but thinks it won’t be worthwhile until 2024. (Seeking Alpha)

- Citroën unveiled the AMI all-electric city car. Seemingly sprung of a

desire to merge the philosophies behind the Smart ForTwo, Bolloré Blucar and Renault Twizy, the AMI is a two-seat

quadricycle (which means that in France 14 year-olds can drive it) with a low

price — €6,000 — and citybound range (70km). (PSA)

- Significance: Citroën has taken a brave approach to marrying the two seemingly incompatible needs of future city cars: to be small and cheap whilst accommodating an (assumed to be expensive) electric drive system. Citroën’s answer had been to create a decidedly no-frills, performance compromised (outside the city) car, but counterbalance that with great inner city practicality and expand the potential customer base by making it as a quadricycle. Where the windowless Twizy (I know you could get ill-fitting fixed panels) was perhaps too revolutionary, this might be the right mix.

- Renault’s wholly owned European dealer group is slightly downsizing, offloading ten sites. (Renault)

- Stressed that a recovery plan (with headline targets if €2 billion in structural cost savings) was still under development and firm decisions wouldn’t be taken until just before the plan is announced in May. (Renault)

Subaru

- Spending $158 million to add a transmission and spare parts warehouse at the Lafayette, USA, plant. (AP)

- Supplier AAM said the all-electric I-Pace was selling only half of Jaguar’s initial forecasts. (Bloomberg)

- Looking to sell off wholly owned Indian dealer group Concorde Motors. (Livemint)

- US regulators complained that Tesla had been less cooperative than rival carmakers in implementing their recommendations to risk the risk of drivers becoming overly reliant on driver assistance features. (CNBC)

- Panasonic is pulling out of Tesla’s solar panel factory but says it has no impact on the partnership to build batteries for cars. (Reuters)

- Investing $400 million in Chinese self-driving developer Pony.ai. (Pony.ai)

- Rebranded the recently acquired fleet leasing arm of Inchcape as Kinto. (Toyota)

- Toyota Tsusho invested in emerging market multimodal developer WhereIsMyTransport. (EU Startups)

- Reported full year 2019 group revenue of €252.6 billion, up 7.1% on a year-over-year basis. Earnings before tax of €18.4 billion rose 17.3%. VW will release detailed financial results in mid-March. (VW)

- Will buy out Audi’s minority shareholders (0.36% of the Audi’s shares), after this is completed, Audi’s legal entity status won’t change and it will remain as a stock corporation at the behest of unions who feel it is protection against the brand’s independence being eroded. (VW)

- Truck making unit Traton will buy up the remaining 5.64% of MAN’s stock that it doesn’t own. (VW)

- Porsche has been testing low speed camera-based autonomous driving to move vehicles around workshop areas. Longtime observers of ponderous self-parking technologies and laidback garage mechanics will wonder whether there is any real world benefit to be achieved. Slightly more interesting is Porsche’s belief that it could be a rich source of training data for on the road driverless applications. (Porsche)

- Škoda is very pleased with the initial results from its BeRider electric scooter rental scheme and is expanding the fleet to 700 units, to be scattered across Prague, Czech Republic. (Škoda)

- Audi is working on a way for shopfloor personnel to create special 3D-printed tools without having to create CAD models manually, saving time and reducing the skill level required to implement new ideas. Detail on how this is accomplished is thin on the ground and photos show staff carefully examining… CAD models. (Audi)

- VW has 60 different types of authority to approve funds, with 25 levels of secondary signature. To make things easier it has created a website to guide users but might want to work on the bureaucracy itself. It seems managers are not even trusted to approve their own travelcards (they can do so for others, but not themselves). Since this example is selected by VW, more ludicrous ones almost certainly abound. (VW page 2)

- Although VW is impressed by the high finishing standards of modern 3D printing, the company doesn’t see the technology as cost effective for mass production yet — with cylinder blocks taking 12 days to print — but has plenty of potential for prototype and small series runs. (VW Page 4)

- An employee at VW’s ItalDesign subsidiary contracted coronavirus, shutting operations there for three days (although diligent staff worked from home). (VW)

- CEO Diess is looking to shake things up by hiring a climate change activist to speak truth to power and “aggressively” challenge the company’s plans for improving its environmental impact. (FT)

- Reached an agreement with German consumers that will see VW pay €830 million in compensation for losses suffered as a result of the diesel scandal. (VW)

- Porsche

unveiled the next step in personalisation. A customer’s fingerprint can be

painted onto the bonnet (would-be identity thieves will sadly have to stick to

applying blusher to the door handles as the image appears to cover too small a

surface area to unlock a smartphone). The cost? A cool €7,500. Porsche haven’t

said how the next owner can get rid of it. (Porsche)

- Significance: Although having your fingerprint on the front of your car seems gauche, the application of specially painted personalisation is notable, albeit at a price point few will probably find bearable.

Other

- Aston Martin reported full year 2019 results. Sales of 5,862 cars, down (9)% year-over-year, resulted in revenues of £997 million, also down (9)%. A profit warning had presaged the operating loss of £(37) million, down from £73 million in 2018. The CFO will step down in April. Aston Martin’s outgoing Chairwoman said the company had suffered from an “unexpectedly large downside risk of underperformance”. The company expects 2020 to be tough, with the new DBX coming at the same time as a reduction in sportscar sales, but wouldn’t be drawn on roughly how many cars it hopes to sell. (AML)

- Aston Martin will produce V12 engines in the UK from 2021, relocating production from Ford’s Cologne site. It wasn’t clear where the factory will be and whether Aston Martin is planning to machine the main components, or buy them in. (AML)

- Nio received a boost by agreeing a deal with the local government in Hefei, China that will see Nio relocate its headquarters there in exchange for funding (said to be almost $1.5 billion). (Nio)

- Lucid will use battery cells sourced from LG Chem. (Lucid)

- Polish consortium ElectroMobility Poland plans on having two vehicles in production by 2023. (BBJ)

- Deutsche Post

announced that it was

shutting electric van maker StreetScooter and was no longer looking for

a buyer. Although the brand is relatively young, the shutdown is ultimately expected

to cost €300 million to €400 million – some of which may be vehicles in

inventory. (Handelsblatt)

- Significance: The closure of StreetScooter raises a number of difficult questions for emerging electric vehicle makers: how big does an anchor customer need to be to ensure viability (since Deutsche Post ordered thousands of vans)? Is the delivery vehicle market less lucrative than many think? If the IP of a company with several years of production experience was considered worthless, what is the value of their assets?

News about other companies and trends

Economic / Political News

- The Geneva show was cancelled as the Swiss government banned events with more than 1,000 people. Many manufacturers announced plans to use online reveals of new products instead. (The Guardian)

Suppliers

- Plastics supplier OK Play is selling its automotive business to Lumax. (Autocar)

- Gestamp reported 2019 revenue of €9.1 billion and EBIT of €504 million. (Gestamp)

- Grammer agreed a series of new loans to expand its credit line and fund the final payment for the acquisition of TMD (which took place in 2018). (Grammer)

- CATL is hoping to raise $2.85 billion for new battery factories. (Reuters)

- Kongsberg reported full year 2019 revenue of €1.16 billion and PBT of €43.5 million. (Kongsberg)

- Bosch invested in internet of things software developer FogHorn. (FINSMES)

- Magna held an investor day. Despite a weak outlook for industry growth in North America and Europe (Magna thinks Europe will be slightly higher by 2022), Magna expects all business units except completed vehicles to see revenue and EBIT margin improvements. (Magna)

Ride-Hailing, Car Sharing & Rental (history)

- Uber is reportedly planning to pay drivers who put an advertising screen on top of their car a $300 one-off fee, plus $100 per week (if they are on the road for 20 hours or more). The firm plans to offer advertisers intelligent swarms of screens which can show the same messages as nearby fixed display boards. (Business Insider)

- Chinese ride hailing company Shouqi Limousine is trying to reassure coronavirus-obsessed customers by installing ultraviolet air purifiers in its cars. (Shouqi)

- Grab and Gojek denied that they were in merger talks but journalists, urged on by their sources, remain convinced that something is afoot. (TechCrunch)

Driverless / Autonomy (history)

- Zoox promises to show everyone “what we’ve been up to” this year, less clear is whether this will be before or after a hoped-for mega fundraising round. (Axios)

- US regulators suspended all passenger services using EasyMile vehicles after a passenger was hurt during an emergency stop. (Reuters)

- Bosch invested in UISEE, a Chinese developer of autonomous off-highway products. (Bosch)

- A research team is experimenting with ground penetrating radar to help drive in poor conditions. The unit is presently far too expensive and large for production vehicles and it is unclear what benefit it offers if a vehicle is already equipped with frequently updated maps because the sensor’s primary purpose seems to be detection of the road surface, rather than creating any useful semantic understanding of driving conditions (partly because the sensor is located so close to the vehicle). (ZDNet)

- Idriverplus, a developer of self-driving vehicles ranging from street sweepers to cars said it will use Velodyne lidar sensors. (Velodyne)

- California released self-driving statistics for 2019, this time in a database file, rather than electronic copies of the detailed reports. (CA DMV)

- Toyota is investing $400 million in Chinese self-driving developer Pony.ai. (Pony.ai)

- Argo AI’s CEO confirmed that Ford’s initial plans for self-driving cars still exclude all-electric vehicles (Ford has earlier talked about plug-in hybrids). He had two reasons for pursuing the course, even as rivals choose all-electric vehicles, or at least hedge their bets: that electric vehicles cost more so profitability is harder and; that fast charging the battery to keep the vehicle in use would reduce its life expectancy too much. (The Verge)

- Porsche has been testing low speed camera-based autonomous driving to move vehicles around workshop areas. Longtime observers of ponderous self-parking technologies and laidback garage mechanics will wonder whether there is any real world benefit to be achieved. Slightly more interesting is Porsche’s belief that it could be a rich source of training data for on the road driverless applications. (Porsche)

- Magna says that next generation electric drives, transmissions and ancillaries could boost electric vehicle range by up to 120km over today’s models. (Magna)

Connectivity

- Driverless car developer Oxbotica and communications infrastructure provider Cisco are undertaking a pilot project to explore the practicalities of using a network of wifi hotspots for data exchange between vehicles instead of relying on onboard modems. (The Engineer)

Other

- Electric moped rental start-up CityScoot is raising €24 million. (TechCrunch)

- Electric scooter rental firm Vogo raised an additional $19 million. (Deal Street Asia)

- Flush with new cash, Tier has acquired the physical assets of shuttered moped rental firm Coup. (TechCrunch)

- Mobile servicing service RepairSmith acquired rival CarDash. (Tech Startups)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 23rd February 2020

Making money from cyber security; customers turning their backs on clever engines and; autonomous pods have a branding problem.Please enjoy our auto industry and mobility briefing for17th February to 23rd February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Oranges And Lemons — FCA has agreed to let Mahle’s diagnostic devices access vehicle computers so that third party repairers can service their cars. The reason they can’t do so already is down to FCA’s cyber security protocols that unfortunately lock out unauthorised repairers, so you need special codes and portals to prove you are a goodie and someone needs to pay for all that. BMW do something similar. Is it just a happy coincidence that third parties must buy their way in (an extra revenue stream compared with those before), or will carmakers find themselves under fire from competition regulators arguing they are making life too hard for third parties?

- If You’re Over Me — Mazda is struggling to generate much interest in the very high tech Skyactiv-X engine. Rather than the hoped for 25% of sales, it is hovering nearer to 5%. The engine is Mazda’s bet that you can persuade customers that electric powertrain is over-hyped and on a well-to-wheel basis internal combustion is the best path. But it doesn’t seem to be working. Is this a sign for Mazda (and others) to bow to the inevitable and come up with powertrain strategies that are more clearly on a pathway to electrification?

- Aint Nothing Going On But The Rent — JLR showed off the Project Vector concept car, saying the vehicle will be used in on-road trials during 2021. The car highlights a key problem for premium brands in an autonomous world: it may be that a bland pod is exactly what Uber et al will be calling out for; it must make sense for vehicle utilisation to be improved by using the same vehicles for local delivery. The problem is that neither of these things speak to either Jaguar or Land Rover’s brand values. If local delivery is a fantastic opportunity for JLR, why not jump in now (Mercedes manage to have the three pointed star on Sprinter and S-Class)? And if it doesn’t fit the brand image now, why will things be different in a few years’ time?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Chart of the week

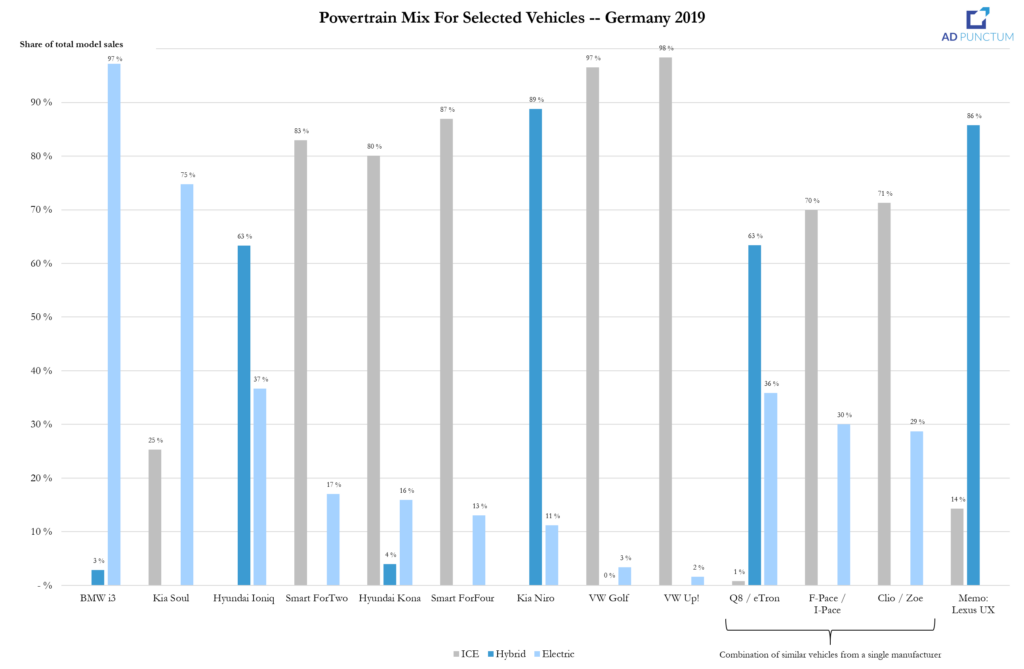

Building on some of the earlier information we’ve shared about electric vehicle registrations in Germany, here’s a piece of analysis that you might find interesting. We looked at vehicles which come with a choice of powertrains: traditional, plug-in hybrid and battery electric vehicles. Because the sample size is small, we added in cars which have a sister product with a different drivetrain (e.g. Renault Zoe and Clio or Jaguar F-Pace and I-Pace).

As you can see from the graph below, VW’s vehicles are something of an outlier, with very small electric shares but those aside, all-electric shares taken upwards of 15% of sales, and in many cases above 30%. If the analysis stands up to scrutiny, these levels would almost certainly meet 2025 and 2030 CO2 targets if applied to the wider fleet. Can you argue that the all-electric share is flattered because some customers might be considering that car due to the limited competitor set when they wouldn’t be interested in the conventionally powered one? Yes. You wouldn’t necessarily have anything other than your own anecdotal objection to base it on, but yes. Here’s the chart:

News about the major automakers

- Efficiency ideas from 8,000 employees saved a claimed €62 million last year, more than half of that came from a single submission regarding the vehicle’s central computer. (BMW)

- Participated in a funding round for existing investment DSP Concepts, alongside Porsche. (Porsche)

- Announced a series of executive moves that will see Daimler’s top management take on roles in the Mercedes-Benz operational divisions and the creation of a COO position. (Daimler)

- Heycar, Daimler and VW’s joint venture for buying cars online acquired UK automotive consumer advice website Honest John, which boasts 25 million visitors. (Automotive Manager)

- Maserati’s new sports car will be called the MC20. (Detroit News)

- Agreed a deal with Mahle to sell access

to vehicle diagnostic systems, on a subscription basis, to workshops that use

Mahle’s hardware. (Auto

Service World)

- Significance: Following BMW’s lead, FCA is monetising access to vehicle systems for third parties (who can currently read diagnostics but have no editing capability). Under the banner of cyber security, manufacturers will have multiple options to control access. However, they will have to be mindful of competition rules that force openness with third party service centres and could get into hot water if a rival broke ranks and made such services available for free.

- Reportedly trimming the dealer network in the UK, historically one of Ford’s largest markets. (Motor Trader)

- Ford has begun installing McDonald’s-esque self-service digital screens in service centres so customers can avoid talking to real humans. (Ford)

Geely (includes Volvo) (history)

- LEVC expects to sell almost 4,000 vehicles in 2020, up from 2,507 in 2019. (LEVC)

- Customers in China can now buy a Geely-branded car online and have it delivered to their door without having to step inside a dealer. (Geely)

- Volvo’s financial results will only be reported every six months, rather than quarterly. (Volvo)

- Claims 30,000 orders for the Chinese market Icon small SUV. (Car Advice)

- Dealers reported that GM would offer them discounts of AUD $8,500 – AUD $17,500 (about $5,600 – $11,600) to shift outgoing Holden models as the brand is retired before the end of 2020. (The Guardian)

- Closing its factory in the Philippines. (Honda)

- Undertaking a series of changes to the legal entity structure in Japan, hoping to improve efficiency. (Honda)

- Eliminated a layer of senior management by combing the 4th and 5th tiers of the organisation. (Honda)

- Recalling around 230,000 minivans and SUVs in North America to fix a problem where moisture can enter the ABS system and cause short circuits, leading to fires. The vehicles were built from 2005 – 2009. (Yonhap)

- Continues to experience stoppages at South Korean factories because of Chinese supplier shortages. (Chosun Ilbo)

- Hyundai and Kia have developed an automatic transmission that uses real time data on weather and traffic conditions, collected via an in-car modem, to decide the best time to change gear (primarily by switching to one of a series of different maps). The primarily benefit is in fewer shifts and less braking. Despite the headlines, it isn’t yet in production. (Hyundai)

- Hyundai’s chairman is stepping down. (Reuters)

- Hyundai Capital’s European joint venture with Santander agreed to buy a 42% share in Sixt Leasing (presently a subsidiary of rental firm Sixt), and plans to take majority control. (Fleet Europe)

- A survey of UK consumers by Kia suggests that one third of them want an electric car as their next purchase. (Kia)

Mazda

- Thus far, Mazda’s high-tech Skyactiv-X gasoline engine has received a muted reception in the US market with less than 5% of customers choosing the motor, far short of hopes that it would claim 25% of sales. (Nikkei)

Nissan and Mitsubishi (history)

- Nissan’s

new CEO pleaded with shareholders to be given more time to come up with a coherent

recovery plan and said he would happily be fired if he fails. (Reuters)

- Significance: Perhaps unwittingly, CEO Uchida is channelling Carlos Ghosn, who pledged to resign if his initial turnaround plan failed.

- Trialling a short-term leasing scheme called “Switch” in Houston, USA. (Nissan)

- Will launch the Opel brand in Japan in 2021. (Opel)

- Faurecia reported 2019 full year revenue of €17.8 billion and operating income of €1.3 billion. (Faurecia)

- PSA’s retail arm plans to recruit 1,300 people in 2020. (PSA)

- Moody’s cut Renault’s debt rating to junk and Standard & Poor’s said its rating outlook was negative. (Reuters)

- France’s finance minister said the government would “play its role as shareholder” to make sure that there weren’t any job cuts in France. Looks like FCA’s trepidation about government intrusion was unwarranted. (Reuters)

- JLR unveiled Project Vector, a four-person minivan with claimed driverless

capability. 20 examples will be part of an on-road test program in 2021. JLR

says it has, in line with the latest fashion, developed a running “skateboard” chassis

that packages drivetrain and batteries beneath the floor. (JLR)

- Significance: JLR’s concept highlights the problem for premium brands in exploring low speed urban transport, namely that it is difficult to translate revenue-bearing attributes associated with private ownership into a pod. The car is co-branded yet carries no real design elements of either marque and JLR mention last mile delivery as a potential use case even though the firm has no credible entry in that space today. These uncomfortable inconsistencies with today’s brand DNA and customer base are, in part, why VW chose a newly invented name, MOIA, for similar activities.

- JLR’s CEO implied that the Project Vector chassis and technology would be made available to third parties, who could invest in the venture. (Autocar)

- Invested in online car financing provider Digital Motors. (JLR)

- JLR says it will run out of parts in the next two weeks if Chinese suppliers don’t resume production with CEO Speth claiming parts were currently being flown out in suitcases to keep factories going. (BBC)

- Reportedly decided not to pursue another bond issue after investors demanded too much interest. (Bloomberg)

- FCA’s soon-to-be-ex CEO Mike Manley is rumoured to be in the running for JLR’s next CEO. (Times of India)

- Rumoured to be switching to prismatic batteries from CATL for entry level Chinese-built Model 3s. (Reuters)

- Tesla fans tracking Cybertruck reservations reckon that more than 535,000 orders have been taken. (Forbes)

- Brazil’s government said it wants Tesla to open a factory in the country but so far it hasn’t got much further than having a video conference with someone at the US embassy. (Reuters)

- Developing batteries for hybrids in collaboration with Toyota Industries. (Toyota)

- Dealers in Germany will get a flat fee for selling ID3 and won’t have a role in negotiating prices. VW hopes that this will mean the same sales experience for the customer whether they are online or offline. What is less clear is whether the dealers will favour cars with traditional engines (and incentive structure) if a client is choosing between, for instance, an ID3 or a Golf. (VW)

- Audi e-Tron production was halted for several days due to a lack of batteries from LG Chem, the same supplier used by the Jaguar I-Pace. (Handelsblatt)

- VW is reportedly struggling with the launch of the ID3 with executives expressing doubts (off the record) that the start of deliveries will take place on schedule. (Manager Magazin)

- Porsche is so pleased with the new companies it is meeting through Startup Autobahn that it has extended the latter’s contract by a further three years. (Porsche)

- Participated in a funding round for audio software developer DSP Concepts, alongside BMW. (Porsche)

- CFO Witter reportedly plans to step down in mid-2021. (Manager Magazin)

- Heycar, Daimler and VW’s joint venture for buying cars online acquired UK automotive consumer advice website Honest John, which boasts 25 million visitors. (Automotive Manager)

- Škoda is re-entering the Sri Lankan market, using an importer model. (Škoda)

- Rumoured to be contemplating a VW-badged sports car, perhaps called the ID R. (Autocar)

- VW’s UK finance arm had its knuckles rapped for failing to tax and insure a handful of vehicles properly. VW said it was because of administrative errors. (MK Citizen)

Other

- W Motors wants to raise $100 million to finance a 500-unit run of a forthcoming all-electric supercar. (Bloomberg)

- Pininfarina will release an even more exclusive version of the Battista, only five will be made. (Pininfarina)

- The CEO of Lucid Motors said the company’s funding was healthy but that he wanted to raise more money (“a nine figure sum”) to accelerate the product development cycle. He intends to hold a demonstration drive in the coming weeks to showcase the Lucid Air’s claimed 400-mile range. (Bloomberg) Reservation numbers are reportedly in “low four figures”. (TechCrunch)

- Atlis showed off the XP “skateboard” chassis the firm hopes to sell (in addition to the XT truck built on the same platform). Using a 1.5 MW charger (which Atliss hopes it can make for under $50,000 per unit), Atlis say the battery pack can gain 500 miles of range in 15 minutes (that is fast considering the 250 kWh size of the pack). (TFLTruck) Watch a shaky version of Atlis’s presentation here.

- Czinger unveiled the 21C, a $1.7 million supercar designed to showcase 15m x 15m automated factories that use 3D printed components, each supposedly capable of making 10,000 chassis per year. (Top Gear)

News about other companies and trends

Economic / Political News

- Passenger car registrations in Europe during January of 1,135 million units fell (7.4)% from prior year. (ACEA)

Suppliers

- Magna reported 2019 full year sales of $39.4 billion and income from operations of $2.2 billion. (Magna)

- Bridgestone reported 2019 full year revenue of 3.525 trillion JPY (about $31.6 billion) and operating profit of 326 billion JPY (about $2.9 billion). (Bridgestone)

- Visteon reported full year 2019 sales of $2.945 billion and net income of $70 million. (Visteon)

- Touchscreen developer UltraSense raised $20 million from investors including Bosch and Sony. (FINSMES)

- Bosch consolidated its internet of things organisation into a single team serving all customer groups. (Bosch)

- Faurecia reported 2019 full year revenue of €17.8 billion and operating income of €1.3 billion. (Faurecia)

Dealers

- Ally Financial is buying credit card and consumer finance firm CardWorks. (Reuters)

- Automotive finance start-up MotoRefi raised $8.6 million. (FINSMES)

Ride-Hailing, Car Sharing & Rental (history)

- Lyft purchased Halo Cars, which provides advertising on car roofs. (Reuters)

- South Korean short-term car rental firm SOCAR raised $18 million. (Deal Street Asia)

- Gojek purchased a 4.3% stake in Indonesian taxi company Blue Bird. (Bloomberg)

- Cabify says it turned a $3 million profit, on an EBITDA basis, in Q4 2019. (Auto Rental News)

Driverless / Autonomy (history)

- A team of researchers working at McAfee undertook strenuous research culminating in an ability to get earlier versions of MobilEye’s forward-looking cameras to mis-classify speed signs and (on some models) feed the incorrect result to the car’s cruise control speed limiter. Although the methods used, and results achieved, seem impractical in everyday use, they highlight the problems with older sensor sets in the field. Even though MobilEye appear to have upgraded current hardware to resist such sabotage, older models were still vulnerable; even those with Tesla’s fabled over the air updates. (Autocar)

- Outrider, a firm developing autonomous trucks for shunting trailers in goods yards, raised $53 million. (TechCrunch)

- US charging start-up Electriphi raised $3.5 million. (TechCrunch)

- Tesla is rumoured to be switching to CATL’s prismatic batteries for entry level Chinese-built Model 3s. (Reuters)

- Toyota is developing batteries for hybrids in collaboration with Toyota Industries. (Toyota)

Other

- Electric scooter rental firm Tier has kept its funding round open and has raised $100 million so far. (Reuters)

- Flying taxi developer Volocopter extended its Series C round and now has €87 million. (TechCrunch)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 16th February 2020

How to meet your CO2 targets; GM exits fringe markets stage left and; mega expensive car dealerships.Please enjoy our auto industry and mobility briefing for10th February to 16th February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Milkshake — BMW and Renault both disclosed a bit more information about how they will meet 2020 EU CO2 targets. They agree that around one third of the improvement will come from improvements to internal combustion engines, with the rest through an increase in electric vehicle mix. Have they got the orders coming through?

- Cups — GM is shutting up shop in Australia, New Zealand and Thailand. The firm will still import cars but the days of purpose-built models are gone. By getting out now, GM can organise a soft landing (enabled by the appetite of Great Wall and VinFast for existing factories). Will any of their competitors regret not moving sooner or has GM’s departure left enough room for everyone?

- Lifestyles Of The Rich & Famous — A new two storey Ferrari dealership in the UK is forecast to cost a cool £9 million. Luxurious brand standards see even mass-market manufacturers demanding dealers cough up nearly £5 million for new sites. Startups have neither the footprint, nor the expensive facilities, will they get left behind in the arms race, or make the existing players look silly by doing far more with far less?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- CEO Zipse says BMW is on course to reduce EU fleet average CO2 by 20% in 2020 versus 2019 (therefore meeting regulatory targets and avoiding fines). One third will come from traditional fuel economy improvements, with the remainder from an increase in the mix of all-electric and plug-in hybrid cars. (Times of India)

- Invested in financing comparison service AutoFi. (BMW)

- Reported Q4 and full year 2019 financial results. 2019 revenue of €173 billion rose 3% on a year-over-year basis whilst EBIT fell over (60)% to €4.3 billion (Daimler’s adjusted figure was €10.3 billion). CEO Källenius declared himself dissatisfied with the company’s ability to translate strong consumer demand into weak bottom line earnings. 2020 guidance is for profits to “significantly” improve. (Daimler)

- Daimler

believes that trucks and passenger cars have “huge synergies” but when it came

to specifics, all the examples were about electrification, begging the question

about what happens when those parts are commoditised..? CEO Källenius cautioned

once again that Daimler might not meet 2020 and 2021 EU CO2 targets

if it meant heavily discounting products. (Seeking

Alpha)

- Significance: Ad Punctum continues to find the logic behind these comments troubling. Firstly, no other mainstream competitor is now talking in such terms, creating substantial reputational risk for Daimler if they pay fines whilst others don’t; secondly, the fine cost of €95 per gram CO2 missed per vehicle sold is higher than the additional product cost required to reduce emissions (especially if it pays for a plug-in hybrid), so it doesn’t seem to make business sense either.

- Renault is discussing “a whole bunch of ideas” with Daimler for future sharing. (Seeking Alpha)

- Recalling around 300,000 cars to fix wiring problems that could cause a fire. (Business Today)

- Expects South America light vehicle industry to increase by 1.5% in 2020, with Brazil growing 6%. (Reuters)

- Stopped production of the 500L in Serbia due to coronavirus-related parts shortages. The factory is a serial downtime candidate due to poor sales and FCA appeared relaxed about a timeline for restarting. (Reuters)

- Moved to a four-day week at the Cologne, Germany, factory due to reduced demand for Fiesta. The lower schedule will reportedly remaining in place until the end of the year. (Automotive News)

- Spin, the scooter rental firm owned by Ford, reckons that employing all personnel (as opposed to using contractors, the practice favoured by many rivals) is a competitive advantage because despite higher fully-fringed pay levels it has lower staff turnover and can invest more in training. (Business Insider)

- Mahindra claims that by pooling development costs for a new C-sized SUV with Ford, the two companies will save a collective 10 billion INR (about $140 million). (Economic Times of India)

- Recalling around 230,000 cars in North America to fix problems with the rear suspension. (Ford)

- Launched a travelling exhibition that will tour Europe and “de-mystify” electric vehicles for consumers. (Ford)

- Recalling recently launched Pumas to fix airbags. (Autocar)

- Ford remains committed to the Australian market, despite GM’s exit. (Mail Online)

Geely (includes Volvo) (history)

- Upgrading the filters in Chinese-market air conditioning units in response to coronavirus. The company is now researching self-cleaning interior buttons and grab handles (Geely)

- Withdrawing the Holden brand in

Australia and New

Zealand, and stopping all engineering operations by 2021. The Chevrolet brand

will also exit Thailand by 2020, with GM’s plant in the country being sold to

Great Wall (who recently purchased a GM factory in India). GM will only sell

high end imported vehicles in these markets. GM said that it couldn’t make a

business case for local production in Thailand, and without a factory Chevrolet

couldn’t be competitive. (GM)

- Significance: GM continues its course of leaving markets, and their associated facilities, which are marginal or lossmaking. The firm has become quite adept at exiting without controversial wholesale plant closures (thus retaining enough goodwill to continue sales of profitable models), showing willingness to subsidise new owners and even licence IP (e.g. with VinFast).

- Kia revealed the next-generation Sorento SUV. The design looks like an homage to Ford’s Explorer. (Kia)

- Hyundai

and Kia will use a modified version of Canoo’s (née EVelozcity) electric rolling

chassis for a series of small electric cars and autonomous pods. (Kia)

- Significance: Following recent investments in, and partnership agreements with, Rimac for sports cars and Arrival for commercial vehicles, this investment implies that Hyundai-Kia’s strategy is to licence chassis technology from third parties where the vehicle is outside the current core product portfolio. It also suggests an appetite for risk, since none of these companies have yet demonstrated the ability to produce in volume.

Mazda

- Recalling around 37,000 cars because of corrosion in the daytime running lights. (Mazda)

Nissan and Mitsubishi (history)

- Nissan reported Q4 2019 (fiscal Q3) revenue of 2.504 trillion JPY (about $22.8 billion) fell (18)% from the same period in 2018. Ordinary income was 37 billion JPY (about $337 million) but there was a net loss of (22) billion JPY (about $(200) million). The forecast for full year operating income was slashed. (Nissan)

- The Opel brand is launching in Colombia and Ecuador. (Opel)

- Reported 2019 full year financial results. Sales of 3.8 million units fell (3.4)% on a year-over-year basis. Revenue of €55.5 billion was similarly affected — down (3.3)% YoY, although Renault said that ignoring exchange it wasn’t quite as bad. Operating income was €2.1 billion, down (30)% versus 2018 and net income was a paltry €15 million. For 2020, Renault hopes that revenue will be about the same, despite expecting sales declines of (3)% – (5)% in its major markets. The Guidance implied that restructuring costs would outweigh operational free cash flow. (Renault)

- Plans to sell a 10% mix of BEV and PHEV in Europe in 2020, plus 10% LPG. The gap to CO2 target should be closed by roughly one third additional sales of BEV and PHEV, one third ICE improvement and elimination of worst performing entities and one third through application of super credits (which is really those BEV and PHEVs again). (Renault Presentation p. 36) Renault aims to sell 100,000 ZOE this year. (Seeking Alpha)

- Plans to reduce fixed costs by at least €2 billion over three years and will announce a series of actions in May within the Renault-Nissan-Mitsubishi alliance to deliver part of this but further details will wait until after the new CEO joins in July. Renault’s comments implied that cost savings from using the (brand new) CMF-B platform shared with Nissan were underwhelming because the top hats were engineered separately. (Seeking Alpha)

- Renault is

discussing “a whole bunch of ideas” with Daimler for future sharing. With LCV a

focus, but not the entire scope of the conversation. (Seeking

Alpha)

- Significance: Given the existing cooperation on the small Citan commercial vehicle, this would imply that a Trafic / Vito / Master / Sprinter tie-up could be on the cards (especially if the FCA/PSA merger means the end of the Trafic / Talento sharing).

- Suspended production of the all-electric I-Pace due to a shortage of batteries. JLR expects the stoppage to be temporary but wouldn’t comment on the root cause. (This Is Money)

- Raising $2.3 billion by issuing new stock, just days after CEO Musk said he didn’t see any need (but we all thought he was going to do it anyway). (Tesla)

- Environmental protestors won a court order forcing Tesla to stop site clearance for the new Brandenburg, Germany, factory to protect animals and woodland but work is likely to ultimately resume. (Manager Magazin)

- A “leaked” copy of Tesla’s employee handbook that reinforces the company’s preferred image of itself as a no-nonsense, go-getting, ass-kicking, world-changing machine sounded more useful as a propaganda tool than in conveying terms of employment. Also, a book seems a bit old-fashioned, shouldn’t it be an app? (Business Insider)

- Recalling around 20,000 Model X (including 3,000 in China) to fix problems with the power steering. (Reuters)

- A speech by Toyota’s boss in Canada calling for an emphasis on hybrid vehicles over battery electric ones highlighted some of the weaknesses in the company’s case: (1) Toyota’s economic rationale leans heavily on an assumption of a shortage of battery materials (hypothesised by others but not proven as a long term issue) and; (2) it offers no alternative for achieving zero tailpipe emissions (such as beefing up the relatively puny motors and batteries of conventional, non plug-in, hybrids). (Driving)

- Continued to leverage the virtues of its electrified fleet by raising a $750 million “green bond” for the captive finance company to offer leases on hybrid cars. (Toyota)

- Made a further investment in Intuition Robotics, a developer of digital companions. (FINSMES)

- Škoda’s forthcoming all-electric SUV will be called the Enyaq. (Škoda)

- German utility E.ON is installing chargers developed in partnership with VW that use batteries to enable discharging at higher rates than the local grid can support. (VW)

- Audi has started offering virtual factory visits, allowing people to tour the shop floor from the comfort of their armchairs. You still have to book a timeslot though. (Audi)

- Offered to settle a class action suit over the diesel scandal directly to the claimants and over the heads of their lawyers, who VW said wanted too fat a fee. If accepted, it will cost VW €830 million. (VW)

- Closing two coal fired power stations in Germany that supply electricity to VW’s sprawling Wolfsburg plant and wants to tear them apart, having declined offers from people hoping to rebuild them. (Reuters)

- Porsche’s motorsport boss implied that the brand is considering an electric version of the 718 sportscar, whilst playing down the idea that it could be a plug-in hybrid. (Auto Motor Und Sport)

Other

- Mahindra is looking for partners on electric vehicles aiming to “collaborate on the back end and compete on the front end”. The comments imply an interest in new partnerships beyond the joint venture with Ford. (Autocar) SoftBank has been mentioned as a potential investor in Mahindra’s electric vehicle arm. (Deal Street Asia)

- A consortium led by Gordon Murray Design unveiled the MOTIV, a small form factor vehicle ready for autonomous sensors and AI. The car is designed for city transit with a top speed of 40 mph. (GMD)

- Lordstown Motors, the Workhorse-related company that hopes to build electric trucks at an ex-GM plant, might have difficulty obtaining the US government loan that is key to its funding plan. Local lawmakers said they will ensure that it gets the money. (Detroit News)

- Nikola unveiled the Badger full size pickup. The brand plans to enter what is increasingly becoming a crowded space with entries from established players and start-ups on the horizon. Nikola’s vehicle features a somewhat unique powertrain — a high performance fuel cell combined with a massive battery. It probably won’t be cheap. (Nikola)

- Nio raised a further $100 million in short-term debt (Nio). The firm told employees that January salaries would be paid late, apparently because of coronavirus. (Bloomberg)

- Westfield reckons that, for niche car makers, all-electric variants cost around £20,000 – £25,000 more than conventionally powered models. (Telegraph)

- BYD’s president says that Chinese electric cars need to become more competitive with Western models, citing a need to improve in safety and reliability. (Yahoo)

- A sketch released by Lister suggested that the forthcoming Storm supercar will be electric. (CarBuzz)

- Pagani released a Huayra-based supercar called the Imola. (Automobile)

- Fisker released an image of a pickup truck called Alaska, then deleted it. (Car and Driver)

News about other companies and trends

Economic / Political News

- After announcing an intention to end sales of new non plug-in or zero emissions cars by 2035, a UK government minister floated the idea of bringing that forward to 2032. (BBC)

Suppliers

- Michelin reported full year 2019 revenue of €24.1 billion and operating income of €3 billion. (Michelin)

- Goodyear reported full year 2019 sales of $14.7 billion and a net loss of $(311) million. (Goodyear)

- Delphi reported 2019 revenue of $4.4 billion and operating income of $141 million. (Delphi)

- BorgWarner (which hopes to buy Delphi) had 2019 sales of $10.2 billion and operating income of $1.3 billion. (BW)

- AAM’s 2019 revenue was $6.53 billion and net loss was $(485) million. (AAM)

Dealers

- Indian omnichannel dealer Shriram Automall acquired online used car site Bluejack. (Autocar)

- Dealer standards are going mad — a new UK Ferrari showroom will cost £9 million. (Motor Trader)

- SureSale, a firm that gives used cars a clean bill of health, raised $7 million. (TechCrunch)

Ride-Hailing, Car Sharing & Rental (history)

- Lyft reported 2019 revenue of $3.6 billion and a net loss of $(2.6) billion. Even taking the highly optimistic measure of adjusted EBITDA the net loss was $(679) million. Lyft seemed pleased and hopes revenue will grow to around $4.5 billion in 2020 with the adjusted EBITDA loss under $(500) million. (Lyft)

- Lyft is buying rental car provider Flexdrive for $20 million. (TechCrunch)

- Peer to peer car rental firm Turo raised $30 million. (Phocuswire)

Driverless / Autonomy (history)

- An ex-Waymo driver took out his frustrations on one of the firm’s self-driving cars in Arizona, causing a crash. Don’t rush to call the opening shots of a new luddite rebellion though, he was sacked for poor performance, not replaced by a robot. (The Verge)

- Yandex has spent $35 million on self-driving research and is running at around $9 million per quarter. (Reuters)

- Lighting supplier Koito invested $50 million in lidar firm Cepton. (Koito)

- Indian moped rental firm Fae Bikes started a charging network. (Charzer)

- Electricity firm EDF acquired a majority stake in charging provider Pod Point. (EDF)

- Renault says that about 80% of charging by French customers is at home or at the office, with the remainder being on public facilities. The company admitted to being surprised by the high interest from rural customers, with 50% of cars going to owners outside cities. (Seeking Alpha)

- German utility E.ON is installing chargers developed

in partnership with VW that use batteries to enable discharging at

higher rates than the local grid can support. (VW)

- Significance: Although this philosophy has been employed before, the application in Germany matters because many engineers at German-based OEMs have convinced themselves that the potential for electric vehicles in the country is low because of the low power levels of the local grid. This method (albeit at a fairly large unit cost) may change their minds, and the attitude of the departments they lead.

- Hyundai and Kia will use a modified version of Canoo’s electric rolling chassis for a series of small electric cars and autonomous pods. (Kia)

- Westfield reckons that, for niche car makers, all-electric variants cost around £20,000 – £25,000 more than conventionally powered models. (Telegraph)

- BYD’s president says that Chinese electric cars need to become more competitive with Western models, citing a need to improve in safety and reliability. (Yahoo)

Other

- BP wants to be fully carbon neutral by 2050, offsetting all CO2 resulting from the oil and gas it produces. It is unclear how this will be achieved. (Reuters)

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

Find our archive here.

Auto Industry Briefing — week ending 9th February 2020

Fewer accidents on the way; the importance of ride hailing; and flip-flopping self-driving car developers. Please enjoy our auto industry and mobility briefing for 3rd February to 9th February 2020. A PDF version can be found here.

Before you read the detail, what were my favourite stories of the past week…?

- Ain’t No Mountain High Enough — Toyota says that a basket of driver assistance systems including emergency braking and lane departure warning reduce rear end collisions by 70% – 90%. This scale of improvement has been suggested for a while, but Toyota has collected data from 10 million vehicles to get its number. If, in future, accidents will reduce tenfold, are self-driving vehicle developers setting themselves tough enough targets by referencing today’s accident rates?

- Basket Case — Ride hailing has become so important to Indonesia’s economy that fares from the biggest location operators will go into the inflation calculation. If catching a cab can be such an important part of the transport mix there, why are so many in the West convinced that it will never catch on?

- Remember What I Told You To Forget — Just a few weeks ago GM (Cruise) was saying that using disengagements as a proxy for progress in driverless car developments was a load of old rubbish. So why are they using the same metric in their investor day presentation (p108) to provide how much progress they have made?

News is arranged by company and topic. Stories that apply to more than one company or topic are duplicated.

Find our archive here.

SIGN UP TO GET THE WEEKLY BRIEFING EMAILED TO YOU

News about the major automakers

- Expanding in-house production of electric motors and battery modules thanks to rising demand for plug-in hybrids. Staff numbers will more than triple and floor space will increase tenfold. (BMW)

- Rumoured to be about to announce 15,000 job losses. (Handelsblatt)

- Stopping production of the X-Class in May. (Autocar)

- Reported full year net revenue of €108 billion, down (2)% on a year-over-year basis. Adjusted EBIT of €6.7 billion was about in line. FCA expects things to improve slightly in 2020. (FCA)

- Reckons that European production could be affected by coronavirus within two to four weeks. (Reuters)

- Settled a tax dispute with Italian authorities over Chrysler’s value. FCA agreed to a higher taxable gain, but the availability of losses carried forward and offsets mean there is no net impact. (Reuters)

Ferrari

- Reported full year shipments of 10,131 cars, up 9.5% on 2018. Revenue of €3.8 billion rose 10.1% and EBIT of €917 million rose 11%. Ferrari upgraded the outlook for 2020. (Ferrari)

- Reported Q4 and full year financial results. In Q4 2019 revenue of $39.7 billion fell (5)% versus prior year whilst adjusted EBIT of $0.5 billion fell two thirds. Full year revenue of $155.9 billion was (3)% worse year-over-year and adjusted EBIT dropped (9)%. Q4 saw a net loss of $(1.7) billion and only just above breakeven in the full year. Ford blamed launch delays on Explorer and big bonuses to UAW workers. (Ford)

- Promoted Jim

Farley (hitherto Ford’s joint number two) to chief operating officer and

announced the “retirement” of 53-year-old Joe Hinrichs (his slightly more powerful

counterpart). Ford also beefed up the already expansive role of its product

supremo (53, but not yet ready to retire). (Ford)

- Significance: In the last two decades, Ford has only had a chief operating officer position twice: under Bill Ford when de facto CEOs couldn’t be given the title because he had claimed it for himself and; Mark Fields was COO whilst being groomed to take over from Alan Mulally. In this context, Farley appears to be a shoe-in for the top job when Hackett goes.

- A puff piece on Farley, timed to coincide with the announcement of his promotion, was long on promises of unspecified action and short on gushing quotes from underlings. It also debuted a new phraseology for improving profits: “bending the curve” of financial performance. Hopefully it won’t catch on. (Detroit Free Press) A cryptic post on LinkedIn by a former Ford marketing executive hinted at what some insiders think.

Geely (includes Volvo) (history)

- Volvo had full year 2019 revenue of 274.1 billion SEK (about $28 billion) and operating profit of 14.3 billion SEK (about $1.5 billion). (Volvo)

- Announced a project to merge Geely and Volvo with a view to a joint listing and the creation of a group that “could realise synergies”. (Geely)

- Reported Q4 2019 and full year financial results. Q4 revenue of $30.8 billion fell (20)% on a year-over-year basis, entirely due to North America (and the UAW strike). Adjusted EBIT of $105 million was (96)% worse. Full year revenue of $137 billion was (7)% down whilst adjusted EBIT of $8.4 billion dropped (29)%. (GM)

- Took the wraps off the next generation Cadillac Escalade large SUV. (GM)

- Reportedly blames an initiative to only offer downsized three-cylinder engines on some models for a slump in Chinese sales and plans to reverse course. (Reuters)

- Despite recently disparaging the measure of miles between reportable disengagements, GM used it in an investor presentation to show how much Cruise had improved. (GM – CMD presentation p108)

- Reported financial results for Q4 2019 (fiscal Q3). Revenue of 3.75 trillion JPY (about $34 billion) fell (5.7)% from a year earlier. Operating profit of 167 billion JPY (about $1.5 billion) fell (2.1)%. (Honda)

- Kia is rumoured to be considering moving its recently opened Indian factory to another part of the country in response to state-level changes to employment laws and incentives. (India Today)

- Kia unveiled the Sonet, a compact SUV due to start sales later in 2020. (Kia)

- Says that almost half of its operations (by revenue) will be impacted by coronavirus-related stoppages. (Hyundai)

Mazda

- Reported Q4 2019 (fiscal Q3) revenue of 849.7 billion JPY (about $7.7 billion), down (5)% versus prior year. Operating profit of 6.5 billion JPY (about $60 million) fell (76)%. (Mazda)

Nissan and Mitsubishi (history)

- Moving to quarterly sales reporting in the US, following the lead of GM, Ford and FCA. (Nissan)

- A UK consortium headed by Nissan completed a 230 mile “self-navigated” trip on public roads. (Nissan)

- The DS brand will be a net positive for PSA’s European fleet average CO2. (Automotive News)

- Unveiled the next generation Mégane, which includes a plug-in hybrid. (Renault)

- Renault Samsung was forced to take down days because of coronavirus-related parts shortages. (Reuters)

Subaru

- Reported Q4 2019 (fiscal Q3) revenue of 2.485 trillion yen (about $22.6 billion) rose 4% versus prior year but operating profit of 153 billion JPY (about $1.4 billion) fell (2)%. (Subaru)

Suzuki

- Reported Q4 2019 (fiscal Q3) revenue of 871 billion JPY (about $7.9 billion), down by (4.3)% on a year-over-year basis. Operating income of 52 billion JPY (about $470 million) dropped (11)%. (Suzuki)

- Building a battery recycling facility in India. (Autocar)

- Taking steps to resource components currently made by suppliers in China for Maruti Suzuki. (Reuters)

- Maruti

Suzuki is focused more on the improvement of internal combustion engines than

electric vehicles because internal forecasts are that even by 2030, only 8% of

the local industry will be electric cars. (Bloomberg)

- Significance: Whilst it is dangerous to read too much into such comments, it is worth noting that a considerable portion of contemporary fuel economy savings are coming from electrification (i.e. anything from 48V to plug-in hybrids). Therefore there is a path where electric vehicle-led improvements can benefit those with internal combustion engines.

- Tata unveiled an array of new products at the Indian Auto Expo, including the Sierra Concept, an all-electric SUV and the production version of the Gravitas. (Tata)

- JLR will reportedly take several down days at Solihull and Castle Bromwich before the end of March. (Reuters)

- Filed patents that indicate the firm is seriously considering steering wheels that contain touchscreens in future vehicle generations. (Electrek)

- Received

negative publicity after it downgraded the capabilities of a car Tesla had

offloaded to a dealer, who then re-sold it to an end customer. Although the car

had driver assistance features enabled at the time of delivery, Tesla

subsequently decided this was an error and removed them, demanding $8,000 for

reinstatement. (Business

Insider)

- Significance: Currently an isolated case, and hopefully it stays that way otherwise Tesla could find itself developing a reputation for tin-eared customer service.

- Elon Musk implied that Autopilot would create maps of features including potholes to help subsequent vehicles avoid them. If true, this further blurs Musk’s criticism of rivals in the self-driving race for relying on maps, when Tesla would be doing much the same (the subtlety may lie in the degree to which the maps decide, rather than merely influence, the vehicle’s route). (Electrek)

- Reported financial results for Q4 2019 (fiscal Q3). Revenue of 7.5 trillion JPY (about $68.7 billion) fell (3.3)% on a year-over-year basis and operating income of 654 billion JPY (about $6 billion) was also down slightly. Net income was way up, aided by gains on equities. (Toyota)

- In 2019, half of Toyota’s sales in Europe were hybrids (p4 of the competitiveness presentation). (Toyota)

- Data

collected from 10 million vehicles fitted with Toyota’s safety system comprising

emergency braking, lane departure alert and automatic high beam, says that rear

end collisions can be reduced by 70% – 90%. (Toyota)

- Significance: Although not a complete surprise, Toyota’s figures will put pressure on self-driving vehicle developers who currently assume that anything better than today’s average accident level is a threshold of safe driving at which autonomy has a business case. In short – if the new standard is a near tenfold reduction from figures they have been assuming, they need to aim higher.

- Working on an all-electric compact car powered by a battery pack that is designed for a second life — in this case, electricity storage in the home as part of a system built by 3rd parties such as Panasonic. (Nikkei)

- Has now acquired enough shares for 20% voting rights in Subaru. (Subaru)